On November 25, I rated Ford (NYSE:F) Sell and indicated:

Ford is struggling, but as always, market participants have been slow to react. This, however, may be changing. The progression of sell-side analyst estimates paint a difficult future for the company and its investors. As Ford's competitors advance their autonomous driving technologies, while Ford scales back its ambitions, I expect future expectations for Ford to continuously be revised downward in the coming quarters, leading to lower stock prices.

Market participants caught up to the deteriorating fundamental picture quicker than even I expected:

Since the article was published, the stock has underperformed the S&P 500 index by more than 17%, and I believe this is just the beginning.

Recent Financial Results

Ford on January 24 announced earnings in line with expectations coupled with a top-line beat. Per usual, Ford generated the majority of its 2017 revenue and all of its pre-tax profits in North America. This market is disproportionately important to the company, as we already knew.

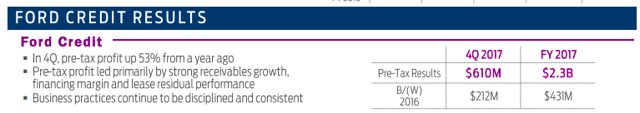

More interestingly, Ford Credit performed well in both 4Q17 and in 2017:

The above table from the company's investor letter shows that Ford Credit generated pre-tax profits of $610 million and $2.3 billion in 4Q17 and 2017, respectively, representing significant increases from previous periods.

The above table from the company's investor letter shows that Ford Credit generated pre-tax profits of $610 million and $2.3 billion in 4Q17 and 2017, respectively, representing significant increases from previous periods.

Taking this analysis one step further, pre-tax profits from Ford Credit comprised nearly 35% and 27% of the total pre-tax profits in 4Q17 and full fiscal year 2017, respectively, up from 19% for both the year-ago quarter and the full fiscal year 2016.

In short, providing financing for its customers has been an increasingly significant source of pre-tax profits for the company.

Rising Interest Rates

The following graph illustrates that interest rates have risen significantly across the yield curve throughout the last six months:

3 Month Treasury Rate data by YCharts

3 Month Treasury Rate data by YCharts

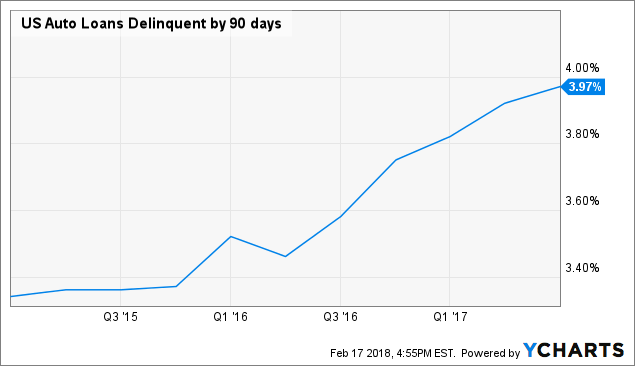

Surging interest rates, if persistent, may negatively affect the company's growing pre-tax income from its financing arm. Readers should note that, even before the recent surge in interest rates, the delinquency rate in the overall U.S. auto loan market had been rising:

US Auto Loans Delinquent by 90 days data by YCharts

US Auto Loans Delinquent by 90 days data by YCharts

Watch These Metrics

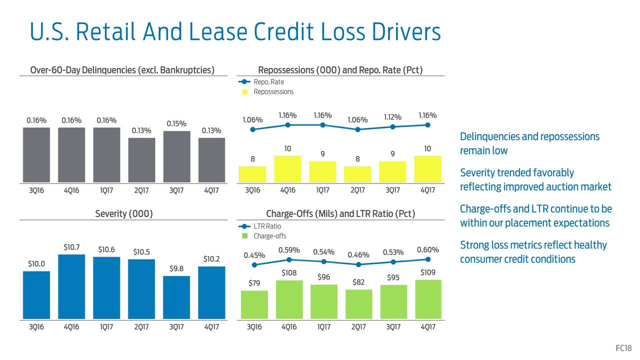

The following slide from the company's latest earnings presentation illustrates the metrics that the company tracks to measure certain credit trends:

Readers should note that the company's charge-offs, LTR ratio, repossessions, and the repo rate have all increased in the last two quarters, but the company notes that these metrics remain within low and expectations. Investors should keep an eye on these metrics in the future.

Bottom Line

Ford's stock price has recently underperformed the overall indices and its competitors, but this may just be the beginning. Rising interest rates may negatively affect the company's financing arm in the coming quarters. Investors should keep a close eye on charge-offs in order to measure the health of Ford Credit.

Follow For Free Articles

If you enjoyed this article, please click "Follow" next to my name. Your support will allow me to invest further time and resources into creating proprietary research for you.

Premium Research

If you're interested in my investment methodology and other holdings, join Value Portfolio. I'm confident that you will find my fundamental research to be insightful, and I look forward to discussing ideas with you.