Quick Take

A recent report by M&A and financing firm Shea & Company has some interesting and potentially valuable insights from the data contained in it.

The Quarterly Enterprise Software Market Review for 2Q 2018 contains a plethora of U.S. software data for those interested in financing, M&A and IPO transactions for the sector.

Of particular importance to investors interested in IPOs is the impressive post-IPO performance of Enterprise Software firms over the last two and ½ years.

Enterprise Software Post-IPO Performance

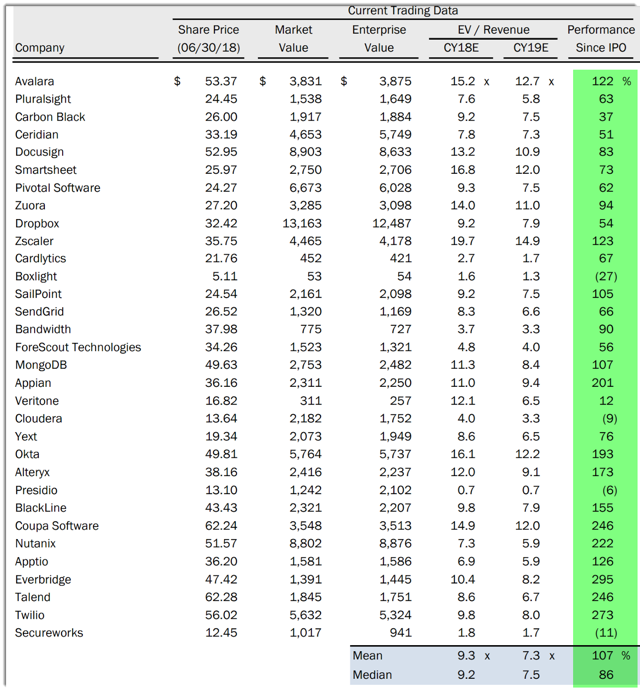

The table below shows Enterprise Software IPO performance as of June 30, 2018. However, an important data point is shown in the far right column which I have highlighted in green.

That column indicates the performance of each stock since the IPO and in relation to the IPO price.

Some notable results:

- There were only four companies that have had a negative return since IPO and two of them were under 10%. This shows there have been very few ‘clunkers’ in the space, indicating generally consistent, high-quality issues.

- Fourteen companies (out of 32 total) have achieved a cumulative return of greater than 100% since IPO.

- Recent IPOs such as DocuSign (NASDAQ:DOCU), Avalara (AVLR) and Pluralsight (PS) are typical of recent impressive returns.

- The median return for all companies was 86%.

(Source: Shea & Company)

(Source: Shea & Company)

DocuSign is an excellent example of an Enterprise Software firm that has outperformed since its IPO.

The above table shows the performance of the stock as of June 30, 2018, when it was priced at $52.95. The stock is currently trading at $60.20, indicating a further 14% return since the end of Q2.

Since going public, DOCU has begun executing on its strategy to expand from its digital signature legacy business into contract lifecycle management software and recently announced an agreement to acquire SpringCM for just this purpose.

All Software Valuations At IPO

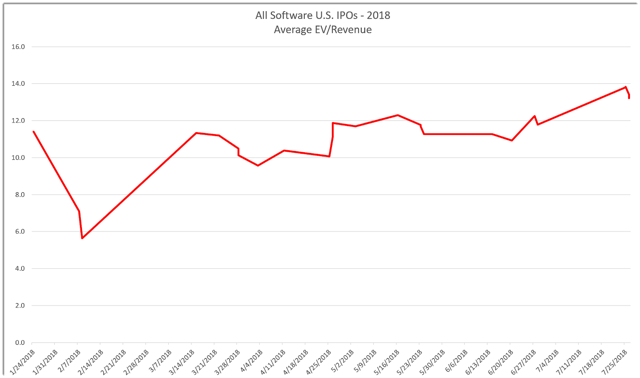

Given the strong performance for the Enterprise Software sector, I took the opportunity to widen the analysis to all software-enabled IPOs to determine whether this performance has resulted in higher prices paid for software IPOs in general.

The chart below shows the EV/Revenue multiples paid in 2018 for all software-enabled IPOs.

- The year started out at just under a 12x multiple and has progressed to an approximately 14x multiple.

- The represents a roughly 16.7% increase in the price paid by IPO investors over the seven months year-to-date for software-related firms.

- Enterprise Software firms, with their 9.2x median EV/Revenue per the table above, have been relatively cheap when compared to all software firms, including Internet, Ecommerce, FinTech and other software-enabled sectors with their current EV/Revenue of nearly 14x.

(Source: IPO Edge Data)

(Source: IPO Edge Data)

An important takeaway for the above data points is that Enterprise Software firms have performed extremely well post-IPO while being more reasonably priced when compared to the 'hotter' sectors of Internet and Ecommerce IPOs.

The role of Chinese firms, with their extremely high multiples and their concentration among Internet, Ecommerce and FinTech sectors may also be a factor in the higher EV/Revenue multiples vs. those of Enterprise Software IPOs.

In any case, interested IPO investors would do well to watch for Enterprise Software IPOs in the coming quarters; they may provide a strong potential for attractive post-IPO returns.