In Canada, they are called the Big 5 or Big 6. They are the biggest Canadians banks that enjoy a wonderful oligopoly situation. They are somewhat protected by the regulatory environment, but more so they are protected due to the brand loyalty of Canadians. Canadians are very loyal to whatever big bank they adopt early in life, and they are slow to change or move to another big bank or credit union or lower fee fintech online bank offering such as Tangerine or simplii. While Canadians might complain about the fees and service and even recent Canadian banking shenanigans including forced selling practices, they are also very proud of the reputation of the Canadians banks. The reputation of Canadian banks was further strengthened in the US financial crisis when most US banks were caught creating and holding crap synthetic and mostly worthless US mortgage debt instruments. The Canadians banks avoided the crap, almost entirely. Some or most of the Canadian banks did not own a dime of that junk.

The Big Banks in Canada did not need to cut their dividends in the Financial Crisis, they all held their dividend for a few years, and then went back to that model of rewarding investors with annual dividend growth.

Canadians even pay the highest mutual fund fees in the developed world at over 2.2% annual (plus the higher TER or trading expense ratios), but they mostly stay put even though there are many sensible low fee options such as building an ETF portfolio or using one of the Canadian Robo Advisors. One of my 'jobs' these days is to help Canadians move out of those high fee funds and find those sensible low fee options. The offer is 'Cut your investment fees by 50-95%'. I'm not the only one singing from this song sheet, but there are very few takers. The scorecard? We have over $1.5 trillion in mutual funds (not all of the terrible, of course, just most of 'em to be fair), and we have $160 billion in ETF products. American investors 'get it'. Canadians, not so much.

You might say I'm a bit confused. I hold the big Canadian banks that have delivered some wonderful dividends and dividend growth and capital appreciation, but my job at cutthecrapinvesting.com is an attempt to reduce their earnings on the wealth management front. Yup.

Once again, the big banks have many oars in the water. They can compensate for the "massive" outflows of investor dollars caused by my blog, ha. And of course the Big 3 have extensive international operations.

Once again, within my Canadian Wide Moat 7 I hold Royal Bank of Canada (RY), TD bank (TD) and Scotiabank (BNS).

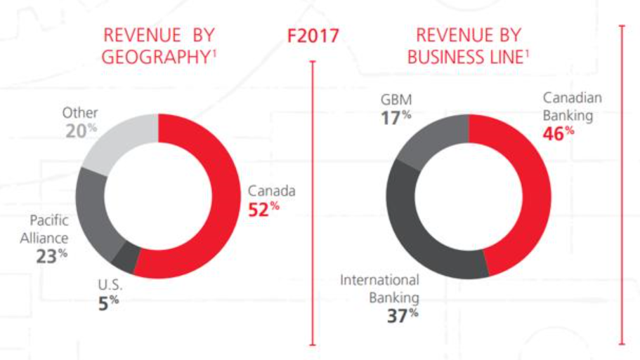

Royal is the favourite of @thedividendguy a passionate dividend investor and blogger, who details that the bank shows a great geographic diversification between Canadian (60%), U.S. (23%) and international (17%) sources of revenue.

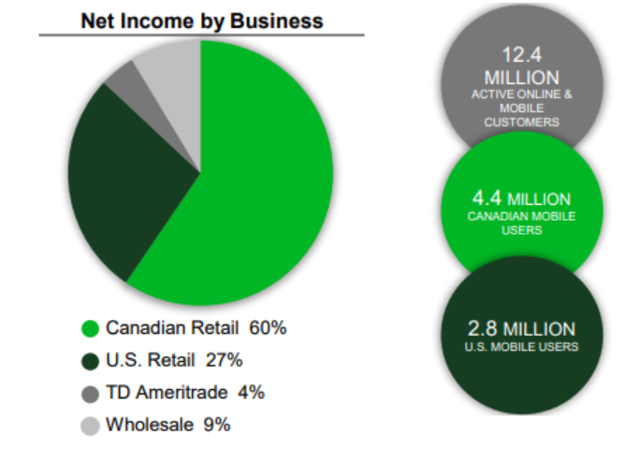

TD is more heavily weighted to the US and The Dividend Guy suggests that TD Bank Is Almost A US Bank After All. Now what's interesting (or telling) here is that TD has more retail outlets in the US, but the make considerably more earnings in Canada. I obviously don't have to spell that out for you, er make that 'do the math for ya'. Banking in Canada is very profitable.

As for my former employer Scotiabank, well it's solid but remains TDG's 3rd choice. Scotia is known as the most International of the Canadian banks with extensive exposure in Asia and Latin America.

As for my former employer Scotiabank, well it's solid but remains TDG's 3rd choice. Scotia is known as the most International of the Canadian banks with extensive exposure in Asia and Latin America.

At the core, you have the Canadian business component driving the earnings allowing for investments in various regions. The oligopoly earnings allows for exploration and development abroad. The big 3 are also very good at ensuring that their exploration also leads to generous earnings and earnings growth. Scotia is certainly focusing on developing markets where there can be exaggerated risks, but with the potential of tapping regions with greater growth potential.

At the core, you have the Canadian business component driving the earnings allowing for investments in various regions. The oligopoly earnings allows for exploration and development abroad. The big 3 are also very good at ensuring that their exploration also leads to generous earnings and earnings growth. Scotia is certainly focusing on developing markets where there can be exaggerated risks, but with the potential of tapping regions with greater growth potential.

So why do the Canadian banks beat the pants off of Warren Buffett (BRK.B)? We might be able to put it down to a 'perpetual discount to the market' as an analyst who knows what they are doing might 'put it'. btw, I am not that analyst. I invest in very simply top line terms. I'm sticking with that oligopoly argument.

We always seem to be able to buy a very decent current earnings yield and a very decent dividend with the big Canadian banks. Why would the market allow an investment that always seems to beat the market, to always be 'cheap'? Ya got me there. This is right under our nose. Well for American investors you'll have to look up above the 49th parallel of course.

At time of writing here are the PE ratios according to my friends at TD Waterhouse.

Royal Bank - 13.4 P/E Ratio

TD Bank - 13.9 P/E Ratio

Scotia - 11.3 P/E Ratio

That's some very generous current earnings when you consider that the US Market (IVV) sits at a boring but not terrible, 24.68 P/E Ratio according to multpl.com. I'll be back with more on that perpetual discount theory, explanation and P/E history.

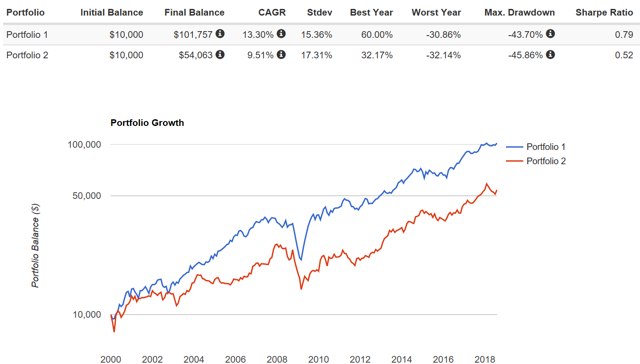

OK, now on to that beating Buffett part. Here's a chart that moves through 2 market corrections. As we know Berkshire beats the US market through this period, and the Big 3 beat Buffett. Here's a chart courtesy of portfoliovisualizer.com. As always past performance does not guarantee future returns, but uh, fingers crossed. Portfolio 1 is the Big 3 Canadian banks, equal weighted and rebalanced annually. Portfolio 2 is BRK.B.

Now I've seen studies that show the beat is greater if we go back another decade or two. I will try and source those. Google is not being of much help. I will contact RBC, who I believe had penned that offering.

Now I've seen studies that show the beat is greater if we go back another decade or two. I will try and source those. Google is not being of much help. I will contact RBC, who I believe had penned that offering.

You might say that the Big 3 are beating Warren at his own game. He likes that wide moat, he likes to buy companies that are 'cheap' that offer a decent current earnings yield, and he certainly likes nice dividends and dividends that grow.

I'll leave any extensive financial and sector evaluation up to you. I am not a stock analyst thought I've done well with a few simple selections based on some very simple themes, not based on quarterly earnings reports or analyst projections.

Oligopoly + Brand Loyalty + Earnings + Growing Dividends =  (image licensed by cutthecrapinvesting - Shutterstock)

(image licensed by cutthecrapinvesting - Shutterstock)

Yup, peace of mind. Investor happiness.

Thanks for reading. If you any insight or theories as to why and how the Big Canadian banks are one of the best large cap investments in North American history, I welcome your comments.

For those who seek wonderful total return potential that also comes attached with generous dividends and an impressive dividend growth history, this stock grouping might be worth more than a look.

Author's note: Thanks for reading. Please always know and invest within your risk tolerance level. Always know all tax implications and consequences. If you liked this article, please hit that "Like" button. If you'd like notices of future articles, click the "Follow" button.

Dale