Editor's note: Seeking Alpha is proud to welcome Niki Schranz as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

Editor's note: Seeking Alpha is proud to welcome Niki Schranz as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to the SA PRO archive. Click here to find out more »

Investment Thesis

Even though Upwork (NASDAQ:UPWK) pulled back since their spectacular IPO in October, I don't think shares are a convincing buy at the moment. While they do operate in a very promising market with great growth potential and have the potential to benefit from powerful network effects, I am not fully confident in their ability to execute. Their revenue growth rate seems a bit low for an upcoming internet platform that is supposed to play an important role in a huge market, and their lack of profitability is a clear risk.

Even though I don't give traditional valuation metrics like PE and PS (or EV/S) a high priority in my stock selection process, I still think that their current EV/S ratio is a bit too high for their growth rate and margin potential.

Connecting Freelancers And Businesses

Upwork operates the largest online marketplace connecting businesses and freelancers. While the Upwork brand exists only since 2015, the company can draw on plenty of experience in the space. The company, that we know today, came out of a merger between two of the leading online talent marketplaces at the time: Elance (founded in 1998) and oDesk (founded in 2003). While they initially had some troubles with their brand name (they creatively called themselves Elance-oDesk after the merger), they have realized the mistake quickly and now seem to be on the right track.

Their online platform helps clients with searching, contracting, collaborating, and paying freelancers - all that in less time and at a lower cost compared to traditional channels. According to the Q3 2018 earnings conference call, clients often receive multiple bids within minutes of posting a job with the median time to hire being 23 hours in 2017.

Freelancers using the platform benefit from access to quality clients and secure and timely payments. It also helps them develop their own brand and build a reputation. Moreover, freelancers gain visibility into opportunities that are in high demand, so that they can invest their time and focus on developing sought-after skills.

What you can probably see from the description above is a possible network effect that could turn out to be a durable competitive advantage. The more businesses there are on the platform looking for talents, the more freelancers will come to compete for projects, making the platform even more useful for businesses. It is clear to me that this simple feedback loop could turn into a very strong and profitable business in the future.

How Big Is The Market Opportunity Really?

As IPOs usually are very story driven, it is important to look at the overall market opportunity in a level-headed manner and to try to differentiate attention-grabbing headline numbers from actual probabilities.

Upwork estimates that the total global GSV-opportunity (Gross Services Volume, representing the total amount of transactions on the platform) was approximately $560 billion in 2017. According to McKinsey, the gig economy could become as big as a $2.7 trillion market by 2025.

These are huge numbers. But what does that actually mean for Upwork? To answer this question, we first have to take a closer look at how much fees they can extract from the total amount of transactions they service.

According to their S-1-Statement, they had over $1.5 billion in GSV and over $225 million in revenue, which computes to a roughly 15% take rate (you will see below that a 15% take rate estimate is actually quite bullish in the long term, but to keep things simple, I prefer to stick to this number for the time being). If we apply this take rate to the estimated market by 2025 of $2.7 trillion, we arrive at a market opportunity of roughly $400 billion. This is the real Total Addressable Market (TAM).

However, in my opinion, it would be foolish to stop here. The TAM is based on the estimates of the global gig economy. You cannot expect Upwork to grab an amount even close to that total.

At the moment, Upwork has a GSV of $1.56 billion, that's less than 0.3% of the current estimated market of $560 billion. How much will they be able to capture? I think that's very hard to say at this point, but considering that we are talking about a very fragmented global market, it would probably be wise not to expect them to capture more than 10% of that market. At 10%, the Serviceable Obtainable Market (SOM) would amount to $40 billion in 2025.

How realistic is it for Upwork to get to a 10% market share? If you look at the raw numbers, it doesn't look very probable to be quite honest. The compound annual growth rate (CAGR) for the whole market, based on the 2017 market estimate of Upwork ($560 billion) and the 2025 estimate of McKinsey ($2.7 trillion), is roughly 22%.

According to Upwork's latest quarterly report (Q3 2018), they had year-on-year GSV growth of 27%. The obvious question arising here is, how will they increase market share significantly if they are only barely outgrowing the overall market? The short answer is - they probably won't.

So, is maybe even the $40 billion SOM a stretch? Only time will tell. To be sure that is still a huge market and shows that the company has a big market opportunity to grow into - especially considering that the company currently has a market cap of around $2 billion. However, it is a far cry from the headline number of $2.7 trillion, which investors should be aware of.

Are Fees Too High?

Upwork gets most of its revenues (88%) from fees charged to freelancers and to clients (Marketplace). The other 10% of revenues come from managed services provided to clients.

There are two kinds of fees: First, there is a payment processing fee for clients amounting to 2.75% per transaction, or a flat fee of $25 per month, which is advantageous if you have more than $910 in payments per month.

The second and more important fee is charged on Freelancers based on their lifetime billings with each client:

- 20% for the first $500 billed to a client across all contracts with them.

- 10% for total billings with a client between $500.01 and $10,000.

- 5% for total billings with a client that exceed $10,000.

What becomes clear is that a "take rate" of 15% will be hard to maintain in the current fee structure. The more business a freelancer makes with a client, the lower the fees will get. That's unavoidable.

The pressure on the take rate is already visible: In the third quarter, it was 14.3% compared to 14.8% a year ago. I think you should expect this percentage to go down continuously in the future. However, that is not necessarily a negative sign. On the contrary, Upwork should probably be happy if their take rate goes down because that would mean that they succeeded in binding their freelancers to the platform, which is exactly what they want to do.

One thing that worries me a bit is that fees do seem to be a bit high. If I was a freelancer and was charged 20% for my first little project, I wouldn't be very happy. And also the 10% fee up to a transaction value of $10,000 seems a bit excessive to me. Remember, this fee structure applies to every single client. So, for freelancers with many different smaller clients, fees will bite into their profits pretty severely. Maybe I'm wrong, but I wouldn't be surprised to see the fee percentages, especially at the entry level, contested in the future (which would put a lot of pressure on margins) - or to see freelancers move to other platforms or try to avoid fees by making off-platform deals.

A Closer Look On Financials - Can We Spot A Trend?

I think it's quite apparent that the success of the company will be driven mainly by growth of GSV. So far, Upwork has been quite successful in increasing its GSV. After oDesk and Elance surpassed $100 million of GSV in 2010 and 2011 respectively (still as stand-alone companies back then), the company blew past $1 billion GSV in 2015 when they launched the Upwork brand. Currently, GSV stands at over $1.5 billion and reached $6.5 billion cumulatively in 2017. In the most recent quarter, GSV increased by 27% year-over-year to $449.5 million.

Two other metrics that management identified as key business metrics in the call were client spend retention, which increased to 108%, up from 95% a year ago (which is a very positive development), and core clients, which grew 22% year-over-year to 101,000.

Core clients are defined as clients that have spent at least $5,000 in their lifetime on the platform and have also spent money on the platform in the last 12 months. Historically, these clients are more likely to continue using the platform and they represent approximately 80% of the GSV - which explains why this metric should be followed closely.

Client spend retention measures how much money a client base from the year before spend on the platform this year. So, a 108% client spend retention in Q3 2018 means that the same client base that spent $1 in the period Q4 2016-Q3 2017, spent $1.08 in the period Q4 2017-Q3 2018. While there are no contractual obligations to spend on a recurrent basis for clients, the client spend retention is supposed to show the recurring nature of the business. Management believes that the retention will stabilize in the 106-108% range in the near term but is focused on increasing this metric by introducing new products and functionality.

In Q3 2018, revenue increased by 23% year-over-year to $64.1 million. This growth number comprises of 23% growth in the marketplace and 21% growth in the management services business. Investors who were hoping for a hidden growth story (like me) are left a bit disappointed, unfortunately. For the full year, 2018 management expects $250.5 million to $252 million, up 24% from $203 million in 2017, taking the high range of guidance.

While gross margin remained consistent year-over-year at 68%, the company is not yet profitable. The non-GAAP net loss was $1.4 million in Q3 2018 compared to a non-GAAP net income of $1.9 million a year ago. The company does not provide guidance for net losses, but they project adjusted EBITDA numbers, which they expect to be between $-0.5 million and $0.5 million for the full year.

One important question investors have to ask themselves is, if there is a visible pathway to profitability.

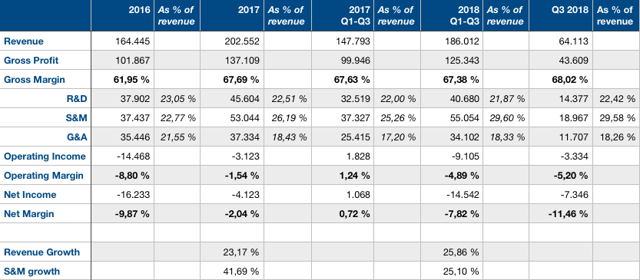

(Source: Author's table.)

I think it is highly unlikely that we will see profits before 2020, and even then, I wouldn't expect them to be very substantial. That is OK since this is an early revenue growth story that is all about grabbing as much business as quickly as possible.

One big take away from the numbers is that the company is increasing Sales and Marketing (S&M) spent (from 23% of revenue in 2016 to 29.58% in Q3 2018), which should spur growth but will also be a detriment to profitability in the short- to mid-term. Operating margins swung from -8.8% in 2016 to almost break-even at -1.54% in 2017, which was mainly a function of expanding gross margins. By expanding S&M spend, the company has widened its negative operating margin again in the first nine months of 2018.

It should also be observed closely, how expanding S&M costs relates to revenue growth. In 2016, revenues grew 23%, while S&M was up almost 42%. In the first nine months of 2018 revenue growth and S&M growth were more aligned at 26% and 25% respectively. Now I won't say you should expect to make any meaningful conclusions from these limited data points. Two growth rates do not make a trend - and therein also lies one of the problems I have with Upwork at the moment.

There are just not enough numbers yet to make meaningful analysis and get a feel for where the business is headed. That's one of the uncertainties that investors have to deal with in IPO investments in general, but I still think it would have been helpful, if Upwork released 2015 numbers in their S-1-Statement, or at least broke down their reported numbers to quarterly figures.

Valuation

The company currently has a market cap of approximately $1.84 billion. According to the most recent quarterly report, the company has $27 million in cash and $25 million in debt. Add to that a nice $187 million that they just raised in their October IPO, and you get to a net cash balance of $189 million. That means the company currently has an Enterprise Value (EV) of $1.65 billion. If we take the high range of managements revenue forecast for the full year 2018 of $252 million, the EV/S ratio is 6.55.

Is that high? Let us compare Upwork to a more mature company with a similar business model. One company that comes immediately to mind is eBay (EBAY) - after all, they also serve as a platform to connect sellers and buyers and collect fees from the transactions.

eBay expects revenues of 10.72 to 10.75 billion for the full year 2018 (midpoint $10.74 billion), has 2.1 billion in cash and 7.7 billion debt as of its latest quarterly report and currently sits at a $28.53 billion market cap. That computes to an EV/S ratio of 3.89. Their YoY revenue growth was 6%. Furthermore, eBay had a gross margin of 77% and a net margin of 27% in its third quarter of 2018.

If we compare these numbers to Upwork head to head we have an EV/S of 6.55 vs. 3.89, revenue growth of 24% vs. 6%, gross margins of 68% vs. 77% and a net margin of -11.46% vs. 27%. So is Upwork overvalued at this point?

As you might know, the market currently is not reluctant to attribute high valuations to unprofitable companies, especially, if they can sport high revenue growth and gross margins. I am generally in favor of that approach if the company can - in addition - show market dominance in its niche and has a clear and visible pathway to profitability. I'm not sure, however, if these criteria are met by Upwork yet, making it difficult to justify a premium valuation of 6.55 EV/S.

At the same time, I would also stress the fact that for young companies with huge market opportunities valuation doesn't matter nearly as much as for mature businesses. What really matters is how the company executes on its market opportunity. But that, unfortunately, is still a bit of an unknown with Upwork.

Conclusion

I think Upwork is an interesting investment and probably worth following. The main story here is their play in the fast-growing gig economy and their potential to grab a considerable amount of that market, profiting from durable network effects in the long run. That's truly exciting.

However, I do have my doubts, if this will really happen. Even though they have already shown to be successful in growing their business significantly, the current revenue growth rate of 24% makes me pause a bit. I'm not confident that Upwork is dominating their market, or is destined to do so in the future.

As far as I understand, the freelancer/talent hiring market is very fragmented and there is quite a bit of competition. Also, their current fees seem a bit excessive to me, especially at the entry level. That could leave room for competition, or put pressure on margins. Even though Upwork currently is the biggest online marketplace for freelancers, at their size (0.3% of the market in 2017) the battle for the freelancer marketplace is far from won. What also makes me a bit wary is that they are not able to significantly outgrow their overall market - although it has to be said that estimates of the overall gig economy market have to be taken with a grain of salt.

At the end of the day, it all comes down to confidence and opportunity cost for me - there are just too many other stocks that I would rather put my money into right now. While I do feel positive about Upwork's story and their potential, I am not confident enough in their financials and execution at this moment. This might change in the future, but for the moment I will not buy any shares.

I plan to follow this company in the next quarters and will especially look if revenue growth can accelerate. If that happens, it might still be early enough to make some handsome profits on the stock.