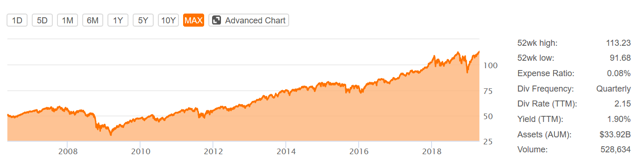

It is incredible how quickly things can change with an Index that is cap weighted and is also practising a form of smart beta. As you may know the Dividend Achievers Index provides one of the most popular dividend growth funds by way of Vanguard's (VIG). In fact the fund has almost $34 billion in assets under management. I believe it is the most popular US dividend ETF followed by its Vanguard cousin, high yield (VYM).

And it has a very successful track record.

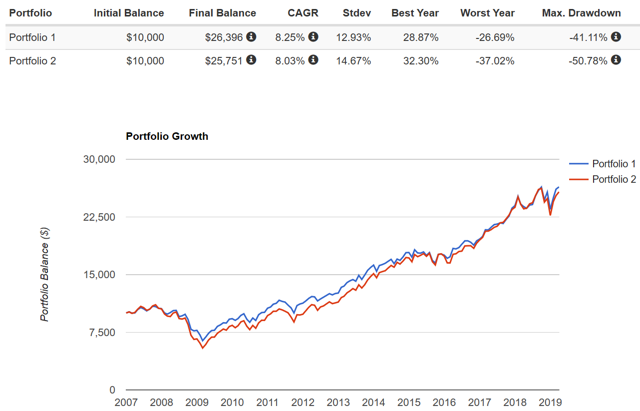

Many will be drawn to the fund due to the potential to deliver better risk adjusted returns. Here's VIG vs the S&P 500 (IVV) from VIG inception of May of 2006.

Portfolio 1 is VIG.

Portfolio 2 is IVV.

Sortino ratio is .89 for VIG and .78 for IVV. VIG simply delivered better risk adjusted returns.

Heading into my semi-retirement years, or my new life/work stage, I embraced the Achievers index, for that potential of nice returns and lesser volatility and drawdown in a major market correction. A market beat is not important, but investors will certainly take that when it comes along.

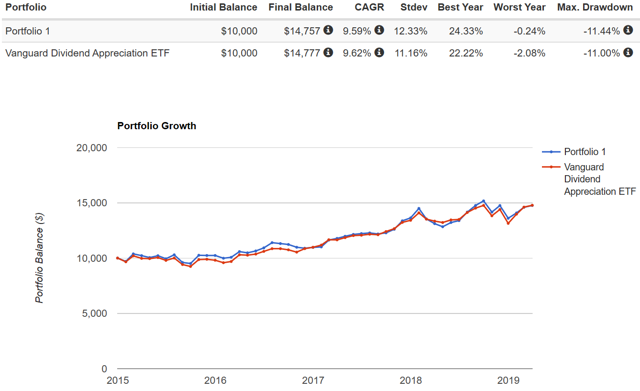

My readers will know that in early 2015 I sold our VIG positions and purchased 15 of the largest cap Dividend Achievers. Here's Buying Dividend Growth Stocks Without Looking. Those top holdings essentially track the underlying total index.

Portfolio 1 is the 15 skimmed largest cap Dividend Achievers.

I made a decision to hold all of the original 15 companies, no matter what. I practiced buy and hold. More than that I only added to the companies that were out of market favour. Here's Can You Simply Add To Your High Quality Dividend Growth Stocks When They're Down, Because They're Down?

I've held and added even when companies were kicked out of the