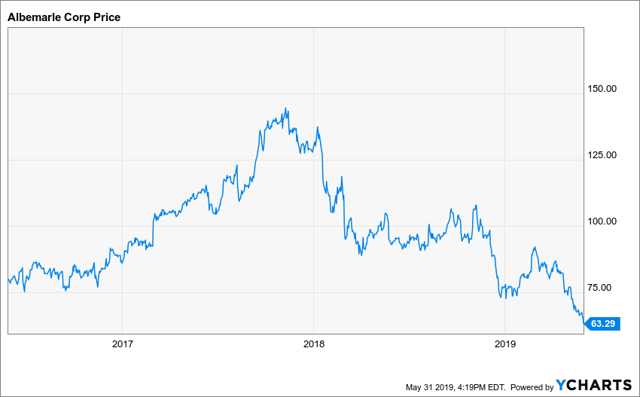

The share price of Albemarle (NYSE:ALB) has been absolutely decimated over the last 1.5 years, and is now trading at $63.29/share, which is the lowest point it has traded at over the last 3 years.

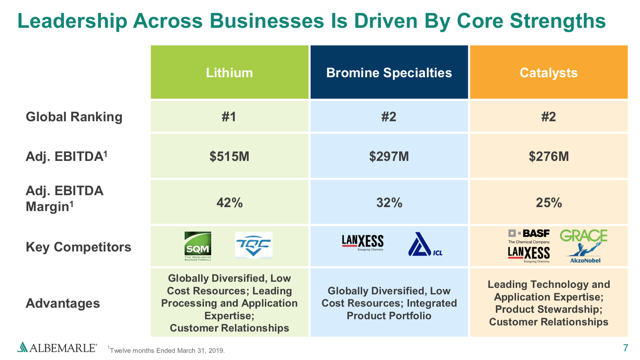

As it pertains to Albemarle, the company is well diversified and generates revenue across three primary product lines: lithium, bromine specialties, and catalysts.

As it pertains to Albemarle, the company is well diversified and generates revenue across three primary product lines: lithium, bromine specialties, and catalysts.

Source: Albemarle May 2019 Corporate Presentation

Source: Albemarle May 2019 Corporate Presentation

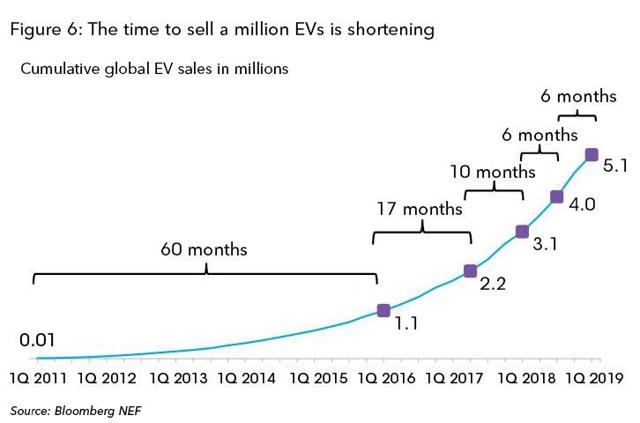

However, in recent years due to the rapid growth experienced in electric vehicles (EVs), which for the most part are currently powered by and require lithium-ion batteries, Albemarle has taken it upon itself to prioritize much of its efforts towards growing their lithium business.

Source: Bloomberg NEF

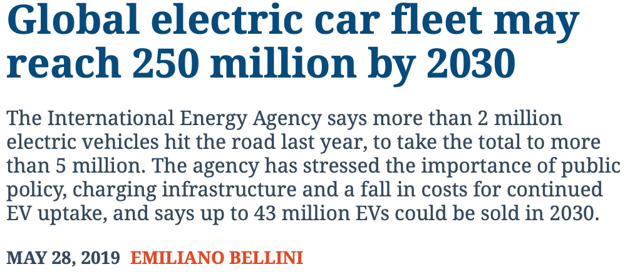

Albemarle's strategy to emphasize on lithium makes sense, as the EV hyper-growth story is only now beginning and arguably still very much in its infancy stage.

Source: PV Magazine

Source: PV Magazine

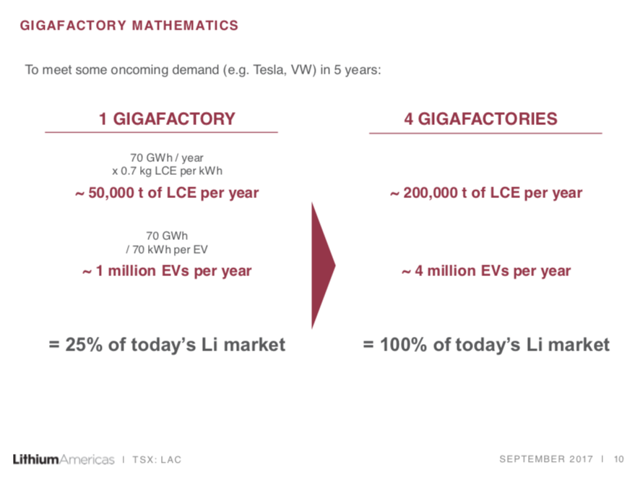

Now, the above headline is one of those things that falls in the category of being "easier said than done", as the following rule-of-thumb numbers will demonstrate; it's estimated the industry will require ~50,000 tonnes of lithium carbonate equivalent (LCE) to meet the lithium-ion battery needs of ~1 million EVs (assuming a 70 kWh lithium-ion battery is equipped per EV, needing 0.7 kg LCE/kWh).

Source: Lithium Americas September 2017

Source: Lithium Americas September 2017

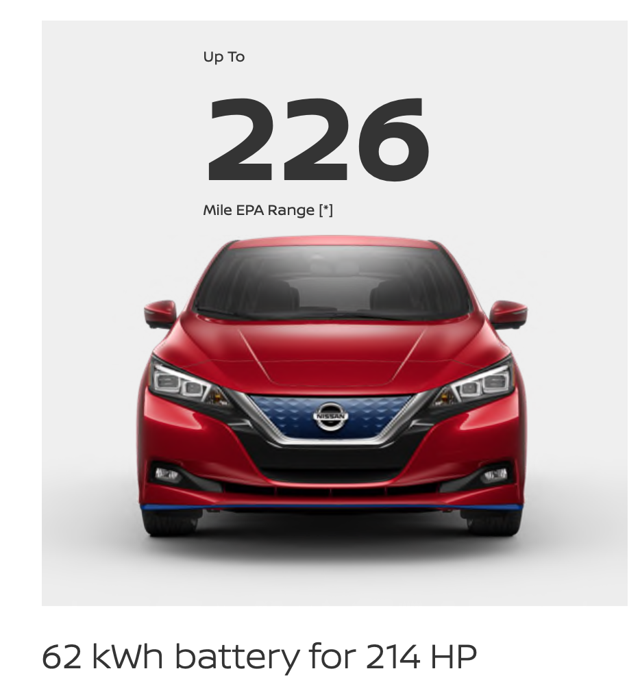

As an example, the latest model of the Nissan Leaf e+ can deliver 226 miles of driving range on a 62 kWh lithium-ion battery (NMC cathode); over time, without a doubt, higher energy density batteries will be coveted/demanded by consumers to reduce/eliminate range anxiety (which is still a big knock against EVs, but this improvement will likely happen gradually over time as battery costs come down).

Source: Nissan USA

Source: Nissan USA

To power 250 million EVs (assuming the continual use of conventional lithium-ion batteries, which due to the inherent nature of evolving technology is of course always subject to change), using the above rule-of-thumb estimates, would require 12.5 million tonnes of LCE (a most staggering and unfathomable number to grasp, presently).

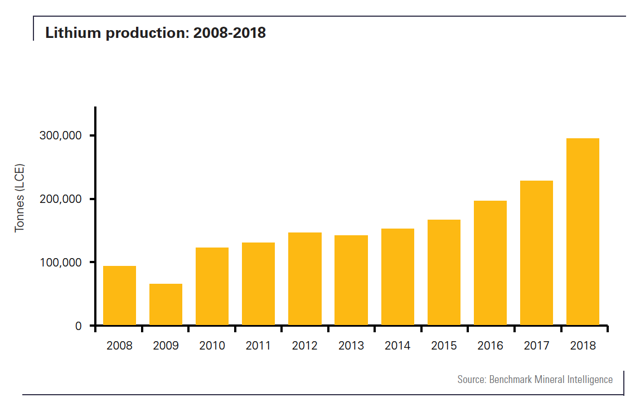

For context, the following slide shows global lithium production (2008-2018), which at the conclusion of 2018 had not yet exceeded 300,000 tonnes annually (currently at ~270,000 tonnes).

Source: Benchmark Mineral Intelligence

Source: Benchmark Mineral Intelligence

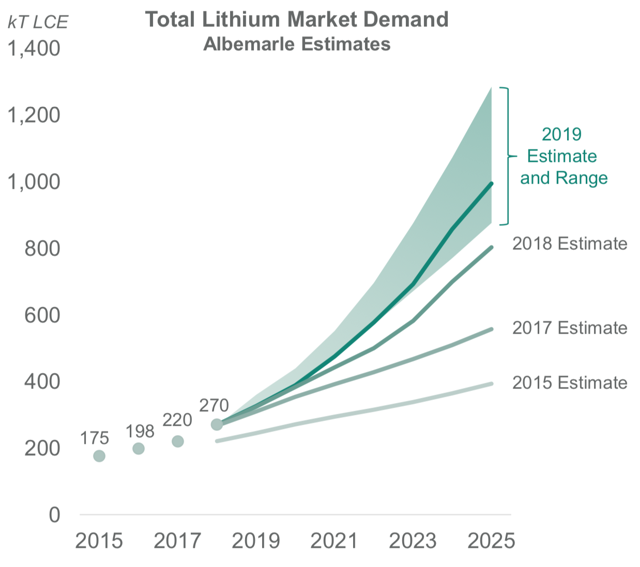

Without jumping too far ahead into the future, though, it's worth noting that just earlier this year, Albemarle produced the following slide showcasing its own demand estimate for LCE reaching (and possibly even eclipsing) 1,000,000 tonnes by the year 2025.

Source: Albemarle February 2019 Corporate Presentation

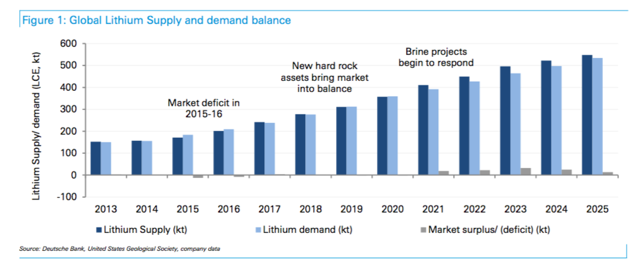

Prior to the string of new lithium demand estimates being routinely revised in the upward direction, back in May 2016, Deutsche Bank put out a market report with the following chart, forecasting LCE demand to reach less than 600,000 tonnes by 2025 (which was arguably considered a "high" target at the time).

Source: Deutsche Bank 2016 Market Report

Suffice it to say, the world is going to need to produce a lot more lithium in the upcoming years if EVs are going to catch on and become mainstream.

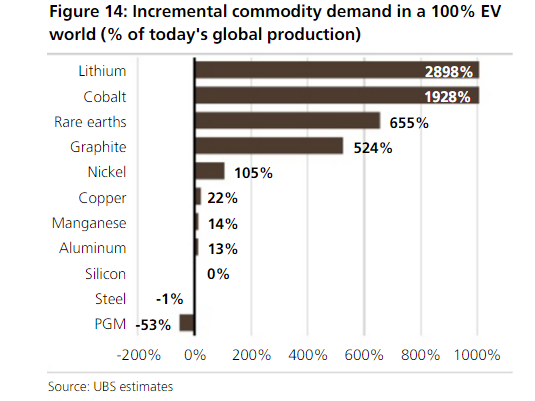

Lithium is a "critical element" for EVs; the following chart is an obvious "exaggeration" of what demand might look like in a shift towards a 100% EV world, but it does highlight the importance of certain commodities, such as lithium.

Source: UBS

With that said, it's important to note that in the commodities business, especially for nascent industries such as lithium, volatility is typically the name of the game, and as we will discuss next, sentiment is prone to swinging violently from one end of the spectrum to the other, at a moment's notice.

Shift in Lithium Sentiment

For lithium, the turning point in sentiment from uber-bullish to the-sky-is-falling-bearish first occurred in early 2018, coinciding with Morgan Stanley's forecast, calling for lithium prices to decline 45% by 2021 due to a plethora of new supply slated to come online to overwhelm demand.

Source: Financial Times

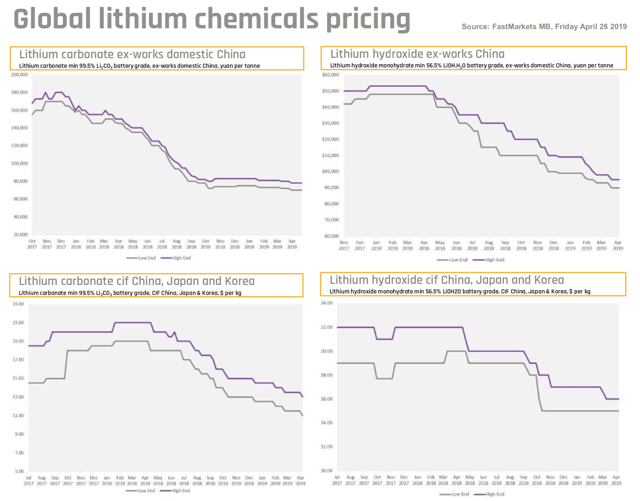

Although time will eventually tell where the supply/demand dynamics end up for lithium, in hindsight, it was most certainly true that lithium prices across the board (i.e., lithium carbonate, lithium hydroxide, spodumene concentrate, etc.) reached an apex around late 2017/early 2018, and have been falling ever since.

Source: Pilbara Minerals March 2019 Quarterly Results Corporate Presentation

The Big 3: Q1 Earnings

For Albemarle, the pain inflicted on its share price has arguably been magnified to a degree over fears of lithium oversupply and falling prices, but moreover, most recently, prevailing negative sentiment was exacerbated due to the disappointing Q1 earnings numbers released from the two other leading lithium producers (Sociedad Química y Minera de Chile (SQM) and Livent (LTHM)), which are considered members of the "Big 3" (with Albemarle being the third member of the group).

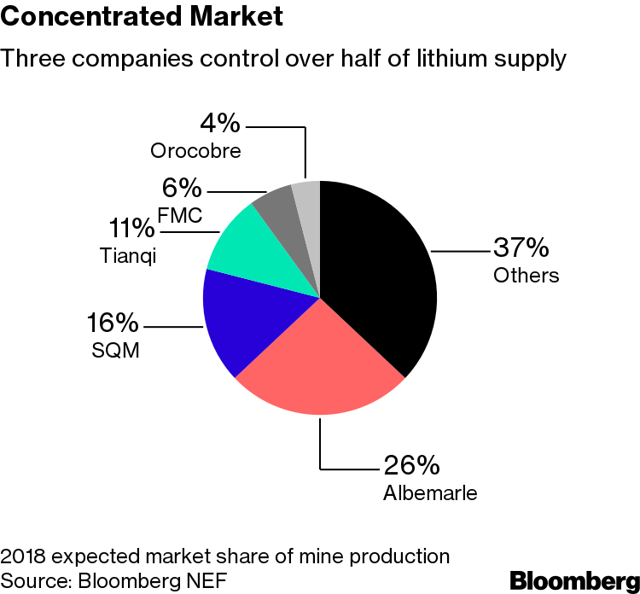

In the past, the "Big 3" moniker was given to the three leading lithium producers (SQM, Livent (a spin-off of FMC (FMC)) and Albemarle) because they used to control a vast majority of the overall market; however, in recent years, players such as Tianqi Lithium have emerged and re-distributed the pieces of the pie, which in 2018, looked like something of the following.

Source: Bloomberg NEF

Source: Bloomberg NEF

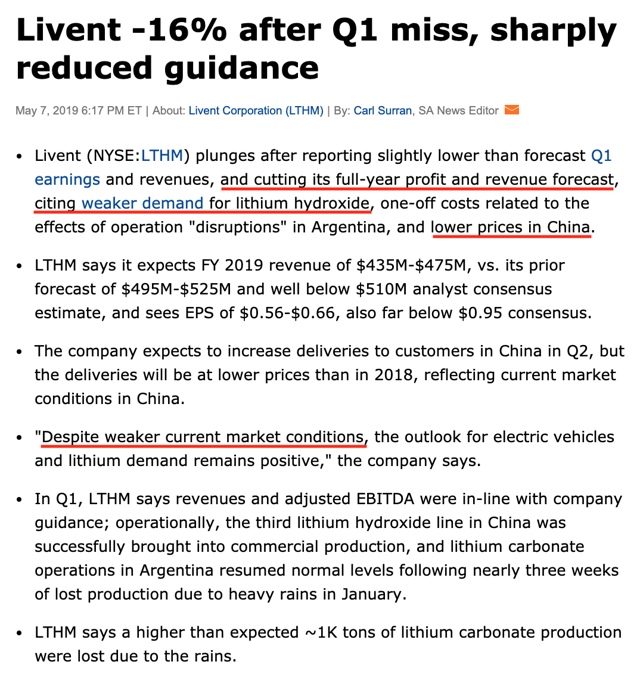

First off, Livent (LTHM) reported its Q1 numbers on May 7, and shares of LTHM fell a staggering -16% due to the company cutting its full-year profit and revenue forecast, and citing "weaker current market conditions".

Source: Seeking Alpha

To better appreciate the context of "weaker" demand for lithium hydroxide (as outlined above), it's important to look into the dynamics of what's going on behind the scenes with EVs.

As Livent President and CEO Paul Graves explains it:

Of the large global auto OEMs continue to commit capital to and provide further detail on the next-generation electric vehicles. The need for batteries with higher nickel chemistries is becoming increasingly clear. This intern is placing the challenge of meeting the higher performance and safety requirements onto the battery chain and especially under the cathode material producers.

In recent conversations with a few of our large established cathode and battery customers, it is becoming increasingly clear that the current facilities being used to manufacture high-nickel cathodes will require additional investment in their processes to meet OEM demands. The result of making these investments is a delay in large scale production of high-nickel chemistries across several of our customers.

To offset the lower volumes of high-nickel cathodes and to improve short-term profitability during this transition, many of these established cathode manufacturers are increasing their production of older catalog chemistries. This has been further reinforced by the changes to incentive structures in China, which has created a window in 2019, but producers of these existing chemistries to delay the introduction of next-generation cathode materials.

However, many of these older chemistries can't use either lithium carbonate or lithium hydroxide. As a result of the lower performance requirements in these applications, high performance lithium hydroxide such as that sold by Livent does not generate the same price premium as in high-nickel applications. And today it's priced relative to the lithium carbonate equivalent. This is consistent with pricing patterns we've seen in these applications historically.

In other words, it's looking more and more like 2019 is a "year of transition" for the automotive sector (particularly in China), as it gears up to inevitably shift towards using high-nickel cathode chemistries (i.e., to enable more energy density + longer driving range, which is what end users are wanting/demanding) in the next generation line of EVs.

For now, however, the prevailing headlines of "weaker" demand for lithium hydroxide coupled with the reported lower sales price are creating some confusion in the marketplace, and very much re-affirming the widespread belief that lithium is in a state of vast oversupply (which is therefore responsible for the drop in prices).

In reality, though, "higher quality" lithium hydroxide products still command a price premium in the market, but because the rollout of high-nickel cathodes is arguably happening slower than anticipated, it's not so apparent at this time.

Here's more specific details, as observed by Livent:

I think earlier to some of our contracted lithium hydroxide customers are delaying net purchases of hydroxide from us as they suspend production of their high-nickel cathode materials while they make additional investments in their existing processes. This delay means that we will have excess hydroxide volumes available in the quarter that will not be sold under existing contracts and will instead likely be sold on the shorter term arrangement primarily in China.

Unlike the rest of the world, the China market remains largely a short-term market for such lithium products with prices set monthly or quarterly basis. Furthermore, much of the demand for hydroxide in China today is driven by lower performance cathodes especially LFP. Consequently, we expect that these sales into China in the quarter will be at prices that are lower than those achieved in the rest of the world today.

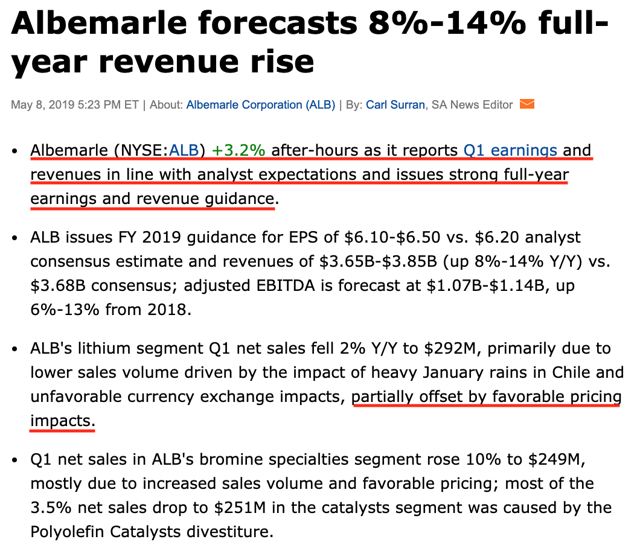

With that backdrop in mind, we next turn to Albemarle, which released its own Q1 earnings numbers after-hours, on May 8.

Source: Seeking Alpha

Source: Seeking Alpha

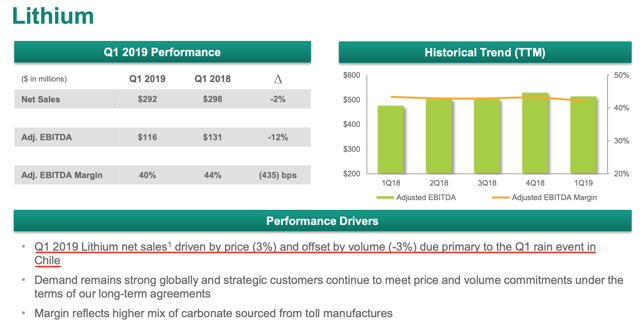

As shown above, shares of ALB actually rose 3.2% after the news hit, as Albemarle reported Q1 results that more or less met market expectations, and perhaps even surprisingly, the company announced that it received "favorable pricing" for its lithium products (which runs completely counter to the "weaker prices" narrative), in addition to a healthy adjusted EBITDA margin of 40%.

Source: Albemarle May 2019 Corporate Presentation

In regard to the "higher" pricing Albemarle was able to obtain in Q1 for its lithium products (at least relative to current environment of declining lithium prices sector-wide), the company attributes this to the long-term sales agreements it has in place with its customers.

From Albemarle.

On a year-over-year basis, pricing was up 3%, benefiting from our long term agreement structure. Volume, however, was down 3% versus prior year, primarily due to the impact of the rain events in the Salar. The adjusted EBITDA margin was solid at 40% and reflects the higher mix of carbonate sourced from toll manufacturers.

The lower sales volume experienced in Q1 was due to flooding that hit Chile/Northern Argentina earlier this year, impacting a number of lithium producers, and not just Albemarle.

Source: The Watchers

Source: The Watchers

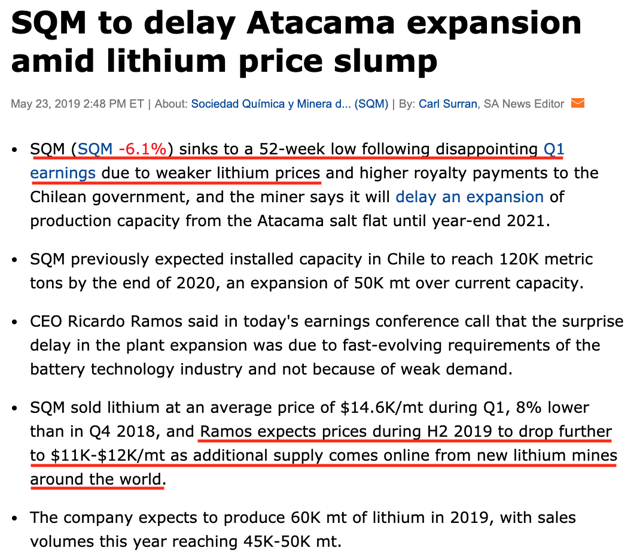

Moving along to Sociedad Química y Minera de Chile (SQM), bringing up the rear with its own Q1 earnings figures, released most recently on May 23, the headlines of a further lithium "price slump" have unfortunately re-surfaced and now re-established its place again in the market, yet again.

Source: Seeking Alpha

In the case of SQM, the company is now expecting the sales price it receives for its own lithium products to fall further, still (in Q1, the average price received was $14,600/t, but expectations for the second half of the year now range between $11-12,000/t).

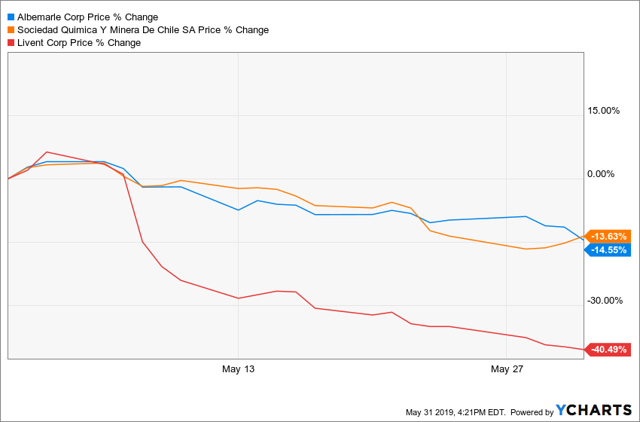

No doubt, it's been a rough month of May for the "Big 3" leading lithium producers, which have all seen their share prices fall by double digits.

- ALB is down -14.55%.

- SQM is down -13.63%.

- LTHM is down -40.49%.

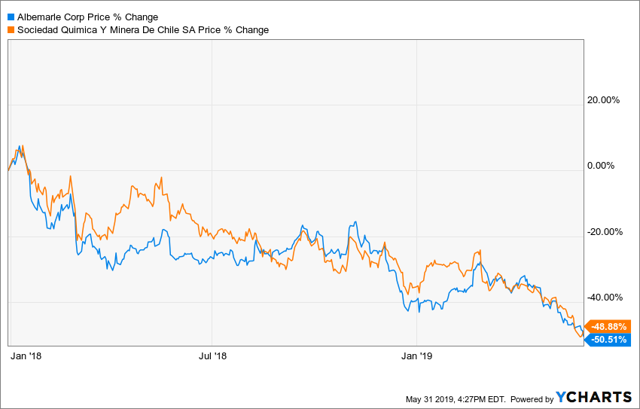

Zooming out a bit further, since the beginning of January 1, 2018, and the downtrend looks even more brutal.

- ALB is down -50.51%.

- SQM is down -48.88%.

LTHM is not shown above since its IPO did not occur until October 2018.

- LTHM is down -62.76%.

In any event, it's been especially tough times in recent years for the "Big 3" lithium producers.

Future Growth

However, despite the massive share price underperformance of ALB lately, behind the scenes, Albemarle has been strategically positioning itself to maintain its prominence in the lithium sector for the foreseeable future.

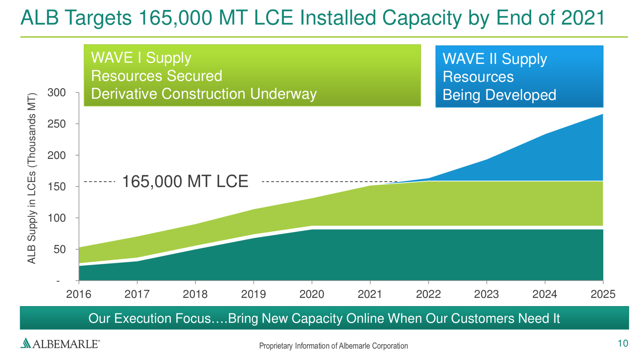

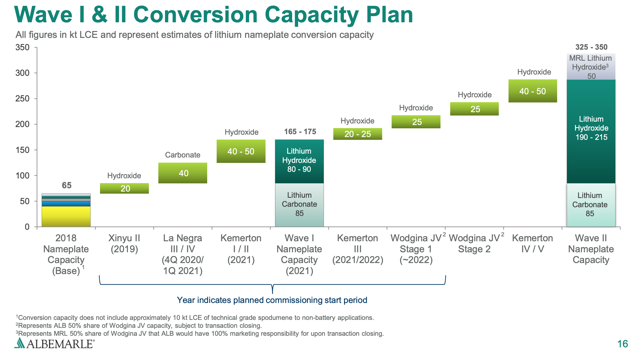

Shown below is Albemarle's roadmap, designed to help the company ramp up its production from today's base nameplate capacity of 65k tpa of LCE up to 165-175k tpa of LCE upon the successful completion of "Wave I" (presumably by the end of 2021), and a further increase to 275-300 ktpa of LCE (while also being responsible for marketing the sale of an additional 50k tpa of lithium hydroxide supply belonging to its Wodgina joint venture partner, Mineral Resources (OTCPK:MALRF)) once "Wave II" is finished (no current timeline is provided for this completion).

Source: Albemarle May 2019 Corporate Presentation

Source: Albemarle May 2019 Corporate Presentation

For 2019, Albemarle's Xinyu II expansion project is not expected to reach its nameplate capacity of 20k tpa (for the production of lithium hydroxide) until the end of this year, which could be good timing (given the context of the market's slower shift to high-nickel cathode chemistries, as discussed earlier).

From Albemarle:

Our new 20,000 met ton Xinyu II lithium hydroxide facility continues to ramp production according to our original schedule. We are shifting from this expansion to customers who have completed their qualification process and have additional qualifications underway. We are on track for full qualification of Xinyu II material, all targeted accounts by the end of the third quarter of this year and expect to achieve a nameplate capacity run rate by year-end.

Further, Albemarle expects to produce ~40k tonnes of lithium carbonate from its existing La Negra I and II operations this year (even after accounting for the impact heavy rains had on reduced production earlier this year, in Q1).

Looking further out, we have the La Negra III and IV expansions on the horizon, which are aiming to bring online an additional 40k tpa of lithium carbonate production, but likely won't be contributing much to the bottom line until mid-2021 (or later).

From Albemarle:

Due to delays in the delivery of certain equipment, we now expect to commission the 40,000 metric ton lithium carbonate plant, La Negra III and IV, late in the fourth quarter of 2020 or in the first quarter of 2021. This will be followed by typical four to six month customer qualification process that would put the first meaningful sales volume around midyear 2021.

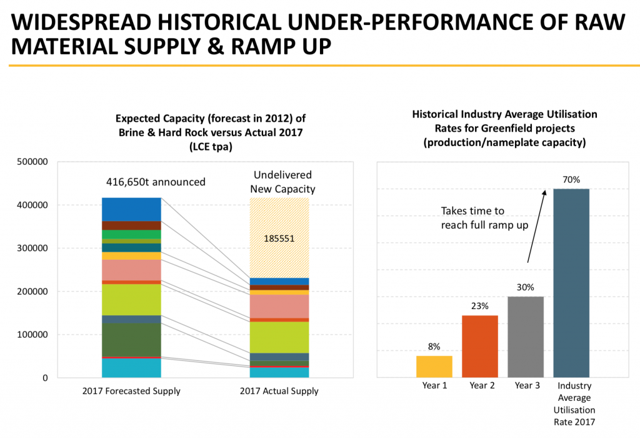

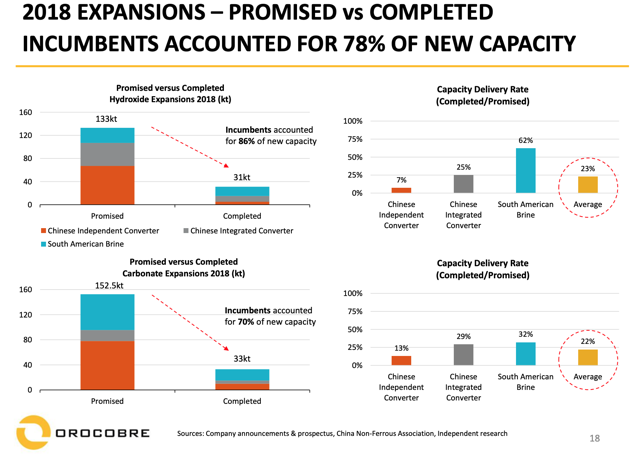

At this point, it's worth emphasizing that commissioning and ramping up a new lithium project up to its designed nameplate capacity is no trivial task (for anybody), and historically this task has proven to be a major hurdle, often underestimated by the market.

Source: Orocobre November 2018 Corporate Presentation

As the slide above shows, widespread underperformance is a very common theme for new lithium projects, and it can take several years to get to even just 70% of nameplate capacity.

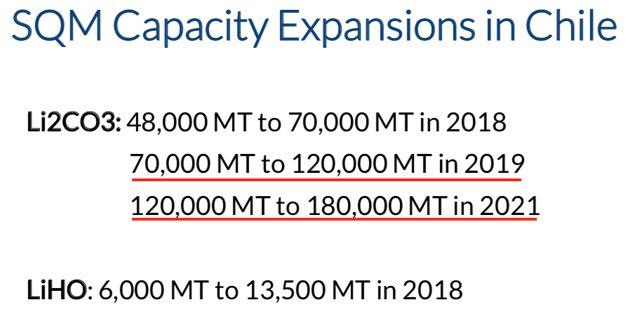

In terms of delays for expansion projects, that's quite normal too in the lithium space, and in fact, SQM just informed the market at the time of its Q1 earnings release that it would need more time, likely until the end of 2021, in order to increase the nameplate capacity of its brine projects in Chile from 70k tpa to 120k tpa.

Previously, SQM anticipated that it could get to 120k tpa nameplate capacity in Chile by the end of this year.

Source: SQM Q1 2018 Earnings Report Corporate Slides

Likely (if history is to be used as a guide), Albemarle will be rather "lucky" (highly successful) if it can manage to get its La Negra III and La Negra IV expansion projects up and producing at/near nameplate capacity in 2021.

Source: Orocobre May 2019 Corporate Presentation

With all that said, turning our attention next to the Kemerton expansion projects, located in Western Australia, these are particularly noteworthy because of the synergies in place; the feedstock material (spodumene concentrate) will be coming from Talison Lithium's (private company owned by joint venture partners Albemarle (49%) and Tianqi Lithium (51%)) world famous Greenbushes Mine, also located in Western Australia.

To make Kemerton a reality, the world's best hard rock (spodumene) lithium mine (i.e., highest grade + largest in production) has to first get a lot bigger.

Source: Mining.com

Source: Mining.com

Already the world's largest hard rock lithium operation, the planned expansion would allow Greenbushes to increase lithium concentrate output to about 1.95 million tonnes a year, as demand for the key ingredient to build batteries that power electric picks up.

The A$516-million ($361m) expansion, announced last year, involves the construction of a new lithium concentrate plant capable of producing 520,000 tonnes a year of chemical-grade lithium concentrate. It also entails a new crushing plant and the necessary infrastructure.

If it receives the nod from Western Australia's environment minister, the last one needed, construction will start this year, with the new plant expected to be commissioned in the last quarter of 2020.

Albemarle, which holds a 49% stake in Talison, is planning a lithium hydroxide manufacturing plant, outside of Bunbury, capable of producing up to 100,000 tonnes per year of lithium hydroxide monohydrate from five 20,000 tonnes per year process trains and up to 1.1-million tonnes a year of tailings.

China’s Tianqi, which has a 51% interest in Talison, is constructing a 24 000 t/y lithium hydroxide plant in Kwinana, just 40 km from Perth.

The "five 20,000 tonnes per year process trains" are the Kemerton expansion projects (i.e., Kemerton I, II, III, IV, V), which are secondary processing facilities needed to produce lithium hydroxide.

Again, although delays are notorious for happening more times than not for lithium expansion projects, it does appear that good traction is being made to get both the Greenbushes and Kemerton expansion projects off the ground.

Source: Mining Magazine

Source: Mining Magazine

For "Wave 1", the successful ramp up and commissioning of Kemerton I and II are on the agenda.

If all goes according to plan, Albemarle should reach a nameplate capacity between 165-175k tpa of LCE by the end of "Wave I" in 2021, which the company was projecting as far back as May 2017.

Source: Albemarle May 2017 Corporate Presentation

Interestingly enough, Albemarle aims to have a very balanced production split (nearly 50/50) by the end of 2021:

- 85k tpa of lithium carbonate

- 80-90k tpa of lithium hydroxide

The above combination mix seems prudent given that the market transition to using more high-nickel cathodes (which prefer the use of lithium hydroxide) could take longer than expected (as mentioned earlier).

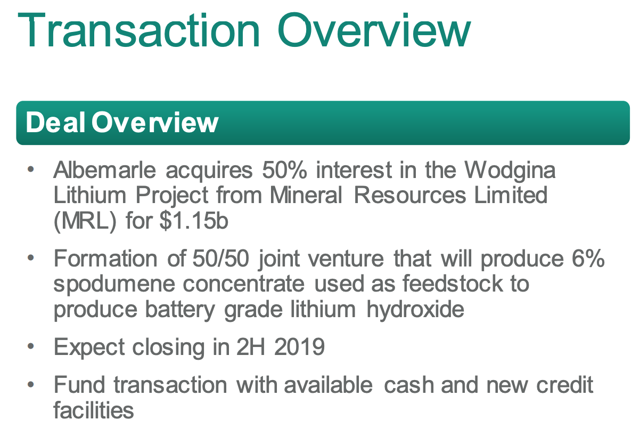

In regard to "Wave II", outside of the Kemerton III, IV, and V expansion projects, the road to getting to a nameplate capacity of 275-300 ktpa of LCE will be paved through the Wodgina Mine, which Albemarle acquired a 50% ownership stake in, back in November 2018, from Mineral Resources for $1.15 billion.

Source: Albemarle Investor Lithium Joint Venture in Western Australia Presentation

Albemarle CEO Luke Kissam had this to say about Wodgina, most recently on the Q1 conference call:

From an MRL standpoint, this is a great partnership to combine the mining expertise they have with the lithium hydroxide expertise that we have. And we are not buying this for this quarter or for the next quarter, but for the next 20 years to be able to drive the returns. And we are still confident in those returns over that period of time and we feel good about the deal.

And we are going to market the Wodgina rock to meet the demand. If the demand is not there, we won't run the plant. So if demand is there, we will run it to meet that demand that we can sell and get a profit on it.

It's noteworthy that "Wave II" is characterized by a growing shift/focus/reliance towards hard rock (spodumene) lithium projects for the production of lithium hydroxide, which in Albemarle's case, also coincides with a growing shift/focus/reliance on Western Australia as a mining/operating jurisdiction.

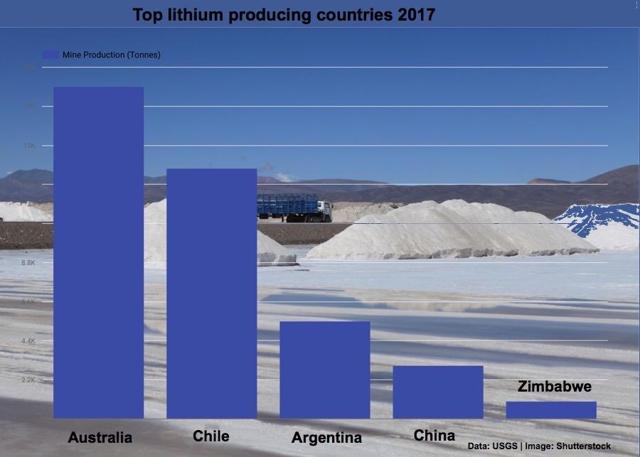

In the past, brine-rich countries such as Chile and Argentina used to be the world's leaders for lithium production, but in recent years, the times have changed, and with hard rock mining gaining popularity as a lithium source, Australia is now at the forefront.

Source: Mining.com

Source: Mining.com

For Albemarle, hedging their lithium production across both hard rock (spodumene) lithium sources in Western Australia and brine lithium sources in Chile could prove to be a shrewd long-term decision, as "putting all your eggs in one basket" could have devastating consequences, in the event, for example, the weather doesn't cooperate, and/or governments change their tax/royalties structures.

Worth analyzing is that Albemarle's "Wave II" expansion plans are entirely devoted to increasing production of lithium hydroxide.

More specifically, by the end of "Wave II", the production split should look something like this:

- 85k tpa of lithium carbonate

- 190-215k tpa of lithium hydroxide

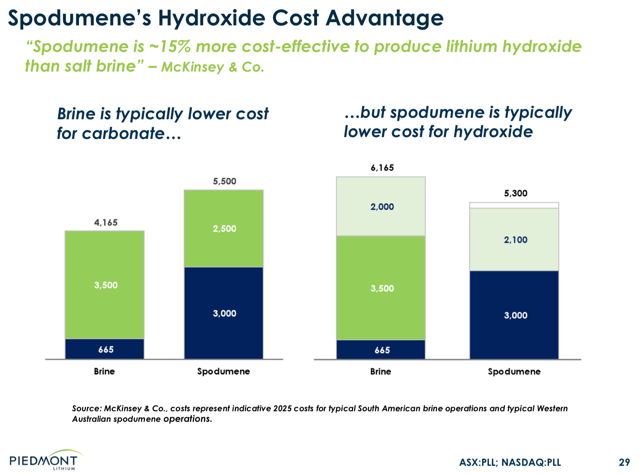

Arguably, the strategy to favor lithium hydroxide (beyond 2021) has to do with the battery industry's expected shift towards using high-nickel cathode chemistries (e.g., NCA (like the type Tesla is using), NMC 8/1/1, etc.), and quite possibly the strategy to favor hard rock (spodumene) lithium sources for the production of lithium hydroxide has to do with the following:

From Design News.

More recently, hard rock mining (primarily from Australia) has become a source of raw materials. “It’s important to understand that from brine, you produce (lithium) carbonate and then you produce hydroxide. Tesla and other makers consume battery-grade (lithium) hydroxide, whereas from hard rock, you can produce either (lithium) hydroxide or (lithium) carbonate. You don’t have to produce carbonate first.

So hard-rock offers you the capacity to produce one or the other. In China, the majority of cathodes (in lithium ion batteries) consume carbonates—although in the future, people feel like hydroxides will be the most used because the likes of Tesla and Panasonic use hydroxide,” explained Martim Facada to Design News.

Which could lead to a competitive cost advantage:

Source: Piedmont Lithium March 2019 Corporate Presentation

In any case, Albemarle has very ambitious plans to grow its lithium business in the future, first attempting to crank up LCE production from 65k tpa -> 165-175k tpa, and then eventually up to 275-300k tpa.

Even further down the line, Albemarle also owns additional assets that could make up "Wave III" someday:

From The Motley Fool.

We are also in the very early stages of assessing Wave 3 opportunities, which are largely new resources including Kings Mountain, North Carolina; Antofalla, Argentina; and other prospective opportunities in our pipeline.

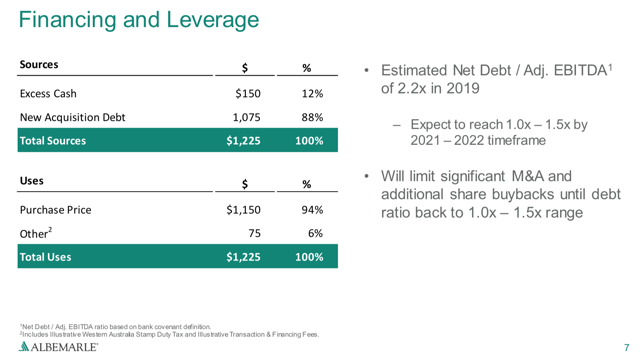

Now, all of this planned future lithium production growth won't come cheap, and Albemarle has an estimated net debt/adjusted EBITDA of 2.2x in 2019, which the company expects will decrease back to the 1-1.5x range, in the 2021-2022 timeframe; presumably, there will not be any meaningful share buybacks and Mergers and Acquisitions (M&A) taking place for the company until at least "Wave I" expansion is completed.

Source: Albemarle Investor Lithium Joint Venture in Western Australia Presentation

For 2019 CAPEX expenses, Albemarle shared the latest details on the Q1 conference call:

Capital expenditures during the first quarter were $216 million, on track with expectations. With the ramp of spending on Kemerton, continued buildout of La Negra and the early stages of the Salar yield improvement project, we continue to expect full year CapEx to range between $800 million and $900 million.

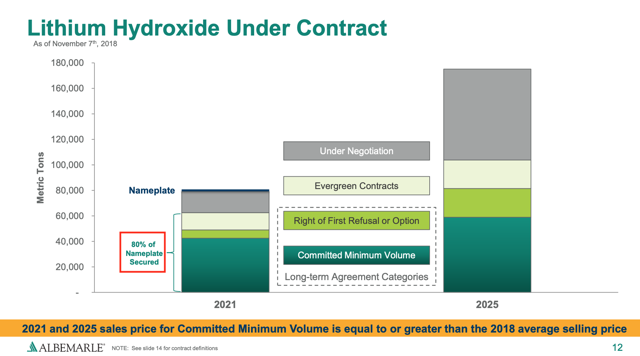

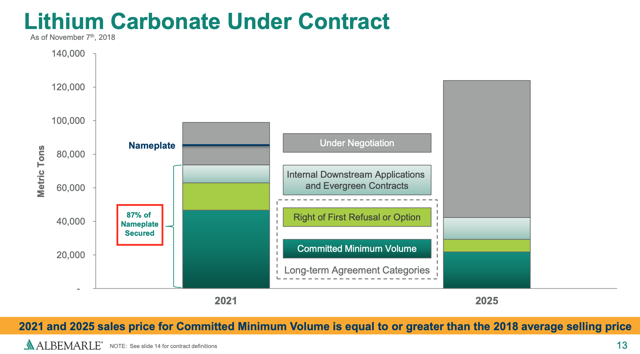

Now, as it pertains to selling lithium, unlike other commodities (e.g., gold), there really isn't a spot market to sell into, so increasing production capacity doesn't really mean much unless a company can lock-in Binding Offtake Agreements (BOAs) with end users/customers.

In the case of Albemarle, currently 80% of lithium hydroxide nameplate capacity for "Wave I" is secured.

Source: Albemarle May 2019 Corporate Presentation

And a further 87% of lithium carbonate nameplate capacity has been secured for "Wave I".

Source: Albemarle May 2019 Corporate Presentation

Worth noting, for both lithium hydroxide and lithium carbonate, the company states the following:

"2021 and 2025 sales price for Committed Minimum Volume is equal to or greater than the 2018 average selling price."

Which should help Albemarle put in a more solid "floor" to a market where declining lithium prices has been the on-going trend in recent memory.

The Search for Value

For speculators interested in the fast-emerging EV/lithium story, a leading cash-generating lithium producer (with immense growth potential on the horizon), such as Albemarle, could be an interesting company to follow; with that said, shares of ALB might also further intrigue value investors since the stock pays a regular dividend (Albemarle is a newest member of the Dividend Aristocrat family, having increased dividend payouts for 25 years straight).

ALB has a forward dividend yield of 2.32% (also, a P/E of 9.86 and forward P/E of 10.16).

Source: Morningstar

Source: Morningstar

For the next payout, shareholders of ALB will receive $0.3675/share; the ex-dividend date is June 13.

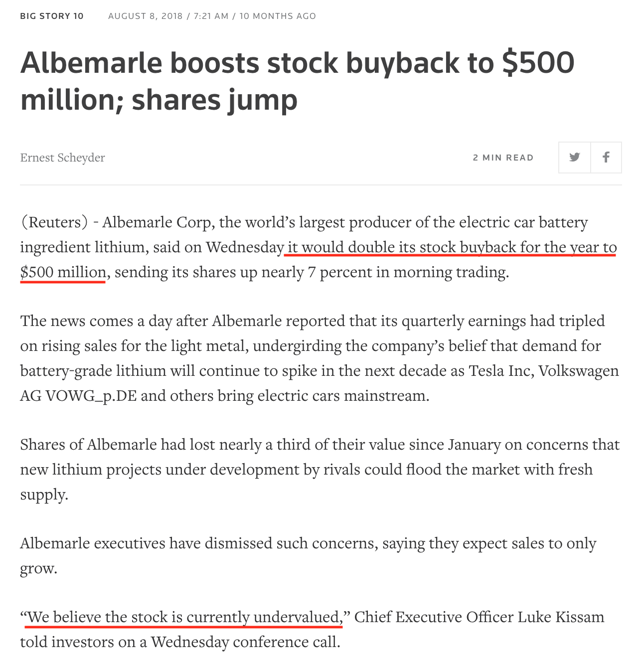

In addition, back in August 2018, Albemarle announced a stock buyback initiative to purchase $500 million worth of company stock; at that particular time, shares of ALB were trading in the ~$90/share range, but nevertheless, CEO Luke Kissam commented that, "we believe the stock is currently undervalued".

Source: Reuters

Source: Reuters

Of course, "value is in the eye of the beholder", but it's worth noting that shares of ALB are now down by -30% or so since the above story was released.

Closing Remarks

Shares of ALB have been crushed over the last ~1.5 years, down -50.51%, and are now trading at $63.29/share, the lowest level in over 3 years. However, despite all of the recent negative sentiment surrounding lithium lately, as the Q1 earnings report showed, Albemarle actually reported a higher lithium sales price than from a year ago.

Further, because Albemarle has long-term sales agreements in place with end users/customers, this should not only help dampen any volatility experienced in lithium prices, but also put a "floor" in place to better ensure the company can stay profitable, even during the tough times.

In terms of future growth, Albemarle has ambitious plans in place to crank up its production profile by bringing up its current nameplate capacity of LCE from 65k tpa to 165-175k tpa once "Wave I" is completed (targeting by the end of 2021), and then eventually to 275-300 ktpa of LCE, by means of "Wave II".

For proper context, please keep in mind that total global LCE production did not reach 300k tonnes in 2018 (and Albemarle is attempting to reach that figure on its own).

Although Albemarle's grow trajectory might sound like it's far-fetched at first glance (and in reality, it's likely going to be very difficult to execute on time), it's important to note that this new projected lithium supply is mostly all accounted for by projects in which the company already owns and has already started construction work on (i.e., Xinyu II, La Negra III and IV, Kemerton); Wodgina would be the exception (the transaction to form a joint venture with Mineral Resources is not expected to close until the second half of this year), but in any case, that's an expansion project for the longer-term (i.e., "Wave II").

By 2021, Albemarle hopes to be able to sell to market a ~50/50 split of both lithium carbonate and lithium hydroxide products, while eventually gravitating towards producing more of the latter down the road as high-nickel cathodes (e.g., NCA (like the type Tesla is using), NMC 8/1/1, etc.) progress into becoming the dominant chemistry of choice. Ideally, Albemarle's timing and transition to producing pre-dominantly lithium hydroxide will be a smooth one that coincides with the market's shift to favoring high-nickel cathode chemistries.

As sort of an added "bonus", Albemarle's growing focus on lithium hydroxide also allows the company the ability to hedge its bets on its lithium sources and jurisdictions.

Generally speaking, for Albemarle's core lithium producing assets (e.g., not accounting for "smaller" assets, such as the company's Silver Peak Mine, a brine operation, located in Nevada, not discussed in this article) diversification would primarily look something like the following:

- Hard rock (spodumene) focus in Western Australia to produce lithium hydroxide.

- Brine focus in Chile to produce lithium carbonate.

Lastly, value investors may be interested in the Albemarle story for its growing dividend (the company is a newest member of the Dividend Aristocrats family), which currently sports a forward yield of 2.32%.

So, although the share price of ALB looks especially down at the moment (trading at/near its 52 week lows), Albemarle is definitely not out by any stretch of the imagination. Behind the scenes, the company continues to put the pieces in place to ensure that it will continue to be a leading lithium producer for many years to come.

The EV paradigm shift and lithium hyper-growth story are only now just getting started; perhaps, someday down the line, we'll be able to look back and say the same was true for Albemarle as well.