2019 began much like 2018 ended for Workiva (NYSE:WK). The leading XBRL (eXtensible Business Reporting Language) service provider continued to increase revenue and client count in the first quarter of 2019. The company even raised guidance for the rest of 2019 after such an exceptional quarter.

The company also mentioned expanding their presence in Europe, as new offices opened in Paris and Frankfurt. Considering new XBRL requirements will impact European nations within the next few years, I think this a wonderful, forward-thinking decision.

However, Workiva continues to fall behind rivals when it comes to XBRL quality. Now thanks to XBRL US, all public companies can view the accuracy of their XBRL filings. This may mean bad news is on the horizon for Workiva. Before we get into the XBRL, let's discuss the company's financial results for the quarter.

Financials

In Q1 2019, the company delivered stellar financial results. The company generated revenue of roughly $70 million in Q1 2019 which is an increase of nearly 17% compared to Q1 2018. As usual, most of this revenue was generated from subscription and support revenue and the rest from professional services. Subscription and support revenue was roughly $56 million, an increase of 21% compared to prior year's first quarter. Most of that revenue came from a deeper penetration of the current customer base. Professional services revenue was roughly $14 million for the quarter, an increase of 3% compared to prior year first quarter.

Not only is revenue rising but so is client count. Workiva finished Q1 2019 with 3,366 clients, a net increase of 247 compared to Q1 2018. The company gained 26 new clients since Q4 2018. Retention remains outstanding as well, as the subscription and service revenue retention rate was over 95% (with add-ons the rate is over 110%).

XBRL - Charlie Hoffman Results

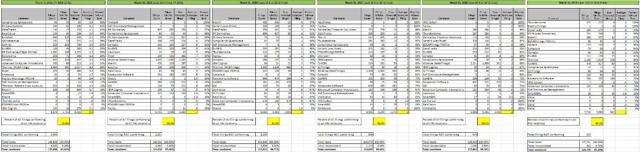

XBRL accuracy results for the current period remain consistent with prior quarters. The graph below illustrates the latest XBRL accuracy results as provided by Charlie Hoffman (For a more in-depth understanding of XBRL or Charlie Hoffman, please refer to my first article).

Data Graphic Provided by Charlie Hoffman's XBRL Blog

Hoffman also included his results over the past six years. I find this to be an interesting comparison as it further illustrates how some XBRL providers have made it a priority to improve their XBRL accuracy results. Below Hoffman's results is a simple graph I created to show the results for the top four XBRL providers over the last six years (please note some vendors have changed their names during that time frame. See my prior article which covers changes for two of these vendors).

As you can clearly see, providers, Toppan Merrill and Donnelley Financial Solutions (DFIN), made huge improvements in a two-year span. From 2014 to 2016, Toppan Merrill went from the worst results of this group to being the most accurate XBRL provider in the marketplace. Since 2016, Toppan Merrill and DFIN have continued to have extremely high XBRL accuracy scores.

Workiva has certainly improved over this duration as well. The company continues to get better each and every year. That being said, DFIN and Toppan Merrill have had accuracy results over 90% for four consecutive years, a feat which Workiva has yet to achieve. My point is that if Workiva wanted to improve their XBRL results it could be accomplished. For Workiva, it seems having the top-notch XBRL quality is not a top priority.

Comparison Data Provided by Charlie Hoffman's XBRL Blog

I'd like to next discuss the developments with XBRL US which I view as more of an issue for Workiva.

XBRL US

XBRL US helps provide new XBRL data quality rules so XBRL can be more usable and consumable. (I've touched on XBRL US in the past, so for more information please view my prior article.) Specifically, within XBRL US, there is a Data Quality Committee (DQC) who help create new common sense XBRL accuracy rules.

There is also a Center for Data Quality (CDQ). The mission of this group is to improve the use of XBRL and to support the DQC so they can improve the quality and usability of XBRL. Again, I'd like to stress that as an XBRL service provider, I think it is a must to be part of this organization.

On a recent XBRL US webinar, the company informed the public about the CDQ and thanked its supporting members. The following is a screenshot from that webcast. As you can see, Workiva is missing:

In my prior article, I stated that not being a member is a serious mistake. I still believe it is a mistake. Regardless, the company could still incorporate the new XBRL rules into Wdesk without making contributions to the CDQ. That hasn't occurred either.

Wdesk is still (technically) a data quality certified application. However, the newest DQC rule set out is rule set 8. Workiva is only certified through rule set 4 as you can see below:

The fourth rule set was available for public review in the summer of 2017 and it was likely approved in fall 2017. For clients using Wdesk, that means you haven't been in compliance with the latest rule sets for almost two years now.

During my time posting about Workiva, I've received messages which have asked me to prove that Workiva results are inaccurate. Now, thanks to the latest update by XBRL US, everyone can view a public entity's filing results to see if they have had any recent XBRL errors.

In a past earnings call, Workiva mentioned they were now doing work for Walmart (WMT). I decided to check recent filings to see if the company had any XBRL errors and sure enough there were errors:

I won't go in the specifics on these errors other than to say these could have easily been resolved if the company validated their XBRL data properly.

I decided to check other stocks listed on the Dow Jones to see the results. Workiva did the XBRL work for most of these companies. Below are the results for two companies that had issues much worse than Walmart, Caterpillar (CAT), and Verizon (VZ):

Graphics from XBRL US

As someone in the world of external reporting, I find the XBRL for both Caterpillar and Verizon to be utterly disgraceful. The companies might as well not even comply with the XBRL mandate if they're going to submit such garbage. That's all this information is garbage. The data isn't serviceable nor is it in any way helpful for investors reviewing the XBRL. With all these errors, I wouldn't be surprised if Verizon or Caterpillar get a call from the SEC about submitting this sort of information.

Now, it was harder to find Dow Jones companies that used other service providers. However, the two I found were Goldman Sachs and 3M. DFIN did the work for Goldman and Toppan Merrill for 3M. As you can see below, the results are flawless:

Graphics from XBRL US

At the end of the day, the filers are ultimately responsible for what they submit to the SEC. Wdesk, like other tools, is self-service product and thus clients can complete their XBRL filings without assistance or they can elect to purchase XBRL services.

Still, I believe many companies are relying solely on their XBRL service provider to ensure their results are accurate. Since Wdesk has not instituted the data quality rules issued by XBRL US over the last few years, it is clear that companies like Caterpillar and Verizon who are using Wdesk are filing with many, easily correctable errors. I would urge public companies to go to XBRL US and review their XBRL results. I only looked at a handful of companies but if you are using Wdesk, it is very likely you have issues as well.

Valuation

For Workiva, I believe profitability is in the distant future with their poor P/E ratio and negative earnings. Workiva's stock price has continued to soar as the stock is now over $50 and is just below its all-time high. The stock's price has now increased by roughly 100% over the last 52 weeks. Many believe this stock can continue to climb higher as analysts from CNN Business project a target price of $55 a share.

I likely would not consider buying until the stock pulled back at least 7% considering it is nearing an all-time high.

Conclusion

Workiva continues to increase revenue and grow client count. Their continuous year over year revenue growth is impressive (especially from their subscription and support business). The business growth overseas I believe will yield benefits as well. In a new market, Workiva will likely continue to boost sales and attract new foreign customers.

However, XBRL accuracy continues to be an issue. Now that XBRL US can show clients their XBRL data quality errors, I believe some clients will begin to review this information and likely begin to take their XBRL more seriously.

Workiva continues to avoid improving the quality of their XBRL validation software and they continue to avoid assisting the CDQ. Yet, revenue continues to increase. If you've read my prior articles, this is a constant trend - growth continues despite subpar XBRL. I don't believe this can continue now that XBRL accuracy results are so visible. Either Workiva will begin to comply with the latest DQC rules or they will begin to lose customers. It is that simple. Workiva cannot continue to tout themselves as the leading XBRL service provider if the results clearly show their software can't help vendors produce serviceable XBRL data.