Image Source: Equity Residential - IR Presentation

By Callum Turcan

We are actively monitoring the REIT space as the US Fed is increasingly leaning towards several interest rate cuts this year, which would greatly behoove most players in the industry. Equity Residential (NYSE:EQR) is a REIT that focuses on apartment complexes in high-density suburban and urban areas in "hot" markets that are experiencing strong economic growth, low levels of unemployment, and where workers in the area are realizing meaningful wage increases. The general idea is that by targeting these areas, Equity Residential will be able to realize solid occupancy rates while also being able to push through rent increases, enabling strong income growth. As of this writing, Equity Residential yields 2.9% and after a lackluster showing from 2015 through most of 2018, shares of EQR are tearing upwards in large part (in our view) due to the prospects of the US Fed cutting rates.

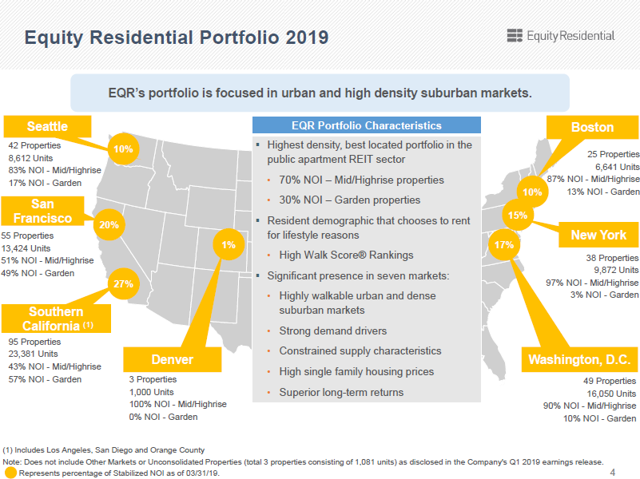

Asset Base Overview

The core markets Equity Residential operates in include Boston, New York, and Washington D.C. in the East Coast, San Francisco, Seattle, and Southern California on the West Coast, and more recently, the company "re-entered" the Denver market in the Rockies. For the most part, these are cities with dynamic economies, large highly skilled workforces, low unemployment rates, strong wage growth, and offer apartment REITs like Equity Residential plenty of quality growth opportunities. Denver fits that description as well, which is likely why the REIT is moving back into that market after acquiring three properties in the area that combined house 1,000 units (this includes a purchase of a property in January 2019).

Image Shown: Equity Residential focuses on metropolitan areas with strong growth trajectories and dynamic economies, which management sees as offering the best income-oriented opportunities for apartment REITs. Recently, Equity Residential has been moving back into Denver, a city that shares several of the same characteristics as the other markets it operates in. Image Source: Equity Residential - IR Presentation

Operational and Financial Outperformance

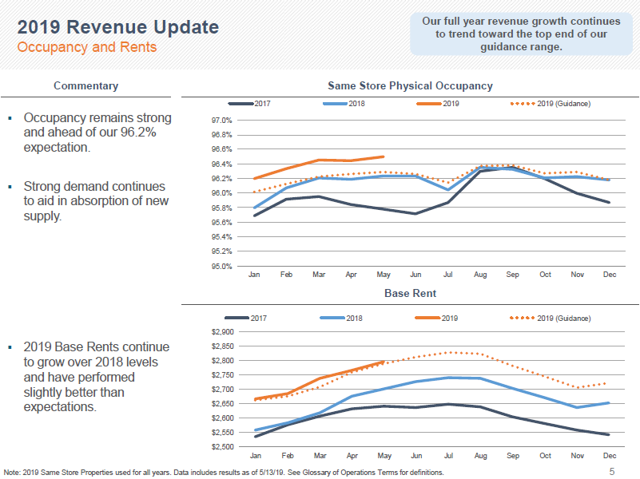

During the first quarter of 2019, Equity Residential realized same-store revenue growth of 3.3% with physical occupancy standing at a nice 96.3%. Tying into this, renewal rates are for the most part trending above 2017 and 2018 levels so far in 2019. Equity Residential President and CEO Mark Parrell noted in the REIT's press release:

"We reported operating results that exceeded our expectations driven by strong demand across all our markets combined with reduced new supply in New York and Boston… As we enter the busiest leasing period of the year, we are well positioned to deliver full year results near the top end of our guidance range if current trends continue. The strength of our business currently and our confidence in its long term prospects led our Board of Trustees to increase our common dividend by 5.1% in March 2019."

Reaching the top of its 2019 guidance would be a nice positive. Equity Residential is expecting to generate FFO (funds from operations) of $3.26-3.36 per share and $3.34-3.44 in normalized FFO per share this year. Note that in 2018, Equity Residential generated $3.14 in FFO per share (which was down a penny from 2017 levels) and $3.25 per share in normalized FFO (which was up almost 4% from 2017 levels). At the top end of management's 2019 guidance, EQR is guiding for 7% annual growth in FFO per share and 6% annual growth in normalized FFO per share, which may be obtainable as the REIT's operational trends have been quite positive so far this year.

At the midpoint of 2019 guidance for normalized FFO, Equity Residential is expecting to maintain a 67% payout ratio under its current dividend policy (when annualized). That provides for a very strong buffer in case America's economy slows down due to trade tensions or other factors, while also allowing for significant payout growth in the future. Below is a look at Equity Residential's operating performance during the first few months of 2019 to get an idea of the trajectory this REIT is on. In particular, note the REIT's outperformance versus 2018 levels and 2019 guidance.

Image Shown: Equity Residential is experiencing both high occupancy rates and rising base rents which management sees as culminating into the REIT reaching the upper end of 2019 guidance. Image Source: Equity Residential - IR Presentation

Another important update is that Equity Residential purchased three apartment properties with a combined 579 units for just under $259 million during the first quarter. To fund these types of acquisitions while also paying out most of its income to shareholders, REITs need to tap capital markets. In early-June, Equity Residential reported an at-the-money share issuance program that has the capacity to issue 13 million shares. As shares of EQR have skyrocketed year-to-date, management seeks to take advantage. The company was given an investment-grade credit rating of A3 with a stable outlook by Moody's Corporation (MCO) back in 2017, indicating the REIT should continue to retain access to capital markets at attractive rates for the foreseeable future.

We caution that this could change at any time due to the REIT's acquisitive habits. At the end of the first quarter of this year, Equity Residential's net debt load stood at $8.9 billion (defined as cash and cash equivalents less mortgage notes payable on a net basis, notes on a net basis, and lines of credit and commercial paper). Management put its net debt to normalized EBITDAre ratio at just over 5.3x at the end of the first quarter. As a heavily indebted enterprise, like most REITs, Equity Residential does come with downside risks that investors need to truly take to heart. Future dividend increases must be managed alongside Equity Residential's need to constantly tap capital markets (for funds and to refinance existing long-term obligations).

Longer-Term Initiatives

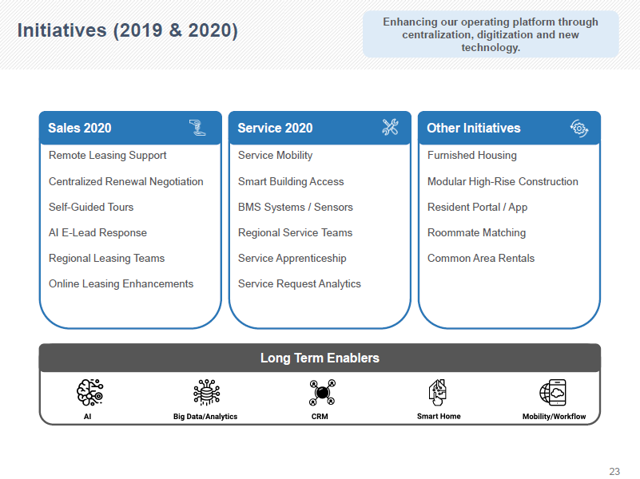

Going forward, management has several initiatives planned to enhance customer service (to encourage lease renewals), make it easier to rent (to win over potential tenants looking for housing), and ultimately to boost the bottom line. Here is a key excerpt from Equity Residential's latest quarterly conference call:

"On the initiatives front, we are focused on creating the right overall digital experience for our prospects residents and employees. During 2019, we are launching a number of new initiatives to further enhance self-service and on demand functionality in the sales and maintenance side of the business, including but not limited to a new resident portal, self-guided tours, mobility for our service teams, testing smart homes and introducing our prospects to LA, which is our artificial intelligence leasing a system. Impact from operating efficiencies gained will likely be in 2020 and 2021. These are exciting times for our industry from a technology standpoint and we are confident that redefining the digital experience and leveraging new technology in our industry will create operating efficiencies for the years to come."

Below is a look at some of those initiatives. Note that these will require modest upfront investments from Equity Residential before any meaningful upside can potentially be realized.

Image Shown: Equity Residential has several initiatives planned over the next few years. Image Source: Equity Residential - IR Presentation

Concluding Thoughts

Equity Residential's strategy is an interesting one as the REIT ties its financial success in large part to the success of several of America's fast-growing metropolises. While its yield is relatively low, management has been steadily pushing through payout increases and due to its strong payout ratio, there remains tons of room for future dividend growth. Again, we caution that Equity Residential's upside needs to be balanced against its large net debt load and potential risks involving a downturn in the US economy (which would likely pressure the REIT's financials). We aren't as interested in the idea as things stand today, but we like Equity Residential's story.