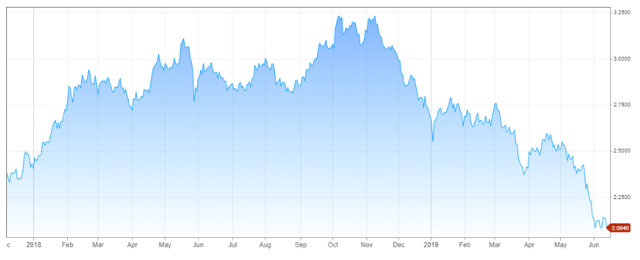

We are always mindful of macro trends and how we position our portfolio to benefit from them. Early 2019 created a dramatic shift in the market's expectations in interest rates.

Source: 10-Year Treasury Yield CNBC

Source: 10-Year Treasury Yield CNBC

After a strong move upward in 2018, interest rates have dropped even more aggressively the first half of 2019.

In a prior article, we observed,

With interest rates declining in 2019 and 2020, we expect that fixed-income investments like preferred stocks and bonds will be one of the best performing asset classes.

This belief has led us to seek out opportunities that will benefit from declining rates. Since we had previously identified "triple-net" REITs as a sector that benefits from declining rates and is somewhat recession resistant, and we are looking for more opportunities in preferred shares, American Finance Trust's (AFIN) new preferred shares American Finance Trust, 7.50% Series A Cumul Red Perp Preferred Stock (OTC:AFINP) was a natural pick for our portfolio.

In our prior article on AFINP, we liked

- The high quality of their real estate with a high percentage of investment grade tenants.

- The potential upside in their multi-tenant properties.

- The better alignment of interests preferred shares have with the external manager.

- The extraordinarily high cash-flow and asset coverage enjoyed by the preferred.

It was inevitable that sooner or later AFIN would take out some corporate level debt, and that recently occurred with the issuance of $242 million in notes that were privately placed.

We view this issuance as reinforcing our belief in AFIN's strong balance sheet as the 7-year A-1 notes were rated AAA by S&P Rating Services and bear interest at only 3.8%. The 10-year A-2 notes were rated A by S&P Rating Services and carry an interest rate of 4.5%.

The fact that AFIN is able to issue debt with such high ratings and low-interest rates is a positive sign for AFINP.

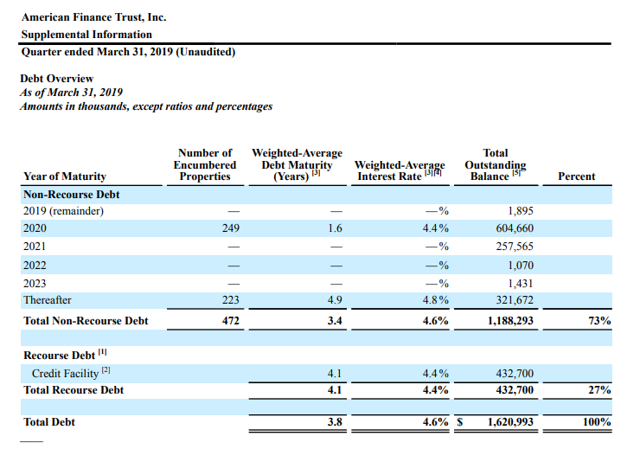

Asset Coverage

When owning preferred shares, it is always important to consider any additions of new debt that is senior to the preferred shares. Even though we do not consider bankruptcy or liquidation to be even close to being in the picture, it is always a good idea to understand what factors would impact recovery in a black-swan scenario.

Source: AFIN Q1 Supplement

Source: AFIN Q1 Supplement

AFIN's dominant debt structure is non-recourse property level mortgages. Non-recourse means that the mortgage is tied to specific property. If the property is underperforming, the borrower can hand the property over to the lender and the lender has no recourse and cannot sue the borrower for any revenues or sales proceeds associated with other properties. This feature helps insulate the portfolio if assets in a particular sector or tenant or geographic location are underperforming.

For preferred shares, it also means that in a liquidation scenario, the non-recourse lender only has priority for the specific property. Consider a liquidation where property A has a $1 million mortgage but is sold for $500,000. Property B has a $1 million mortgage and sells for $1.5 million. The lender for property A has no right to the $500,000 in excess proceeds generated from property B and would have to write off the loss.

This provides a lot of security for the preferred shares because AFIN has $1.1 billion in properties that are unencumbered. Previously, the only recourse debt that AFIN had was their revolving credit facility. So in a liquidation event, only the credit facility would have seniority for any proceeds from the unencumbered properties.

With the $242 million in new notes, that dynamic changes slightly, as the notes will have seniority over the preferred shares. The stated purpose of the notes is to pay off a portion of the credit facility. So initially, outstanding debt should not change as the credit facility is reduced by $242 million.

At the end of the first quarter, AFIN had $3.368 billion in total assets to cover $1.621 billion in debt. The preferred shares are a negligible portion of the capital structure with only $30 million in par value. Total debt and preferred coverage is in excess of 2.07x.In other words, even if AFIN sold all of their property at 50% of book value, there would be more than enough to pay off all their debt and to redeem the preferred shares at par.

Cash Flow

In terms of cash flow, the new debt creates a slight improvement in interest expense with fixed interest at 4.15% compared with a floating rate that was at 4.4% in the first quarter.

In the first quarter, AFIN saw their AFFO improve, growing 7% quarter over quarter to $26.3 million. This makes AFINP's dividend extremely safe since it will only be $2.25 million/year. This means that AFIN's annualized AFFO covers the preferred dividend over 46x.

This coverage is important because the preferred dividend has to be paid before the common shares can receive any dividend. Additionally, tax rules require REITs to distribute at least 90% of their taxable income to maintain their REIT status. Even in bankruptcies, lenders and courts usually allow distributions to maintain REIT status since it is in the best interest of all parties that it be maintained.

With a dividend that is so small in relation to cash flow, the preferred dividend is very secure in almost any imaginable scenario. AFIN would have to make less than $2.5 million in taxable income to even partially suspend the preferred dividend. With over $3.3 billion in assets and $105 million in annual AFFO, that just isn't going to happen.

AFIN's interest EBITDA coverage will remain in excess of 2.6x, leaving more than enough for the company to comfortably pay not only the preferred dividend but also their common dividend.

It is these types of strong credit metrics that caused S&P to provide AAA and A ratings for the notes.

Looking To The Future

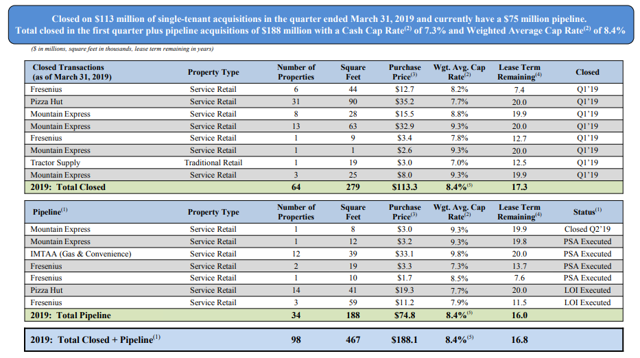

Source: AFIN Presentation

Source: AFIN Presentation

The funds that AFIN borrowed on their credit facility were used to acquire properties at a weighted average cap rate of 8.4%. These properties have very long lease terms, from 7.4 to 20 years. Since they can borrow money in the low- to mid-4% range, these acquisitions will be AFFO positive from day one.

In fact, AFIN covered the common dividend with AFFO in the first quarter and we expect that the common dividend coverage will improve as the year goes on. The improving cash flow is obviously bullish for the preferred shares, though since the acquisitions were primarily paid with debt from the revolver, they do not improve asset coverage unless the property values improve.

One thing that is very likely is that AFIN will look to issue more common equity in the second half in order to pay off the remaining balance on the credit facility. While this would be dilutive for common shareholders, it would be beneficial for preferred shareholders by improving asset coverage.

AFIN continues to grow their NNN portfolio, and occupancy ticked up from 99.4% to 99.5%. With 74% of the tenant's investment grade or investment grade equivalent, this is a strong portfolio that will provide AFIN a stable base for decades.

Triple-net leases are great for landlords because most of the property level expenses are the responsibility of the tenant. With very long-term leases, that usually have several extension options, the tenants have an invested interest in the property and are responsible for its care. This dynamic creates a stable flowof cash for the landlord with little risk. This is the same type of business that Realty Income (O), Spirit Realty (SRC) and National Retail Properties (NNN) are involved in.

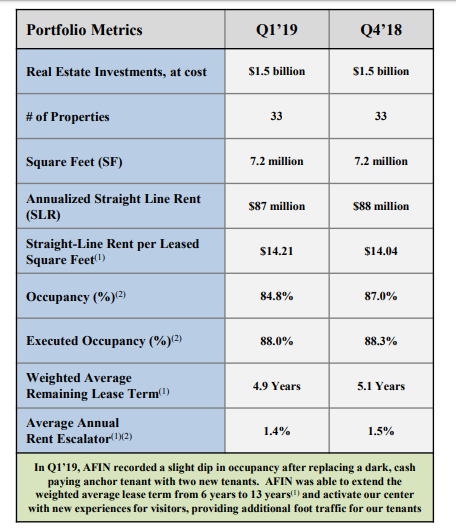

Source: AFIN Presentation

Source: AFIN Presentation

AFIN's multi-tenant properties had a slight dip in the first quarter, but this was due to them negotiating a lease termination with an anchor tenant that was paying rent but was not occupying the store. AFIN negotiated a deal to let the tenant out of their remaining lease, allowing them to move in two new tenants that will pay rent in future quarters.

As part of the deal, the previous tenant will pay a termination fee that will be enough to cover the conversion costs for the new tenants and more than a full year's rent in excess proceeds. This is the benefit of leasing to tenants with strong credit ratings: Even when the tenant chooses to close the store, they continue paying rent and are often willing to pay a significant sum to get out of a longer-term lease.

The multi-tenant property occupancy has room to increase and will provide upside for AFIN.

Dispositions

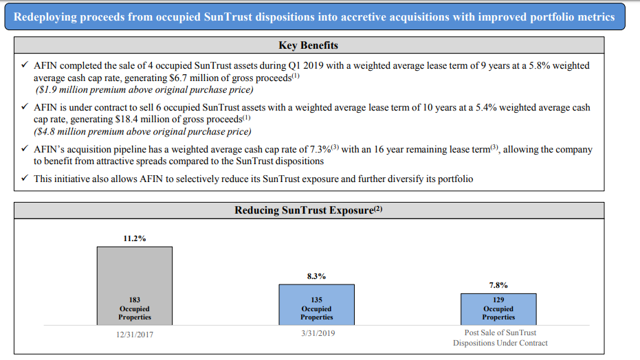

In our prior article, we discussed how we prefer that triple-net REITs keep their exposure to a particular tenant under 5%. This is one rule of thumb that AFIN has been violating with SunTrust Bank (STI).

Source: AFIN Presentation

Source: AFIN Presentation

Fortunately, this "problem" is one that AFIN has been solving in a very profitable way. AFIN sold four properties in the first quarter and is under contract to sell an additional six properties. These transactions are being done at cap rates in the 5% range, and they are able to redeploy the proceeds into higher yielding properties that also have longer lease terms.

We expect that AFIN will continue to sell these properties opportunistically at substantial profits that can be redeployed, and will be under 5% exposure by the end of 2020.

Conclusion

AFIN continues to have a premium quality portfolio, invested primarily in triple-net lease properties leased to investment grade tenants. With cash flow improving and AFFO finally covering their common dividend, the preferred shares are in a stronger position today than they were even a few months ago.

The introduction of debt that is senior to the preferred shares was inevitable, however, it is highly rated at AAA and A by S&P. Clearly, S&P saw the same strengths in the balance sheet that we saw. It is great that AFIN is able to access debt at such attractive prices relative to the yields they can invest at.

We remain very confident in the preferred shares having strong asset coverage over 2.07x, with an even better cushion when we consider that the bulk of debt is non-recourse. AFFO coverage is incredibly high at over 46x and growing. This provides us great assurance that the preferred dividends will continue to get paid.

AFIN is firing on all cylinders and the only thing that keeps us away from the common shares is their external manager AR Global. AR Global has a history of issuing common equity at unattractive prices. With a balance on their credit facility that will not be paid in full with the new notes, we believe that AR Global will repeat what they have done with other REITs they manage, like Global Net Lease (GNL), and issue shares sooner rather than later.

While dilutive for common shareholders, an equity issuance to reduce debt is beneficial for preferred shareholders.

AFINP goes ex-dividend for the first time on July 2, with the dividend payable on July 15.The ex-dividend date is less than two weeks from today, and it will be slightly oversized, accounting for more than a full quarter of time due to the timing of the IPO. With approximately $0.45 in accrued dividends, AFINP is a strong buy under $25.60. Investors can lock in a 7.5%-plus yield with a company that has a strong portfolio, limited debt and great future potential.

High Dividend Opportunities, The #1 Service for Income Investors and Retirees

We are the largest community of income investors and retirees with over 2700 members. Our aim is to generate high immediate income. We recently launched our all-Preferred Stock & Bond portfolio for safe high-yields ahead of a weaker economy and market volatility.

Join us today and get instant access to our model portfolio targeting 9-10% yield, our preferred stock portfolio, our bond portfolio, and income tracking tools. You also get access to our report entitled "Our Favorite Picks for 2019"