Market narratives often persist in the face of contradicting data (for instance, the "Retail Apocalypse"). Doing your diligence helps maintain the objectivity needed to see when a narrative is wrong and if there is value in a particular sector or stock.

This firm has been steadily growing profits, is more efficient than its peers, and should benefit from a structural shift in the way it customers do business. However, overblown fears of a housing crash have the stock priced as if profits will be nearly cut in half. Builders FirstSource (NYSE:BLDR) is this week's Long Idea.

Long-Term Track Record of Profit Growth

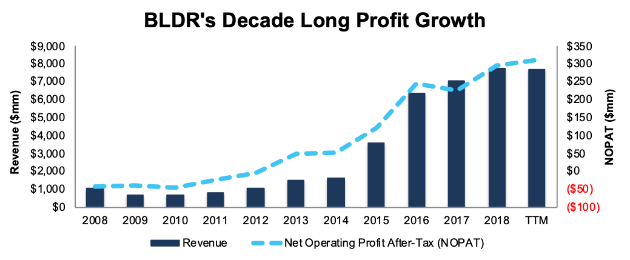

Investors who focus solely on headlines may be surprised to learn that BLDR has consistently grown profits, both in the years after the housing crash and recently. Since 2015, BLDR has grown after-tax operating profit (NOPAT) by 35% compounded annually. Trailing twelve month NOPAT of $310 million is up 26% year-over-year. Long-term, BLDR has grown NOPAT by 32% compounded annually since 2007.

Figure 1: BLDR's Revenue & NOPAT Since 2008

Leveraging Leading Market Share and A More Efficient Business

BLDR has managed to achieve a level of scale and market share that is rare in the highly fragmented professional building materials industry. Through its strategic acquisition of ProBuild in 2015, which more than doubled the firm's revenue, Builders FirstSource became the largest supplier of structural building products for new residential construction and repair and remodeling in the United States.

In the 2018 ProSales 100, which ranks all professional building suppliers, regardless of product type, by sales, BLDR ranked second, with a 13% market share. The top firm is ABC Supply, a roofing and siding manufacturer, and not a competitor of BLDR. Its closest competitors, BMC Stock Holdings and 84 Lumber each earned a 6% share of the overall professional building suppliers market.

Get our long and short/warning ideas. Access to top accounting and finance experts.

Deliverables:

1. Daily - long & short idea updates, forensic accounting insights, chat

2. Weekly - exclusive access to in-depth long & short ideas

3. Monthly - 40 large, 40 small cap ideas from the Most Attractive & Most Dangerous Stocks Model Portfolios

This paper compares our analytics on a mega cap company to other major providers. The Appendix details exactly how we stack up.

Harvard Business School featured our unique technological capabilities in “New Constructs: Disrupting Fundamental Analysis with Robo-Analysts”.