Introduction

This article is a refresh and an update of an article I originally posted in 2015. However, the principles I am presenting are timeless and worthy of being revisited. Moreover, I have updated the supporting examples to more precisely reflect our current market environment.

Managing an investment portfolio is a very personal matter. Consequently, the most important consideration is to design a portfolio that meets your own unique goals, objectives and risk tolerances. Everyone is different, and consequently, every investment portfolio can and should be appropriately different as well. Stated more straightforwardly, I do not believe in cookie-cutter or one-size-fits-all approaches to portfolio design.

In the same vein, I believe that investment portfolios, especially retirement investment portfolios, should be designed and constructed to meet the specific needs of the individual it is built for. In some cases, the objective might be current income and safety. In other cases, the objective might be the necessity to earn the highest possible rate of return. Importantly, the most appropriate objective for each individual case will often be driven by factors that are external to the portfolio itself.

Two of the most important external factors are the size of the portfolio relative to the investor's needs, and/or the amount of time the investor has before entering the withdrawal phase. These important factors are the major contributors regarding whether the individual will be required to harvest principle upon retirement, or whether they will be able to live comfortably off the income their portfolio can prudently generate.

Of course, the optimum scenario belongs to the prudent planner and disciplined saver that started early and built up a portfolio over time that can generate more than enough income to live off during retirement. More simply put, the larger the size of your portfolio, the more options you have. For example, if you have amassed a portfolio that is large enough to generate more income than you need to live off, you can position your portfolio as riskless as possible if you so choose.

On the other hand, if you have determined that you must continue to grow your assets to meet your needs, then you will be required to take on more risk. Therefore, I believe that the best investment advice that any individual can receive is to start early and save regularly. Whether you are inclined to invest in equity (stocks, real estate, etc.) or debt (bonds, CDs, etc.), the sooner you start, and the more often you contribute, the more you will accumulate over time. I am a firm believer that no matter what type of investment you choose, "time in" is more relevant and better than "timing."

Nevertheless, and with the above stated, this article is oriented to those investors that have had the good fortune to amass assets large enough to comfortably live off in retirement. However, the specific size that a portfolio needs to be will also differ from one individual to the next. Some people desire or require lavish lifestyles while others will be more modest with their needs. Regardless, the primary focus of this article will be on implementing portfolio design principles that apply best practices for achieving yield or income.

Principle Number 1: Be Realistic with Your Yield Objective

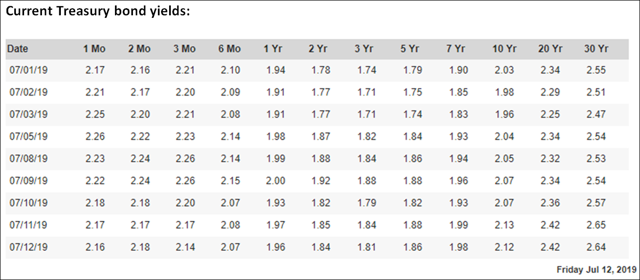

Establishing a realistic assessment of available current market yields should be the first step that every investor investing for income should take. From my perspective, this takes precedence over calculating the yield you require from your portfolio in order to meet your needs. Therefore, I believe the best place to start is by examining the yields available from Treasury bonds, widely considered the least risky investment of all. An intelligent baseline and perspective of the yield you can realistically achieve on your portfolio is best established by being fully cognizant of the yields that the lowest-risk investments provide.

The following snapshot taken from the US Department of the Treasury shows the current yield on Treasury bonds as of July 12, 2019:

Current Treasury bond yields

After establishing the yields available from the lowest-risk fixed-income investments, it is then prudent to move on to and conduct a review of the lowest-risk dividend-paying equities. Regarding equities, the current yield of the S&P 500 sits around 2%. Furthermore, a review of the yields available on the prestigious dividend growth stocks comprising the S&P Dividend Aristocrats are a sensible place to focus your search.

After establishing the yields available from the lowest-risk fixed-income investments, it is then prudent to move on to and conduct a review of the lowest-risk dividend-paying equities. Regarding equities, the current yield of the S&P 500 sits around 2%. Furthermore, a review of the yields available on the prestigious dividend growth stocks comprising the S&P Dividend Aristocrats are a sensible place to focus your search.

The S&P Dividend Aristocrats constituents currently offer yields ranging from a low of .5% to a high of 6.09%. However, I would argue that the sweet spots of blue-chip dividend growth stocks are 2% to 3%. For those more interested in growth, the 2% current yield is more often associated with higher growth potential, while the 3% current yield is more associated with moderate growth and above-average income. However, prudent investors can also combine these appropriate dividend growth stocks with higher yielding equities such as REITs and/or MLPs if you don’t mind the K-1s. From my perspective, reaching for yields beyond the above quoted numbers requires taking on more risk than many retirees should be willing to take.

With those numbers in mind, I believe a conservatively-oriented retirement portfolio can figure on a blended average dividend yield without taking on undue risk of between 3 and 4%. But most importantly, they could also conservatively expect a growth yield (yield on cost increase) of 6 to 8% going forward. I would consider these numbers prudent, and realistic given today’s yield environment.

Of course, as I previously mentioned, there are higher yields than what I’ve described above available, however, in order to receive those higher yields, you must also be willing to go higher up the risk ladder. If your personal situation requires that you take on that extra risk, then I recommend being very diligent with your ongoing research and due diligence. High-yield, high-risk investments can be very volatile even over the short run.

However, there is an important consideration when examining the yields on dividend-paying equities that is not required when examining fixed-income yields. When examining the yields on blue-chip dividend paying stalwarts, it is important to evaluate current valuation. In other words, it's important to determine what dividend yields are available from blue chips when they are fairly valued. Additionally, it's also important to evaluate available yields on blue chips with different growth potential characteristics.

The following are representative examples of the current range of higher-yielding, moderate-yielding and lower-yielding blue-chip dividend growth stocks. I believe these examples provide a realistic and prudent range of the yields currently available that can be researched with the objective to construct a realistic and appropriate yielding retirement portfolio. However, I am also including examples that may not be appropriate for retirement portfolios.

Later in part 2 of this series, I will discuss different strategies of integrating fairly-valued dividend-growth stocks into retirement portfolios in order to meet various income objectives.

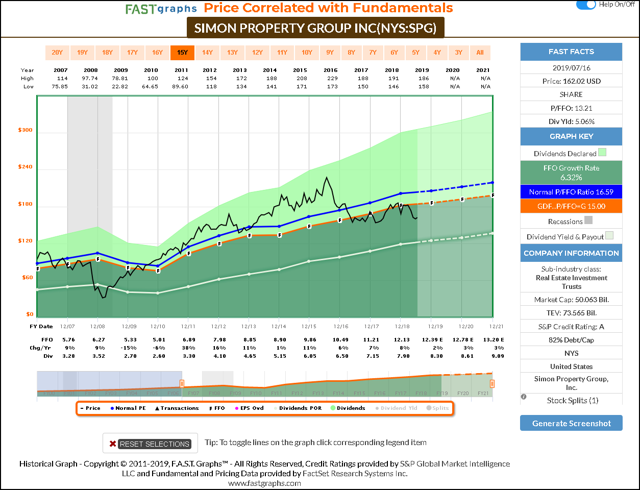

Simon Property Group (SPG): Higher-Yielding Quality REIT Appropriate For Retirement Accounts

Simon Property Group is a high-yielding and high-quality REIT. But most importantly, it is currently available at a very attractive valuation. Consequently, I suggest that it represents an excellent candidate to not only turbocharge the yield on your retirement portfolio, but also provide above-average long-term capital appreciation as well.

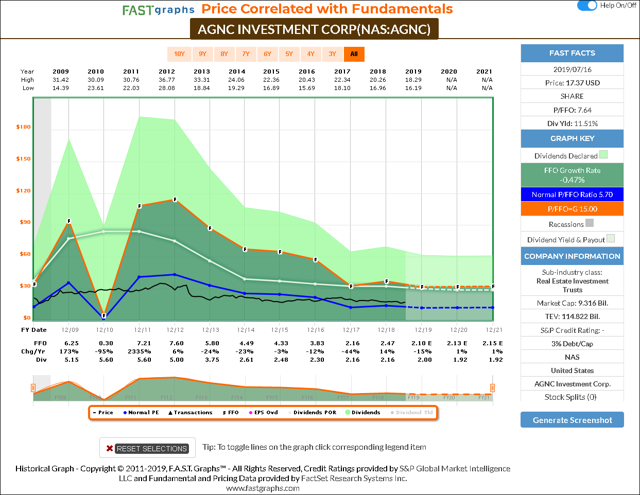

AGNC Investment Corp. (AGNC): A High-Yield Higher Risk REIT Questionably Appropriate

AGNC Investment Corp. (AGNC): A High-Yield Higher Risk REIT Questionably Appropriate

In contrast to high-quality Simon Property Group, AGNC Investment Corp. is a mortgage REITs that utilizes leverage. Statistically, this investment looks quite enticing. Its price to FFO is very low at 7.64 and its current dividend yield is 11.51%. Although S&P is not given the credit rating, and only shows 3% debt to capital. Therefore, at first glance it statistically appears to be a phenomenal income investment.

However, closer scrutiny will illustrate that the company has significantly cut its dividend several times since 2009. Additionally, FFO has a negative growth rate over that same timeframe. Later in the FAST Graphs analyze out loud video, I will elaborate on its historical performance. Importantly, a historical review of AGNC’s performance will clearly illustrate the risk as well as the opportunity of investing in this extremely high-yield investment.

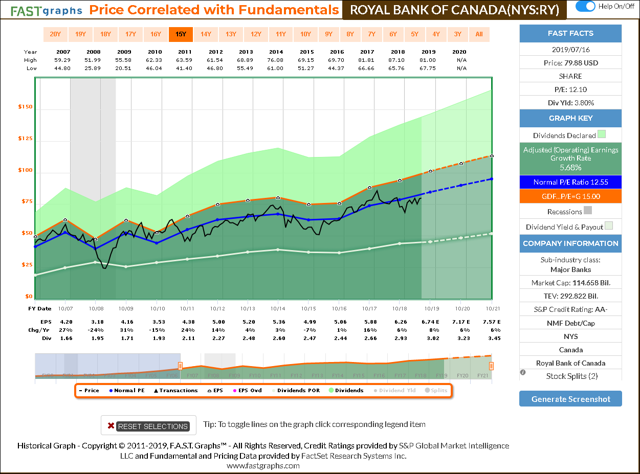

Royal Bank of Canada (RY)

Royal Bank of Canada (RY)

Royal Bank of Canada represents an opportunity to invest in a fairly valued high-quality above-average yielding financial. The company is AA- rated and trades at a blended P/E ratio of 11.8, which is below its traditionally low normal P/E ratio of 12.73.

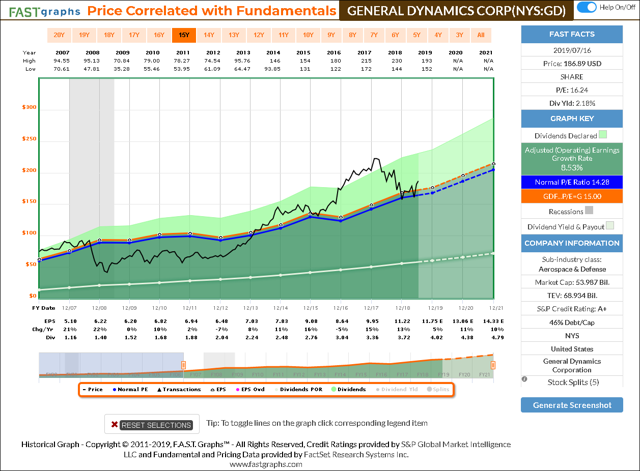

General Dynamics Corp. (GD)

General Dynamics is a high-quality dividend growth stock that is fully valued offering a slightly above-market dividend yield. However, this example represents an opportunity to invest in an above-average growing blue-chip for a predictable above-average future total return.

Later in the video, I will utilize this example to provide a profound insight into just how important valuation is to future returns. I have recently come across several comments where investors suggest that holding a stock for the long run is more important than initially purchasing it at an attractive valuation. In the video, I will show just how wrong that type of thinking really is. Time in the market is critical and important, but buying at sound valuation is even more important.

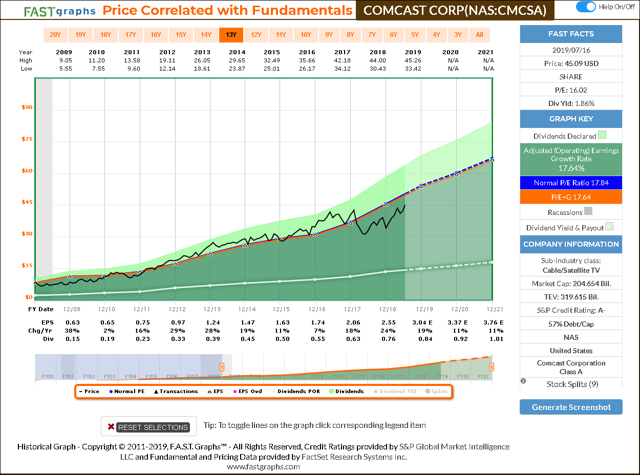

Comcast Corp. (CMCSA)

The Comcast Corp. example represents a faster-growing blue-chip dividend growth stock with a slightly below-market yield. This type of dividend growth stock can be very appealing to dividend growth investors still in the accumulation phase. Although this company has only been paying a dividend since 1999, its dividend growth yield (yield on cost) has consistently grown at approximately 20% per annum.

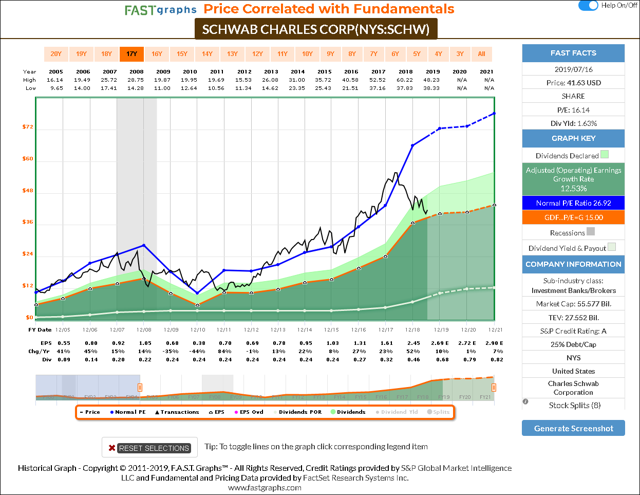

Charles Schwab Corp. (SCHW)

I included Charles Schwab Corp. in order to provide an example of a high-quality blue-chip dividend growth stock that appears reasonably attractive on the surface, but may not be appropriate for retirement accounts when scrutinized more closely. The company is A rated, and has a low debt to capital ratio of 25%. Although the company has historically been awarded a premium valuation by the market, its current valuation, although historically low, does not appear attractive relative to future expectations for growth.

At this point, we now have a perspective on the yields that are currently and generally available from the most conservative fixed-income and reasonably-valued dividend growth stocks. Since these are, in theory at least, the lowest-risk equity and fixed-income options available, we can utilize this information as a guide towards assessing risk as we seek suitable income-producing investments.

At this point, we now have a perspective on the yields that are currently and generally available from the most conservative fixed-income and reasonably-valued dividend growth stocks. Since these are, in theory at least, the lowest-risk equity and fixed-income options available, we can utilize this information as a guide towards assessing risk as we seek suitable income-producing investments.

Additionally, we have discovered that the highest-quality fixed-income investments offer very low current yields even if we purchased the longest maturities. Therefore, if we are assessing investment opportunities in bonds, we should immediately recognize that any bond offering current yields in excess of our low-risk baseline would logically contain higher risk. However, for the purposes of this series of articles, I will be excluding any further discussion on bonds and focusing exclusively on the dividend and dividend growth component of a retirement portfolio.

Regarding the high-quality dividend stocks examined above, their current yields range from 1.63% to 11.51%. However, as a general statement, growth expectations are higher with the lower-yielding equities and vice versa. This is an important perspective depending on whether the individual investor is more in need of capital appreciation or current income. On the other hand, my examples also include exceptions to that general statement. As with all rules of thumb, there are always exceptions.

Finally, the important point behind this exercise is that we now have a clear understanding and knowledge of a reasonable and general range of dividend yields we can expect from high-quality equities. Therefore, later when we start talking about specific portfolio construction, we should be clear about the yield options available to us. Consequently, we are protecting ourselves from the temptation of yield chasing because we are unmistakably aware that anything outside our established prudent yield range implies significant risk.

Video covering the example stocks referenced above

The above are simply pictures of the graphs of the sample companies I chose to illustrate the various opportunities available with dividend growth stocks. Clearly, I did not even begin to touch the surface of the various options that are available. The reader should be fully cognizant of that fact. Nevertheless, the real value of those examples will be more fully and clearly expressed by watching the following short video. Although a picture’s worth a thousand words, a video is worth many more. Please don’t skip the video, because this is where the true information and analysis can be found in this article.

Principle Number 2: Determine How Much Income Your Portfolio Needs To Produce

The second step after determining the range of prudent yields available is to calculate how much income we need to live off of in retirement. As previously suggested, this calculation will vary from one individual to the next. Once we have determined how much income we will need, we should take an inventory of any sources of income we have outside of our retirement portfolio. For most retirees, this will be Social Security. However, income sources can also include pensions, rental income from real estate properties, interests in businesses, etc.

These income sources should be subtracted from our gross income need in order to determine how much income our retirement portfolio needs to generate. For example, if an individual has determined that they need $75,000 worth of income in order to retire comfortably, and are receiving $25,000 worth of Social Security income, then their portfolio would be required to generate an additional $50,000 worth of income.

Once this has been accomplished, the process of determining the yield that your equity portfolio must generate is a simple process. You simply divide your income need by your total portfolio value and that will determine the overall yield your portfolio must generate. Staying with the example presented above, if you had a $1 million portfolio, you would simply divide your $50,000 supplemental income need by $1,000,000 and determine that your portfolio must yield 5%.

Now, here is where things get tricky, and also why this simple process is so important. Based on the previously discovered ranges of yields available from conservative equities, it's imperative that we understand that a 5% yield target on our equity portfolio would require an aggressive higher-risk strategy. Consequently, we should immediately realize that we only have limited realistic options if our goal is to have our portfolio fund our retirement without harvesting principle.

Therefore, we must either be willing to accept a lower level of retirement income, or we must be willing to take on the excessive risk required to generate our 5% yield target. If neither of those options are acceptable, then we must accept the fact that we will be required to harvest assets in order to supplement and fund our desired standard of retirement living.

For additional perspective, let's utilize the same above example but with a larger accumulated portfolio. If the individual had accumulated a $2 million portfolio and was receiving the same $25,000 per annum of Social Security and had the same $75,000 income need, the math works much better. In this case, if you divide the $50,000 supplemental income need by the $2 million portfolio value, you discover your portfolio only needs to earn 2.5% to meet your goal. Based on the range of high-quality dividend yields available currently, the 2 ½% target yield is both realistic and comfortable, if not easily achievable.

Even better, as I will illustrate in part 2 of this series, a 3% current yield is currently very achievable and would offer a total level of supplemental income greater than our established need. There are numerous advantages when a portfolio produces more income than is needed. These would include, but are not limited to, excess capital available for additional investment in order to provide a greater margin of financial security, and/or discretionary income that can be utilized for luxury purchases. Perhaps the sports car you always wanted but do not need, or a first-class luxury vacation.

Finally, we should not forget the fact that a properly designed dividend growth retirement portfolio should experience a steadily increasing level of dividend income each year. Therefore, a properly designed dividend growth retirement portfolio will fight inflation from the growth and income alone, and any capital appreciation would represent a bonus above that.

The Advantages And Benefits Of A Retirement Portfolio Capable Of Producing Enough Income

Although there are many investing strategies and philosophies that people can choose to follow, there is one that beats them all. Those wise and prudent people that started saving early in life are typically the ones that amass retirement portfolios capable of meeting their long-term needs. The simple act of putting away even a little bit of money every month reaps huge benefits over time. Unfortunately, far too many people lack the discipline or wisdom to execute a sound long-term retirement plan.

However, those people that have been prudent enough to save and plan wisely for retirement are blessed with many incredible and important investing options. Perhaps the most important of all is that they are empowered to take on less investment risk at precisely the time when they shouldn't be taking any risks.

There is a general investing principle that applies. Investing for income, and investing in income-producing investments are generally less risky than investing for growth or in growth-oriented investments. In the same vein, generating a growing income stream through investing in dividend-growth stocks is more predictable than investing for capital appreciation or total return. High-quality dividend growth stocks with long histories of growing their dividends every year can continue to produce a higher rate of income even if the prices of their publicly-traded stocks are dropping. In retirement, a predictable growing income stream is of paramount importance.

Summary and Conclusions

The primary focus of this series of articles is directed to retired investors that have amassed portfolios capable of producing the income they need to support themselves after they've quit working. The two primary principles I've articulated in this part 1 are offered as fundamental principles to consider and apply when designing or constructing their retirement portfolio. These principles can be utilized to reconstitute a portfolio that has previously been more growth oriented when in the accumulation phase. Additionally, these principles can be utilized to effectively manage the portfolios of already retired investors focused on income.

Some readers might consider the advice offered in this article too fundamental or elementary. However, a lesson we can all learn from professional athletes is the importance of focusing on fundamentals. For example, I am an avid golfer and often take lessons from a professional instructor. I'm embarrassed to admit that for many years his instruction always started out by correcting my grip on the golf club. Over and over again, he would remind me that everything good with a golf swing happens and starts with the correct grip. I believe the two primary principles presented in this article are analogous to the successful management of a retirement portfolio, just as the proper grip is to a sound golf swing.

Consequently, regarding the first fundamental principle I presented, I suggest that it is critical to have a clear and realistic perspective on what the markets are capable of providing. When you are clear on what a prudent portfolio is realistically capable of providing, you can make sound decisions and avoid critical mistakes. This is especially true for investors focused on income. For example, when you understand that a 3% current yield is all that is prudently available, you are less likely to be tempted to invest in entities offering aggressive yields of 10% or better. As the old saying goes: "when something appears to be too good to be true, it probably is."

Regarding the second fundamental principle I presented, it's far easier to choose appropriate investments when you have a precise understanding of what you need. Like the recently deceased Yogi Berra once said "if you don't know where you're going, how are you going to know when you get there."

In part 2, I will present various strategies and approaches on how to construct a retirement portfolio that can produce the income you need commensurate with the amount of risk you are willing to assume. As I indicated in the introduction, there is no cookie-cutter or one-size-fits-all approach that works for everyone. Therefore, my objective will be to provide conceptual strategies that can be uniquely applied to meet each individual retired investor's income needs.

If you enjoyed this article, scroll up and click on the "Follow" button next to our name to see updates on our future articles in your feed.

If you’re primarily interested in investing in high-quality dividend growth stocks, I would like to respectfully suggest looking at The Dividend Kings. The service is dedicated towards identifying the highest-quality dividend growth stocks that can be purchased at sound and attractive valuations. Take advantage of our 14 day free trial and see how we can help you identify the most attractive blue-chip dividend growth stocks for your portfolios.