The recent decline in the enterprise value of Telenav (TNAV) is not justified. The company may report less revenue with General Motors installing Google (GOOG) apps in its vehicles. The market pushed the company's EV/sales ratio down to illogical levels. It's trading below 1x sales with an enterprise value of $170-$180 million. Bear in mind that in fiscal year 2019, revenue was equal to $220 million, and General Motors was only responsible for 18% of the company's revenue.

Business And Customer Concentration

Founded in 1999, Telenav offers wireless location-based services for vehicles. The company provides its connected car platform and sells its services to automobile manufacturers and suppliers.

Source: Company’s Website

Telenav has three business segments: Automotive, advertising, and mobile navigation. Most of the company's revenue is generated from the delivery of software. A smaller amount of revenue is generated from brought-in automotive navigation solutions, advertising solutions, and mobile navigation.

Source: Company’s Website

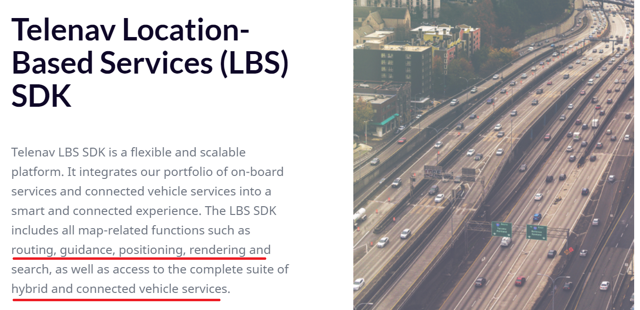

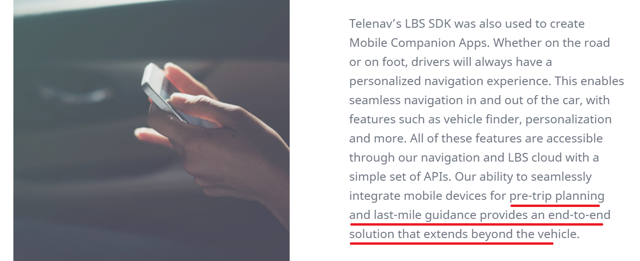

The lines below offer information on the map-related functions provided by Telenav's software. Besides, note that the company provides a mobile app and different APIs, which extends beyond the vehicle.

Source: Company’s Website

Source: Company’s Website

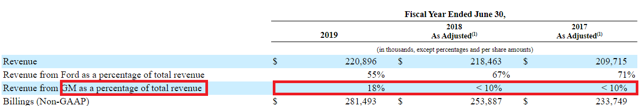

In our view, Telenav reports high customer concentration, which, in our opinion, is the company's most significant risk. As shown in the image below, the company works for several car manufacturers, but two companies (Ford (NYSE:F) and General Motors) are a source of a large amount of revenue.

We provide our connected car products and services directly to automobile manufacturers such as Ford Motor Company and affiliated entities, General Motors Holdings and its affiliates, or GM, Toyota Motor (TM), or Toyota. We also provide our products and services indirectly through tier ones such as Xevo, Inc., or Xevo, for certain Toyota solutions; LG Electronics, Inc., or LG, for certain Opel solutions; and Panasonic Automotive Systems Company of America, or Panasonic, for certain Fiat Chrysler Automobiles, or FCA, solutions. Source: 10-k

In the year ended June 30, 2019, Ford was responsible for 55% of the total amount of revenue, and General Motors was responsible for 18% of the total amount of sales. The table below offers further information on the matter:

Source: Company’s Website

With this information in mind, the biggest fear of shareholders will most likely be that Telenav may lose its relationship with Ford or General Motors. As a result, the valuation of the company could decline a bit.

The Relationship With General Motors

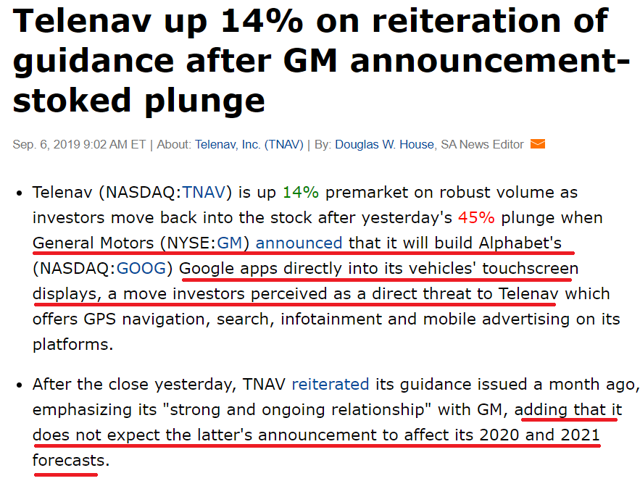

General Motors announced that it would install Google apps directly into its cars' touchscreen displays. As a result, in September 2019, Telenav lost more than 40% of its market capitalization. Check the image below for more on the massive value destruction:

Source: Seeking Alpha

As shown in the lines below, Telenav accepted that the decision made by GM would damage its revenue line. Sales are not expected to be affected until 2022. However, the market usually reacts to dovish information as it is known. Most analysts will accept that the share price declined. With that, we wondered whether valuation lost is excessive.

Source: Seeking Alpha

As mentioned above, in 2019, the total amount of revenue from GM was equal to only 18% of the total amount of revenue. With this in mind, the loss of valuation does not make sense. We would have expected the company to lose 20% or even 30% of its enterprise value. The chart below shows that the company lost ~60% of its total enterprise value:

Source: Ycharts

That's not all. In the last annual report, the company noted that both Ford and General Motors included Apple's CarPlay and Google's Android Auto on some of their vehicles. With this in mind, the reaction of the market is even more surprising. Market analysts were most likely expecting that General Motors will use products from Google. Read the lines below for more information on the matter:

Ford offers Apple’s CarPlay and Google’s Android Auto on its vehicles in North America equipped with its SYNC 3 platform and announced that Waze is available on its vehicles equipped with the SYNC 3 platform, which may reduce the number of vehicle purchasers who purchase built-in navigation services. GM also offers Apple’s CarPlay and Google’s Android Auto on most of its vehicles in North America. Source: 10-k

Small Revenue Growth And FCF Growth

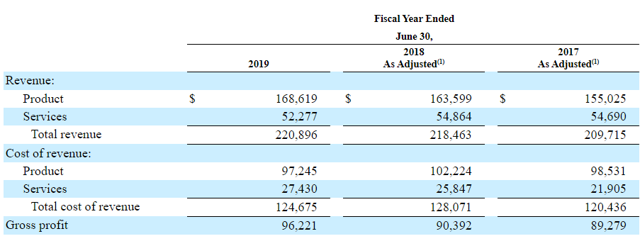

The company's revenue growth will not impress most growth investors. In 2019 and 2018, revenue increased by 3% and 5%, respectively. With that, what's favorable on the company's business model is the gross profit margin. In 2019 and 2018, it was equal to 43% and 41%, respectively.

As shown in the table below, Telenav makes most of its revenue, 76% in 2019, from the sale of revenue. The rest of the revenue is generated through the sale of the company's services. The table below offers further information on the matter:

Source: 10-k

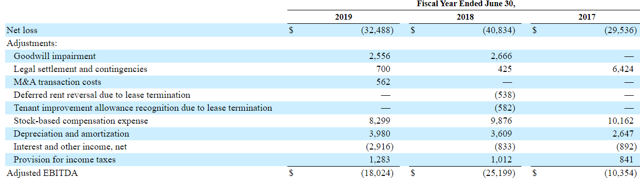

Shareholders should understand well that the company's EBITDA was negative in the last three years. As a result, the market is most likely pushing Telenav's valuation down. The net income losses and the EBITDA figures are shown in the image below:

Source: 10-k

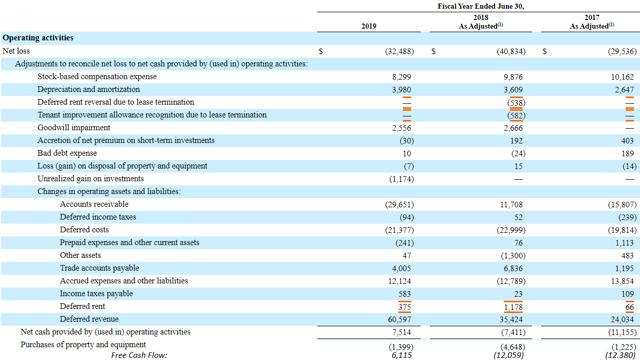

Value investors and private equity analysts will most likely appreciate that in 2019, for the first time in the last three years, the FCF was positive. Both the CFO and FCF increased to $7.514 million and $6.11 million, respectively. Notice that the company does not report restructuring expenses. See more details in the lines and the table below:

Source: 10-k

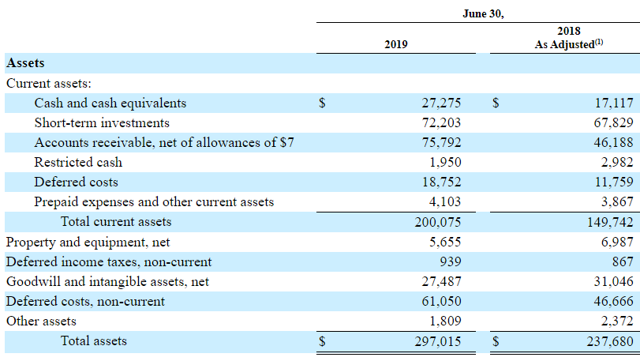

Balance Sheet

With an asset/liability ratio of 1.43x and $99.47 million in cash and short-term investments, the company's financial situation is strong. In our view, most analysts will not be worried about the company's financial stability. The image below offers the last balance sheet reported in the previous annual report:

Source: 10-k

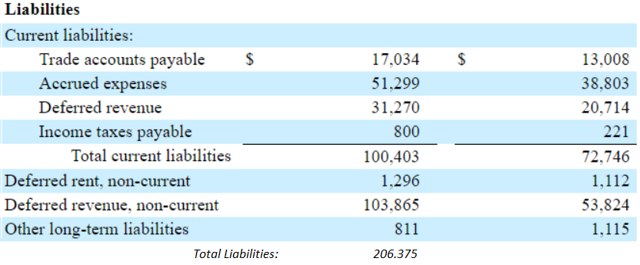

What investors will appreciate on the liability side is that Telenav does not report any debt. The most significant liabilities are accrued expenses and deferred revenue, $135 million. Investors should not worry about the company's amount of deferred revenue. In our opinion, it's very favorable. It means that Telenav receives payments for services that it had still not provided. A list of liabilities is shown in the image below:

Source: 10-k

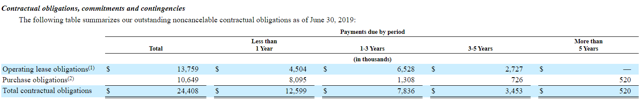

Investors will not worry about the table of contractual obligations. The company reports only operating lease obligations worth $13.7 million and purchase obligations of $10.6 million. The image below offers further information on the matter:

Source: 10-k

Valuation

The following companies are competitors of Telenav:

AISIN AW CO., Ltd

AutoNavi Software Co.Ltd.

Robert Bosch GmbH

Elektrobit Corporation

Garmin, Ltd. (GRMN)

HERE

Navinfo Co., Ltd.

NNG LLC

Shenyang MXNavi Co., Ltd.

TomTom (OTCPK:TMOAF)

Apple (AAPL)

Google

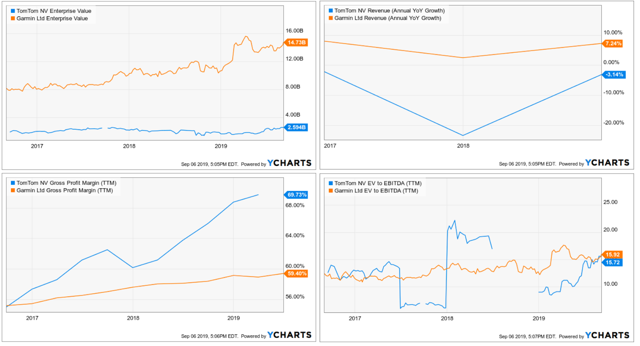

As shown in the chart below, competitors trade at 3.3x-4.2x sales with a gross profit margin of 59%-69% and revenue growth of 7%. Telenav should trade at less than 3.3x because its gross profit margin is below that of competitors. In our opinion, 2x-2.5x sales will most likely be reasonable.

Source: Ycharts

Source: Ycharts

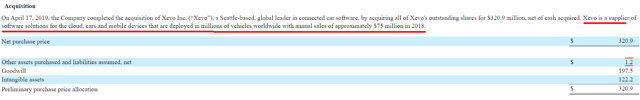

On April 17, 2019, Lear acquired Xevo Inc. for $320.9 million. In the last quarterly report for Lear, the company noted that in 2018, Xevo reported sales of $75 million. It means that Xevo was acquired for 4.2x, which is approximately the ratio of Garmin. Note that the ratio registered in the transaction includes the control premium. It's usually a bit higher than the trading ratio. The image below offers further details on the transition:

With 47 million shares and the share price of $5.85, the enterprise value equals $274 million. The company does not have debt, but it reports $99.47 million in cash and investments. With these figures, the enterprise value equals $174 million. With 2.5x sales, Telenav should have revenue of approximately $69 million.

In 2019, the company reported revenue of $220 million, which means that the market is expecting a sale decline of more than 68%. In our opinion, the market pushed the share price too much down.

In fiscal year 2019, General Motors was not even the source of 20% of Telenav's revenue. Let's assume that the company will lose 18% of its revenue. Thus, forward revenue of $180 million is reasonable. At 2x sales, Telenav will have an enterprise value of $360 million, which makes more sense than the current valuation of $170-$180 million.

Conclusion And Risks

Given the relationship with GM and the total amount of revenue, Telenav's enterprise value declined too much. In our view, the total valuation will most likely be close to $360 million or more. Market analysts need to review Telenav again. Currently, it appears quite undervalued.

Sale of new vehicles is subject to delay due to general economic conditions. If vehicle manufacturers plan to sell fewer cars or consumer demand declines, Telenav will most likely suffer a decline in revenue. As a result, the valuation of the company may decline. Market participants need to understand this risk well.