This article is intended to be the first in a continuing series of ideas focused on cheap valuation, out-of-favor, oversold stocks for investors to consider a turnaround. Whether a quick bounce play for speculators or a long-term buy idea requiring more research, I hope returning readers and followers of the Bottom Fishing Club will find this effort truly worthwhile. While my regular Victory Formation articles will still emphasize upside and downside momentum in a select group of blue-chips, the new Bottom Fishing Club posts will center on deeply inexpensive and prospective picks from any market capitalization size.

Armstrong Flooring (AFI) manufactures and sells prefabricated floors. Odds are good you will be standing on at least one of their products during an average day. Whether at home, school, work or play, Armstrong tiles, lock-in planks, and flooring sheets are what we walk on. Designed in linoleum, vinyl, laminate, carpet and rigid materials, the company’s floors are installed across the U.S.

Picture Source: www.armstrongflooring.com

Picture Source: www.armstrongflooring.com

2019-20 Turnaround Potential

Armstrong has not earned a profit since fiscal 2016, and revenues have been in steady decline for years. The stock price peaked at $22 in 2017, after converting to a publicly-traded shareholder ownership structure in 2016, a spin-off of Armstrong World Industries (AWI). The company sold its wood flooring division at the end of 2018 for $100 million. It partly used these proceeds to buy back common shares in a Dutch auction during June. About 15% of outstanding shares were retired.

The corporation has smartly turned to new leadership in 2019. Lately, they have hired a successful competitor’s top-flight manager to be the new CEO and President. Just a few weeks ago, a press release announced this major change in direction:

Armstrong Flooring, Inc, North America’s largest producer of resilient flooring products, announced today that its Board of Directors has appointed Michel Vermette, President, Residential Carpet at Mohawk Industries, as President and Chief Executive Officer and a member of the Board, effective Sept. 11, 2019. Armstrong Flooring Chairman Larry S. McWilliams, who has served as interim President and CEO since May 3, 2019, will remain Chairman of the Board.

Overall, Wall Street now expects Armstrong to break-even or be a slightly profitable business during 2020, with the help of organizational cost-cutting, asset sales, and new management direction.

Cheap Valuation

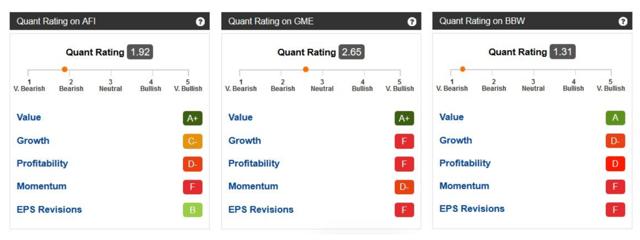

My last two articles on Seeking Alpha have focused on similar selections to Armstrong Flooring. Both GameStop (GME) and Build-A-Bear (BBW) are small caps, heavily sold during 2019, that nonetheless hold strong fundamental values in September-October. Below are graphs of the new Quant Ratings on Seeking Alpha for individual equities. Despite low overall scores, the “Value” rating of A+ for Armstrong is the same “A” score achieved by GameStop and Build-A-Bear. You can read more about my fishing expeditions in Build-A-Bear here, and GameStop here.

Source: SA Quant Score for AFI

Source: SA Quant Score for AFI

At a $6 share quote and $130 million market cap, Armstrong Flooring is trading at a valuation under 50% of net tangible assets, only 20% of annual sales, less than its net working capital, and roughly 3x yearly operating cash flow generation (adjusted for one-time items and working capital changes). Basically, today’s financial ratio valuation is HALF the typical comparisons made since trading began in 2016.

Selling Momentum Nears Exhaustion?

Just like GameStop and Build-A-Bear, stock trading momentum appears ready to shift from intense selling during 2019 to something more positive for owners. On the chart below, you can review the steady selling from $15 in May to $6 today.

Notice how the Average Directional Index [ADX] trend reversed in September from a strong downward momentum bias near 40 to a more regular number around 25 of late. The orange trendline of heightened downside momentum was broken with steady buying in the first half of September, when the new CEO was hired. For reference, the sharp rise and drop in the ADX line in early January proved a great entry point for a 10-15% gain into February.

Notice how the Average Directional Index [ADX] trend reversed in September from a strong downward momentum bias near 40 to a more regular number around 25 of late. The orange trendline of heightened downside momentum was broken with steady buying in the first half of September, when the new CEO was hired. For reference, the sharp rise and drop in the ADX line in early January proved a great entry point for a 10-15% gain into February.

The green circles are highlighting an oversold momentum condition in early October for the Relative Strength Index (RSI) and Money Flow Index [MFI] indicators. Pulling it all together, the odds of a lasting price bottom being outlined in the next few weeks looks promising.

Final Thoughts

Barring a stock market crash or another deep real estate recession, I believe Armstrong Flooring has solid turnaround potential into 2020. From today’s oversold, undervalued price, any type of good news should propel the stock quote higher. An unexpected return to operating profitability next year could bring takeover and acquisition interest, if the stock quote fails to rise substantially.

When buying this small cap, higher-risk equity, be sure to consider a stop-loss sell order to limit potential setbacks in your portfolio. For traders and speculators trying to capture a quick 10% or 20% bounce higher in worth, use a 5% or 10% stop-sell price point. For long-term investors in large portfolio designs, a 10% or 20% stop level seems appropriate.

You can become a member of the Bottom Fishing Club and get timely articles on well-positioned, oversold turnaround picks by clicking on the Follow button (Get Email Alerts) at the top of this article.