After several years of investing in individual stocks, reading their annual reports, and valuing them using various metrics, I sat down and created a spreadsheet that listed the prices of all my buys and sells, calculated the tax and transaction costs, and discovered that though I had bought several stocks that doubled, the losses I incurred in my other investments balanced my wins to where the difference between my net gain from careful stock picking and what I would have earned had I invested only in the Vanguard Total Stock Market was so small that it made no sense to keep on using so many hours of my valuable time pursuing the dream that I could beat the market.

This validated the argument made by the Bogleheads, who follow the teachings of John C. Bogle, founder of Vanguard and prime popularizer of the index investing strategy, that "buying the whole market" is a better strategy for the average investor than stock picking. I'm not the only one who has figured this out over the past decade. Total market index funds have become very popular to the point where, Vanguard's Total Stock Market fund (MUTF:VTSAX) now invests $827.2 billion dollars of assets under management and has become the largest of all mutual funds.

ETF investors should note that because of Vanguard's patented way of managing funds, the ETF that corresponds to VTSAX, VTI is nothing more than a share class of the VTSAX mutual fund and its assets are counted into the fund's total AUM.

So popular is this investing approach that the other big mutual fund also offer total stock market index funds too, most notably Schwab and Fidelity. This article will focus on VTSAX, but the conclusions drawn here will apply equally to any other cap weighted Total Stock Market Index Fund.

Do Investors Know What They Own?

It often seems like they don't. It is common to hear people in online discussions respond to a post about some high flying stock by saying, "I own a Total Stock Market Index Fund so I already own that company." Morningstar's description of VTSAX reinforces this message. They headline their review of the fund, "This fund owns just about all investible U.S. stocks at a low price."

But since it is my investing mantra to "know what I own," I have taken the time to dive deep into the numbers to see how meaningful the claim is that by investing in a Total Market Index Fund like VTSAX I am owning the market. What I have found makes it very clear that what I am buying when I buy a share of any Total Market Index Fund is not, in practical terms, a collection of broadly diversified stocks.

Almost One-Third of Your Total Market Index Fund Investment Goes Into Only 25 Stocks

Vanguard helpfully lists the top ten holdings of all its funds, and the first thing any aware investor should note is that, though VTSAX owns 3,624 stocks, as of the end of the last quarter, 10 stocks made up 19.10% of the fund's holdings. That means that over 19 cents of each dollar you invest in the fund goes into just those ten stocks.

Vanguard helpfully allows you to see the dollar amounts invested in not only the top ten, but in every single one of the 3,624 stocks that make up its index, ranked by the size of the fund's investment in the company. So I went down that list, which is ranked from largest to smallest holding, and pulled out a representative sample of stocks of various market caps, to see how much of them I was buying with my VTSAX investment dollar.

Vanguard helpfully allows you to see the dollar amounts invested in not only the top ten, but in every single one of the 3,624 stocks that make up its index, ranked by the size of the fund's investment in the company. So I went down that list, which is ranked from largest to smallest holding, and pulled out a representative sample of stocks of various market caps, to see how much of them I was buying with my VTSAX investment dollar.

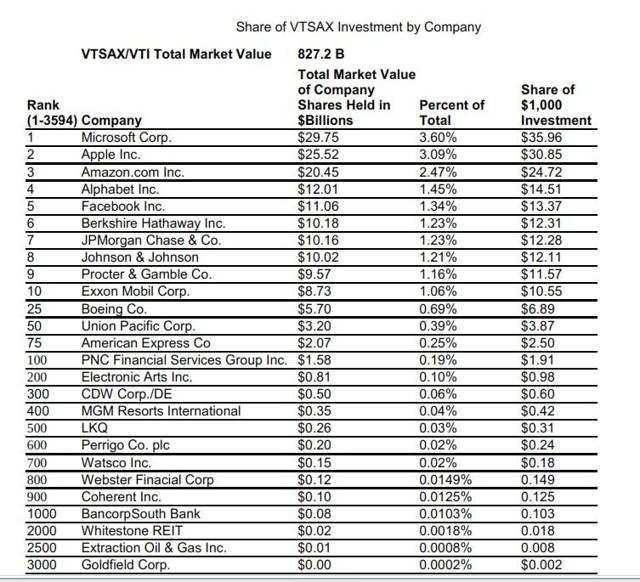

You can see the results in the table below. To make these numbers more real-world, the table also shows you how much of the sampled stocks you would be buying if you were to buy $1,000s worth of VTSAX.

A note on methodology: I divided the market value of each stock held by the fund's total AUM, $827.2B, to get the percentage for each holding. I checked the numbers I got using this method against the percentages Vanguard figures for its top 10 holdings, to ensure this is the correct calculation. Because I rounded amounts to the nearest ten million, rounding errors explain any differences from percentages Vanguard displays.

A note on methodology: I divided the market value of each stock held by the fund's total AUM, $827.2B, to get the percentage for each holding. I checked the numbers I got using this method against the percentages Vanguard figures for its top 10 holdings, to ensure this is the correct calculation. Because I rounded amounts to the nearest ten million, rounding errors explain any differences from percentages Vanguard displays.

As you can see, every time you buy $1,000 worth of VTSAX, you are buying $35.96 of Microsoft (MSFT), and big slugs of the next nine stocks. But by the time you get down to the 25th-ranked stock, Boeing Co. (BA), you are only buying $6.89 worth.

Using the figures that Vanguard supplies, it turns out that the top 25 stocks make up 30% of the assets under management.

How Is Ownership of the Rest of the 3624 Stocks Owned Divvied Up?

By the time you get to the 50th ranked stock, Union Pacific Corp. (UNP), you are only buying $3.87 worth of its stock. Drop down 50 more ranks, and you are buying only $1.91 worth of the 100th-ranked stock in the index, PNC Financial Service Group, Inc. (PNC). This is only 5.3% of the amount you are investing in Microsoft stock. So you are buying twenty times more Microsoft than you the stock ranked 100th by size. So much for the top 100 stocks in the index. There are still another 3,494 stocks to buy!

You can see what happens further down the list. By the time we have gotten to 500th stock in our list, LKQ Corp. (LKQ), only $.31 of our $1,000 investment in VTSAX is going into that stock. That is .9% of what we put into Microsoft. And the first five hundred stocks still make up only 14% of all the stocks listed in the index. As you can see from the table above, the amount we buy of the next 1,000 stocks declines to where e are only buying $.10 worth of the 1,000th-ranked stock, BancorpSouth Bank (BXS). And we still have another 2,594 stocks to buy! Each one of which we will be investing less than a dime in with our $1,000 investment, and far less for most of them.

So it is pretty clear that whatever fantasy the owner of VTSAX might have about "owning the market" in terms of what the stocks they own can do for their portfolio, the top 100 stocks are probably all that matter.

Mid-Cap Stocks Will Make Almost No Difference in Our Portfolio Growth

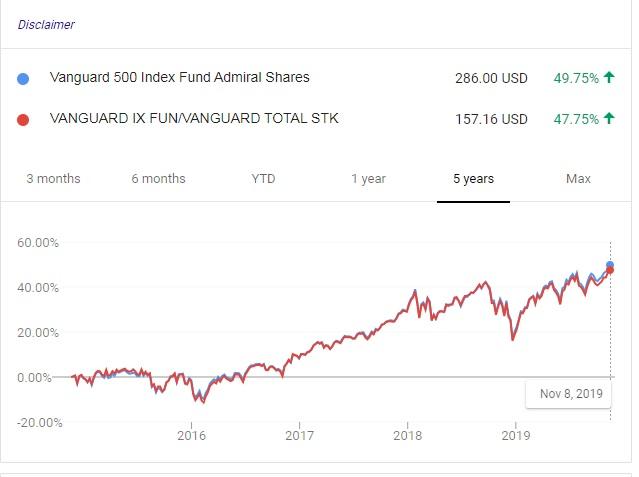

From the numbers just shared, you can see why historically the performance of the VTSAX has differed very little from that of the 30 stocks that make up the Dow Jones Average or from that of the 500 stocks that make up the S&P 500 index, which is also cap weighed. The graphs below demonstrate that index funds that invest using the S&P 500 index and, for that matter the Dow 30 Industrials index perform almost identically to VTSAX, with the slight differences that occur from time to time being attributable to fund expenses and the fact that Dow and the S&P curate the stocks in their lists, rotate out losers, and do not include those that are unprofitable, unlike VTSAX.

Dow Jones Industrial Average Vs. Vanguard Total Stock Market Index Fund

Vanguard Total Stock Market Index Fund Vs. Vanguard 500 Index Fund

Vanguard Total Stock Market Index Fund Vs. Vanguard 500 Index Fund

The Performance of Very Few Stocks Greatly Affects Your Total Stock Market Index Fund Performance

If you had a million-dollar portfolio you would only get a significant boost if one of the top 25 stocks that represent 30% of AUM were to double. Our million-dollar investment gives us $35,960 worth of Microsoft, and $6,890 of Boeing. If either were to double, that would be a significant gain for our million-dollar portfolio. But if a mid-cap stock like LKQ were to double - which is more likely than those top 10 behemoths - our $310 investment would become $620, representing a portfolio gain of only .03%. The same works in reverse. Most of your Total Stock Market Index Fund's losses will be generated by those top funds, too.

Knowing What You Own Leads to Better Investment Decisions

Even with all this taken into account, I have been very happy with my investment in Vanguard's Total Stock Market Index Fund, which I have held for decades. I recommended it to my kids, who don't have the time to study investing. It did perform just about as well as all my high-touch stock picking did over a three-year period. So it makes a good "set it and forget it" portfolio.

It also currently pays a competitive dividend. Its 1.84% yield is better than the Vanguard Dividend Appreciation Index Fund (and ETF)'s 1.83% and is only 3 basis points less than the dividend paid by the Vanguard Dividend Growth Fund.

But make no mistake, when you buy a Total Stock Market Index Fund you are effectively buying a fairly small basket of large-cap stocks. For an index fund investor to get significant exposure to mid-cap or small-cap funds, they will have to buy index funds that specialize only in those categories. And even then, because these are also cap-weighted funds, it is possible most of the dollars invested will go to buy the stock of the top companies in the fund. But now that you know how to analyze the holdings of an index fund, you can figure out just how top-heavy a fund is on your own.