Co-produced with Preferred Stock Trader

Introduction

We at High Dividend Opportunities are of the belief that we will be in a low to falling interest rate environment for at least some years or much longer. Therefore, we have been presenting a series of articles on undervalued and relatively safe high-yielding preferred stocks and baby bonds. So far, our view is playing out as prices of preferred stocks have risen strongly this year with yields moving lower. It's getting difficult to find relatively safe high-yielding preferred stocks and baby bonds. Today we believe we have an exceptional and unusual value to offer readers and subscribers. That value is in RLJ Lodging Trust Preferred "A" stock (RLJ-A) (RLJ.PA).

We first wrote about RLJ-A about one year ago. At that time the price was $25.44. We are happy to report that RLJ-A is up $2.94 per share since then and it has been a nice winner. However, with the serious preferred stock rally we have seen this year, and the deleveraging that has occurred at RLJ over the past year, we believe that RLJ-A is just as undervalued now as it was when we first recommended it. A number of our other preferred stock picks have seen larger gains than RLJ-A.

RLJ Lodging Trust

RLJ Lodging Trust (NYSE:NYSE:RLJ) is an internally-managed hotel REIT that specializes in premium-branded full-service hotels. To quote from their June 30, 2019, 10-Q SEC filing:

As of June 30, 2019, the Company owned 128 hotel properties with approximately 25,600 rooms, located in 23 states and the District of Columbia. The Company, through wholly-owned subsidiaries, owned a 100% interest in 124 of its hotel properties, a 98.3% controlling interest in the DoubleTree Metropolitan Hotel New York City, a 95% controlling interest in The Knickerbocker, and 50% interests in entities owning two hotel properties. The Company consolidates its real estate interests in the 126 hotel properties in which it holds a controlling financial interest, and the Company records the real estate interests in the two hotels in which it holds an indirect 50% interest using the equity method of accounting. The Company leases 127 of the 128 hotel properties to its taxable REIT subsidiaries ("TRS"), of which the Company owns a controlling financial interest.

RLJ has been seriously deleveraging. They are now in excellent position to withstand a recession and should have no trouble continuing to pay preferred stock dividends regardless of the economic environment. From having sold seven hotels in 2018, they sold an additional 23 hotels in the first half of 2019 and another 18 hotels during the recently completed third quarter. This brings the number of hotels they own from 158, at the beginning of 2018, to only 110 now. That's quite a deleveraging and their balance sheet reflects this.

RLJ Lodging Trust Preferred "A" Stock

RLJ-A (RLJ.PA) is a convertible preferred stock that was issued by Felcor Lodging before Felcor was bought by RLJ. There's virtually no hope that RLJ-A will be worth converting into common and we call these types of convertible preferreds "busted convertibles." But one of the great features of a busted convertible preferred is that there's no call date, so there's virtually no limit to how high the price can go. In fact RLJ-A traded near $29 in October 2017. When it was a preferred stock of Felcor, it also traded up near $29.00 a couple of times and Felcor was a poorly performing and significantly more leveraged hotel REIT than RLJ.

Let's look at a couple of examples of convertible preferred stocks. Lexington's preferred share LXP-C (LXP.PC) also is a busted convertible, and although it has a par of $50, it currently trades at $57.16 While convertible preferred share of EPR, EPR-E (EPR.PE) is not "busted," this $25 par preferred stock currently trades at $38.54. If we take the current yield on the standard EPR-G preferred stock, which is 5.65%, and apply that to the par $25 EPR-E, EPR-E should trade at $40.35 to give the equivalent yield. It's actually the fact that EPR-E is not busted that may be keeping it below relative fair value with EPR-G. And in fact, with EPR-G only having a 5.1% yield-to-call, EPR-E should likely sell for near $43.00 as a plain busted convertible preferred stock. This example is simply to show you how far over par a convertible preferred stock might trade.

RLJ-A Vital Statistics

RLJ-A is a cumulative, convertible preferred stock. Because RLJ-A is a profitable REIT, Americans receive a 20% reduction in the amount of tax they must pay on RLJ-A dividends. Here are the vital statistics:

- Current Price: $28.38

- Annual Dividend: $1.95

- Current Stripped Yield: 6.95%

- Call Date: None

- Record Dates: Last business day of each quarter

- Next ex-dividend date: December 30th

Coverage

RLJ has an enterprise value of $5.4 billion with $2.2 billion in debt and $322 in preferred stock at par. Enterprise value is thus a solid 2.15 times debt plus preferred stock.

In terms of interest and dividend coverage, RLJ should have annual EBITDA of around $405 million in 2019. Interest expense is expected to be around $95 million with preferred dividends at $25 million. Thus, we have a very solid 3.35 times coverage of interest plus preferred dividends. If we subtract interest from EBITDA, we get $310 million of EBTDA which covers the preferred dividends by a very large 12 times.

In terms of liquidity, RLJ has a huge cash hoard of $846 million as of Sept. 30, 2019, up from $320 million at the beginning of the year - due to hotel sales. RLJ has $322 million in preferred stock ($360 million at today's price) and could easily repurchase all preferred stock and still have a very large cash balance. Additionally, the annual cost of the preferred dividend paid by RLJ is only $25 million, so with $846 in cash there need be no worry about RLJ-A's dividend being paid.

They also have only 19 hotels encumbered, so they can easily obtain more liquidity by getting mortgages on some of their other 91 hotels.

Comparison To Other Hotel REIT Preferred Stocks

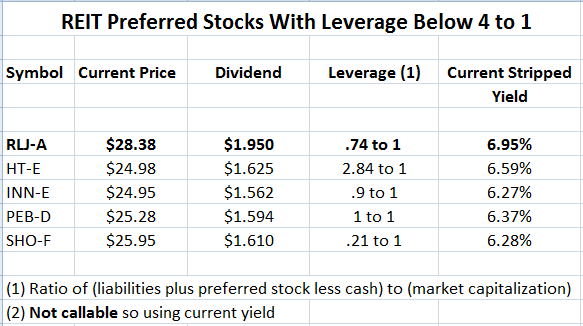

In the chart below, we have taken preferred stocks from all of the hotel REITs with leverage below 4-to-1. Additionally, we have chosen the preferred stock from each hotel REIT that has the longest call date to at least get the best comparison we can with the non-callable RLJ-A. Leverage below is calculated as the ratio of liabilities plus preferred stock less cash to market capitalization (net liabilities to market capitalization).

Source: Authors

After considering that SHO-F has a yield-to-call of only 4.45%, the above chart shows that RLJ-A is clearly the best value among hotel REIT preferred stocks. RLJ-A provides a significantly better yield than HT-E despite HT-E carrying almost four times the net leverage of RLJ-A. Additionally, compared to Summit Hotel Properties (INN) preferred E series INN-E (INN.PE) and Pebblebrook Hotel Trust (PEB)'s series D preferred PEB-D (PEB.PD), whose net leverage metrics are inferior but at least close to that of RLJ-A, RLJ-A's current yield is significantly higher. And of course, RLJ-A has virtually unlimited price upside while the others are somewhat tethered to par.

In terms of liquidity, RLJ's cash on hand is 17 times that of INN and 28 times that of PEB. To put this into perspective, RLJ's cash amounts to 30% of its market capitalization while PEB's cash only amounts to 1% of its market capitalization and INN's cash amounts to 4% of its market cap. RLJ has more than 2.3 times as much cash as preferred stock while INN has almost 5 times more preferred stock than cash and PEB has 17 times more preferred stock than cash.

Sunstone Hotel Investors (SHO) has an amazing balance sheet, but because we expect their preferred series F SHO-F (SHO.PF) to be called and therefore to yield only 4.5%, we like RLJ-A much better.

Fair Value of RLJ-A

In the above chart, as well as in terms of liquidity, the hotel REIT with the closest risk metrics to RLJ is INN. Even though RLJ has lower net leverage than INN, much more liquidity, and has the advantage of no call date, to be conservative we will use INN-E's current stripped yield of 6.27% to value RLJ-A.

For RLJ-A to be at a conservative fair value relative to closest but inferior peer INN-E, RLJ-A would trade at $31.50. At $31.50 RLJ-A would have a current stripped yield of 6.27% like that of INN-E. Thus, we put the fair value of RLJ-A at $3.12 per share higher than its current price.

It's important to note that the prices of most of the peer hotel preferred stocks used in the above chart are significantly lower than the highs they traded at just during the last 40 days. PEB-D traded as high as $27.10 on Oct. 24 and now trades at $25.28, or $1.82 lower. INN-E traded as high as $26.95 on Oct. 23 and now trades at $24.95, off $2.00 per share. And SHO-F traded as high as $27.99 on Oct. 22 and now trades at $25.95, $2.04 per share lower than its price was less than six weeks ago. So our fair value for RLJ-A is calculated using peer hotel REIT preferred prices that are far off their highs. This provides room for a possible revaluation upwards of RLJ-A's fair value price should long rates start to head down and peer hotel preferred stocks start to rally back towards their prices from 40 days ago. Around Oct. 23, we had calculated RLJ-A's fair value to be a whopping $35.00 per share.

RLJ-A's Price Today Versus A Year Ago

As we stated earlier, we have a very nice gain since we recommended RLJ-A on Oct. 28, 2018. However, we believe RLJ-A's undervaluation is now just as great as it was a year ago. This is despite its price rise over the last year. In our last article, we provided a fair value of $28.40 for RLJ-A, $3.00 above its then current price. Now we have a fair value price that is $3.12 higher than its current price.

This large rise in the fair value of RLJ-A since October of last year is due to two factors.

- RLJ-A has sold a large number of hotels since our previous article, thus greatly improving its balance sheet, and it now has great liquidity with its massive cash hoard. RLJ-A is simply a safer preferred stock than it was a year ago.

- The whole preferred stock market has rallied very strongly from a year ago which has increased the relative fair value of all preferred stocks and lowered their yields. So now we are comparing RLJ-A's yield to a significantly lower average preferred stock yield.

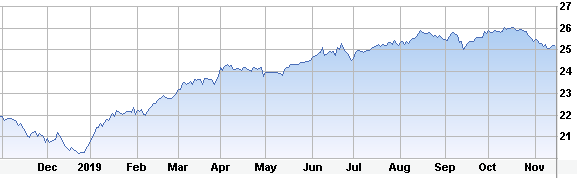

Public Storage (PSA) Preferred E series PSA-E (PSA.PE) Price Chart Since Oct. 28, 2018:

Source: Etrade

PSA preferred stocks are generally considered the bellwether preferred stocks. We chose to examine PSA-E as it's least affected by its call date which makes it best to compare to non-callable RLJ-A. As we can see from the above chart, since a year ago, PSA-E has risen in price from $22.00 to $25.26. That's a 14.8% gain. During this same period, RLJ-A has risen from $25.44 to $28.38, for a smaller 11.5% gain, despite its large deleveraging. So RLJ-A's price gain since last year has not caused it to become relatively less undervalued.

Conclusion/Summary

We have shown that relative to hotel REIT preferred stocks that are as similar as we can get to RLJ-A, RLJ-A is very undervalued. As far as we are aware, there's no other safe preferred stock that sells for more than $3.00 below relative fair value. Our estimate of relative fair value is $31.50, and that's strictly based on a conservative yield comparison with peers with no value given to RLJ-A for not having a call date and no value given for its much superior liquidity vs. its peers. RLJ has more than 2.5 times as much cash as preferred stock outstanding.

Additionally, we used peer hotel REIT preferred stock prices that are way down from just 40 days ago to calculate fair value for RLJ-A. If long rates should start to fall and peer hotel REIT preferred prices start to rise, RLJ-A's fair value could significantly rise. Just 40 days ago we had RLJ-A's fair value at $35.00 per share.

No hotel REIT is preparing itself for a possible recession like RLJ, having sold 48 of its 158 hotels since the beginning of 2018. Additionally, RLJ-A has very high EBITDA coverage of interest and preferred dividends and $845 million in cash. Having $845 million in cash when annual preferred stock dividends only amount to $25 million makes RLJ-A an extremely safe preferred stock.

RLJ-A is in the enviable position of having no call date so the price upside is virtually unlimited.

Additionally, as a profitable REIT on a GAAP basis, its $1.95 annual dividend qualifies for a 20% tax reduction, making its effective yield even higher relative to other fixed-income investments which have no tax benefits.

Thanks for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates.

Join The High Dividend Opportunities Family for Thanksgiving Dinner!

We are the most subscribed-to service in the high-yield space, consistently the highest-ranked service on Seeking Alpha since 2016. As a member, you will receive unbeatable analysis to achieve high immediate income, in addition to retirement strategies. We are offering a limited time discount for the first 100 members who join.

Don’t Go Hungry This Thanksgiving. Let your dividends pay for your meal! Join us to get instant access to our model portfolio targeting 9-10% yield, our preferred stock and bond portfolio, and our report "Our Favorite High-Yield Picks Today". Start your free two-week trial today!