This article is part of a series that provides an ongoing analysis of the changes made to Southeastern Asset Management’s 13F portfolio on a quarterly basis. It is based on Southeastern’s regulatory 13F Form filed on 11/14/2019. Please visit our Tracking Mason Hawkins’ Southeastern Asset Management Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q2 2019.

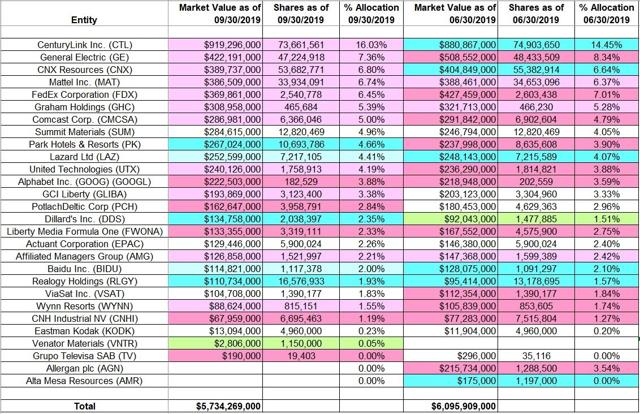

This quarter, Southeastern’s 13F portfolio value decreased ~6%, from $6.10B to $5.73B. The number of holdings decreased from 27 to 26. The top three holdings are at ~30%, while the top five are at ~43% of the 13F assets: CenturyLink (CTL), General Electric (GE), CNX Resources (CNX), Mattel Inc. (MAT), and FedEx (FDX).

Southeastern is best known for its investor-friendly attributes. The mutual funds in the Longleaf family are Longleaf Partners Fund (LLPFX) incepted in 1987, Longleaf Small-Cap Fund (LLSCX) incepted in 1989, Longleaf International Fund (LLINX) incepted in 1998, and the Longleaf Global Fund (LLGLX) incepted in 2012. The flagship Longleaf Partners Fund had a 15.51% return in 2017 and a dismal negative 18% return in 2018. Through Q3 2019, LLPFX was up 1.70%, compared to 20.55% for the S&P 500 Index. Although the fund is focused on US mid- and large-cap businesses, the current allocation has two non-US companies in the top ten: CK Hutchison (OTCPK:CKHUY) and LafargeHolcim Ltd. (OTCPK:HCMLF). Cash allocation is at ~15%, up marginally compared to last quarter.

Note: Although their mutual funds are well-known among retail investors, it should be noted that a sizable portion of Southeastern’s AUM ($13B total) is attributable to separately managed accounts.

Stake Disposals

Allergan plc (AGN): AGN was a 3.54% portfolio stake purchased in Q4 2017 at prices between $164 and $211, and increased by over one-third next quarter at prices between $144 and $188. Q3 2018 saw a ~23% reduction at prices between $167 and $193. The next two quarters also saw a combined ~13% trimming. There was another one-third selling last quarter at prices between $116 and $167. The disposal this quarter was at prices between $156 and $170. The stock currently trades at $185.

Note: AbbVie (ABBV) agreed to acquire Allergan in a cash-and-stock deal ($120.30 cash and 0.866 shares of ABBV for each AGN held) in June.

Alta Mesa Resources (AMR): The minutely small AMR stake was disposed during the quarter.

New Stakes

Venator Materials (VNTR): VNTR is a minutely small 0.05% of the portfolio stake established during the quarter.

Stake Decreases

CenturyLink: CTL is currently the largest 13F position at ~16% of the portfolio. It came about as a result of the acquisition of Level 3 Communications by CenturyLink that closed in October 2017. Southeastern had a huge 28M share stake in Level 3, for which they received ~40M CTL shares in the ratio 1:1.4286. The terms called for $26.50 per share in cash as well. The position was increased by ~75% in Q4 2017 at prices between $13.50 and $20.50. The stock is now at $14.49. There was an ~11% stake increase last quarter, while this quarter there was marginal trimming.

Note: Their cost basis on the position is ~$16. Southeastern has a ~7% ownership stake in CenturyLink.

General Electric: The large (top-three) 7.36% GE position was established in Q4 2017 at prices between $17 and $25, and increased by ~185% next quarter at prices between $13 and $19. Q3 2018 saw another ~26% increase at prices between $11.25 and $14.25, and that was followed with a ~40% further increase next quarter at prices between $6.70 and $13.50. The stock is now at $11.27. The last two quarters had seen a ~20% selling at prices between $8 and $11. This quarter also saw a ~2% trimming.

CNX Resources: CNX is a top-five 6.80% of the 13F portfolio stake. The original position is from 2012, when ~25M shares were purchased in the high-$20s price range. Q4 2014 and Q1 2015 saw a stake doubling at prices between $24 and $39. There was an ~18% stake increase last quarter at prices between $6.15 and $10.90. The stock is now at $6.91. This quarter saw a ~3% trimming.

Note: The prices quoted above are adjusted for the coal spin-off last November. Southeastern has a ~30% ownership stake in CNX Resources.

Mattel Inc.: MAT is now a large (top-five) 6.74% portfolio stake. It was established in Q3 2017 at prices between $14.50 and $21.50, and increased by ~250% the following quarter at prices between $13 and $19. The stock currently trades well below those ranges at $11.70. For investors attempting to follow Southeastern, MAT is a good option to consider for further research. The last few quarters have only minor adjustments.

Note: Southeastern has a ~10% ownership stake in Mattel Inc.

FedEx Corporation: FDX is a very long-term position that has been in the portfolio since 2000. Currently, it is a large (top-five) stake at ~6.45% of the portfolio. In recent activity, the five quarters through Q4 2017 saw a combined ~50% reduction at prices between $170 and $250. The stock currently trades at ~$160. Q1 2019 saw a ~10% stake increase, while last quarter there was a similar reduction.

Graham Holdings (GHC): GHC is a ~5% of the portfolio stake first purchased in 2013. Q2 and Q3 2014 saw a ~30% increase at prices between $286 and $360. The stock currently trades at ~$632. H2 2018 had seen minor trimming, and that was followed with a ~20% reduction in Q1 2019 at prices between $641 and $688. There was a ~9% trimming last quarter. Southeastern is harvesting gains. This quarter saw marginal trimming.

Note: The prices quoted above are adjusted for the spin-off of Cable One (CABO) from Graham Holdings that closed on July 1, 2015. Shareholders of GHC received one share of CABO for each share of GHC held. Southeastern controls ~15% of Graham Holdings.

Comcast Corporation (CMCSA): CMCSA is a fairly large ~5% of the portfolio position purchased last March in the low-$30s, and the stock currently trades at $44.15. Q2 2018 saw a ~27% increase at prices between $30.50 and $34.50, while next quarter saw a ~20% selling at prices between $33 and $38. There was another ~43% reduction in Q4 2018 at prices between $33 and $39.50. The last three quarters have also seen a ~25% selling at prices between $34.25 and $47.

United Technologies (UTX): The bulk of the current ~4% UTX position was purchased in Q4 2015 at prices between $88 and $101. Q1 2016 saw a ~30% increase at around the same price range. The stock currently trades at ~$148. The last three years have seen a ~73% selling at prices between ~$98 and ~$142.

Alphabet Inc. (GOOG, GOOGL): GOOG is a ~4% portfolio position purchased in Q1 2015 at prices between $492 and $575, and increased by ~50% the following quarter at prices between $520 and $565. In recent activity, the last three years have seen an ~83% reduction at prices between $750 and $1272. The stock is now at ~$1305. Southeastern is realizing huge gains.

GCI Liberty (GLIBA): Most of 3.38% GLIBA stake was built in Q4 2018 at prices between $40 and $51. The stock currently trades well above that range at ~$71. This quarter saw a ~6% trimming.

PotlatchDeltic Corp. (PCH): PCH is a ~3% position established in Q4 2018 at prices between $29 and $40, and it is now at $43.43. This quarter saw a ~15% selling at prices between $36 and $42.

Note: Southeastern’s ownership stake in PotlatchDeltic is 4.6% of the business.

Liberty Media Formula One (FWONA, FWONK): FWONK is a 2.33% of the portfolio stake established in Q2 2016 at prices between $17.50 and $20, and the stock currently trades well above that range at $45.09. There was a one-third reduction in Q2 2017 at prices between $30.50 and $37, while Q2 2018 saw a similar increase at around the same price range. Q1 2019 saw a ~27% selling at prices between $30.50 and $35.50, and that was followed with an ~11% trimming last quarter. Southeastern is harvesting gains. This quarter also saw a ~28% selling at prices between $37 and $43.

Note: Following acquisition of Formula One, Liberty Media was renamed Liberty Media Formula one and the stock symbols changed.

Affiliated Managers Group (AMG): The 2.21% AMG stake was purchased in Q3 2018 at prices between $137 and $160, and increased by ~55% next quarter at prices between $90 and $138. The stock is now below the low end of those ranges at $85.37. The last three quarters have seen a ~17% selling at prices between $74.50 and $116.

Wynn Resorts (WYNN): The 1.74% WYNN stake was purchased in Q4 2018 at prices between $92 and $127, and the stock currently trades at ~$121. The last three quarters have seen the stake reduced by ~52% at prices between $103 and $150.

CNH Industrial NV (CNHI): CNHI is a 1.19% of the portfolio position built up from Q3 2014 at prices between $7.50 and $10. In recent activity, Q2 2018 saw a one-third increase at prices between $10.50 and $13, while the next two quarters saw a ~23% selling at prices between $8.50 and $12.50. The stock is now at ~$10.75. The last three quarters have seen a ~37% reduction at prices between $8.50 and $11.30.

Grupo Televisa SAB (TV): The minutely small TV position was further sold down during the quarter.

Stake Increases

Park Hotels & Resorts (PK): PK, the December 2016 spin-off from Hilton Worldwide (HLT), is a 5.54% portfolio position purchased in Q2 2017 at prices between $25 and $28, and doubled the following quarter at around the same price range. The stock is now at ~$23.65. Q1 2018 saw an ~180% increase in the mid-$20s price range, as they got a large allocation from a subscription sale by distressed Chinese conglomerate HNA, which sold its 25% stake. The last five quarters had seen a ~60% selling at prices between $26 and $34, while this quarter saw a ~24% stake increase at prices between $23 and $28.

Note: Southeastern controls ~5% of Park Hotels & Resorts.

Lazard Ltd. (LAZ): The LAZ position was a very small stake first purchased in Q3 2018. The next quarter saw the position built to a 2.17% portfolio stake at prices between $34 and $48. There was another ~40% stake increase in Q1 2019 at prices between $35.25 and $41. The stock is now at $38.64. Last quarter also saw a ~25% stake increase at prices between $31 and $40.50. This quarter saw a marginal further increase.

Dillard’s Inc. (DDS): DDS is a 2.35% of the portfolio position purchased last quarter at prices between $56 and $76. This quarter saw a ~38% stake increase at prices between $55 and $79. The stock currently trades at $71.80.

Baidu Inc. (BIDU): BIDU was a very small 1% of the portfolio position as of Q1 2018. The four quarters through Q1 2019 saw the position doubled at prices between $155 and $280, and that was followed with another ~35% increase last quarter at prices between $108 and $185. The stock currently trades below those ranges at ~$119, and the stake is now at ~2% of the portfolio. This quarter saw a ~2% stake increase.

Realogy Holdings (RLGY): RLGY is a 1.93% stake purchased in Q4 2017 at prices between $26 and $34, and increased by ~20% next quarter. There was an ~18% increase in Q2 2018 at prices between $23 and $28, and that was followed with a ~24% increase next quarter at prices between $20 and $24. The stock is currently at $10.47. The last three quarters have seen a ~75% stake increase at prices between $4.50 and $18.50.

Note: Southeastern owns ~15% of the business.

Kept Steady

Summit Materials (SUM): The ~5% SUM stake was established in Q3 2018 at prices between $18 and $27, and increased by ~40% in Q1 2019 at prices between $11.25 and $18. The stock currently trades at $23.87.

Note: Southeastern controls ~11% of the business.

Actuant Corporation (EPAC): The bulk of the 2.26% portfolio stake in EPAC was purchased in Q3 2015 at prices between $18 and $25, and it is now at $24.56.

Note: Southeastern has a 9.8% ownership stake in Actuant Corporation.

Viasat Inc. (VSAT): The 1.83% VSAT stake was first purchased in Q2 2014, with the majority acquired the following quarter at prices between $54 and $59. Q3 2015 saw a one-third increase at prices between $56 and $64.50. There was a ~16% increase in Q1 2017 at prices between $63 and $70, and that was followed with an ~11% increase in Q3 2017. The stock currently trades at $73.50. The seven quarters through Q2 2019 had seen a ~76% selling at prices between $58 and $94.

Eastman Kodak (KODK): The KODK stake was kept steady this quarter.

Note: Southeastern has a 55.8% ownership stake in Eastman Kodak (4.96M shares in the 13F report and the rest in preferred converts).

The spreadsheet below highlights changes to Southeastern’s 13F stock holdings in Q3 2019: