Exhibiting impressive inorganic growth and operating in the HVAC/R distribution industry since many years, Watsco (NYSE:WSO) is a name to be remembered. The only issue is its market capitalization, which appears overvalued as compared to its peers. Besides, the market may have not discounted that there may exist an agency problem. Executive officers own more than 50% of the total amount of voting power.

Growing Through Acquisitions

Headquartered in Miami, Florida, Watsco is the largest distributor of air conditioning, heating, and refrigeration equipment as well as related parts and supplies in the HVAC/R distribution industry in the United States and Canada. The company's business philosophy is based on "buy and build:"

Source: 10-K And Author's Work

Watsco's current corporate size was obtained thanks to an aggressive inorganic growth. Watsco has acquired a total of 60 HVAC/R distribution businesses in its history. As a result, in the last 30 years, the revenue growth has been quite impressive. With sales of $64.1 million in 1989, in 2018, the company reported $4.5 billion. As of December 31, 2018, Watsco operated from 571 locations in 37 U.S. States, Canada, Mexico, and Puerto Rico.

The market will appreciate the company's experience in the M&A industry. Watsco brings a lot of expertise of integrating new businesses, which, at the end of the day, is what matters. With this knowledge, the company can offer larger revenue growth. Watsco explains its strategy with the following words:

"Through a combination of sales and market share growth, opening of new locations, tuck-in acquisitions, expansion of product lines, improved pricing, and programs that have resulted in higher gross profit, performance incentives, and a culture of equity value for key leadership, we have produced substantial sales and earnings growth post-acquisition. We continue to pursue additional strategic acquisitions, investments and/or joint ventures to allow further penetration in existing markets and expansion into new geographic markets." Source: 10-k

On top of it, HVAC/R distribution industry seems to be very fragmented. There seem to exist ~2,100 distribution companies in the US and Canada. As a result, we would not expect the company to face a lot of antitrust problems. Watsco Inc. will be able to acquire small competitors. Regulators will most probably not stop deals.

According to the 2019 IBIS World Industry Report, Watsco's total addressable market equals $96 billion. There is a small amount of manufacturers; Carrier Corporation, Daikin Industries (OTCPK:DKILF), Rheem Manufacturing Company, and Trane Inc. These manufacturers sell their equipment to distributors, contractors, and dealers, which sell and install the products for consumers and businesses. Yes, there is significant industry concentration among manufacturers. Regulators may stop deals among manufacturers, which is not an issue for Watsco. The company acquires dealers and distributors.

The company's organic growth is based on customer service, product expansion, and technology to satisfy the needs of the higher growth and higher margin replacement market. In our view, the company's M&A strategy is more interesting than Watsco's organic growth. However, it is good to know that the company is not only acquiring business. The company knows how to treat customers, so that the businesses acquired continue to perform.

Watsco responds to customer needs with the following initiatives:

Source: 10-K And Author's Work

Sales Analysis

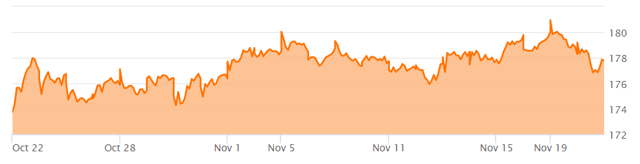

Watsco reported EPS of $2.20, $0.05 less than what the market expected. It is not ideal. However, the market seemed to appreciate the sales reported, $10 million larger than expected. As shown in the image below, the new financial figures pushed up the share price from $173 to more than $180:

Source: Seeking Alpha

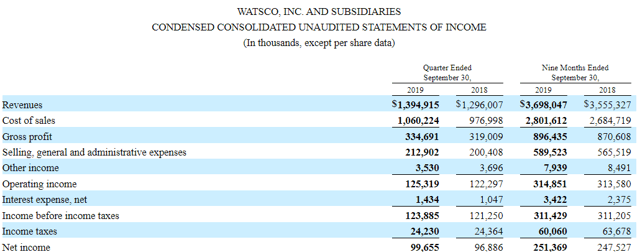

We don't think shareholders will complain about the Q3 figures. In the nine months ended September 30, 2019, with sales of $3.698 billion, Watsco is growing at 4% as compared to the same period in 2018. The net profit margin is 6%, the same figure obtained in the nine months ended September 30, 2018. The image below offers additional information:

Source: 10-Q

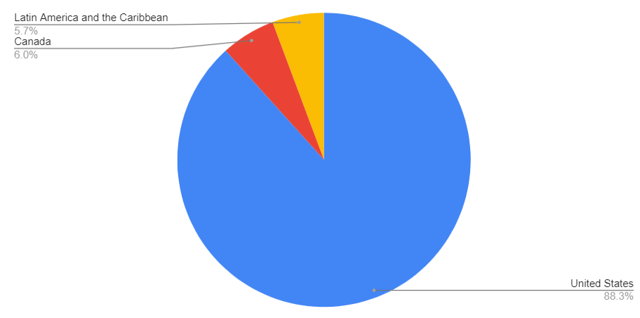

Watsco Inc. continues to generate a significant amount of revenue in the United States. Only ~11% of the sales were generated from Latin America. It is, in or view, one of the most interesting points of Watsco. With a significant amount of expertise acquired in the United States, the company could sell a lot in the international markets. If the company decides to acquire business abroad, revenue growth may creep up.

Source: Sales Breakdown - Nine months ended September 30, 2019

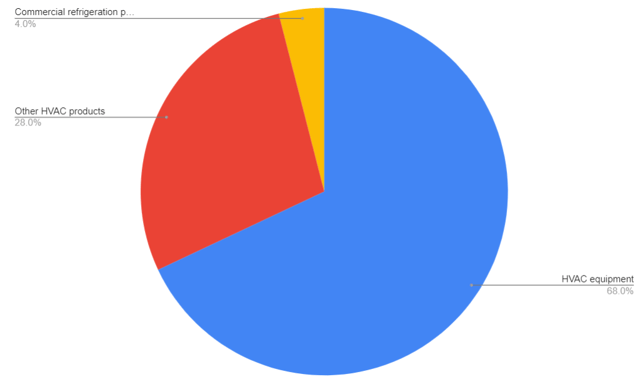

With regards to the type of products sold, the sale of HVAC equipment is very significant. It represents 68% of the total amount of revenue in the nine months ended September 30, 2019. Refrigeration and other products are sold, but it is not the company's core business:

Source: Sales Breakdown - Nine months ended September 30, 2019

Good Financial Shape

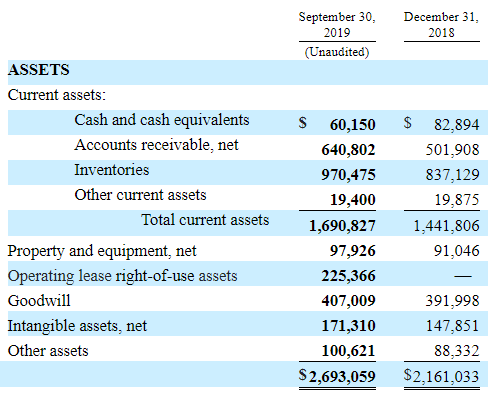

With an asset/liability ratio of more than 3x, we believe that the company's financial situation is stable. After more than 50 years of operation, most businesses don't report such beneficial financial shape.

Watsco does not report a lot of cash. As of September 30, 2019, cash in hand is equal to only $60 million. The most significant assets are accounts receivable, which is $640 million, goodwill, and intangible assets. Goodwill is equal to $407 million, which, in our view, is a small amount given the amount of businesses acquired. It is beneficial. Many investors don't appreciate a lot of intangibles in the balance sheet. Note that accountants many times impair them, which most likely pushes the company's valuation down.

See the list of assets in the image below:

Source: 10-Q

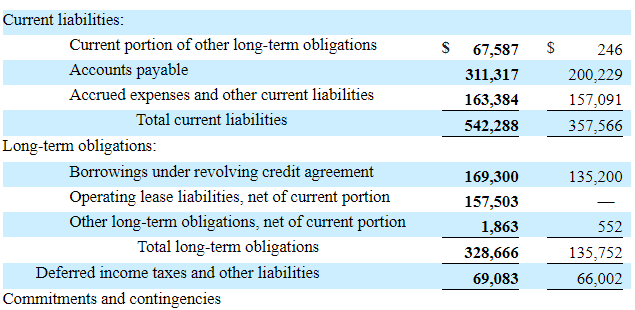

With $311 million in accounts payable, the company is financing its operations thanks to good relationships with manufacturers. We like this fact very much. The company has some debt. As of September 30, 2019, short-term and long-term debt was equal to $236 million. The debt/EBITDA ratio is ~0.6x, which is not worrying.

The list of liabilities is shown in the image below:

Source: 10-Q

The Company Is Overvalued

As of November 27, 2019, the total share count is equal to 35 million, which makes a market capitalization of $6.2 billion. With $60 million in cash reported in the last 10-Q and $236 million in debt, the enterprise value is $6.4 billion. 2020 sales are expected to be $5.075 billion, and 2020 EBITDA may be $433 million. Thus, the company's EBITDA margin would be equal to 8.5%, and the EV/EBITDA ratio is 14x.

Watsco competes with several distributors and air conditioning and heating equipment manufacturers. Players in a given region compete on quality, price, customer service, and product availability.

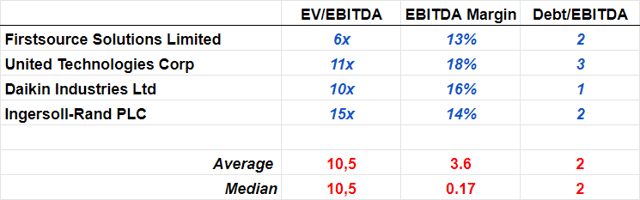

Most distributors are private companies, which is not ideal. We don't have a lot of information to assess the company's valuation. As a result, we decided to use the valuation multiples of manufacturers:

Source: Author's Work And YCharts

Most peers report an EBITDA margin of more than 13%. The group reports a median EV/EBITDA ratio of 10.5x and an average of 10.5x. In light of these figures, Watsco Inc. is overvalued at 14x EBITDA. Yes, the company's revenue growth will most likely continue, and the financial situation is favourable. However, we don't see further upside in the stock price. In our view, the valuation would make sense at 10x EBITDA, an enterprise value of $4.3 billion, and a share price of $100-$130.

Risks

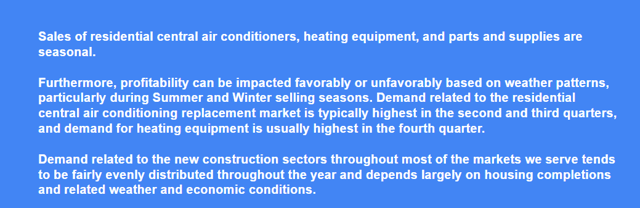

Among the risks highlighted in the annual report, shareholders need to know the company's seasonality risk. Besides, the Watsco's revenue depends on weather patterns, which can be detrimental or favorable for the company's bottom line:

Source: 10-K And Author's Work

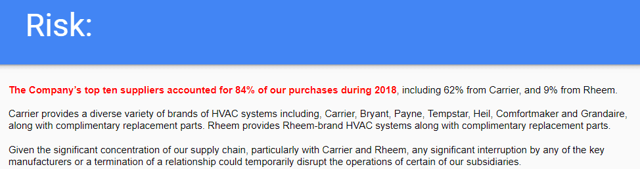

Watsco's shareholders may suffer risk from the lack of suppliers. In 2018, the company acquired 84% of its products from ten suppliers. Besides, Carrier was responsive for 62% of the total amount of purchases. As a result, we believe that the company may not have a lot of bargaining power while negotiating with HVAC manufacturers. In the future, it may hurt the company's EBITDA margin.

Source: 10-K And Author's Work

Additionally, directors own a significant amount of class B common stock, which gives them 56% of the voting power. Hence, the Board of Directors is controlled by directors and executive officers:

"As of December 31, 2018, our directors and executive officers and entities affiliated with them owned Class B common stock representing 89% of the outstanding shares of Class B common stock. These interests represent 56% of the aggregate combined voting power. Accordingly, our directors and executive officers collectively have the voting power to elect six members of our nine-person Board of Directors." Source: 10-k

Most readers know that when directors own full control of the Board of Directors, there is the risk of agency conflicts between management and shareholders. There is a significant amount of literature about the matter:

Source: Wiley

Our Takeaway

Watsco is a magnificent business created through both inorganic and organic growth. We see a lot of business catalysts, such as the internationalization of its business model or additional M&A growth. Having said so, we believe that the shares are currently overvalued. Other companies operating in the same sector report higher EBITDA margin and less EV/EBITDA ratio than Watsco. Furthermore, there is an agency risk, which the market may have not taken into account. With all this, we would not buy shares until they go down to $100-130.