Baker Hughes (NASDAQ:BKR) reports quarterly earnings January 22nd. Analysts expect revenue of $6.48 billion and EPS of $0.31. The revenue estimate implies double-digit growth sequentially. Investors should focus on the following key items.

More Stagnation In North America?

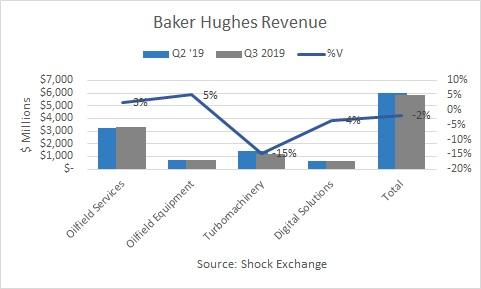

I have been bearish on the global economy for years. I have specifically avoided cyclical names like Baker Hughes. OPEC supply cuts have buoyed oil prices and spurred E&P. Things may have changed in Q4 2018 when shale oil plays began to suffer budget exhaustion, hurting E&P in the oil patch. In Q3 2019, Baker Hughes reported revenue of $5.9 billion, down 2% Q/Q.

North America land drilling has been the hottest market for oil services firms, and it remains in focus. Halliburton's (HAL) revenue from North America fell by double digits. Schlumberger's (SLB) revenue in the region grew 2%, not via land drilling activity, but by offshore sales.

Baker Hughes's short cycle businesses are comprised of Oilfield Services and Digital Solutions. The company generated combined $4.0 billion in revenue from these segments, up 2% sequentially. They represented over 65% of Baker Hughes's total revenue, so their performance will likely have an out-sized impact on the company's total results.

The U.S. rig count has been stagnant to declining for most of the year. Active drilling rigs in the U.S. fell by 8 last week, suggesting headwinds still exist in the oil patch. November industrial production rose, yet it has been stagnant for much of 2019; until it shows consistent traction it could be a bad sign for the economy and North America E&P.

Turbomachinery revenue was $1.2 billion, down by double digits. Baker Hughes sold its high-speed reciprocating compressor business and natural gas solutions business; the sale may have had a negative impact on Turbomachinery's top line growth. Oilfield Equipment revenue grew in the mid-single-digit

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.