In this article, we examine the significant weekly order flow and market structure developments driving WTI price action.

As noted in last week’s WTI Weekly, the primary expectation for this week was for price discovery lower, barring failure of 61.40s as resistance. This expectation did not play out as last Friday’s support held early week. Buying interest emerged, 60.59s/60.89s, in Monday and Tuesday’s auctions before price discovery higher developed following Wednesday’s holiday. The market traded through key resistance, 61.40s, to 61.97s ahead of Friday’s close, settling at 61.72s.

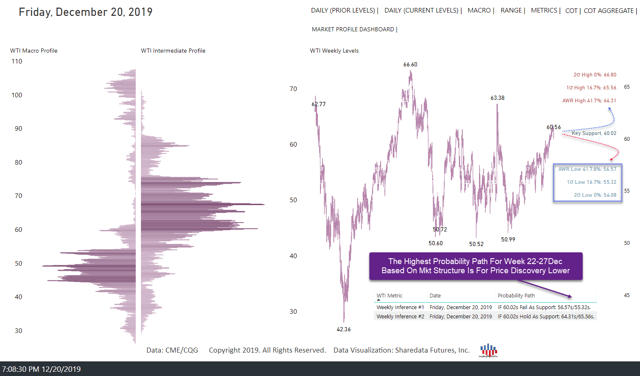

22-27 December 2019

This week’s auction saw balance development, 60.10s-60.77s, in Monday’s auction following last Friday’s aggressive long liquidation to 60.02s. Buying interest emerged, 60.59s, ahead of Monday’s NY close. Price discovery higher began early in Tuesday’s trade as buying interest emerged, 60.89s, into Tuesday’s NY close. Price discovery higher continued upon Tuesday’s Globex re-open, achieving a stopping point, 61.54s, ahead of the Wednesday’s holiday.

Minor price discovery lower developed early in Thursday’s trade to 61.07s. Structural buy excess developed, 61.07s-61.20s, before price discovery higher continued, achieving a stopping point, 61.83s, ahead of Thursday’s NY close. Minor price discovery higher developed early in Friday’s trade, achieving the weekly stopping point high, 61.97s. Selling interest emerged into Friday’s London auction developing balance, 61.97s-61.24s, through the EIA release (-5.4 million vs. -1.7 million expected) ahead of Friday’s close, settling at 61.72s.

This week’s primary expectation was for price discovery lower barring failure of 61.40s as resistance. This probability path did not play out as price discovery higher developed through 61.40s to 61.97s before structural selling interest emerged, halting the buy-side sequence. This week’s rotation (187 ticks) traded below the average weekly range expectancy (387 ticks).

Looking ahead, response to this week’s key resistance, 61.80s-62s, will be key. Sell-side failure to drive price lower from this key resistance will