Prosperity Banchsares (NYSE:PB) completed the acquisition of LegacyTexas Bank in November 2019, which is expected to push up earnings by a high single digit growth rate in 2020. The merger will support earnings growth by not only driving up earning assets but also improving non-interest income. However, initially the merger will constrain bottom-line growth due to a temporary surge in operating expenses. The benefit from the merger appears to be mostly priced-in as the current market price is quite close to the one-year ahead target price; therefore, it is better to wait for a price dip before considering investing in this stock.

Expenses to Surge Till System Conversion in Mid 2020

PB plans to run LegacyTexas separately as Prosperity Bank dba LegacyTexas Bank till the systems are completely merged by early June 2020, as mentioned in the press release. The parallel run of LegacyTexas' system and PB's system is likely to create high operating expenses in the first half of next year. After the mid of 2020 when the redundancy is reduced, I'm expecting PB's expenses to fall to a more normal level. PB's non-interest expenses are likely to fall by around 7% sequentially in the third quarter of 2020. The management expects 25% cost savings from the merger, the full effect of which they expect to be experienced in 2021.

Loan Growth Appears Promising

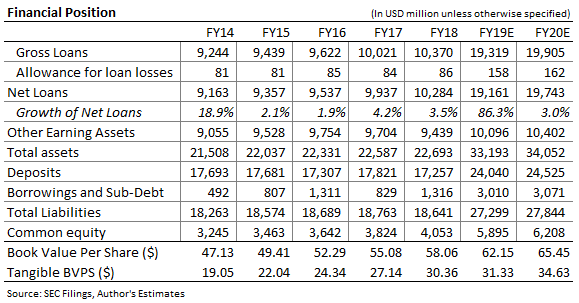

PB's loan portfolio has received a significant boost from the acquisition of LegacyTexas in November 2019. According to the press release, PB gained $9.1 billion in loans through the acquisition, which corresponds to around 86% increase. PB may runoff around $500 million of the loans acquired, according to the conference call discussion. As a result of the merger in late 2019, average loans in 2020 are expected to be 54% higher than the average loans for 2019.

Prospects of organic growth are also bright because PB caters primarily to the strong and expanding economy of Texas. As per the latest release, the state's leading index was reported at 1.95 by the Federal Reserve Bank of Philadelphia, which suggests that GDP growth is likely to remain strong in Texas in the coming quarters. Moreover, the state's index is above the index for the nation (1.27), suggesting that Texas will continue to lead in economic growth. Furthermore, as gleaned from the third quarter investor conference call, the management appears positive about consumer loan growth due to low unemployment and the apparent consumer confidence. However, the management expects commercial customers to pause a bit due to geopolitical concerns.

Based on the prospects of organic loan growth, I'm expecting PB's loan book to be 3% higher by the end of 2020 compared to December 2019. The table below shows my estimates for PB's loan growth, along with other key balance sheet items.

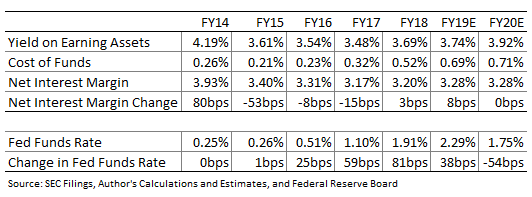

LegacyTexas to Boost Margin in 4QFY19

As 38% of PB's loan portfolio at the end of September 2019 consisted of fixed rate loans, part of the yield impact of the three Fed rate cuts this year will be lagged by a few years. The loan mix is expected to ameliorate the negative impact of the rate cut on net interest margin, or NIM. Further relief for NIM is expected to come from the recent improvement in PB's deposit mix. The proportion of non-interest bearing deposits in total deposits increased to 34.2% by the end of September 2019, from 33.7% at the end of June 2019 and 32.8% at the end of December 2018. Due to these factors, the sensitivity of PB's NIM to interest rate changes is expected to be low in the coming quarters. The management had a similar opinion, as during the conference call the CEO of PB stated:

If interest rates go down 50 basis points, we see probably a flat margin.

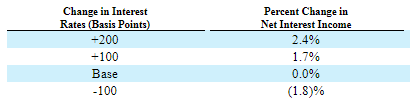

The results of a simulation conducted by the management, given in SEC filings, also show that PB's asset sensitivity is quite low. A 100bps change in interest rates can reduce net interest income by only 1.8% in the next twelve months of the rate cut, as shown below.

The above table should be only loosely taken as a guide because it shows the effect of an instantaneous shock, while in reality the monetary easing in 2019 was gradual. Therefore the actual impact will be lower than that implied by the simulation results. Furthermore, the simulation does not incorporate the impact of PB's acquisition of LegacyTexas. The management expects the combined NIM upon merger to be around 3.4%, as mentioned in the conference call.

Keeping in view the above mentioned drivers and constraining factors, I'm expecting PB's NIM to increase by 9bps on a sequential basis in 4QFY19 due to the merger and Fed rate cuts, and then to remain mostly stable in 2020.

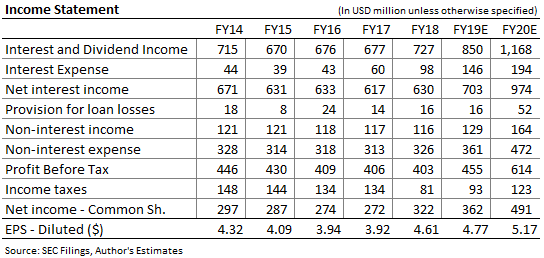

Growth Rate of High Single Digits Expected for Earnings Per Share

The merger with LegacyTexas is expected to be the key driver of earnings in 2020. Apart from its contribution towards growth in earning assets, the merger is also expected to boost non-interest income through an addition in fee income generating accounts. In addition, organic growth of the balance sheet is also expected to support bottom-line growth. As a result, I'm expecting PB's net income to grow by 35.7% year over year in 2020. Some dilution is expected from the 26 million new shares issued (source: S-4 filing) for the shareholders of LegacyTexas; therefore, earnings per share will increase by a lower rate than net income. I'm expecting earnings per share to increase by 8.5% year over year to $5.17, as shown in the table below.

Offering Dividend Yield of 2.6%

Based on the prospects of earnings increase, I'm expecting PB to increase dividends in the last quarter of 2020 by $0.02 to $0.48 per share. This will lead to full year dividend of $1.86 per share in 2020, suggesting a modest dividend yield of 2.58%.

The combined impact of dividends and earnings is expected to lead to a rise in equity book value next year. Implementation of the new accounting standard for credit losses, called CECL, is also expected to impact equity when it is implemented in the beginning of 2020. Consequently, I'm expecting PB to close 2020 with book value per share of $65.5, up 9% from $60.1 at the end of September 2019. My equity estimate for year-end 2019 is 43% higher than the September 2019 closing figure due to an addition of $1.7 billion in equity following the merger of LegacyTexas.

PB's share buyback program also has the potential to impact equity book value, but I have excluded it from my estimates. As the current market price is very high compared to the price the management last bought shares at (around $64 per share), it's reasonable to presume that the share repurchase will be on hold till a more opportune time. The management too hinted at a pause in the conference call.

Adopting Neutral Rating

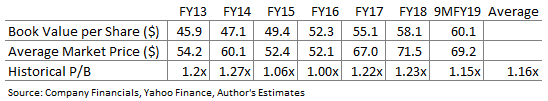

I'm using the historical price to book multiple, P/B, to value PB. The stock has traded at an average P/B multiple of 1.16 in the past as shown below.

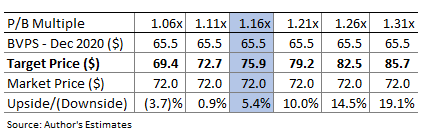

Multiplying this P/B ratio with the forecast book value per share of $65.5 gives a target price of $75.9 for December 2020. This target price implies a mid-single digit price upside of 5.4% from MTB's December 30 closing price. The following table shows sensitivity of the target price to P/B multiple.

I'm adopting a neutral rating on PB based on the mid-single digit price upside. I believe the stock is currently not trading at an attractive enough price to be considered for investment. If the stock price dropped to $69 or below then PB will offer expected capital appreciation of 10% to the target price. Therefore, market price of $69 (or below) seems to be a good entry point in my opinion.