In this article, we examine the significant weekly order flow and market structure developments driving NYSEARCA:XLU price action.

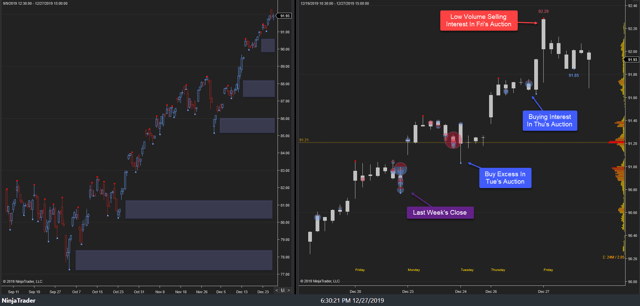

As noted in last week’s XLU Weekly, the highest probability path for this week was for price discovery higher, barring failure of 64.06s as support. This week’s primary expectation did not play out as price discovery lower developed early week to 63.74s, testing key support. Buying interest emerged there before price discovery higher developed to 64.38s ahead of Friday’s close, settling at 64.94s.

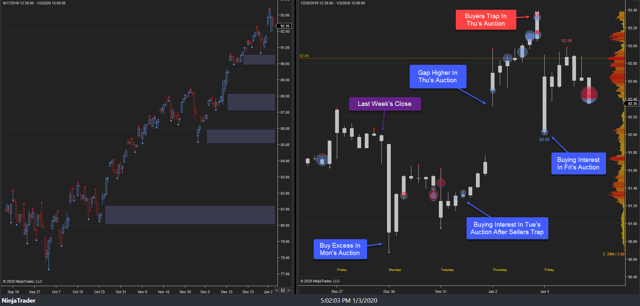

30 December 2019-03 January 2020:

This week’s auction saw buying interest early in Monday’s auction drive price higher to 64.38s where buying interest emerged, 64.28s-64.36s, into Monday’s close. Monday’s late buyers held the auction as price discovery higher continued in Tuesday’s trade, achieving a stopping point, 64.70s, where buying interest emerged ahead of Wednesday’s holiday.

A minor probe higher developed early in Thursday’s trade, achieving the weekly stopping point high, 64.75s, where buyers trapped, halting the buy-side sequence. Aggressive price discovery lower developed, achieving the weekly stopping point low, 63.56s, where buy excess emerged ahead of buying interest, halting the sell-side sequence ahead of Thursday’s close. Minor price discovery higher continued in Friday’s trade to 64.17s ahead of Friday’s close, settling at 63.94s.

This week’s auction did not see the primary expectation play out even though key support, 63.77s, held. Within the larger context, this week’s auction saw balance development near major supply, 64.50s-65s.

Looking ahead, the focus into next week centers upon response to the key demand cluster, 64s-63.60s. Sell-side failure at this key cluster would target key supply cluster above, 64.70s-65.12s/new all-time highs, respectively. Alternatively, buy-side failure within this key cluster would target key demand clusters below, 63.20s-62.65s/61.80s-61.30s, respectively. From a structural perspective, the highest probability path near-term is sell-side, barring failure of 64.75s as resistance. Within this near-term context, the intermediate term (3-6 month) bias is now neutral between 64.94s-61.31s and at