While we believe Peloton will beat its Q2 2020 guidance given the modest numbers provided by the management team, we see significant headwind in Peloton's ability to continue growing into the future due to several reasons, including the potential for the new home trial for Peloton Bikes to backfire, an increasing churn rate, and the deterioration of previously favorable unit economics. We expect a short-term pop in the share price, but the upcoming lockup expiration will likely mute any dramatic upward movement.

(Source: onepeloton.com)

Introduction

Peloton Interactive is a fitness equipment company that recently made headlines with its controversial (yet hilariously overblown) "Peloton Wife" ad. The company is best known for its signature exercise bike called the Peloton Bike. The company also manufactures a treadmill called the Peloton Tread and creates content for their equipment that they tout to be "engaging-to-the-point-of-addictive." The company utilizes a direct-to-consumer, multi-channel sales model to sell its products. Consumers interested in the product can test out any of their equipment at one of their 81 showrooms or the bike at home through the company's 30-day home trial program.

(Source: CNN.com)

The company has three sources of revenue consisting of connected fitness products, subscription service, and other. Connected fitness products revenue comes from the sale of the Peloton Bike ($2,245) and the Peloton Tread ($4,295). Subscription service revenue is generated through Peloton's $39.00/month Connected Fitness Subscription for owners of Peloton products and $12.99/month digital subscription for non-owners who want access to Peloton's content library on their own devices. Other constitutes Peloton-branded apparel.

Peloton Snapshot

| Ticker | NASDAQ: PTON |

| Price | $29.65 |

| Shares Outstanding | 280.5mm |

| Market Capitalization | $8.5bn |

| Cash & Short Term Investments | $1.5bn |

| Debt | $483.8mm |

| Enterprise Value | $7.5bn |

| Short Interest | 9.8% |

| Industry | Leisure Products |

(Source: Capital IQ as of 1/8/2020)

Q1 2020 Earnings Result

Peloton recorded Q1 2020 (ending 9/30/2019) revenue of $228.1mm consisting of $157.6mm of products, $67.2mm of subscriptions, and $3.3mm of other. Total revenue grew by 103% YoY, while products and subscriptions grew by 102% and 112%, respectively. Gross margin was 46%, with products and subscription margins standing at 43% and 56%, respectively. Overall margin improved slightly vs. 45.8% last year, but products gross margin fell from 45.8% while subscription margin grew from 48.6% vs. Q1 2019. This seems to be very much in line with what management explained regarding products gross margin decreasing due to 1) the new production mix with the tread and 2) the overall ramp in production. Net loss for the quarter was $51.1mm when accounting for the change in foreign currency translation adjustment of $1.3mm.

Management provided forecasts for revenue of $410mm to $420mm and connected fitness subscribers of 680k to 685k for Q2 2020. FY2020 forecasts consisted of revenue of $1.45bn to $1.50bn and connected fitness subscribers of 885k to 895k. Management also touched upon the launch in Germany in Q2 2020 and the recent acquisition of their Taiwanese bike manufacturer Tonic Fitness in October.

While we believe Peloton will beat its Q2 2020 guidance given the modest numbers provided by the management team, we see significant headwind in Peloton's ability to continue growing into the future due to several reasons we'll outline below.

Takeaway #1: Launch of Home Trial

Peloton launched its home trial program in September, which allows customers to test out the Peloton Bike for 30-days before deciding to keep it. We see this move as a grow-at-all-cost model. By selling products to customers with a return guarantee, Peloton may be able to convert its customers who were initially on the fence; this may inflate short-term sales numbers into the holiday season. Nonetheless, we may see clawbacks starting in January 2020.

In the latest earnings call, management stated that the company has started piloting a resale program for its returned inventory. This will likely interfere with the company's new products if they're offered at a reasonable discount. We believe management will be cautious when navigating this new sales outlet, but inventory cost could start ballooning and gross margin could start dropping as more used equipment is offered to customers.

(Source: onepeloton.com)

Takeaway #2: Higher Churn Rate

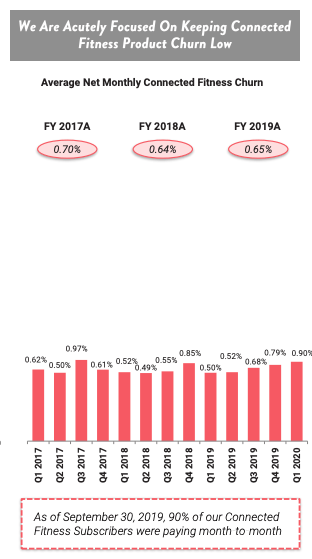

The average monthly churn rate for digital subscriptions stood at 0.90%, which represents the second highest churn rate seen going back to Q1 2017. In the past two years, Q1 churn rates have been on the lower-end when looking at the full year. This significant increase in churn rate is a cause of concern for us, and management stated that they're expecting churn rate to continue increasing as 1) prepaid subscriptions start rolling off and 2) more people utilize home trials to test out the products.

For those of you who may not be familiar, Peloton used to offer 12-month subscriptions with 1 month free and 24-month subscriptions with 3 months free for prepaid subscribers. Along with this, they offered these customers 0% APR for up to 39-months. Peloton ended the program back in July 2018 but continued offering the 0% APR for all qualified customers.

Based on our model and historical numbers, we see the churn rate being heavily back-weighted as Q4 churn rates tend to be the highest for the company. With the addition of the home trial, we could see the 2020 average churn rate exceeding 1.05% as higher volumes of equipment sold during the holiday season get returned in Q3 2020. We're currently modeling a 1.08% average churn rate for the year.

(Source: Peloton Earnings Presentation)

Takeaway #3: Net Customer Acquisition Cost

One of the items touted by management in the S-1 filing was the unit economics of Peloton products and the company's ability to offset net customer acquisition cost (net CAC) with gross profit earned on its fitness products. This unit economic model seems to have suffered during the latest quarter with the net CAC reaching $86, according to management. While the CAC number bounced around significantly at $183, $(33), and $5 during 2017, 2018, and 2019, respectively, we see the effect of aggressive sales and marketing tactics coming into play here. We see this cost going up as production ramps and gross margin normalizes closer to the forecasted 41-42% range from the exception gross margin of 46% during this quarter.

Fear the Expiration

The three takeaways we mentioned earlier is related to our longer-term concern for the company. In the short-term regarding Q2 earnings results, we see the company beating forecasted connected fitness subscribers and hitting closer to 700k users vs. 680-685k guided. We see Mr. Market reacting positively to the news but expect muted movements due to the upcoming lock-up expiration.

As seen with Uber Technologies (NASDAQ: UBER) and Beyond Meat (NASDAQ: BYND), volumes tend to trend upwards before peaking on the lock-up expiration date. Stock prices plummet accordingly as well. We expect similar price actions for Peloton as we near the lock-up expiration date of March 24, 2020.

Uber Technologies (NASDAQ: UBER)

(Source: Tikr.com)

Beyond Meat (NASDAQ: BYND)

(Source: Tikr.com)

Final Thoughts

Peloton has now become a household name for many people outside of Silicon Valley. Although we like the short-term thesis of the company, we're hesitant to enter into a position due to the upcoming lock-up expiration. Longer-term, we see unit economics breaking down due to the excessive spending in sales and marketing, increased inventory of returned products, and lower margins. We'll provide further analysis as we conduct more research, and we welcome all comments and questions.