This is not an article about investing in PTE. I have plenty of those, here is the latest. This is merely an update on recent events for anyone following the stock.

So, That Happened

So, That Happened

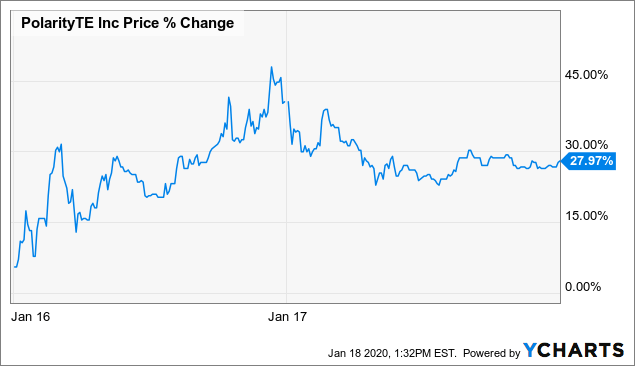

Data by YCharts

Data by YChartsI woke up Thursday morning, as always, at 4 AM Pacific Time, and I saw all my accounts were up a lot premarket. “Apple,” I thought.

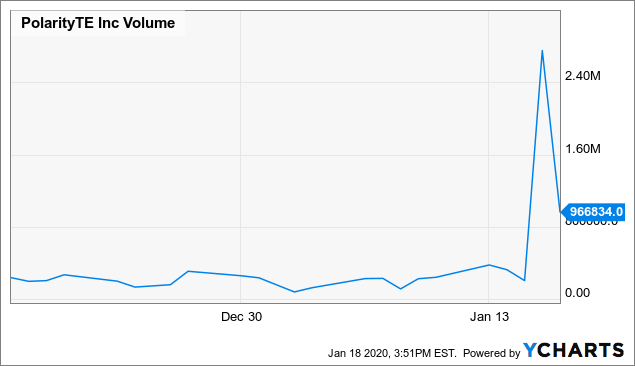

But no, there was an unusual amount of volume on my microcap biotech, PolarityTE (PTE). There were only about 20k shares traded at that point, but that number is usually zero. The stock was up around 5%.

Nothing in the Reuters news feed. The company did have a new study publish (WARNING: grizzly clinical photos at that link) a week before, and though it was more good news for them on that front, it was hardly earth-shattering. And like I said, a week old when all this happened. The messages were coming in, and I frankly had no answers

I asked Twitter, and there were answers:

Fine, June. Institutional money has been coming on since the leadership change in June. But why Thursday?

Fine, June. Institutional money has been coming on since the leadership change in June. But why Thursday?

Another:

This, of course, happens every month. Why these options?

This, of course, happens every month. Why these options?

Why?

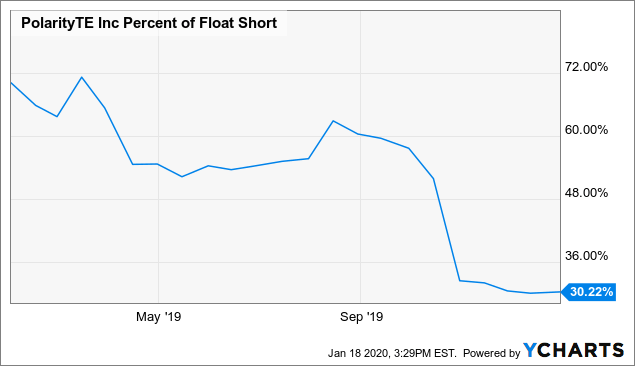

PolarityTE has only about 25 million shares, about 13 million in the public float. Of that, a very large portion had been held short until October, but still at around 30%.

Data by YCharts

Data by YChartsAdd in those institutional longs, and this is about as tightly-held a company as you will find. When there is this sort of volume, with 3.5 million shares traded over 2 days, the stock is going to move.

Data by YCharts

Data by YChartsBut even at the 2-day volume-weighted average price, $3.95, that 3.5 million shares was only around $14 million traded. My point is that it doesn’t take much money to make this stock go haywire.

But what set it off premarket on Thursday? Most likely, it was this retweet from Wednesday night:

David Seaburg is the President of PolarityTE, and its most public-facing executive. Gasparino is this guy:

David Seaburg is the President of PolarityTE, and its most public-facing executive. Gasparino is this guy:

Like I said, it doesn’t take much to get this stock moving. In either direction.

I asked Seaburg for comment when the stock was “only” up 20% on Thursday morning. This was his response.

All I’ll say is that we are doing everything we said we would when we took this company over. We overcame so many nonsense headwinds in 2019 because we kept our heads down and stayed focused on our strategy, which includes continuing to build an arsenal of credible evidence around SkinTE. We have such a unique and amazing technology, so I never questioned if SkinTE would get the recognition it deserves in publications like this, it was just a matter of when.

This is all true. After some mismanagement from the founder, he was ousted in June and replaced by a much more competent group, led by Seaburg. They were getting a lot of heat on the conference and study circuit in 2019, and are continuing in 2020. They will next have a report on their head-to-head burn victim study this quarter.

Anyway that’s everything I know. Look for a full review after they report, probably mid-February.