(We previously wrote about Altria, Philip Morris, British American Tobacco and Imperial Brands as "Blue Sky Capital")

Introduction

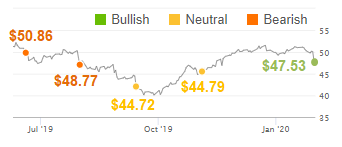

We initiated our coverage on Altria (NYSE:MO) with a Bearish rating last June, and upgraded it to Neutral in September after the share price fell 12% in 3 months. We are now upgrading our rating to Buy, after 19Q4 results last Thursday, because of the receding risk from e-vapor:

| Librarian Capital Altria Rating History vs. Share Price

NB. Share prices as of the day of article submission. Source: Seeking Alpha; annotations by Librarian Capital. |

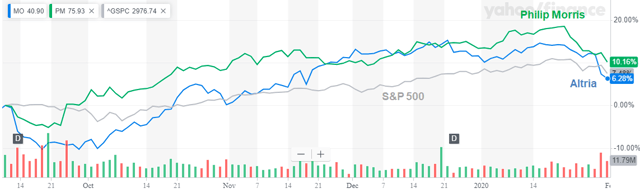

Since our Neutral rating in September, Altria shares have gained 10.0% (including $1.68 in dividends), ahead of the S&P 500 but behind Philip Morris (PM), on which we have had a Buy rating through this period:

| Altria Share Price vs. PM & S&P 500 (Since 11-Sep) NB. PM shares received $2.34 in dividends during this period. Source: Yahoo Finance (01-Feb-20). |

Altria shares have fallen 5.1% since results last Thursday, so our upgrade once again represents a different view to most of the market.

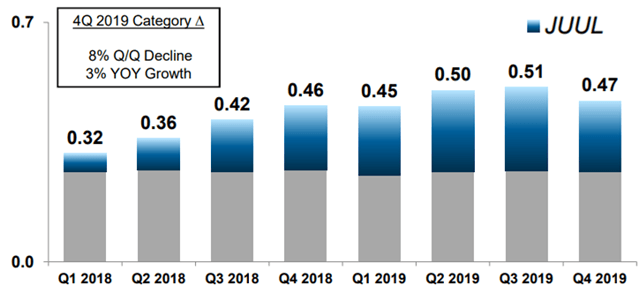

U.S. E-vapor Reversed into Decline

The most important development within Altria's 19Q4 results was the reverse of the U.S. e-vapor category from growth into a 8% quarter-on-quarter decline. This means the category’s year-on-year growth rate has sharply decelerated from approx. 40% in Q2 and 20% in Q3, to only 3% in Q4:

| US E-Vapor Category Volume by Quarter (2018-19) NB. Figures in billion sticks equivalent. Source: Altria results presentation (19Q4). |

Just as Juul was the main generator of the category’s growth since late 2017, it was the main source of its decline in Q4. Its category share fell from 48% to 44%, which implies a 15% quarter-on-quarter volume decline. Since late Q3, Juul has had to announce new retail access controls (August 29), the withdrawal of most of its non-tobacco flavors (October 17) and the mint flavor as well (November 7). The removal of all non-tobacco/menthol flavors was particularly damaging, given they were more than 70% of Juul's sales.

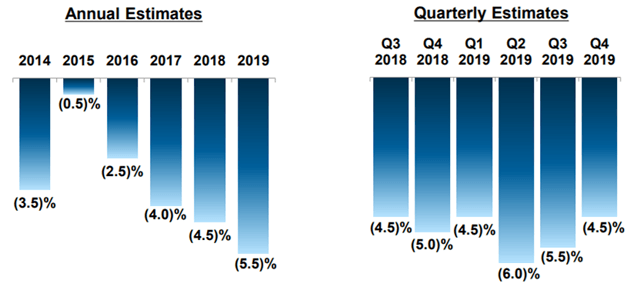

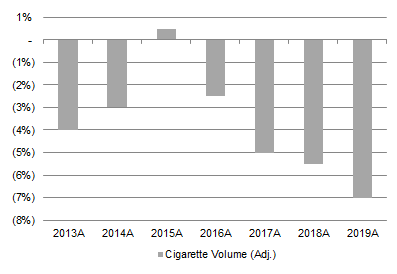

Correspondingly, the year-on-year decline in U.S. cigarette industry volumes decelerated, from 5.5-6.0% in the two preceding quarters to 4.5% in 19Q4:

| U.S. Cigarette Industry Volume Decline Y/Y (2014-2019) Source: Altria results presentation (19Q4). |

Altria’s Smokeables volumes only declined 6% year-on-year in 19Q4 (on an adjusted basis), better than the 7.5% for Q1 to Q3, reducing the full-year decline to 7%:

| Altria Smokeable Volume Decline Y/Y (2014-2019)

Source: Altria company filings. |

For 2020, Altria expects the U.S. industry volume decline to be in the 4-6% range, no worse than the last 3 years. Management now expects e-vapor to have a “continued slowdown” or even a "decline", and for this to result in less pressure on cigarette volumes. As Altria's CEO explained:

“With regard to e-vapor, it’s hard to precisely predict what’s going to happen to that category. But if you just turn to the fourth quarter of this year, its year-over-year growth rate was only 3%. And I think that we really expect that we’re going to see a continued slowdown or even maybe a decline in the e-vapor category over the next couple of years. And I think that’s going to result in less pressure on the cigarette category.”

Howard Willard, Altria CEO (19Q4 earnings call)

Other factors still in play are likely of limited impact in 2020. While Congress has raised the minimum smoking age to 21 in December, some states had already had this restriction before. Similarly, while there are other Reduced Risk Products in the market such as Philip Morris' IQOS or oral tobacco products, they are mostly marketed by existing tobacco players.

Nonetheless, Altria stated a belief that tobacco volumes would remain “dynamic” and “expects continued volatility across tobacco categories”, and will no longer provide a multi-year outlook for industry volumes.

Discontinuation of Most Services to Juul

Altria also wrote down the value of its Juul investment by another $4.1bn, because management now expects “no equity contributions from Juul through 2022”. $8.6bn of the original $12.8bn value has now been written off.

Altria also revised other terms with Juul, including a discontinuation of all non- regulatory services. This means that Altria will no longer help Juul expand its distribution in the U.S.

“We’ve agreed with JUUL to continue providing regulatory affairs services … And we will discontinue all other services by the end of March”

“(Juul) utilized some of our services such as the salesforce ... (Their discontinuation) gives us the opportunity to really invest in our sales and distribution organization and having them focus on our two core tobacco segments as well as the expansion of IQOS and on!”

Howard Willard, Altria CEO (19Q4 earnings call)

Together with Juul's ongoing restructuring (with a planned 16% reduction in its headcount), we believe this would have a material impact on Juul’s growth. This is positive for cigarette volumes in both U.S. and non-U.S. markets, the latter benefiting Philip Morris, British American Tobacco (BTI) and Imperial Brands (OTCQX:IMBBY).

19Q4 Financials

Altria's 19Q4 results were stable.

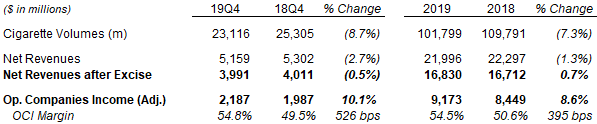

In the Smokeables segment, inventory moves turn the 6% decline in adjusted volumes to an 8.7% decline in reported volumes. Net Revenues fell 2.7% despite price increases, but Net Revenues after Excise had a smaller decline of 0.5%; Operating Companies Income ("OCI") increased 10.1%, with the majority of the $200m increase likely from the group's annualised cost savings of $600m during 2019:

| Altria Smokeables Segment Financials (19Q4 vs. Prior Year)

Source: Altria results press release (19Q4). |

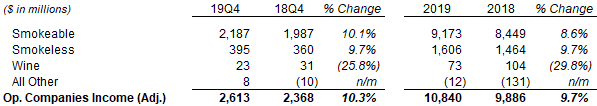

Smokeables remain approx. 85% of group OCI and the key driver for its P&L:

| Altria OCI by Segment (19Q4 vs. Prior Year)

Source: Altria results press release (19Q4). |

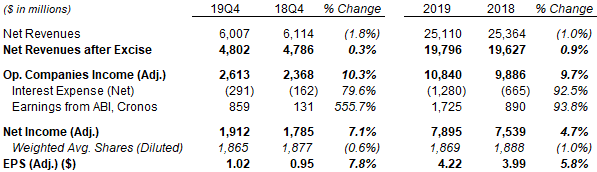

Group OCI grew 10.3% year-on-year in 19Q4 and 9.7% for the full-year. Adjusted Net Income grew more slowly, at 7.1% and 4.7% respectively, due to the Interest Expense on the extra debt associated the Juul investment. Adjusted Net Income excludes the $8.6bn write-down on Juul and $1.4bn of mark-to-market losses on Altria's Cronos (OTC:CRON) investment:

| Altria Group Financials (19Q4 vs. Prior Year)

Source: Altria results press release (19Q4). |

Management EPS Guidance

Management again reduced its 2020-22 EPS CAGR outlook, from 5-8% to 4-7% (it was 7-9% before Q3 results), “primarily” due to the expectation of zero earnings from Juul. An outlook for 2020 was provided for the first time, with the same 4-7% EPS growth, despite investments in IQOS and other areas.

Our View on Future Earnings

We believe the threat to U.S. cigarette volumes has significantly receded.

Growth in U.S. e-vapor will now be structurally lower, given the problems facing Juul and the likely complete removal of all non-tobacco/menthol flavours from the market. Former e-vapor leader NJOY halted the sale of its fruit flavours in late January, and it is only a matter of time before BAT and Imperial Brands follow voluntarily or are forced to by the FDA. IQOS is marketed by Altria in the U.S., and oral tobacco has only had limited impact on cigarette volumes historically. While there are other new developments, such as disposable e-cigs that are exempted from proposed FDA policies, they remain too early-stage to have an impact; the FDA proposals on restricting nicotine and menthol will also likely not be material within 2020.

We now assume Altria's annual cigarette volume decline to be 5%, essentially back to the pre-Juul 2017 level, and better than 19Q4's 6%. As we will explain below, this would mean a 2% OCI growth, thanks to benefits from a positive price/mix, flat excise, and lower Cost of Sales.

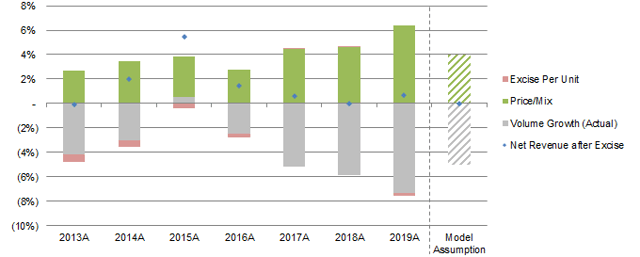

Historically, Smokeables has had growth in Net Revenues after Excise despite volume declines. Price/mix has always been positive, excise per cigarette has actually been rising only slightly or flat, likely due to the mix shift towards lower-tax states. Along with a 5% volume decline, we assume a 4% price/mix benefit and flat excise each year, which gives flat Net Revenues after Excise:

| Altria Smokeables Revenue Growth Drivers (2013-19) Source: Altria company filings, Librarian Capital estimates. |

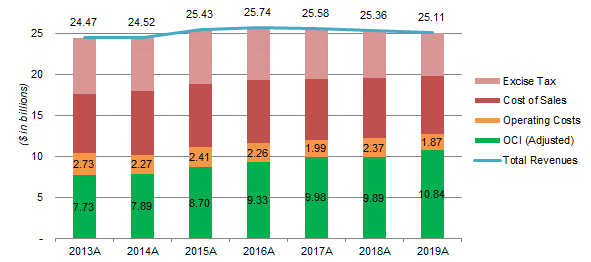

OCI growth will also benefit from lower volumes requiring less Cost of Sales. Between 2016 and 2019, even as group revenues fell $634m, OCI rose $1.51bn, with all but $388m of this coming from lower Cost of Sales:

| Altria Group Costs & Profits (2013-189)

NB. The difference between OCI and EBIT is "general corporate expenses"; Altria does not disclose Cost of Sales by segment. Source: Altria company filings. |

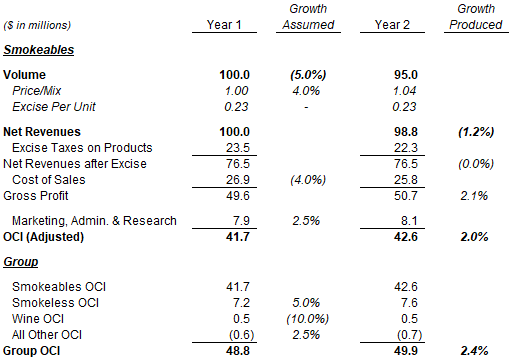

We have constructed some illustrative calculations for Altria's future OCI growth below. In addition to assumptions stated above, we have taken Altria’s 2019 margin profile and assumed an Operating Expense growth of 2.5% each year. This leads to Smokeables OCI growing at 2.0% annually and, including some growth from other segments (mostly from Smokeless), group OCI growing at 2.4% in the first year:

| Illustrative Altria Forecasts (Year 2)

Source: Librarian Capital estimates. |

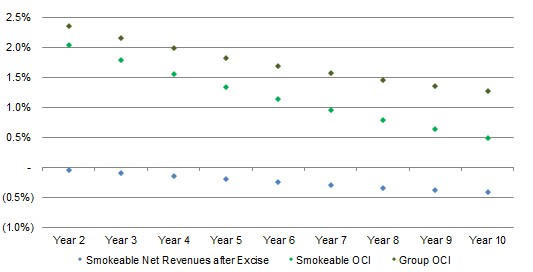

In this scenario, Net Revenues and OCI would continue growing for years but at a decelerating rate, as excise and Cost of Sales become smaller relatively, with group OCI growth decelerating from 2.4% in year 2 to 1.3% by year 10:

| Illustrative Altria Revenue & OCI Growth Rates (Years 2-10)

Source: Librarian Capital estimates. |

So long as OCI growth remains positive, financial leverage would mean that Net Income would grow slightly faster, so likely at approx. 2.5% to 1.5% annually between year 2 and year 10 (similarly decelerating over time).

Valuation

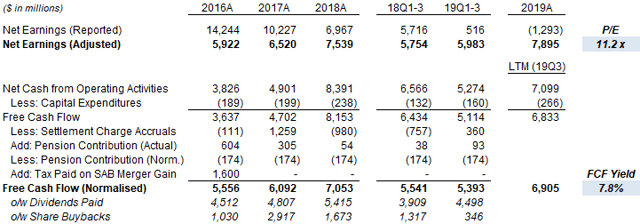

At $47.53, Altria shares are on 11.2x 2019 P/E and a 7.8% last-twelve-months Free Cash Flow ("FCF") Yield; the dividend yield is 7.1% ($3.36 per share):

| Altria Net Income, Cashflow & Valuation NB. 19Q4 cashflow data not available at time of writing. Source: Altria company filings. |

Minority stakes in Anheuser-Busch InBev (BUD), Juul and Cronos are worth 24% of the current market capitalisation (with $15.6bn of the $21.0bn from BUD, whose dividends are already in the cashflows).

Altria has historically distributed most of its FCF, and we expect buybacks to resume after it has reduced its leverage to the target level. We expect buybacks to reduce the share count by 0.5-1.0% each year, taking the Net Income growth of 1.5-2.5% above to an EPS growth of 2.5-3.0%. (Net debt / EBITDA is now 2.3x, down from 2.5x at 19Q1, but still higher than the 2x level in previous years.)

Conclusion

We believe Altria shares offer an asymmetric risk/reward where the downside risk has receded and a bull case could return 20-30% in the next 12 months.

With a current dividend yield above 7% and a likely stable/growing Net Income, given U.S. e-vapor growth has reversed and Altria volume decline is decelerating, we believe the downside risk has been largely removed. While other long-term risks remain, these will likely not be material during 2020.

We assume a 5% annual volume decline for Altria Smokeables which, with the benefits from price/mix, excise and Cost of Sales, could still give an organic Net Income CAGR of around +2%.

In a bull case, given historic investor attraction towards dividend stocks and Altria in particular, there is a meaningful chance of Altria re-rating upwards, and returning to the $55-65 range seen in much of 2018, if volumes improve. The $55-65 price range would represent a 5.5-6.5% dividend yield based on a 2020 dividend of $3.50 (4% higher than current). At the current price of $47.53, this would imply a 20-30% return over the next 12 months.

Otherwise, with stable valuation multiples, Altria shares should return just under 10% in the next 12 months, consisting of 7% in dividends, and a 2.5-3.0% EPS growth that translates to the same in share price growth.

We upgrade our rating on Altria to Buy.

(We continue to prefer Philip Morris for its lower downside risk, thanks to its zero U.S. exposure and future-proof IQOS product.)

Note: A track record of my past recommendations can be found here.