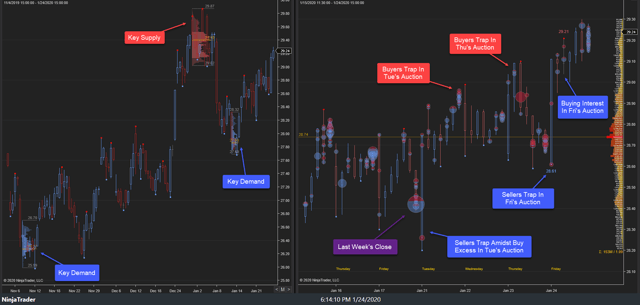

In this article, we examine the significant weekly order flow and market structure developments driving NYSEARCA:GDX price action.

In our most recent GDX Weekly, it was noted that the highest probability path was for price discovery higher, barring failure of 28.60s as support. After a week of balance trade, 28.23s-29.24s, price discovery lower developed this week as the key support, 28.60s, failed. Sell-side continuation developed to 27.77s within the key near support area where buying interest emerged, developing balance, 27.77s-28.67s, ahead of Friday’s close, settling at 27.93s.

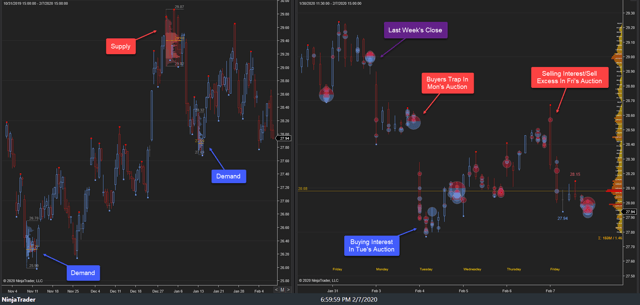

03-07 February 2020:

This week’s auction saw price discovery lower in Monday’s auction as last Friday’s late buyers failed to hold the auction. Price discovery lower developed in Monday’s trade, achieving a stopping point, 28.40s, as buying interest emerged. Minor retracement higher developed to 28.69s before buying interest emerged, 28.55s-28.57s, at/near key support into Monday’s close. Monday’s late buyers failed to hold the auction as a gap lower open developed in Tuesday’s trade. Sell-side continuation unfolded, achieving the weekly stopping point low, 27.77s, within the key January 2020 demand area. Buying interest emerged there, 27.79s-27.93s, halting the sell-side sequence.

Price discovery higher began in Tuesday’s trade, continuing into Thursday’s auction, achieving a stopping point, 28.51s, where buying interest emerged, 28.51s-28.43s, testing the sell-side breakdown area into Thursday’s close. Thursday’s late buyers held the auction initially in Friday’s trade as a probe higher developed, achieving the weekly stopping point high, 28.67s. Sell excess developed there, halting the buy-side sequence at/near key resistance (prior support). Price discovery lower ensued to 27.94s, before narrow balance developed, 27.94s-28.15s, ahead of Friday’s close, settling at 27.93s.

This week’s auction saw a sell-side breakdown through key near-term support, 28.60s, before a re-test of this area held and price traded lower to the key near-term demand area, 28s-27.70s. Within the larger context, balance development continues, 31s-25.98s, following