On Wednesday, January 29, 2020, Norwegian telecommunications giant Telenor ASA (OTCQX:TELNF) announced its fourth-quarter 2019 earnings results. At first glance, these results appeared to be relatively solid, as the company delivered strong year-over-year revenue growth along with a substantial profit. A closer look at the actual earnings report does indeed show that Telenor delivered a very solid quarter and managed to correct a few of the problems that have been plaguing it over the last year or so. Thus, shareholders should be quite pleased with these results, and the company continues to be an attractive international telecommunications play.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company's earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article, as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Telenor's fourth-quarter 2019 earnings results:

- Telenor reported total revenues of NOK 31.808 billion in the fourth quarter of 2019. This represents a 17.50% increase over the NOK 27.070 billion that it brought in during the prior-year quarter.

- The company reported an EBITDA of NOK 11.882 billion in the most recent quarter. This compares quite favorably to the NOK 10.124 billion that it reported in the year-ago quarter.

- Telenor added 2.6 million subscribers in the fourth quarter. This brings the company's subscriber base up to 186 million compared to the 174 million that it had at the end of 2018.

- The company had a negative free cash flow of NOK 8.734 billion during the current period. This is substantially worse than the negative NOK 141 million that it reported in the year-ago period.

- Telenor ASA reported a net income of NOK 2.709 billion in the fourth quarter of 2019. This represents a substantial 75.45% increase over the NOK 1.544 billion that it reported in the fourth quarter of 2018.

One of the first things that anyone reviewing these results is likely to notice is that, with the exception of free cash flow, all of the company's measures of financial performance increased compared to the year-ago quarter. One of the reasons for this is that its reporting currency, the Norwegian krone, declined against several of the other national currencies of the nations in which the company does business. This is partly due to oil prices. While Telenor itself does not sell any energy products, the value of Norway's currency is somewhat dependent on oil prices due to that being the nation's largest industry. As I have explained in a few recent articles, energy prices globally were lower in the most recent quarter than they were in the equivalent quarter of last year. The reason why this would affect the company's results should be fairly obvious, as every unit of a foreign currency received converts into more Norwegian kroner when the company converts the foreign currency received back into Norwegian currency for reporting purposes. Unfortunately, though, this does not represent actual growth, since the reported numbers depend on currency fluctuations and not on actually expanding the business. In this case though, the company did deliver actual real growth, as its revenues went up by 2% year over year when measured in the currencies that its customers actually pay with.

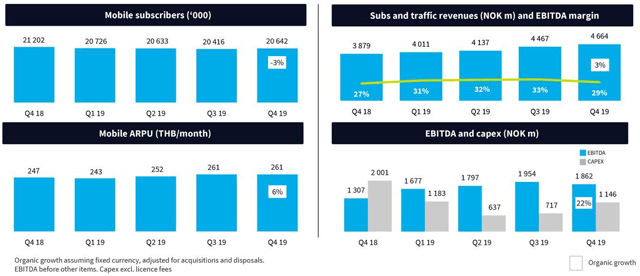

One important metric that we use to measure the performance of telecommunications companies is average revenue per user. At its core, this metric is exactly what it sounds like - the average amount of revenue that the company brings in from each of its users. This is important because telecommunications firms typically have a variety of both fixed-line and mobile plans, and also generate money from the sale of devices, certain applications, and ancillary services. It thus can serve as a measurement of the demand for the company's services. Fortunately, Telenor delivered growth in average revenue per user in both its mobile and fixed-line businesses. We can see this clearly here:

Source: Telenor ASA

This is undeniably the kind of thing that we like to see, as it shows that the company's customers are willing to pay more for its services and possibly purchase more services than they did a year ago. The company itself points this out, as it states that there has been an increase in customers purchasing add-on services to their existing plans. Regardless, this represents clear growth and is the kind of thing that we should appreciate as investors.

One of Telenor's most important markets is its home country of Norway, which also happens to be one of the wealthiest nations in the world. The company's results in this country were, unfortunately, weak during the quarter. As we can see here, Telenor's results were generally weaker than in the third quarter, but they did show marked improvements in most areas compared to the fourth quarter of last year. We can see this clearly here:

Source: Telenor ASA

One of the reasons for this is that Telenor added 17,000 fiber customers to its subscriber base over the past year. This is exactly what it sounds like - people wanting a fiber optic connection to their homes or businesses to carry data over the internet, along with potentially television and telephone service. This clearly shows us that fixed-line communications is not being replaced by wireless as some analysts thought, although copper-line communication is certainly being supplanted.

Unfortunately, Telenor did see its mobile subscription base in Norway decline by 11,000 during the quarter. This is generally not the kind of thing that we like to see, as most people will not abandon their mobile phones, so this means that these people likely found better cellular deals with one of the company's competitors. It is important to note, though, that 9,000 of these defections were pre-paid customers. Pre-paid cellular customers are often among the least financially secure customers of a company like this, and they usually paid much less on average than post-paid customers who have higher incomes and better credit profiles. Thus, the pre-paid customers that the company lost were likely among its least desirable customers. This is likely one reason why Telenor's average revenue per user increased despite the loss in mobile customers. Therefore, it does not appear that investors should worry about this.

Another of the company's major markets is Finland, which lies right next to the Scandinavian peninsula. This is a nation that the company made special mention of in the CEO's statement of its earnings report. Sigve Brekke, Telenor's president and CEO, stated:

During the year, our customer base increased by 12 million, resulting in a total base of 186 million. Throughout 2019, we have continued our strategic journey set out at the Capital Markets Day in 2017 with clear ambitions. Delivering on these ambitions over several years has given us the flexibility to further develop our portfolio, resulting in the acquisition of DNA in Finland in 2019.

Unfortunately, the acquisition of DNA has not exactly panned out the way that the company planned. As we can see here, Telenor saw most of its relevant metrics decline in the fourth quarter compared to the third, although it did generally beat its year-ago numbers:

Source: Telenor ASA

It is important to note that all of these figures have been adjusted to account for the impact of Telenor's acquisition of DNA. In practice, the company did see substantial growth across the board due to the combination of this company with Telenor's original business in the nation. However, as this was not organic growth, it is best to exclude it in order to get an accurate comparison year over year.

There were still some bright spots in the company's Finnish operations, though. One of the best things is that DNA saw its average revenue per user increase by 3% in the quarter. This was due to some of the same factors as in Norway, although Finnish people dropped their pay TV services in relatively large numbers, indicating that the nation's customers seem to prefer streaming services. They are clearly willing to pay up for faster broadband connections though, so Telenor is able to make up for the loss of television revenues.

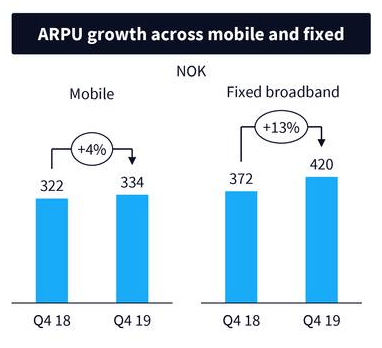

As I have discussed in previous articles, Telenor's operation in Thailand, dtac (TACJF), has been struggling for a long time. This was partly due to the very high level of competition in Thailand that resulted in its competitors being willing to accept minimal or no profits on their cellular data plans in order to grab market share. I predicted in this article, though, that dtac would be able to return to growth and begin to once again reward Telenor. This actually happened in the fourth quarter of this year. As we can see here, dtac generally delivered both quarter-over-quarter and year-over-year growth in most relevant categories:

Source: Telenor ASA

One of the most significant reasons for this is that dtac has been improving its network, as I discussed in the article that I linked earlier. This has allowed the company to improve its customer satisfaction and retention. This is evident in the fact that the company boosted its subscription and traffic revenues by 3% quarter over quarter and gained 200,000 subscribers in the quarter. This may be an indication that satisfied customers have been recommending the service to their friends and family, which would prove positive for growth going forward.

Another nation in which Telenor was experiencing some difficulty is the Southeast Asian nation of Myanmar. The company also managed to reverse its fortunes in this nation during the quarter, although average revenue per user development disappointed. We can see this here:

Source: Telenor ASA

As we can see, Telenor delivered positive growth in all areas except average revenue per user in the nation compared to the prior-year quarter. One of the biggest reasons for this is that the company added 684,000 new users during the quarter and many of its existing users increased their data usage. Myanmar differs somewhat from the United States and other developed nations in that there aren't generally unlimited data plans or plans with data limits so high that most people will never hit them. Rather, a customer's bill is directly proportional to the amount of data that they use. Thus, when customers increase their data usage, they pay more money to Telenor. This directly benefits the company's shareholders. Telenor reports that 64% of its customers in Myanmar are active data users and consume an average of 4.3 gigabytes per month. This is still less than the average Western consumer uses, so it might represent a growth area for the company.

In conclusion, this was a reasonably solid quarter for Telenor that saw the company successfully executing on several of its growth ambitions. It also managed to turn around its operations in a few of its weaker markets, which shareholders should appreciate. Overall, investors should appreciate this, and Telenor remains a solid holding for someone looking for a foreign telecommunications firm.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. We are currently offering a two-week free trial for the service, so check us out!