Investment Thesis

Coivd-19 is the most significant black swan event since the 9/11 attacks on the United States in 2001. The streets of mid-town are empty, commerce is at a stand-still, universities are shuttered, and the longest bull market in US history is dead. We have to accept that what was true even in January of this year is no longer valid because of this unforeseen event.

Coivd-19 is the most significant black swan event since the 9/11 attacks on the United States in 2001. The streets of mid-town are empty, commerce is at a stand-still, universities are shuttered, and the longest bull market in US history is dead. We have to accept that what was true even in January of this year is no longer valid because of this unforeseen event.

Previously, I wrote about how Pinterest (NYSE:PINS) was one of my top picks of the year and assigned the company a fair valuation of $25 based on forward revenues and target multiple of enterprise value to revenue based on a peer group of companies. My appraisal of market mispricing to the downside was shared by Wall Street as shares quickly appreciated to these levels after this forward sales guidance was reiterated during its FY20 earnings disclosure. Unfortunately, things have changed. Market multiples have contracted and previous guidance can no longer be treated as valid.

That being said, Pinterest is in a unique position. The nature of the company's business places it in a precarious position to sink or shine, and unfortunately not do much else in between. A good valuation requires a strong ability to forecast future revenue, and in the case of PINS, an average of peer-group market multiples. Even using a discounted cash flow model, the lowest discount (meaning often the most significant input) is placed on the nearest-term free cash flow to firm, which is ultimately determined by revenue and net income. I would be disingenuous if I told you I had any idea how the company will perform until management offers some guiding remarks, so I will not be focusing on the valuation in this article. Instead, my emphasis is going to be on the bull vs. bear narrative, and what scenarios could play out for the company and ultimately inform the severity of the impact on sales.

The Macro Environment

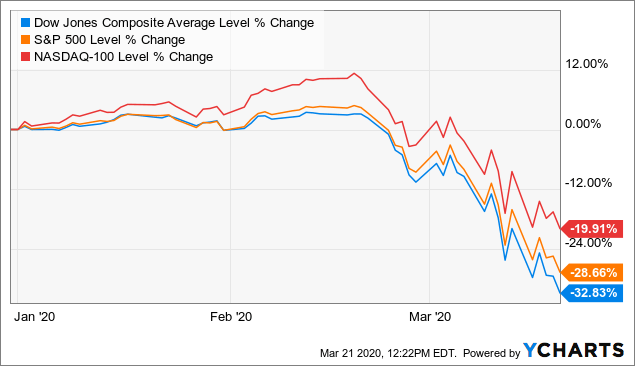

Data by YCharts

Data by YCharts

To begin, it's important to understand the macro environment of the market today. Public stock exchanges operate on a demand-based pricing model. If fear sets in, funds sell off, and risk managers panic, then stock prices go down, but it's only meaningful if we have the underlying economic data and earnings. Right now, the selling is anticipatory of a global recession, but at this time, we simply do not know how severe the impact will be. Bill Ackman of Pershing Square gave an already infamous tearful warning that the mishandling of this crisis could lead to economic devastation that could rival the Great Depression. We have already seen a spike of 33% in unemployment claims and these figures are said to be only the beginning of what is to be a devastating blow to the gig economy and middle-class workers surviving paycheck to paycheck.

You might not fit this description, but make no mistake, this impacts us all. Even if your business and your business's clients are able to operate from home, you are ultimately impacted by consumer spending. Imagine a payment processing company that operates on a business-to-business sales basis and primarily sells to small businesses that operate business-to-customer. Your company might not see a direct impact immediately, but your company's stakeholders, the B2C client you sell to, will see a decline in sales from mass layoffs in the impacted industries. This could lead them to either go under or pivot to a cheaper alternative, and suddenly your business has lost a client account.

This is the case for the interactive media sub-industry in which you find companies like Facebook (FB), Google (GOOG) (GOOGL), Twitter (TWTR), Match Group (MTCH), Snap (SNAP), and of course, Pinterest. These companies largely make their money by delivering targeted advertisements from marketers to their user base. Think of the internet as a jungle filled with ticks. When you go to a website, a bunch of ticks grab on and follow you around until you remove them. These ticks are called "cookies" and they latch onto your IP address and ping back to home when you visit certain websites. This is very attractive to a marketing team because they can go to ad exchanges and assign bid values for ads to be delivered to users based on viewing activity (i.e. an airline will bid more for someone who viewed flights, then hotels, than someone who just viewed flights). The two clear leaders here are Google and Facebook that often are given dedicated ad budgets when companies plan out their sales and marketing spend, while their smaller competitors fight over trial budgets. That being said, Pinterest exists in a unique position within these firms.

The Bull Case

In a sales cycle, there are generally a few phases of customer engagement. The first stage is education. This stage consists largely of the customer learning of a problem and realizing they need a solution. Customers in education tend to be more passive and I would wager these describe most of the ads being served on most interactive media platforms. The next stage is selection, this when customers have realized the problem and the need for a solution, and are actively evaluating potential solutions. Given that Pinterest is a platform often used by shoppers looking for inspiration for recipes, vacations, outfits, and home decor, this means many of the platform's users are in the selection phase and are better prospects than those on other platforms.

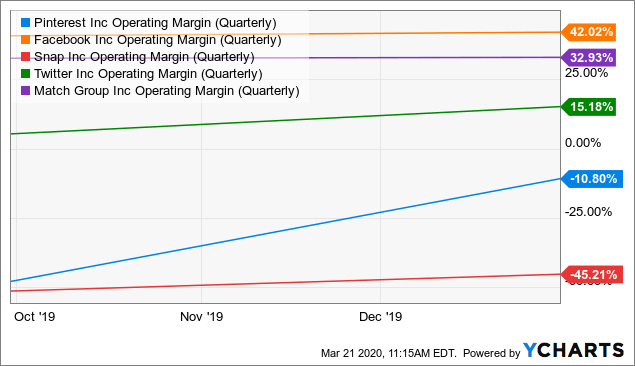

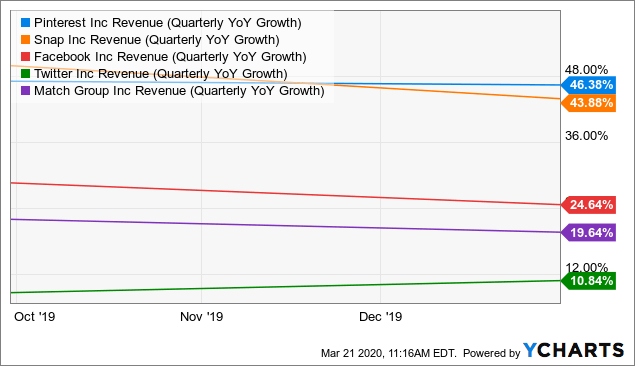

What this means for Pinterest is that its ads can command a premium price tag and the argument for reinvestment and expansion of customer spend should be easier to make. Over time, the company benefits from economies of scale and margins improve from renewals and word of mouth, driving down the cost of sales and sales & marketing as percentages of revenue. This trend is evident in the company's income statements (see graphs below):

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

The first chart above shows the company's operating margins. Although they are negative, they are improving, and doing so while maintaining the highest levels of sales growth among the selected peer group (see chart 2). This makes the case that sales growth is coming at a lower cost, thus that businesses are capitalizing on the opportunity to market to customers in selection vs. education via the Pinterest ad platform. In an environment where billions across the world will be isolated in their homes and forced to find ways to occupy themselves, this could prove to be a positive for PINS.

Many weddings, vacations, and movies have been postponed indefinitely. Those who were to attend may be seeking an escape, as are those who are looking for a light at the end of the tunnel. This increase in user engagement could help to smooth some of the declines in sales. Additionally, many are taking this opportunity to take care of their homes by reorganizing, cleaning out closets, and re-purposing spaces into exercise areas and home offices. This means that there could be a market out there for those using Pinterest in conjunction with Amazon (AMZN) or Walmart (WMT) to adapt to extended quarantines and working from home. How much of a benefit this will have is uncertain, as this goes back to my previous illustration of pain in the supply chain.

The Bear Case

Yes, many will be fantasizing about exotic travel and an escape from isolation, but for those ads to have value, someone needs to be on the other end of the transaction to pay for them. I began this sentence and decided to look for sources of notable layoffs or negative headlines from major travel and tourism companies - there were too many to choose from. This article likely won't be published for several days, so I encourage you to go to Google news and type "travel industry lay-offs" or "travel bankruptcy" to see the latest, as I'm certain things will be worse by then, but at the time of writing, $150 billion in bailouts are being requested and CEOs are calling this "worse than 9/11 and 2008 combined," a claim that is further reinforced by expectations that Delta Air Lines (DAL) will see revenue drop 80% y/y. That game is in the process of ending, and when it ends, and people can see through it all, they'll say this marked the end of private equity and the excessive use of leverage.

Make no mistake, this is to the travel and tourism what 2008 was to the banks with some even comparing (click translate in browser for English) Boeing (BA) to Lehman Brothers. When companies are faced with these kind of crises, you see them scale back the expenses that they can. Layoffs are painful, despite what cartoons and stereotypes say, executives are human and they do not like to destroy lives and livelihoods, and thus other variable costs are usually cut first - specifically marketing campaign budgets. This means the company has to get choosy about what platforms it advertises on and what ads stay up. For a company that is thriving off of trial budgets, that is a bleak prospect.

These pains are not exclusive to travel and leisure, and extend especially into mid-market private equity and venture capital backed companies. Marc Cohodes, famous short-focused hedge fund manager, recently said the following in regards to the way private equity operates: "That game is in the process of ending and when it ends, and people can see through it all, they'll say this marked the end of private equity and the excessive use of leverage," illustrating expected strain on the operations of portfolio companies. Even the top names KKR (KKR) and Blackstone (BX) are not safe according to Bill Ackman who said "(Blackstone and KKR) do a tremendous job. But every one of their companies has a lot of leverage. Every one of their companies goes bankrupt if this thing rolls out over 18 months". In this kind of an environment, advertising is not going to be priority, nor are trial budgets going to be something critical in minds of corporate executives or their board of directors.

These macro pressures might very well be too for those cabin fever stricken shoppers to offset, especially if we see many of these users faced with a loss of income. Simply put, this is not a good time to be a growth business that isn't turning a profit. This is also true for Snap and the recently debt-burdened (though profitable) Match Group, in addition to Pinterest.

Final Thoughts

I am no longer in Pinterest personally. I will reevaluate after Q1 results and commentary from management is released, but I do not see a sufficient risk-reward trade-off despite the selling. In my view, the bear case is just too compelling to overlook despite the unique position the company has in the marketplace. For the time being, companies like Facebook and Google are much better positioned to endure a crisis like this than any of its smaller peers. It is important to remember that despite Pinterest and its industry not being directly exposed to the impact of the Covid-19 outbreak, this does not mean it is immune from the pain felt across the market. Until more reads on employment, the spread of the virus, and the company's earnings have been disclosed, I am going Neutral on the stock.