I have long avoided Tesla (NASDAQ:TSLA) shares because of the rogue nature of CEO, Elon Musk; the heightened cult status among its investors; the operational red flags; and the poor corporate governance. However, having looked deeper into the financials and the business more recently, it looks like the company is emerging from a period of risk into a more sustainable phase of its existence. On this basis, the shares actually look more reasonable on the recent pullback.

A Catalog of Red Flags

My rule of thumb is that a good investment starts with the management and leadership of a business, which in turn requires good corporate governance. In the case of TSLA, it is hard to find a more polarizing character than Elon Musk as its CEO. I have long avoided the shares due to his public behavior and frankly irresponsible approach to communications with investors and, in many ways, I was correct to do so. Elon's run-in with the SEC for his "funding secured" tweets was a prime example of the unpredictable risks that he brings to his business. The Board's unwillingness to chastise him for such behavior was almost just as alarming in my opinion. Today, I still don't feel comfortable with his volatile management approach!

From raising equity when they say they don't need it, to providing investors with hard-to-reach targets, or to the acquisition of SolarCity, TSLA has not been an easy company for traditional investors to get behind. But for me, the most alarming event in recent times was the company's efforts to achieve Elon's aggressive production goals for the Model 3 in July 2019 by extending the factory with a "tent". There were plenty of reports that employees were pressured to hit targets by cutting corners.

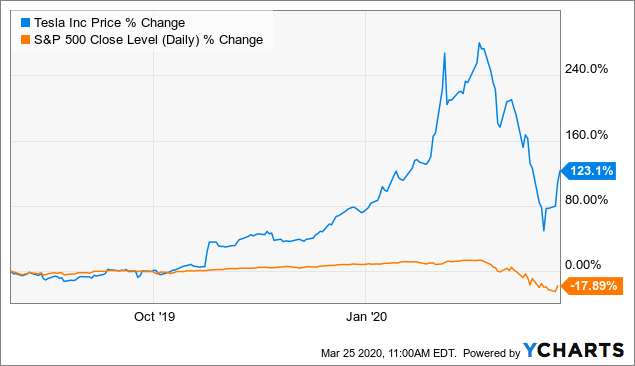

If this was General Motors (GM), how would the market have reacted? The stock would have plummeted in my view. But TSLA shares have gained significantly since the reports in July 2019, far outpacing the returns of the S&P 500:

Data by YCharts

Data by YCharts

Cash Flows Turned Positive

But then I saw that TSLA actually generated $1 billion of free cash flow (FCF) in 2019. Having previously not looked at the finances in much detail, while knowing that Musk was always promising to generate a profit eventually, I had assumed that the company was not generating much cash. But here we are with $1 billion of FCF and a small profit (albeit, adjusted profits excluding stock-based compensation). This piqued my interest.

I also noted that, on a personal level, the choices for going green for my most recent (3 years ago) and potentially upcoming purchase of a vehicle are very limited - particularly if I want more than 250-300 miles of range from an EV. Tesla really stands out with their range of product, with competitors launching real alternatives only from late 2020 onward - at the earliest.

I dug into the financials and built a model to see what I could find - to be honest, I was expecting to find more red flags and concerns. And I did find some negatives, but also found some encouraging signs.

Regulatory Credits

First of all, I wanted to check my concern that most of the company's auto earnings came from regulatory credits. Regulatory credits are generated by Tesla's sale of zero-emission vehicles, and are sold to 3rd parties to help them manage their own carbon allowances. These credits are effectively 100% margin.

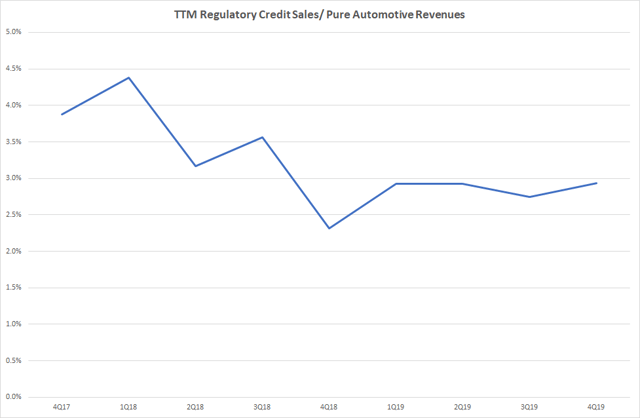

Since 2016, the % of auto revenues before credits represented by the regulatory credits sold has come down from a high of 4.5% to settle around the current 3% level. Looking at the trend on a trailing 12-month basis by quarter, we can see this dynamic at play:

Source: TSLA earnings reports

If I subject these earnings to a 24% tax rate, from 2016 to 2019, regulatory credits contributed the following to TSLA's business:

% contribution To: | 2016 | 2017 | 2018 | 2019 |

Auto Revenues | 4.8 | 3.7 | 2.3 | 2.9 |

Auto Gross Profits | 18.9 | 16.3 | 9.6 | 13.4 |

Total Revenues | 4.3 | 3.1 | 1.9 | 2.4 |

Total Gross Profits | 18.9 | 16.2 | 10.1 | 14.8 |

EBITDA | 49.2 | 76.4 | 16.7 | 19.4 |

Source: TSLA earnings reports

Furthermore, EPS and FCF without the credit sales would have been materially worse:

2016 | 2017 | 2018 | 2019 | |

Adjusted EPS | -$2.87 | -$8.66 | -$1.29 | $0.24 |

Adjusted EPS ex-Credits | -$4.46 | -$10.32 | -$3.12 | -$2.27 |

FCF | -1,405 | -3,475 | -3 | 1,078 |

FCF ex-Credits | -1,634 | -3,749 | -321 | 627 |

Source: TSLA earnings, own assumptions

On the one hand, the company has made good use of the regulatory credits - and why not? But on the other hand, it leaves me questioning the underlying profitability of the business, particularly prior to 2019. However, with the FCF generation in 2019 turning positive even after accounting for the credits, it seems that this potential negative is becoming less of a headwind to the thesis.

Indeed, even if I assume in my model that the regulatory credit sales start to diminish - presumably as more car companies sell EV and hybrid vehicles, and other industrial businesses make progress on their carbon emissions - TSLA stands to generate significantly better profits and FCF regardless. And I am already trying to account for a significant downturn in business this year due to the Coronavirus epidemic. In fact, with a 16% drop in automotive revenues this year, I have the company generating -$737 million of FCF before the benefit of the credits. The credits turn that to -$348 million. Though not ideal in any way, this draw on capital is certainly manageable - not least thanks to the recent capital raising of over $2 billion!

Going forward, it does seem likely that the regulatory credits become significantly less important to the business's profits and cash flows, both of which I have improving meaningfully through the next 5 years.

Competition and Market Share

Another gripe I had with the stock was the perception that the market was giving TSLA the lion's share of the EV market, and significant market share in overall global automotive sales for the foreseeable future. In some ways this perception was borne through the company's market capitalization exceeding that of the likes of General Motors and BMW (OTCPK:BMWYY). Intuitively, with the company's unit volumes of less than 400k in 2019 versus GM's 2.9 million and BMW's 2.5 million, the current $92 billion market capitalization seems extreme versus the combined market capitalization of GM and BMW at around $62 billion.

Today, TSLA has around 17% share of the EV market globally and around 38% in the US. The company's global share has increased from 10% in 2017, but the US share has declined from a peak of 50% in 2018. With so many global players in the overall automotive market, it is not unreasonable to assume that TSLA's market share is likely to cap out relatively soon, while the US share is more likely to decline at the margin.

Source: own assumptions, Bloomberg

What does this mean for the company's business? What is perhaps often overlooked is the simple fact that EV penetration remains very, very low in the US and on a global basis in terms of cars sold each year. By my calculations, global EV penetration was only 2.4% in 2019, up from less than 1% in 2016. Forecasts for future penetration rates vary, but as an example, the chart below from WattEV2Buy shows an expectation for 30-40% penetration rates by 2040 on a worldwide basis:

I am assuming in my models that EV penetration rates reach 6.8% by 2024 globally and 8.5% in the US market, representing around 50bp of expansion from 2021 onward in each. At the same time I'm assuming that TSLA maintains share at a more stable 30% - maybe that's too bullish, but given the lack of visibility into any real competition from their peers in the next few years, I wouldn't be surprised to see them maintain this market share. Outside of the US, I am assuming their share struggles to rise, primarily due to more intense competition from non-US peers. Overall, TSLA's global share rises to around 21.4% in 2021 and then dwindles to a more stable 16-17% share through 2024.

I don't feel that these assumptions are too aggressive, though I note that TSLA will need to double their unit sales to just over 1 million vehicles in 2024. This will naturally require significant capital investment, which I try to capture in my CAPEX assumptions.

Still, based on these assumptions, I have the company growing units from 2019 to 2024 at a CAGR of nearly 24%, even encompassing a 23% decline in 2020 (and subsequent rebound in 2021). That's pretty decent volume growth, with upside potential if their market share performance comes out better than I have assumed.

In other words, TSLA is benefiting from being a pure-play in a secular growth sub-segment of the auto industry. As such, market share declines can still be accompanied by decent volume and revenue growth.

Unit Economics

So the volumes should be very strong, but does the company make money on those cars? For the first 9 months of 2019, GM's auto unit had gross margins of around 12% with BMW at around 20%. TSLA's automotive gross margin is around 21-23%, but this includes the benefit of the regulatory credit sales. Excluding these sales, gross margins are around 19-20%. In this way, TSLA looks fairly "healthy" - at least in the context of an auto manufacturer.

What is encouraging is the fact that they have managed to maintain the gross margin performance despite the mix shift to the lower priced Model 3. We can see this dynamic in the following chart:

Source: TSLA earnings releases, own calculations

The gross margin remains stable(ish) in the face of the declining ASPs, suggesting the company is doing a good job at maintaining unit economics even with a lower-priced product. Part of this will be simple scale economics, but there is also the natural tailwind of improving costs from battery technology advances.

I feel comfortable assuming that gross margins can remain stable around the 22% level excluding credits, especially as they ramp up Model Y and the Tesla Semi in future years.

Coronavirus Impact

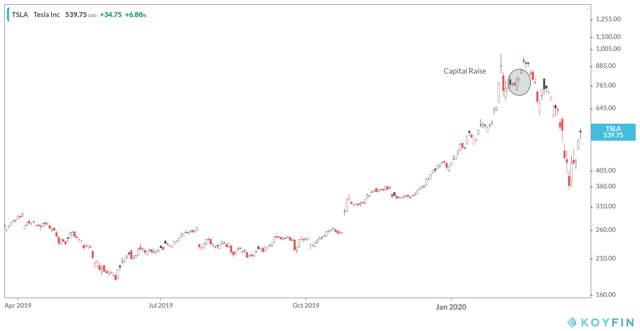

The problem now of course is that the current consensus numbers will invariably be far too high thanks to the impacts across all of TSLA's major markets from the Covid-19 epidemic. I have tried to build some expectation into my model, but note that the company's highly astute capital raise early in 2020 will have created significant buffer. TSLA raised $2.67 billion of capital by issuing shares at $767 per share. Given the subsequent decline to under $600, and the huge rally we saw in the year, Elon Musk (or at least his CFO) looks like a hero.

Source: Koyfin

My model will be wrong. But I am assuming that TSLA's volumes decline by 22%, 40% and 30% year-over-year in 2Q through 4Q 2020. I am building in a significant impact to the global auto industry through 2020 due to the collapse in economic activity and growing number of country-wide lock-downs occurring in the bid to battle the virus. This all means that TSLA swings back to a loss in 2020, and back to negative FCF.

I am, however, assuming that we emerge from the pandemic with economies still intact, and with pent-up demand and huge economic stimulus available worldwide I expect demand to rebound sharply in 2021. As such I have TSLA achieving their 500k+ units in 2021 (originally targeted for 2020). The sales then grow to over 1 million units by 2024.

The company's FCF profile ends up as follows:

Source: own modelling

Given the dire backdrop, this FCF profile actually looks very solid.

Valuation

So overall, I am less concerned about TSLA's financial model, though my hesitancy about Elon Musk's capabilities as CEO remains. In terms of valuation, I was anticipating my model showing that TSLA would be woefully overvalued… but that negative conclusion is not so clear.

On the face of it, the stock's multiples and yields don't look very attractive.

Source: own modelling

But then, the growth exiting 2024 remains high, supported by only 7% EV penetration worldwide and TSLA's exiting market share within EV of 17%. As such, the multiples deserve to be relatively high.

My DCF using a WACC of 8% and long-term FCF growth of 3-5% yields a fair value in 2021 of $595 to $965. This is a wide range, offering upside of 12-82% from current levels. If we use a worst-case based on 0% growth from 2024 onward, we have downside to $361 today, or around 30% downside. Interestingly enough, that worst-case marks the recent share price low.

Conclusion

TSLA remains a risky proposition, but the business appears to be emerging from the riskier phase of its life, and the prospects ahead look much brighter and perhaps even more visible. After the recent sell-off, the shares are looking much more reasonably valued, and based on my work I see potential for the shares to rise back above $900 even in the face of the imminent global economic malaise.

From one who has historically considered the shares too expensive and the business too risky, I find myself much more interested in the shares with a 5 year view.