Let me be clear: Right now is no time to be a hero when purchasing mortgage REITs. I have often explained to others, "we cover the commercial mREIT sector and we have avoided the residential sector due to the excessive risks."

However, we have a mortgage REIT expert on our team and today Rubicon Associates is collaborating with me to provide readers with insight into one of Wall Street's favorite mREIT names.

Buying the common or preferred stock of hybrid mREITs or predominately non-agency mREITs is investing in the unknowable. Margin calls will make or break hybrid and non-agency mREITs and their outcome is somewhat unknowable.

We would rather miss $4 of upside than risk $10 of downside. As a result, we are not buying the common of any mREIT and are instead focusing on the preferred slice of the capital structure, which we have been investing in and writing about for years.

As a result of margin call pressures and a defensive posture, Two Harbors Investment Corp (TWO) sold their non-agency portfolio, which was approximately 9% of their portfolio and 22% of their capital allocation.

Important: First and foremost, we have to state that TWO has suspended their dividend until the markets calms down and prices mortgage risk accordingly. While this delays the cash flow, we believe it is a prudent course of action as it ensures the financial strength of the REIT. If you rely on current investment income, this is not an appropriate investment.

After the sale they are left with a $20 billion agency and MSR portfolio and keenly focused on leverage (TWO stated that post-sale leverage is 7.5x, around two turns lower than AGNC Investment (AGNC), comparable to Annaly Capital Management's (NLY), one turn lower than Capstead Mortgage's (CMO) and two turns lower than Armour Residential REIT (ARR)).

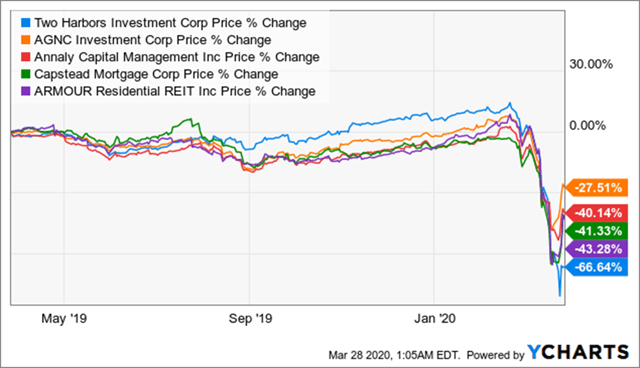

TWO has performed notably worse than its new peer group has done:

Data by YCharts

Data by YCharts

We understand the performance, as it had a non-agency RMBS component to it, but the firm is now much cleaner in terms of portfolio composition.

Having agency MBS means there will be the ability to fund (especially with the Fed backstopping essentially the entire agency MBS market) and less price pressure on the portfolio. The agency MBS portfolio is, of course, affected by prepayments, but the company believes the majority of the portfolio is somewhat prepay resilient due to lower loan balances and higher LTV loans (both of which reduce the refinancing incentive).

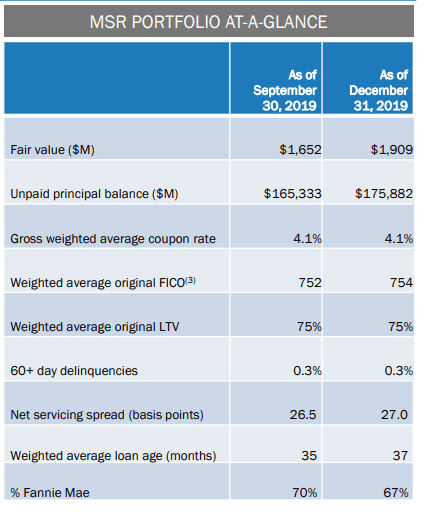

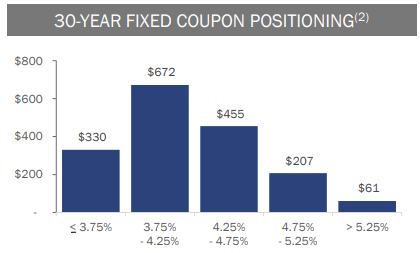

The MSR portfolio will continue to be pressured as homeowners refinance at lower levels, but the portfolio comprises lower-rate mortgages:

Source: Q4 Investor presentation.

Source: Q4 Investor presentation.

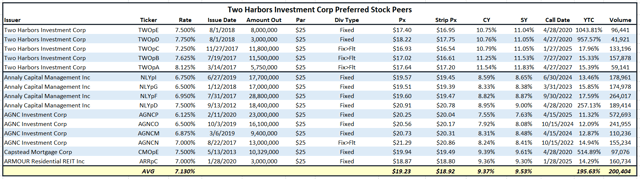

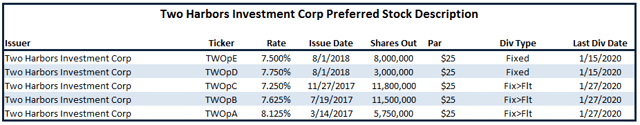

While we believe the firm has lower risk than it did, and that it is better positioned for a potential longer period of economic stress, we are not an equity player in the REIT as we believe the space will continue to feel pressure. We (Rubicon Associates) are, however, investors in the preferred slice of the capital structure. Two Harbors has the following preferred stock outstanding:

Source: author spreadsheet

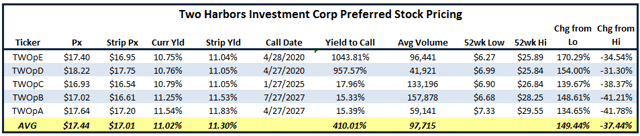

Which have the following market picture:

Source: author spreadsheet

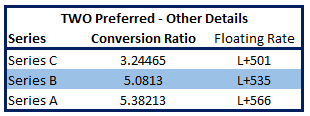

Given the above information, we would focus on the Series A (TWO.PA) or Series B (TWO.PB). Personally, we realize that in the near term liquidity is going to be sketchy and we're willing to sell liquidity to buy a little extra yield. As a result, we are looking at the Series A. In addition to the extra yield, the Series A looks relatively more attractive if we consider the following data as well:

Source: author spreadsheet

The Series A has the highest conversion ratio in the event of a change of control conversion and also has the highest spread to LIBOR, if the security is not redeemed and goes to a floating rate.

Here's the rub: The floating rate is based on LIBOR - which, in theory, is going away. As a result, we have to look at the fallback language in the documents to see how the floating rate will be based.

Series A and B: if no such rate appears on "Reuters Page LIBOR01" or if the "Reuters Page LIBOR01" is not available at approximately 11:00 a.m. (London time) on the relevant Dividend Determination Date, then we will select four nationally-recognized banks in the London interbank market and request that the principal London offices of those four selected banks provide us with their offered quotation for deposits in U.S. dollars for a period of three months, commencing on the first day of the applicable Dividend Period, to prime banks in the London interbank market at approximately 11:00 a.m. (London time) on that Dividend Determination Date for the applicable Dividend Period.

Offered quotations must be based on a principal amount equal to an amount that, in our discretion, is representative of a single transaction in U.S. dollars in the London interbank market at that time. If at least two quotations are provided, the Three-Month LIBOR Rate for such Dividend Period will be the arithmetic mean (rounded upward if necessary, to the nearest 0.00001 of 1%) of those quotations.

If fewer than two quotations are provided, the Three-Month LIBOR Rate for such Dividend Period will be the arithmetic mean (rounded upward if necessary, to the nearest 0.00001 of 1%) of the rates quoted at approximately 11:00 a.m. (New York City time) on that Dividend Determination Date for such Dividend Period by three nationally-recognized banks in New York, New York selected by us, for loans in U.S. dollars to nationally-recognized European banks (as selected by us), for a period of three months commencing on the first day of such Dividend Period.

The rates quoted must be based on an amount that, in our discretion, is representative of a single transaction in U.S. dollars in that market at that time. If fewer than three New York City banks selected by us do not quote rates in the manner described above, the Three-Month LIBOR Rate for the applicable Dividend Period will be the same as for the immediately preceding Dividend Period, or, if there was no such Dividend Period, the dividend shall be calculated at the dividend rate in effect for the immediately preceding Dividend Period.

We think this fallback language is weak (to say the most). Compare this with the Series C (TWO.PC) fallback language:

Notwithstanding the foregoing:

(A) If we determine on the relevant Dividend Determination Date that the LIBOR base rate has been discontinued, then we will appoint a Calculation Agent (as defined below) and the Calculation Agent will use a substitute or successor base rate that it has determined in its sole discretion is most comparable to the LIBOR base rate, provided that if the Calculation Agent determines there is an industry-accepted successor base rate, then the Calculation Agent shall use such successor base rate; and

(B) If the Calculation Agent has determined a substitute or successor base rate in accordance with the foregoing, the Calculation Agent in its sole discretion may determine what business day convention to use, the definition of business day, the dividend determination date and any other.

This is written the way fallback language is currently written, and much cleaner.

The trade-off now becomes: the Series A/B has two more years of redemption protection, higher yields and lower dollar prices, but potential issues when (if) the securities begin to float.

Personally, we believe the agreements will be amended to provide for better fallback language, and we're willing to buy this risk. It is always essential to know the risk you buy and whether it is an acceptable risk.

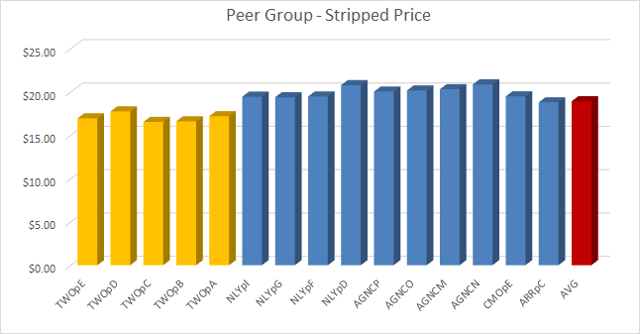

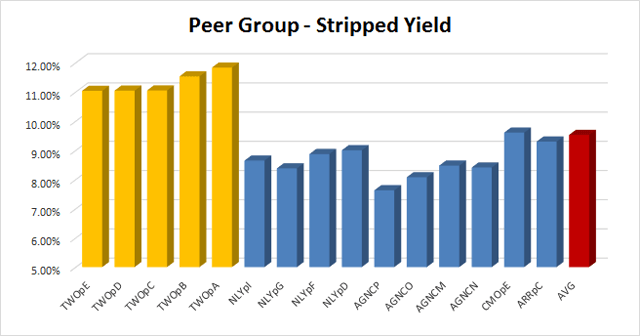

The following table compares the Two Harbors preferred stock with other preferred stock issued by mREITs focused on the agency MBS space - notably, Annaly Capital, AGNC Investment, Capstead Mortgage and Armour Residential:

Two Harbors preferred trades 150-200 basis points wide to the other peers, which I believe is unwarranted. It has to trade at a discount to AGNC and NLY due to the significant difference in the size of the portfolio and financing ability, but we believe it is overdone at these levels. As well, at 150 bps wide to Capstead and Armour - both smaller players - it represents value and has a lower going in price.

Source: author spreadsheet

Source: author spreadsheet

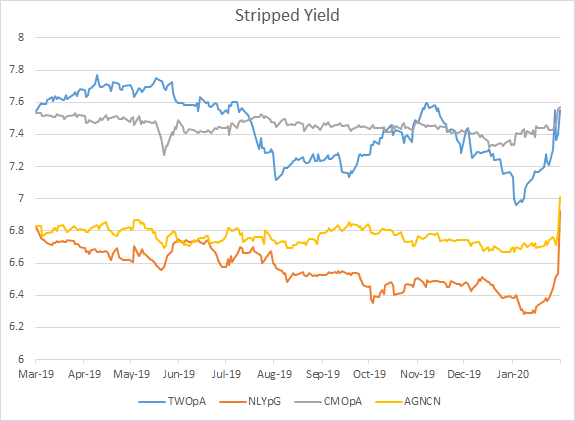

A sample of these "pre-corona":

Source: author spreadsheet

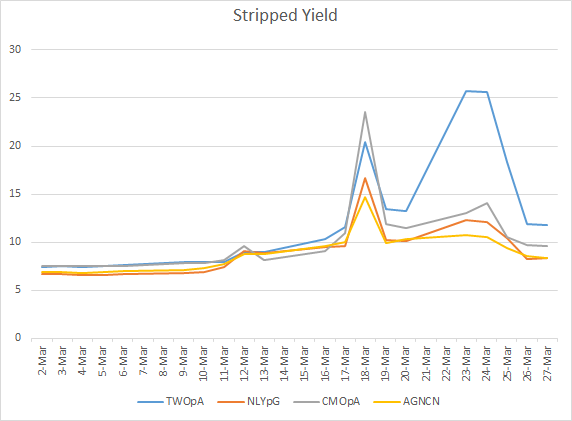

And here they are "after corona":

Source: author spreadsheet

The Bottom Line

We do not believe the market has fully repriced the risk (or, better put, lower risk) in Two Harbors preferred and in light of this, the shares are compelling. We must note, however, that the turbulence in mREIT shares (equity or preferred) is not over.

An investor must leg into their positions and always use limit orders. These investments are not for everyone. There is risk and volatility within this space that has to be considered and these should be within an investor's portfolio risk tolerance and guidelines. Positions should be sized accordingly and, again, legged into.

Helpful Links:

- TWO Series C prospectus

- TWO Series B prospectus

- TWO Series A prospectus

- TWO Q4 Investor presentation

- AGNC Investment Q4 2019 presentation

- NLY Q4 2019 release

Rubicon is long: NLYpI, NLY, AGNCN, AGNCP

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Markets will eventually recover, and may reward patient investors...

Investors need to remain disciplined with their investment process throughout the volatility. At iREIT on Alpha we offer unparalleled research that now includes a "daily" vodcast and mortgage REIT coverage. "There is great opportunity" to take advantage of the selloff.. subscribe to iREIT on Alpha (2-week free trial).

The FASTEST GROWING REIT Service on Seeking Alpha!