Market Intro

Asian stocks (AAXJ) were a mixed bag in the Thursday session, while European shares (VGK) traded about 1.5% higher, depending on the index.

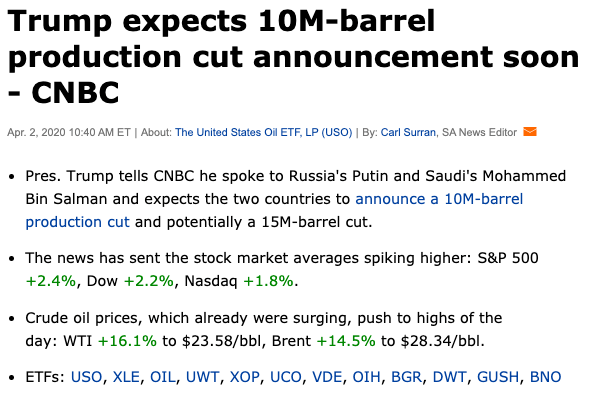

US equities (SPY, DIA) are responding to the positive prospects in a shift in the negotiations (or lack thereof) between Saudi Arabia and Russia (details below). Shares are up between 1.25% (QQQ) and 2.50% (IWM) as we approach 11:00AM EST.

Spot VIX stands at 53.

Thoughts on Volatility

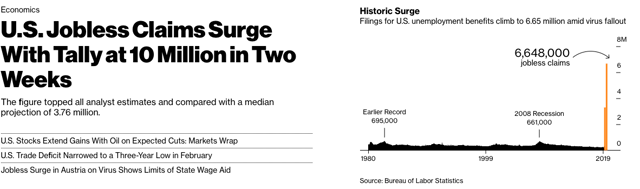

10MM jobless claims in two weeks... absolutely incomprehensible!

Of course, traders of all stripes will be waiting with bated breath for the initial print on the NFP tomorrow morning. In light of the circumstances, it would not surprise me in the least if we see some pretty large-scale revisions. Two Thursday's in a row, US equities have managed to breeze by some rather damning jobless claims figures. We'll see if tomorrow can complete a trifecta of sorts.

Brent's increases are all over the map at this point. In the visual above it's up 14.5%. In the initial tag from Stock Cats it's 35%. The pricing is absolutely all over the map.

Supply is a major part of the equation, but oil traders understand very well that demand makes up the other side of the value dynamic. My own read on the matter is that the negotiations can keep the world from swimming in an ocean of "excess reserves", but the lockdowns and nerves associated with movement will need to lift sooner rather than later to mount a sustained rally.

Still, investors in energy shares (XLE) have every reason to cheer the news: the sector SPDR is up 10.5% for the day at present.

The Baby Boom generation holds a great deal of US wealth, or global wealth for that matter. This creates an interesting dynamic, because many from this generation