With the global economy nearly shutdown outside of parts of Asia, investors shouldn't be surprised by dire views for the digital advertising markets. Pinterest (NYSE:PINS) has seen their stock crumble to post-IPO lows amidst strong engagement. New reports calculate the scale of short-term destruction in the ad market, but investors need to realize that even the most dire outcomes have ad revenues rebounding next year. My investment thesis is only more bullish on dips here.

Image Source: Pinterest website

Image Source: Pinterest website

Tough Times Ahead

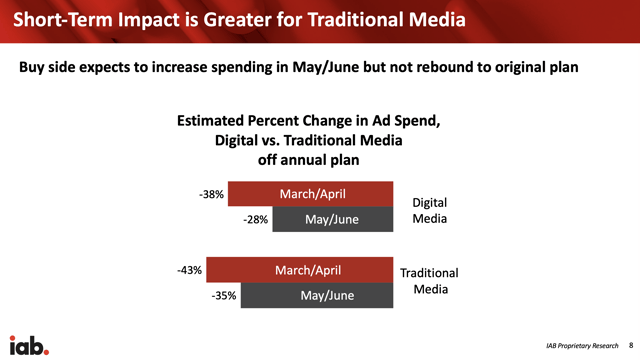

According to research by Interactive Advertising Bureau, the advertising budgets around the world are expected to crash through June. A substantial 74% of media buyers surveyed expect the hit in advertising spending will be worse than the financial crisis.

For Pinterest, the impact is in the digital media space where the March/April period expects a 38% dip while pain is expected to continue in the May/June period with another 28% decline. The social media space is forecast to due about 5 percentage better than the other sectors, but a 23% dip is still meaningful.

Source: iab

The digital ad space hardly existed during the financial crisis and even Google (GOOG) (GOOGL) was relatively small at the time. In that time period, the digital advertising budget has grown from only 12% to 55% of overall ad budgets now. IAB only forecasts ad revenues bouncing back 4% in 2021 after declines this year.

Remember, these estimates are in the middle of the pandemic peak when small businesses aren't sure when they will re-open.

Pinterest Impact

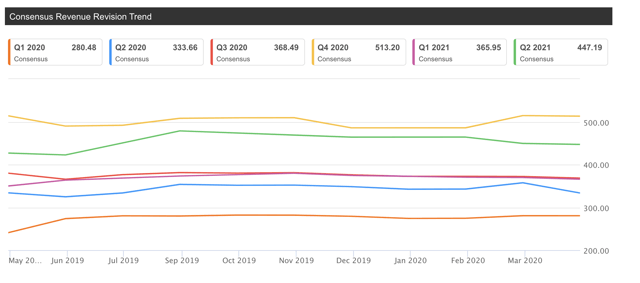

At this point, Pinterest and all of the stocks in the social media space are going to feel the impact. Analysts haven't generally cut revenue estimates for the next few quarters yet. The big question is how a company expecting 30%+ growth will handle an advertising market where the ad bucket has collapsed.

Like the other social plays, Pinterest has already outlined some huge jumps in engagement. Back on March 24, the site saw an all-time high in usage with more saves and searches on the platform than any prior weekend.

For Q2'19, Pinterest reported revenues of $261 million while analysts are up at $317 million for the this quarter, down from a peak above $350 million. Some analysts have the quarterly number dropping below $200 million suggesting the social media company will fully participate in the 30% decline in the space in the quarter.

Source: SA earnings estimates

The worse case scenario is likely a 30% decline in revenues with a good chance Pinterest far outpaces the declines of the global ad market. The company is highly unlikely to maintain flat revenues despite the higher engagement here.

These numbers really aren't meaningful. The stock should be valued based on future numbers knowing a global economic recovery will take place. Analysts originally expected Pinterest to generate 2021 revenues in the $2.0 billion range and investors probably shouldn't deviate much from this target. Either, a stay-at-home economy will boost usage with a corresponding ad boost or a return to normal life will see engagement slow, but ad demand surge.

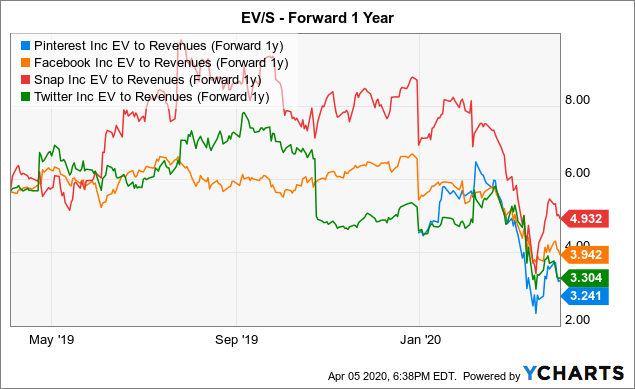

The stock remains the cheapest in the social media space with a forward EV/S multiple of 3.2x. Both Facebook (FB) and Twitter (TWTR) with far better cash balances and cash flows trade at slightly higher multiples. Snap (SNAP) remains the large outlier despite the company already burning substantial cash flows prior to the virus outbreak shutting down the global economy.

The part making Pinterest more appealing than Snap is the $1.7 billion cash balance and the company was already breaking even. The results in the next few quarters will be difficult, but Pinterest has a clear path back towards breakeven once the pandemic is over.

Takeaway

The key investor takeaway that Pinterest remains the cheapest social media stock based on the EV/S multiple. Investors should use the weakness in the stock and signs of Covid-19 cases stabilizing as indications these lows won't last for much longer.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.