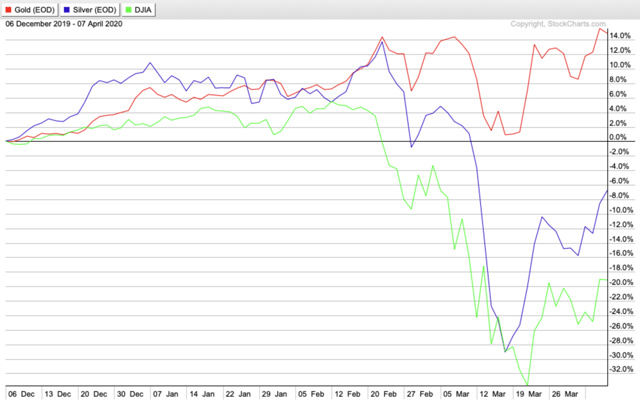

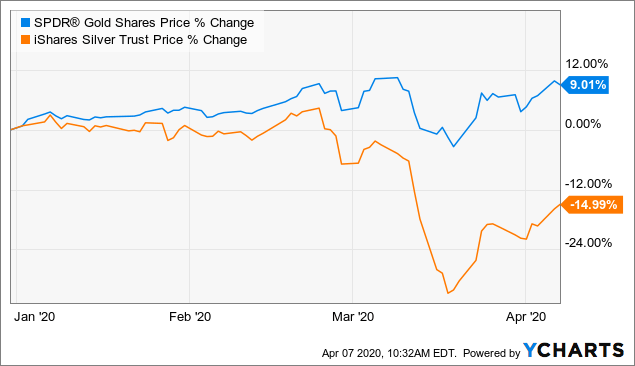

The iShares Silver Trust (NYSEARCA:SLV) — a physical silver ETF — was crushed last month. Silver is an industrial and precious metal, and industrial demand has been greatly reduced during the current global lockdown. The industrial side of the equation has been carrying far more weight than the investment side — given SLV is lower by 15% this year, while gold is up almost 10%.

Data by YCharts

Data by YCharts

But now a significant amount of worldwide silver supply is dormant, which is potentially more than fully offsetting this loss in demand. I believe that the reduction in supply, along with other bullish factors, could result in a spike in SLV.

In this article, I will explain why.

50% Of Worldwide Silver Supply Is Potentially Offline

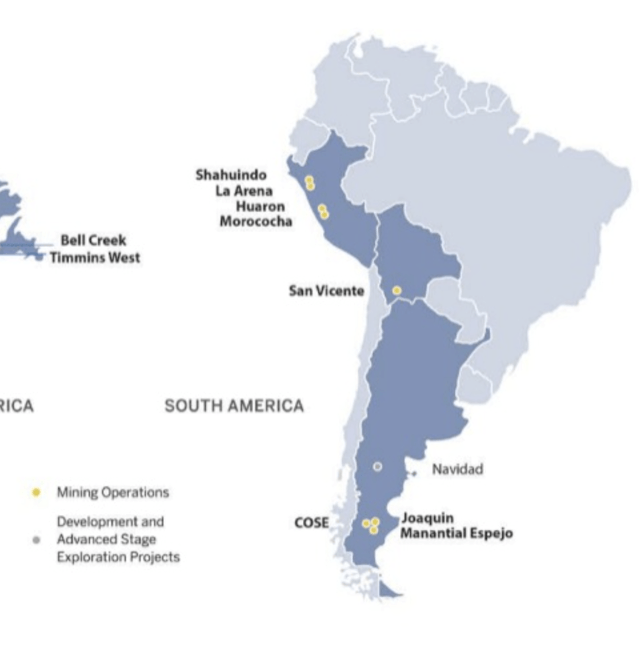

Disruptions in the silver mining sector caused by COVID-19 are increasing by the day. Peru, Bolivia, and Argentina account for ~25% of worldwide silver output; those countries announced lockdowns within the last few weeks. Mining companies that operate in those regions have announced temporary suspensions of activities.

In March, Pan American Silver (PAAS) announced that all of its operations in the aforementioned countries were being halted. For PAAS, that amounts to 6 gold and silver mines, and just over half of its 28 million ounces of silver production.

(Source: Pan American Silver)

Silver (and gold) production in Mexico is now being taken offline as well, as last week, the Government of Mexico announced the closure of non-essential activities until the end of this month.

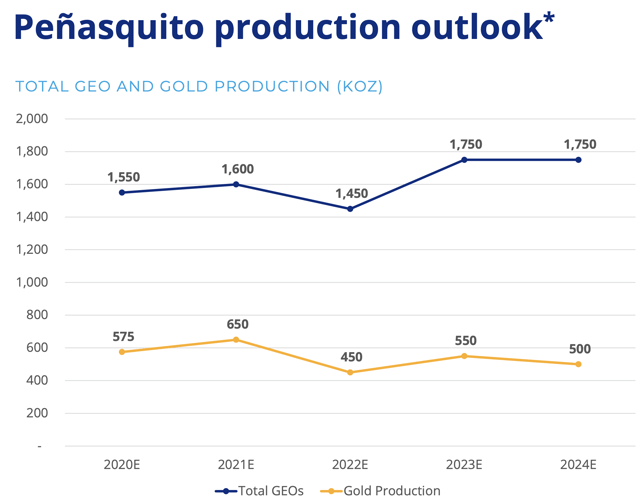

While not all mining companies have ramped down operations in the country - as some "push for late exemptions" from the government - many large mines have shut down. Newmont's massive Peñasquito operation is now dormant; the mine produces ~30 million ounces of silver per year, and ~1.5 million gold equivalent ounces in total.

(Source: Newmont)

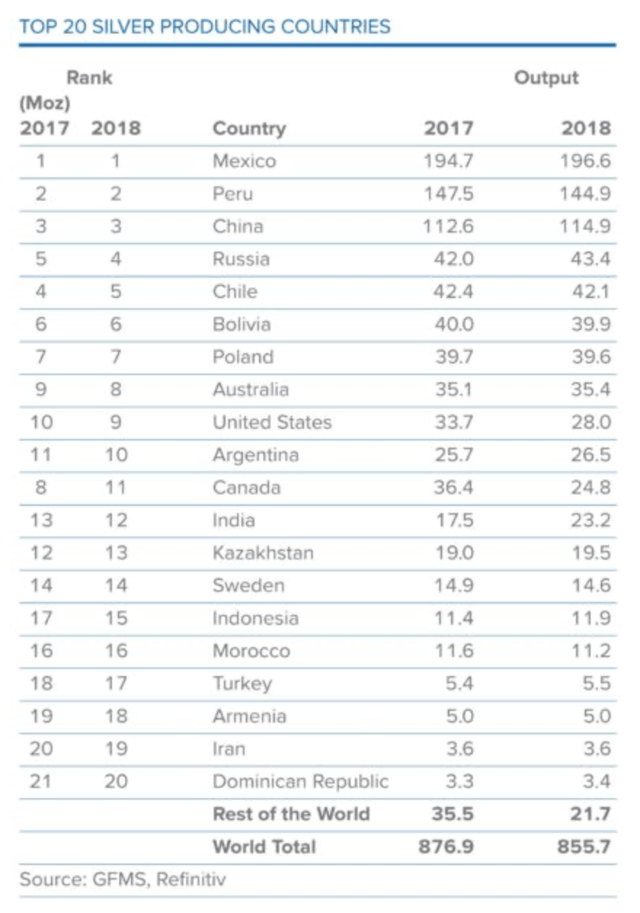

Taking silver production in Peru offline was a big hit to worldwide Ag output, as Peru is the second-largest silver producing country (2018 output of 144.9 million ounces). Having Mexico go down as well means that almost 50% of the global silver supply is potentially mothballed - as Mexico is the top producer with 196.6 million ounces of silver in 2018. Argentina announced a few days ago that mining is an essential business in the country, so it looks like mines in that region will open back up soon. But if Peru and Mexico don't change their stance, then silver supply will be greatly impacted. Production from China - the world's 3rd largest silver producing country in 2018 - appears safe, as China is on the mend and mines in the region have reopened. Russia is a wildcard, as are many other countries on the list. It's possible that 50%+ of the global silver production is offline before this is all over.

(Source: GFMS, Refinitiv, The Silver Institute)

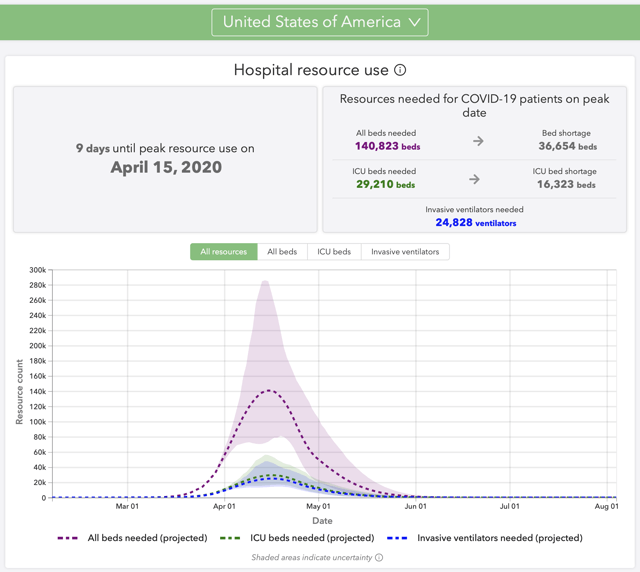

Many countries are only calling for 2-4 week long shutdowns. However, I wouldn't be surprised if this is a 3-month ordeal. If we look at the expected peak in the coronavirus in the U.S. (which will likely be the peak for many other countries around the world), and following the expected trajectory for recovery (using Wuhan and other data as a reference), then cases will not reach negligible levels until the end of June. If there is one sector that could return to work quicker than anticipated, it would be the mining industry - because of the remote locations of most of these operations. It's not out of the realm of possibility that mines could be reopened well before the all-clear is given to other industries in other countries. I just don't think it's going to be in 2 weeks. 1-2 months is more reasonable, and then it will take a few weeks to ramp back up.

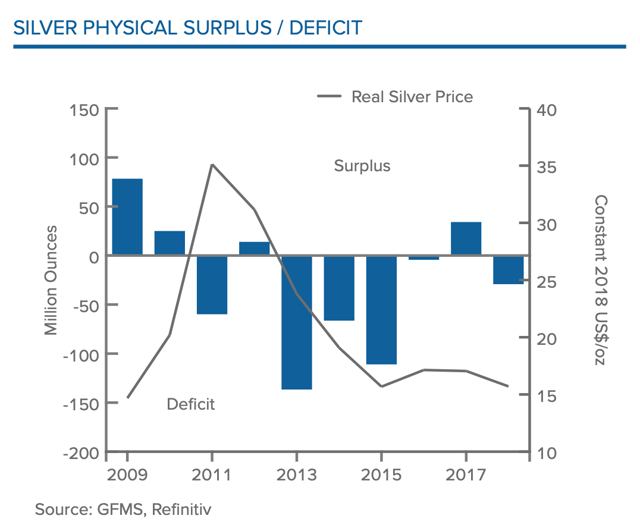

(Source: Healthdata.org)

The physical silver market has been operating at a deficit for 5 out of the last 6 reported years (2019 data hasn't been released yet). There is a global stock of above ground silver that helps to mitigate any shortfall in supply, but we have never experienced a disruption like this before. With so much silver production now offline, and possibly over 50% dormant if the situation worsens, the readily available supply of silver could move down to levels not seen in years, even if the supply disruption only lasts a few months. The price of silver can be greatly influenced even by small movements in available stock.

(Source: GFMS, Refinitiv, The Silver Institute)

How Demand Is Being Impacted Because Of COVID-19

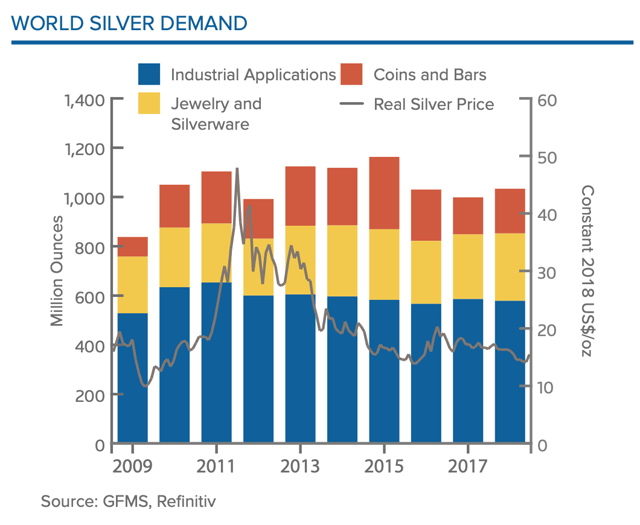

The majority of the annual worldwide silver demand comes from industrial applications; investment demand only accounts for about 20%. Jewelry and silverware make up the remaining percentage.

(Source: GFMS, Refinitiv, The Silver Institute)

As the world is still in a fierce fight with the coronavirus, typical industrial and jewelry/silverware demand is not there, and likely won't be for at least a few more months. Having said that, China was the first to go down, while the rest of the world was still consuming. China could need to replenish inventory, even if demand is lacking at this moment.

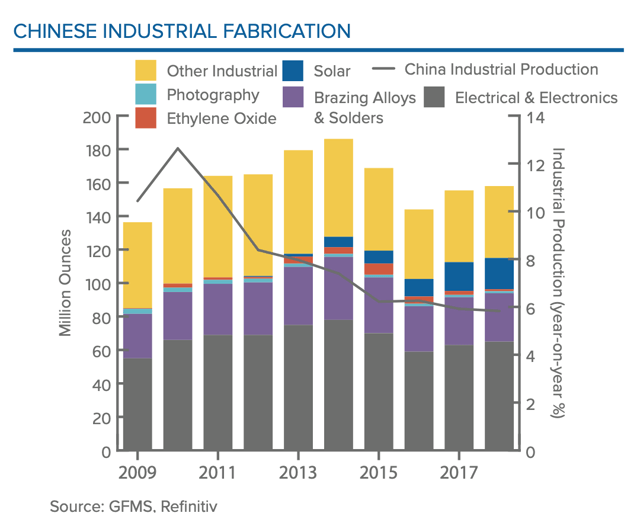

China and Japan account for 40% of silver's industrial demand, as they are major suppliers of electrical and electronics (semiconductors, cell phones, etc.), and in the case of Japan, solar panels as well. Those two countries are getting back to normal. For Chinese citizens, consumption is ramping up again.

(Source: GFMS, Refinitiv, The Silver Institute)

With industrial demand for silver likely in the process of coming back in China, this should ease fears in the physical silver market.

On the investment side, there has been some very odd activity lately. There is a major shortage of physical silver (bars and coins) available to purchase. So much so that premiums being charged are the highest I have ever seen.

In the early 2000s, I was buying 100 oz physical silver bars at around $4-5 per ounce. The premiums (i.e., the price you pay above spot) at the time were around 35 cents (or 5-7%). Over the last several weeks, the premiums for silver have been as high as 50%. If you can find a 100 oz bar to purchase, you will be paying $19-20 (if not more) per ounce today; meanwhile, the spot price is just under $15.

For anybody buying physical silver today, they would need the metal to increase ~35% just to get back to breakeven on their purchase.

Given the lack of available "for sale" silver inventory to purchase by investors, and the unheard of premiums being paid, investment demand is clearly overwhelming supply by a significant margin.

It's also important to note that the lower the price of silver, the more ounces that an investor can buy. If say, investment demand in any given year is 200 million ounces if the price is $18 per ounce (or $3.6 billion in total dollar volume), and then silver moves down to $12 (which it did last month), then for that same $3.6 billion, 300 million ounces of silver can be bought.

Also, just a couple billion dollars of increased investment demand for silver could offset all of the decline in industrial demand that is occurring. In other words, it only takes investment demand to increase from ~$3–4 billion, to ~$5–6 billion to make up the difference. This is worldwide.

A Look At The Crash Of 2008

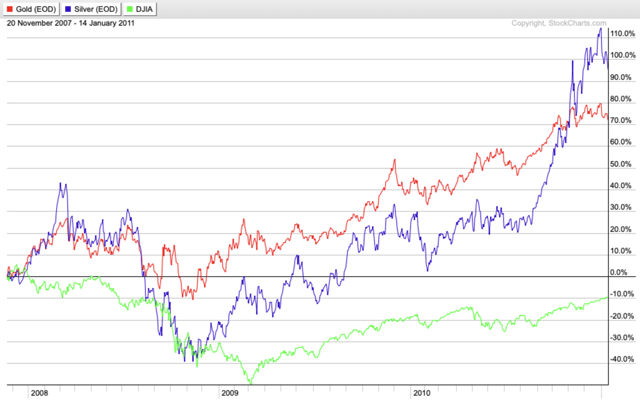

Gold and silver will get taken down during the initial panic selling phase of any stock market crash. Gold typically bottoms well before the stock market, and fully recovers within a short period of time. Silver will underperform gold during the sell-off (as silver's industrial component weighs heavily), but silver will hit its low at the same time as gold. From that bottom, silver will usually outperform - not only eventually catching up to gold, but surpassing it.

If we analyze the 2008 crash, you can see that gold (in red) and silver (in blue) dropped with the market, but both bottomed several months before the Dow (green). By the time the stock market hit its low, gold had fully recovered. Silver was still down at that stage, but it eventually got back to even, and then charged higher. Meanwhile, the stock market was still showing sharp losses.

(Source: StockCharts.com)

Analyzing the current crash, we see the initial takedown of gold and silver during the panic selling phase - as investors jettisoned all assets to raise liquidity. The metals bottomed before the stock market, gold has fully recovered, and silver is attempting to do the same. Gold and silver are in almost the same position as they were in 2008, as is the Dow. We don't know what the next 6-12 months hold for all asset classes, but I believe this plays out in similar fashion to the Great Financial Crisis. It's just happening at a much quicker pace because of how the global economy came to a sudden stop, and how central banks and governments around the world have quickly responded with unheard of amounts of stimulus. M2 in the U.S. has increased at an enormous rate over the last few weeks, which is likely why the recovery in gold has been so swift.

(Source: StockCharts.com)

SLV Can Spike In This Environment

Given the amount of silver production that is now offline, coupled with:

1.) Returning industrial demand from China.

2.) Investment demand that has overwhelmed the market - depleting for-sale inventory.

and

3.) Surging M2

...a possible scenario is unfolding in which there is a spike in SLV over the next 6-12 months (maybe much sooner).

I don't want to put out a price forecast, but if there is a supply shock, I'm not talking about something so minuscule as say SLV at $17. That's far too low.

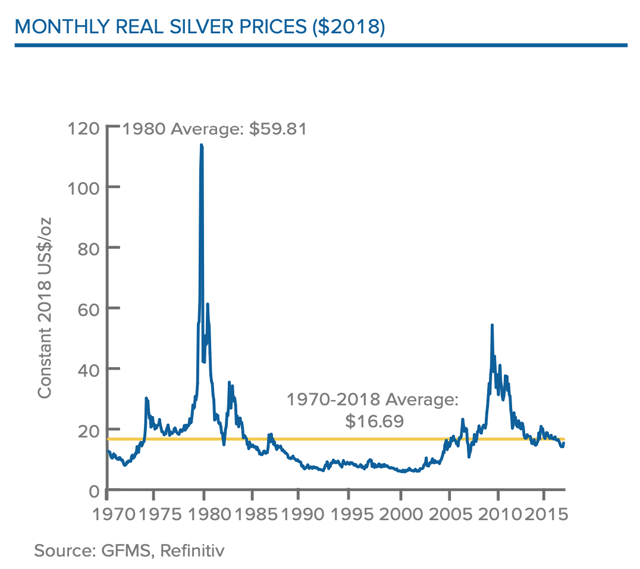

There have been several occasions over the last 50 years in which silver prices spiked higher. The most notable is the one that took place in 1979-1980. There was another in 2011, which saw silver increase from $17-18 to $50 in just a matter of months. Both of these near-vertical ascents were the result of high rates of money supply growth due to financial crises, although silver got a boost in 1980 as there was also an attempt to corner the market.

(Source: GFMS, Refinitiv, The Silver Institute)

Even if SLV doesn't take a similar path to 1980 and 2011, the near-term risk/reward is extremely attractive. After all, physical silver is still trading 10% below its 50-year average price, and investors that buy SLV are avoiding the excessive premium in the physical market.

At minimum, all of these bullish factors discussed above should take pressure off of SLV and allow it to close the gap with gold. If investment demand surges even more, then that's when SLV enters the potential spike scenario.

Subscribe To The Gold Edge

If you would like additional in-depth analysis of the sector, including all of my top picks, subscribe to The Gold Edge. The Gold Edge offers what I believe to be the most comprehensive coverage you will find on the precious metals sector. Click here for details and to become a member of the most popular gold-focused service on Seeking Alpha.