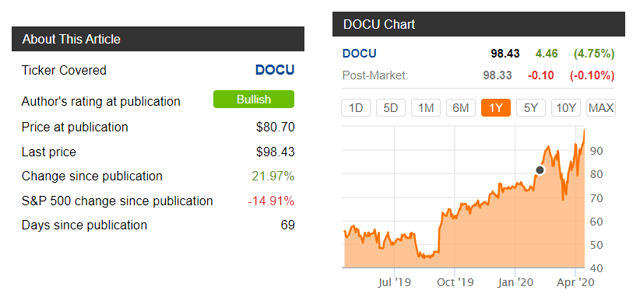

DocuSign, Inc. (NASDAQ:DOCU) is the industry leader in electronic signatures and appears to be one of the beneficiaries of the pandemic that has resulted in a massive work-from-home movement. In fact, I wrote an article on DocuSign a little less than 2 months ago, and the stock is up 22% while the S&P 500 is down 15%.

(Source: Seeking Alpha)

The stock price is now breaking out to a new all-time high.

I learned a long time ago that it is not wise to bet against a strong bullish move even though the stock price, in my opinion, is a little overvalued. The fundamentals that I typically examine are good, fundamentals such as revenue growth, free cash flow and fulfillment of the Rule of 40. Therefore, I am reiterating my bullish rating for DocuSign.

Stock Valuation

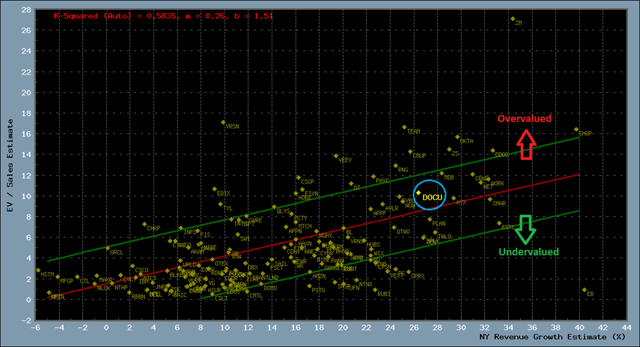

I use a custom technique to estimate the relative valuation of the stock price versus the remaining 152 stocks in my digital transformation stock universe. The technique consists of creating a scatter plot of enterprise value/forward sales versus estimated forward Y-o-Y sales growth. The plot below illustrates how DocuSign stacks up against the other stocks on a relative basis.

(Source: Portfolio123/private software)

A best-fit line is drawn in red on the scatter plot and represents a typical valuation based on next year's sales growth. As can be seen from the scatter plot, DocuSign is situated above the (red) best-fit line suggesting that the company is modestly overvalued on a relative basis. However, it is not sufficiently overvalued to be a deterrent from buying the stock.

The Rule Of 40

One industry metric that is often used for software companies is the Rule of 40. The metric sidesteps the valuation dilemma for high-growth companies that generally don't show profits. The Rule of 40 allows for both revenue