Note: This article was amended on 17/4/2020 to include updated information.

Note:

I have previously covered Diamond Offshore Drilling (DO), so investors should view this as an update to my earlier articles on the company.

On Thursday morning, leading offshore driller Diamond Offshore Drilling ("Diamond Offshore") shocked investors with its decision to not make the semiannual interest payment under its 5.7% 2039 notes. In addition, the company disclosed having retained restructuring advisors.

While the company still has the usual 30-day grace period to make the payment, investors should not expect this to happen as the recent double whammy of new oil price war and COVID-19-related demand destruction has caused key customers to reduce capex across the board as already evidenced by the most recent updates from peers Noble Corporation (NE) and Borr Drilling (BORR), leaving basically the entire industry with unsustainably high debtloads relative to the anticipated levels of business activity going forward.

Photo: Semi-Submersible Rig "Ocean GreatWhite" - Source: West Highland Free Press

Despite Diamond Offshore's debt repayment schedule appearing rather light with only $250 million of unsecured notes due in 2023, the bond market has already reflected market participants' expectations for a potential debt restructuring in recent months. Even before yesterday's carnage, the company's notes were trading at massive discounts to face value, clearly signaling expectations for a massive haircut.

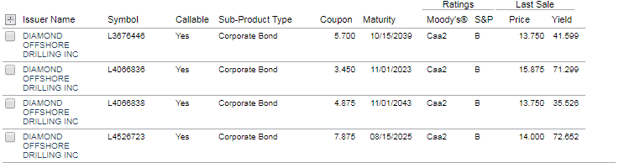

On average, the company's approximately $2 billion in bond debt is now changing hands at just below 15% of face value which calculates to an anticipated recovery of not even $300 million for noteholders:

Source: Finra

Four weeks ago, the company disclosed a $400 million draw under its previously undrawn $950 million revolving credit facility.

Given Thursday's disclosures one would have expected Diamond Offshore to draw down the entire amount before skipping the interest payment as the company