Given the strong reader reception to my recent Antero Resources article, "A Potential 5-Bagger Or A Zero," this is a follow-up piece where I share some high-level modeling with the SA readership.

Despite the exceptionally bullish natural gas setup for 2021, given that many U.S. oil shale producers will be forced to shut in production (and so, associated gas production will fall rapidly), as U.S. land-based storage risks hitting top tank by mid-May 2020, Antero Resources' equity continues to lag the pack.

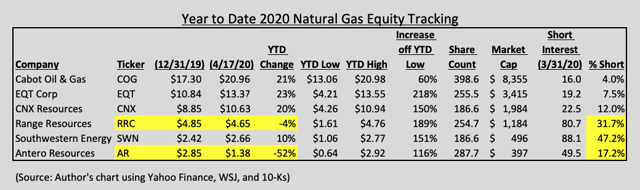

I would argue that a great deal of this negative pricing divergence between its more respected peer group (respected by the market that is, at least as of April 17, 2020): Cabot Oil & Gas (COG), Range Resources Corp. (RRC), EQT Corporation (EQT), Southwestern Energy Company (SWN) and CNX Resources Corporation (CNX) is driven by perception more than reality. The market continues, and mysteriously so, in my view, placing Antero in purgatory. By the way, as I am solely focused on the largest publicly traded natural gas producers, the market has completely written off Chesapeake Energy (CHK) and Gulfport Energy (GPOR), largely due to their debt loads and high cost structures.

For perspective on Antero's stock price lag, enclosed below is a chart I created to illustrate the how dramatic that lag has been year to date through April 17th. By the way, and despite the extra time required to assemble, I would argue that a table like this captures the relative performance better than copying and pasting a few charts from a financial website.

As you can see, year to date, there has been a dramatic divergence in Antero's stock price since the start of the year. The market's three favorite natural gas darlings (Cabot, EQT Corp., and CNX Resources Corp.) are all up at least 20%, Southern is up 10%, Range is down 4% and Antero