This article was highlighted for PRO subscribers, Seeking Alpha's service for professional investors. Find out how you can get the best content on Seeking Alpha here.

Three months ago the market deemed ARMOUR Residential (NYSE:ARR) to be sufficiently safe that it was able to issue a 7% preferred C (ARR.PC) (ARR-C) to redeem its 7.875% preferred B. Since the B was issued, interest rates fell a bit and ARR has become better known, unlocking a lower cost of capital.

My goodness, have things changed in a short period of time.

That 7% preferred issued just 3 months ago is now trading around $21.50 giving it an 8.1% current yield and 25% upside to par.

Has risk increased this much or is this a good buying opportunity? We believe it is the latter and will attempt to demonstrate why, but first, let us take a look at the vitals.

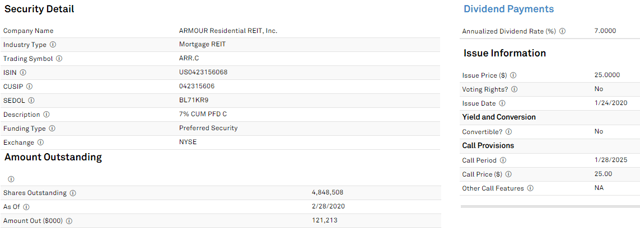

Preferred details

This seems to be a normal preferred without the nuances that sometimes are snuck into these things. In particular we look for 4 things

- Is it cumulative?

- Fixed or floating?

- Size of issue

- Call date

Based on the details below it looks healthy in each regard.

Preferreds are generally going to be less liquid than common shares, but this problem is exacerbated when the preferred issue is particularly small. At $121mm outstanding this is a medium sized REIT preferred so one should be able to accumulate a decent size position using careful trading. Liquidity is not ample, but it is manageable.

Some mortgage REIT preferreds switch to being floating rate (LIBOR + X%) at a preset time. While these can function as a nice hedge, many of the rates are downgrades for investors given how much interest rates have dropped since they were underwritten. LIBOR + 4.5% may have seemed like a nice rate at the time the preferreds were issued, but with how far interest rates have fallen the date at which the preferred switches to variable rate may end up being a punishment.

Thus, we like that this is a fixed rate preferred. All the provisions of ARR-C look standard to us. There are seemingly no tricks here and the performance of ARR-C will simply be tied to the fundamentals of the company.

Good enough line

As we analyze ARMOUR Residential I want to keep a particular perspective in mind; the good enough line.

The value of a preferred does not change in the same way the common changes. Its value only cares that the company does well enough. If ARR remains stable or better, the preferred is worth its liquidation preference of $25. The coupon does not change and the liquidation preference does not change, so all we are looking to determine is that ARR remains sufficiently strong to be able to consistently pay the preferred dividend.

This is of particular importance because ARR has sustained some damage from the current macroeconomic environment. After analyzing the damage I believe it is quite clear that ARR is still above the good enough line and therefore the preferred is still worth $25 despite its market price of $21.50.

One time damage - not runrate

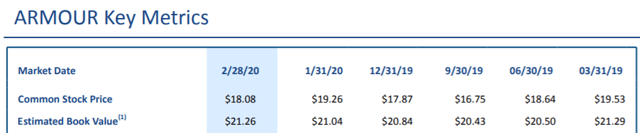

ARMOUR Residential's end of February company update showed the book value at $21.26 which had been in roughly that range for at least a year.

Its March 31st 2020 update announced an estimated book value of "over $11".

The language is vague, but if it was over $12 the term over $11 would not be used, so I would interpret this to mean that book value is between $11 and $12 and likely closer to the $11 side.

That is quite a drop and it is clear why the market was concerned. If the declines continued at this pace, ARR would go out of business rather quickly. However, the losses were one time in nature. Book value was lost primarily through 3 mechanisms.

- Prepayments

- Spreads blowing out

- Rapid deleveraging

ARMOUR's assets are overwhelmingly Agency MBS which means they are backed by the government and default is not as much of a concern as it would be with most asset classes. There is, however, some value lost when home owners prepay their mortgages. Most RMBS securities over the past few years have been purchased at premiums to par at around 104%-106% of par value. The idea is that over the life of the loan, the relatively higher coupon payment will make up for the premium paid to net a total yield (after amortization of premium) that is above cost of capital.

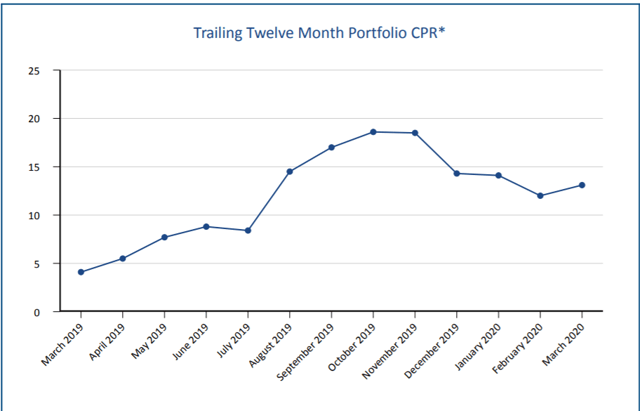

Well, when a homeowner refinances and thus prepays their mortgage in its entirety, the holder of the security no longer gets to collect that premium coupon. ARR receives the principal back (100%) and whatever premium they paid in excess of the principal is immediately amortized. Thus, the most ARR can really lose on its agency RMBS is that 4%-6% premium. To get a sense for how much this impacts book value, we can look at prepayment rates to see roughly how many loans this happened to. ARR publishes prepayment data which we have pasted below.

Note that this data goes through March 5th and as we know from the book value delta most of the damage occurred in March and perhaps early April.

We believe some of this damage was the result of higher prepayment rates as the Fed cut interest rates substantially which may have made refinancing more attractive. The 4%-6% loss on the refinanced loans was amplified by ARR's leverage and as of 2/28/20 implied leverage was 9.6X.

There is a soft cap on how high prepayments could have gone simply due to the bottleneck of banking personnel. It takes a certain amount of paperwork to refinance which naturally limits the pace.

Beyond elevated prepayment rates, book value was damaged by mark to market of securities.

Blown out spreads

While interest rates dropped, risk premiums rose and while agency securities are usually toward the lower end of the risk spectrum, they are still not as safe as treasuries and anything that wasn't treasuries or cash had its risk premium expand in the market panic related to the economic shutdown.

Most of ARR's assets are level 1 assets with clearly visible market prices. As such, their value is adjusted in a mark-to-market basis so as the market price of such securities fluctuates so does the book value of ARR. As spreads blew out, ARR's book value declined.

This mark to market in combination with the accelerated amortization of purchase premiums caused enough book value erosion to force ARR to get margin calls and this is where the major damage kicked in.

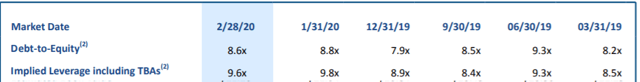

As margin calls came in, ARR was forced to sell its securities at the depressed prices that were present in the blown out spread environment. Based on the end of same March update linked earlier, we know that ARR was successful at meeting these margin calls and is no longer being forced to sell. In the process of meeting these calls, leverage rapidly declined from the implied leverage of 9.6X at the end of February, to 4.4X at the end of end of March. From that same press release:

"ARMOUR reduced its short-term security repurchase facilities borrowings, in aggregate, to approximately $3.46 billion. As a result, the Company's "leverage" was approximately 4.4 to 1 (based on repurchase agreements divided by stockholders' equity)."

Due to the urgent timing of the sales into a bad market, ARR lost a tremendous amount of value and that is how book value declined from over $21 to just over $11 in such a short time period. In assessing the impact it is important to recognize 2 things.

- It is permanent harm. The book value will not snap back from the mark to market as RMBS pricing normalizes because they no longer own the securities they sold. Since they were forced to sell at the bottom their portfolio will be much smaller when prices go back up, so the positive mark to market adjustment upon price stabilization will be substantially smaller

- It is one time in nature. The losses have occurred, but there is no mechanism by which the losses will repeat. The environment staying challenging will not cause repeated declines. For further rapid losses to occur, spreads would have to blow out even further and that is seeming increasingly unlikely as the economy heads toward stabilization (whether it is 3 months or 2 years away).

Because the book value declines are somewhat permanent, I am neutral on common shares. The market price of ARR has fallen about as much as the book value has fallen and I believe the slight discount to book at which it currently trades is appropriate.

The preferred looks much better positioned. Recall the good enough line that we discussed earlier. Since the rapid book value declines were one time in nature and ARR is now somewhat low leverage for an mREIT, it would be fairly difficult for book value to drop anywhere close to $0 and as long as book value remains positive, the preferred is unimpaired from a liquidation value standpoint. Thus, we view the current discount ($21.50 vs. a par of $25) to be quite attractive.

The other key aspect of valuing the preferred is ensuring the dividends are safe. For this we turn to net interest margin or NIM.

Positive NIM

NIM fluctuates over time with cost of capital and asset yield. ARR's NIM was stable through the end of February as seen below.

Since then, we believe NIM has marginally increased. Asset yield likely declined slightly from higher CPR as the accelerated amortization is subtracted from interest payments. This was likely more than offset by a larger decline in the cost of funds. Between the lower interest rates and the Fed injecting so much liquidity into the system, short-term borrowing has gotten extraordinarily cheap.

So what does a slightly higher NIM mean for earnings?

Well, ordinarily it would be higher earnings, but we must adjust it for the dramatically lower leverage. A slightly higher NIM at 4.4X leverage is likely to produce significantly less earnings than a slightly lower NIM at 9.6X leverage.

Again, look at this from the perspective of the good enough line.

The reduced forward earnings potential makes the decline in common price close to appropriate, but it does not impact the preferred.

ARR still has easily enough earnings to pay the preferred dividend and the lower leverage substantially reduces earnings volatility going forward. As a preferred holder I do not care how ample earnings are as long as they are consistently high enough to cover preferred dividends with enough left over to maintain a stable business. Given the increased NIM, I think it is quite clearly above this line.

Putting it together

Overall, ARR is a diminished company but it is now more stable and the macro environment is also becoming more stable. The liquidity crunch that hit mREITs over the past couple of months has largely resolved and it looks like smooth sailing ahead. Earnings and book value will likely remain at the new lower level, but both are positioned to slowly grow from there. Consequently, we are neutral on common shares and bullish on the preferred.

At $21.50, ARR-C has 16% upside to par and an 8.1% carrying yield. We believe it will return to around $25 as soon as it becomes clear that ARR is in a stable place. It seems to be a strong risk adjusted return proposition.

For a full toolkit on building a growing stream of dividend income, please consider joining Retirement Income Solutions. As a member you will get:

- Access to Two Real Money REIT Portfolios

- Real-Time Trade Alerts

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team's decades of collective experience in REIT investing. On Retirement Income Solutions, we don't only share our ideas, we also discuss best trading practices and offer members a chance to participate and grow.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $240 before it expires!