Along with the seemingly limitless monetary expansion, gold, silver, and gold miners/GSMs have performed extremely well lately. In fact, VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) has surged by roughly 70% over the past year, and is up by a remarkable 120% since the low in the mid-March flash crash was put in. In comparison, the S&P 500 (SP500) is about flat over the last year.

Despite the gold miners' notable out-performance over the past year, the segment is likely to appreciate much higher going forward.

About GDX

GDX aims to imitate the price and yield performance of the NYSE Arca Gold Miners Index (GDMNTR), which is intended to track the overall performance of companies involved in the gold mining industry. The ETF has total net assets of roughly $15.5 billion, and has 51 holdings.

Some of the fund's top holdings include Newmont Mining (NEM) 15.71%, Franco-Nevada (FNV) 8.4%, Barrick Gold (GOLD) 14.71%, Wheaton Precious Metals (WPM) 5.86%. These four stocks alone account for roughly 45% of GDX's total weight.

Making More Money

With gold prices near an all-time high, gold miners are making increasingly more money. For instance, Newmont Mining, GDX's largest holdings, reported AISC of $1,030 in Q1, while the price of gold mostly fluctuated around $1,500 - $1,600 throughout the quarter. The company also reported a 43% jump in YoY revenues, and a 21% QoQ rise in net income.

Newmont is expected to report $2.29 in EPS this year, roughly a 74% increase over the $1.32 figure the company delivered in 2019. Furthermore, NEM is expected to increase EPS to $3.14 next year, which puts its forward 2021 P/E ratio at roughly 20. Additionally, the company could beat EPS estimates, as forward guidance appears to be predicated on relatively subdued gold price appreciation, with 2021 revenue growth projections of only around 7%.

Want the whole picture? If you would like full articles that include technical analysis, trade triggers, portfolio strategies, options insight, and much more, consider joining Albright Investment Group!

- Subscribe now and obtain the best of both worlds, deep value insight, coupled with top-performing growth strategies.

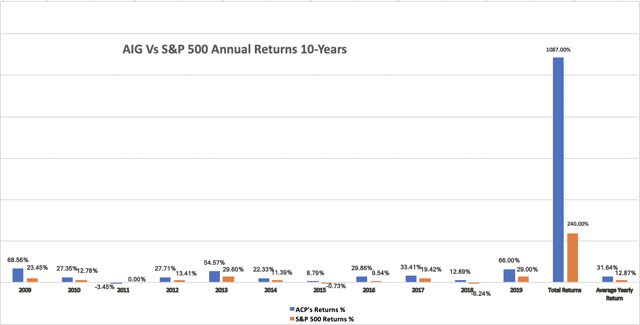

- Receive access to our top-performing real-time portfolio that returned 38.5% in H1 2019, as well as 66% in our stock and ETF segment for the full year.

- Don't hesitate, click here to find out more, become a member of our investment community, and start beating the market today!