This article was highlighted for PRO subscribers, Seeking Alpha’s service for professional investors. Find out how you can get the best content on Seeking Alpha here.

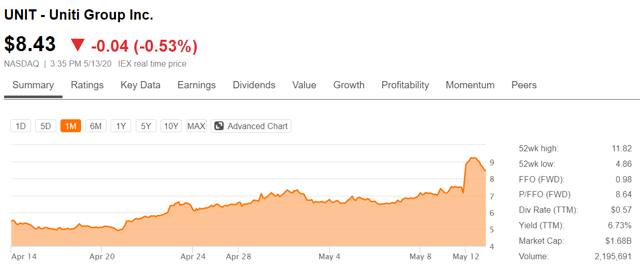

A cloud of uncertainty that has enshrouded Uniti Group (NASDAQ:UNIT) over the past few years has dissipated. There is finally some clarity into future cash flows which allows a proper valuation. In updating our models to include the latest data, we believe UNIT is worth about $13 per share which provides substantial upside over the current price.

We will begin by adjusting guidance for the new lease agreement and follow with a relative valuation.

Adjusting guidance

Uniti provided 2020 guidance in their 1Q20 report, but the guidance did not include the impact of the new lease agreement. Let us go over the terms of the deal and follow with our outlook assuming Windstream (WINMQ) emerges from bankruptcy as planned.

The deal

In early March, Uniti and Windstream reached an agreement in principal on how they were going to amend the current lease for WIN’s emergence from bankruptcy. Judge Drain, who presides over WIN’s bankruptcy proceedings, has recently approved this deal making it quite likely to go through. Key aspects of the new agreement that impact UNIT’s future earnings and balance sheet are as follows.

- $1.75B in growth capital improvement or GCI to be paid by Uniti and owned by Uniti.

- WIN will pay UNIT extra rent equal to an 8.0% cap rate on the GCI with 0.5% escalators.

- Transfer to UNIT of indefeasible rights of use (IRUs).

- Uniti buys 0.4mm fiber route miles for $40mm. These assets produce $30mm annual EBITDA when combined with the IRUs.

- Uniti pays $432-$490mm to WIN over 5 years depending on how fast it is paid.

- 38.633mm shares of UNIT stock issued at $6.33 to WIN creditors, the proceeds of which go to WIN.

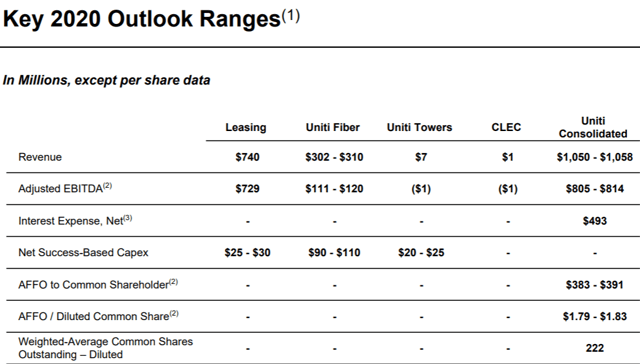

With its first-quarter report, UNIT provided earnings guidance for 2020 shown below.

The above outlook excludes the deal as UNIT chose to not include it in guidance due to uncertainty of timing. The lease amendment will take place at the sooner of WIN’s emergence from bankruptcy or February of 2021. If things go smoothly, we are anticipating WIN emerging around September of 2020.

So, let us calculate proforma earnings including the impact of the new lease terms.

The growth capital improvements can be thought of as a new acquisition pipeline in which UNIT builds out $1.75B of assets over the next 10 years at an 8% cap rate. This is indistinguishable from a market rate, so the GCI has a present value of roughly zero. In exchange for a fairly sizable capital outlay, UNIT is increasing the value of its asset network and getting fairly compensated through rent increases.

While the GCI is fine, it should be noted that UNIT is losing the former arrangement in which WIN was building out the network and UNIT was granted ownership. This original deal was somewhat unfair to WIN and the value that UNIT was gaining will no longer be gained. That said, the value gains were only negligibly showing up in earnings, so there is no material adjustment that needs to be made to guidance.

We see 3 main detractors from earnings

- $432-490mm paid to WIN.

- $40mm paid to win for assets.

- Issuance of 38.633mm shares to WIN.

UNIT can choose to pay only $432mm if they pay the full amount by the end of year 1 rather than paying over a 5-year period. When combined with the $40mm in asset purchases, this causes 2 adjustments:

- Debt rises by $472mm.

- Interest expense rises by $37.7mm assuming an 8% cost of financing.

Offsetting this is the $30mm in EBITDA, from the IRUs which also represents $30mm in AFFO. As interest expense detracts from AFFO but not EBITDA, total impact of the deal to EBITDA should be +$30mm and total impact to AFFO should be negative -$7.7mm (+$30mm less $37.7mm interest expense).

Finally, the issuance of 38.633mm shares will increase share count to about 260.633mm. Since the proceeds of this share issuance are going to WIN, there is no positive adjustment to assets or cash.

Putting it together, post deal AFFO should be about $380mm annually which divided over the new share count is $1.45 a share.

Thus, UNIT took a bit of a hit in the new lease agreement which I think was broadly anticipated. In exchange, UNIT will get a substantially stronger tenant as much of WIN’s debt is becoming equity through the bankruptcy restructuring.

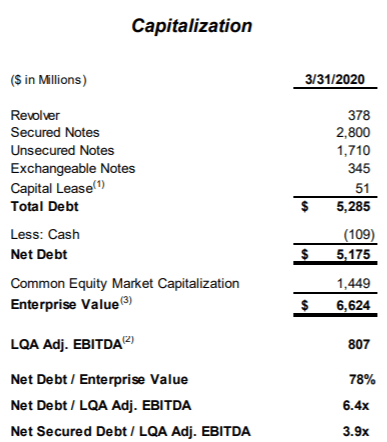

We are also interested in finding UNIT’s new leverage level after the deal. Here is where it stood at 3/31/20.

Source: UNIT

Source: UNIT

As calculated before, debt will rise by about $472mm and EBITDA will rise by $30mm. Thus, the new debt and EBITDA are $5,647mm and $837mm, respectively, which raises debt to EBITDA to 6.75X.

So, given new earnings and new leverage levels, what is UNIT worth?

Valuation

Uniti is rather challenging to value as it is a unique REIT, so we will value it based on both multiple of an earnings metric and a peer comp.

Although fiber is a different asset from other REITs, it is definitely a tech asset which would make the data center and tower REITs the most similar. UNIT does have some tower capabilities as evinced by its recent sale of a tower portfolio at a sizable gain ($38mm gain per the earnings report guidance). Fiber is in the same vertical industry as data centers and towers given that both data centers and tower use fiber in their daily function. Additionally, UNIT’s tenants are similar to those of the tower REITs. Therefore, I would propose that upon stabilization, UNIT could trade at a multiple similar to these sectors.

UNIT is somewhat higher leveraged at 6.7X debt to EBITDA while the publicly traded tower REITs are at 5.5X and the public data center REITs are 6.0X debt to EBITDA on average. To account for this difference, I would suggest the use of a leverage neutral earnings metric. EPS, FFO/share and AFFO/share are not leverage neutral, so I will use EV/EBITDA which is a leverage neutral metric.

Tower REITs, American Tower (AMT), Crown Castle (CCI) and SBA Communications (SBAC), trade at an average of 27.8X EBITDA. Data centers, CyrusOne (CONE), CoreSite (COR), Digital Realty (DLR), QTS Realty (QTS) and Equinix (EQIX), trade at an average of 22.8X EBITDA. (EBITDA data as of 3/31/20).

We estimate that is the base range in which UNIT should trade. I would adjust this down a bit for the delta in growth. Towers have rapid organic growth and data centers have rapid external growth causing both to grow in the high single digits. UNIT’s EBITDA growth will be a bit slower as its revenues are based on long-term contracts which have escalators of about 0.5% annually.

Further, we should adjust the multiple for differences in cost of debt capital. Recall that EV/EBITDA is a leverage neutral multiple, so we do not need to adjust for amount of leverage. We do, however, have to adjust for cost of leverage. Due to the uncertainties of Windstream and the concentration of WIN as a tenant, UNIT’s cost of debt capital is quite high at around 8%. We anticipate this will eventually come down, but until it does, we should discount UNIT, as the higher interest expense means its EBITDA (which is a BEFORE interest figure) will not flow through as well to the bottom line. The data center and tower REITs all have access to significantly cheaper debt.

In my opinion, a 7 turn discount for the lower growth and another 5 turn discount for the cost of debt would be appropriate. This implies a trading multiple range for UNIT of 10.8X to 15.8X. In the near to medium term, I would be more comfortable with the lower end of that range until it is more clear that Windstream really is a stable tenant. 10.8X EBITDA implies an enterprise value of $9.03B, subtracting $5.65B in debt leaves $3.383B for the common or about $13 per share.

Another means of valuing UNIT would be with a direct fiber comp. Zayo Group Holdings (ZAYO) was arguably the closest comp as it is also a fiber owner as its primary business. ZAYO was recently purchased by Digital Colony, an affiliate of Colony Capital (CLNY). The purchase as reported by SNL below:

“Under the agreement, shareholders will receive $35 in cash per share of Zayo's common stock in a transaction valued at $14.3 billion, including the assumption of $5.9 billion of Zayo's net debt obligations.”

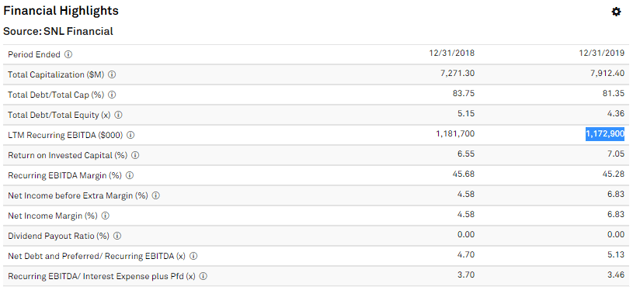

As of 12/31/19, ZAYO had $1.172B of EBITDA which puts the transaction at 12.2X EV/EBITDA.

If Uniti Group were valued at the same multiple, it would have an enterprise value of $10.2B (837mm EBITDA X 12.2 multiple). Subtracting $5.65B in post-deal debt, this leaves $4.55B for common or about $17.47 per share.

In my opinion, Colony overpaid for ZAYO, so I would estimate UNIT’s value to be a bit lower than $17.47. There are also error bars here as ZAYO is not a perfect comp due to differences in fiber location and lease up potential.

The purchase price of ZAYO affirms that $13.00 would not be an unrealistic price for UNIT.

Finally, we could look at it as an AFFO multiple. I value most REITs on AFFO, and while UNIT is unusual, it is still the AFFO from which it pays dividends. At $13.00 per share, UNIT would be trading at a 9X multiple on its $1.45 of post-deal AFFO/share. This represents a massive discount to most REITs with major REIT indexes hovering around 20X which again suggests that $13.00 would not be an unreasonable price despite it being so far above current market.

Although the approval of judge Drain has gone a long way to removing the uncertainty, it could still take a bit for the market to feel comfortable. The next big step in assuaging fears will be WIN’s successful emergence from bankruptcy. Things can always go wrong in bankruptcy court, so this is not a certainty, but given the agreement and the proposals within WIN (not involving UNIT), we think there is a clear runway for emergence with most of the debt paid off or turned into equity.

Potential for upside beyond fair value

Despite the troubles and setbacks of recent years, UNIT is a growth company. The contractual revenues should provide a solid cash flow base, but do not present a ceiling given that most of their fiber has additional capacity beyond that which is being used. Over time, there is potential to lease up the fiber well beyond current leasing with minimal capex involved.

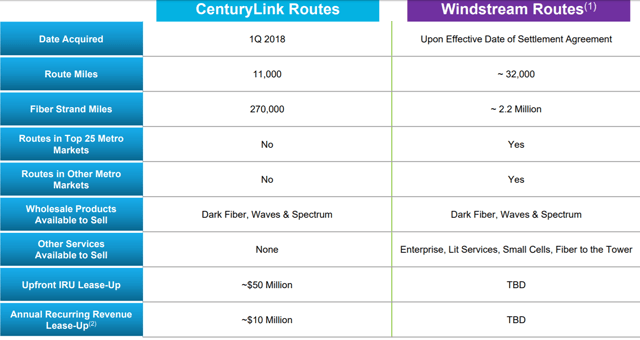

Take a look at UNIT’s lease-up of some fiber it bought from CenturyLink (CTL).

It stands to reason that the much bigger package of fiber UNIT will be able to lease post-deal can generate even more incremental revenue. Since WIN had previously held IRUs, UNIT has not been able to shop this fiber around. We suspect the 2.2mm strand miles will be of use to new customers.

UNIT is one of the largest fiber owners in the country, but until the deal completes, a large portion of its fiber has been locked by the IRUs. Once UNIT has full leasing rights, they can begin to claim a market share more commensurate with their sizable asset base.

Putting it together

Given the nearly 20% rise in UNIT shares following the judge’s approval of the amended lease, it may feel like you missed the boat, but we see significantly more upside remaining.

There is no doubt that this is a somewhat risky play given the tenant concentration, but there is nowhere else in the tech REIT sector that has a valuation anywhere close to this opportunistic.

For a full toolkit on building a growing stream of dividend income, please consider joining Retirement Income Solutions. As a member you will get:

- Access to Two Real Money REIT Portfolios

- Real-Time Trade Alerts

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Retirement Income Solutions, we don’t only share our ideas, we also discuss best trading practices and offer members a chance to participate and grow.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $240 before it expires!