Edge computing is likely to be the next important wave in computing after cloud computing and will be driven largely by the adoption of 5G. Cloudflare (NYSE:NET) is positioned to be a leader in this market with its global network, large customer base and technology portfolio of security, performance and reliability solutions. Although Cloudflare trades on a high EV/S multiple and has had a significant increase in share price in recent months, I believe it is deeply undervalued based on its market opportunity and the vision of the leadership team.

Market

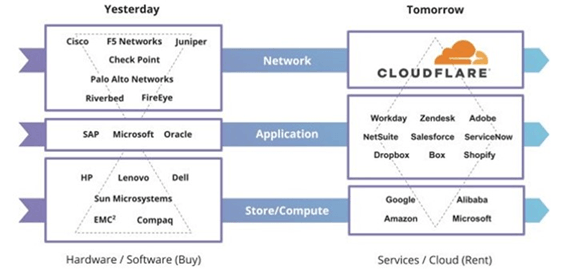

The internet was originally designed to deliver fault tolerance and robust connectivity, not to deliver the security, performance, and reliability required by modern businesses. To resolve this problem, companies have traditionally deployed hardware on-premise or in data centers to deliver functionality like Virtual Private Networks (VPN), firewalls, routing, traffic optimization and load balancing.

As enterprises continue to shift IT to the cloud, they require reliable, low latency, secure and private networks which are difficult to achieve with traditional approaches or by using multiple point-cloud solutions, as it is expensive and difficult to manage. Cloudflare aims to overcome these issues by providing a simple and scalable platform which offers a broad range of network services to deliver reliability, performance and security.

Table 1: Approach to Networking

(source: Cloudflare)

The key markets currently addressed by Cloudflare's platform include:

- VPN

- Internal and external firewalls

- Web security (including web application firewalls and content filtering)

- Distributed denial of service (DDoS) prevention

- Intrusion detection and prevention

- Application delivery controls

- Content Delivery Networks (CDN)

- Domain Name Systems (DNS)

- Advanced Threat Prevention (ATP)

- Wide Area Network (WAN) technology

Figure 1: Evolution of the Enterprise Stack

(source: Cloudflare)

Cloudflare's current product and service portfolio addresses a large number of use cases, representing a large and growing total addressable market. They are also actively developing new products to address adjacent markets that are not included in the estimate of their addressable market which could expand significantly in areas like IoT and edge computing.

Figure 2: Cloudflare Total Addressable Market

(source: Cloudflare)

One of the most promising future markets that Cloudflare's global network could address is the edge data center market. Edge data centers are small data centers located close to end users which aim to boost the performance and reliability of apps and services and reduce the cost of running them by shortening the distance data has to travel, thereby mitigating bandwidth and latency issues. While it is currently unclear how large the edge data center market will be, it is reasonable to assume it will become a huge market over the next decade, driven by applications which require high bandwidth and low latency (IoT, machine learning, augmented reality). Cloudflare is well positioned to be competitive in this market due to their large global footprint and expertise in network reliability, security and performance.

Cloudflare

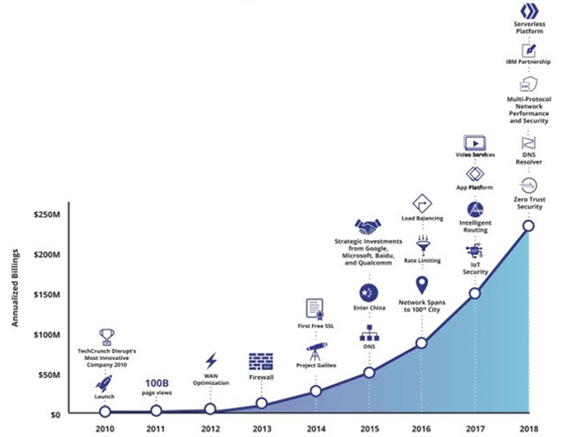

Cloudflare was launched in 2010 and has since grown to be one of the largest CDNs in the world, handling an estimated 5-10% of internet traffic in 2018. Cloudflare delivers a broad range of network services to both free users and paying customers, which aim to increase security, performance and reliability while decreasing complexity. These services are becoming increasingly important to help companies manage public and hybrid clouds, avoid vendor lock-in and be able to utilize best of breed applications. Cloudflare's platform serves as a scalable, easy-to-use, unified control plane across on-premise, hybrid cloud, public cloud and Software-as-a-Service (SAAS) applications.

Figure 3: Cloudflare Key Milestones

(source: Cloudflare)

To act as a CDN providing effective Distributed Denial of Service (DDoS) protection Cloudflare had to build a network spanning 193 cities in over 90 countries which interconnects with over 8,000 networks globally, including major ISPs, cloud services and enterprises. Cloudflare estimates they operate within 100 milliseconds of 98% of the Internet-connected population in the developed world, and 93% of the Internet-connected population globally. This distributed network is a source of competitive advantage and positions Cloudflare to compete in growing markets like IoT, edge data centers and network security.

Figure 4: Cloudflare's Global Network Coverage

(source: Cloudflare)

Cloudflare built services like a CDN and domain name servers not because these were target markets but because they were essential to deliver other services that their customers would require. Cloudflare is now leveraging their strong position in web infrastructure to deliver the broadest portfolio of products possible as they believe this approach will be superior to point-cloud solutions in the long run.

Figure 5: Cloudflare Business Model

(source: Cloudflare)

Cloudflare is not only developing a broad product portfolio but also targeting a broad customer base, offering easy-to-use products across a range of service and pricing levels, including free. To some extent this can be considered a marketing initiative, as Cloudflare is developing relationships with free users, some of whom will go on to be paying customers. It is also largely a data acquisition strategy as the 20+ million internet properties using the Cloudflare platform act as a global sensor network, which can be used to optimize traffic and provide intelligence on cyber-attacks.

Cloudflare's large user base and the amount of internet traffic that comes with it also allows Cloudflare to negotiate favorable agreements with Internet Service Providers (ISPs) that allows them to place their equipment directly in ISPs' data centers, which substantially lowers bandwidth and co-location expenses.

In the past, achieving internet security, performance and reliability required expensive hardware and an IT team to manage it, which was prohibitive for many companies. Cloudflare has chosen to target this underserved market with their tiered services. This is a classic disruption strategy, where the needs of an underserved customer segment are met with a basic service which is improved overtime allowing the company to expand upmarket. Cloudflare's recent introduction of services targeting larger enterprise customers, like zero trust security and distributed storage is the beginning of Cloudflare's expansion upmarket.

Figure 6: Cloudflare Product Launches and Large Customer Growth

(source: Cloudflare)

Figure 7: Cloudflare Growth Strategy

(source: Cloudflare)

Cloudflare has used less attractive markets to build the resources, processes and competencies necessary to enter more attractive markets. This could be considered analogous to Amazon (AMZN) where a dominant position in ecommerce has been used to build the company and enter a broad range of markets where the company could succeed.

Figure 8: Amazon Share Price and Product Innovations

(source: Created by author using data from Yahoo Finance)

The question is whether Cloudflare has the necessary competencies to succeed as they target larger customers. Having been largely focused on self-serve customers in the past, they now need to be able to successfully sell and implement services for large enterprises, which is not easy for every company to accomplish, even if they have a strong product, as Google Cloud (GOOG) has shown.

Signs of Cloudflare's strategy succeeding will include:

- Increased average revenue per customer

- Increasing number of enterprise customers

- Increased net retention rate through land and expand strategy with enterprise users

- Continued introduction of new products and services which build on existing resources, processes and competencies

Cloudflare offers a broad range of services which is expanding and aims to provide network security, performance and reliability.

Figure 9: Cloudflare Products

(source: Cloudflare)

Performance:

- CDN: Large global network caches static content closer to users, with granular control over how content is cached and purged, reducing latency. Dynamic content is delivered over the fastest most reliable private backbone links. Caching content helps to limit bandwidth consumption.

- Website Optimizations: Ensures that website content is being delivered in a manner which improves the user experience through compression, tuned TCP settings, optimization of images and optimization of the order of resource delivery. Browser insights measure the TCP connection time, DNS response time, Time to First Byte and page load time.

- DNS: Provides fast response time, redundancy and security through DDoS mitigation and DNSSEC (protects users from man in the middle attacks). Also provides traffic analytics and load balancing to reduce latency and improve availability.

- Load Balancing: Improves performance and availability by steering traffic away from overutilized or geographically distant servers.

- Argo Smart Routing: Cloudflare routes over 10 trillion global requests per month giving it real-time insights into congestion so that traffic can be routed across the fastest and most reliable network paths. All Argo traffic is encrypted end-to-end across the Cloudflare network helping to ensure security.

- Railgun: Railgun compresses previously unreachable web objects by leveraging techniques similar to those used in the compression of high-quality video. The uncacheable portion of websites which must come from the server is compressed before sending, which typically achieves 99.6% compression and speed up of 700%.

- Stream: Video streaming platform which integrates video storage, encoding and a customizable player with Cloudflare's network.

- Workers: Cloudflare's serverless platform enables customers to write and deploy code (C, C++, JavaScript, Rust, Go) at the edge (adopted by more than 20% of new customers). Workers reduce latency while allowing easy code updates without burdening endpoints.

- Mobile SDK: network diagnostics tool for any app which provides visibility into application performance and load times.

Security

Figure 10: Cloudflare Security Products

(source: Cloudflare)

Figure 11: Cloudflare Security Products

(source: Cloudflare)

- DNSSEC: Guarantees a web application's traffic is safely routed to the correct servers, preventing man in the middle attacks.

- Web Application Firewall (WAF): Protects web applications from malicious attacks by blocking, challenging or logging suspicious requests based on user requirements. Cloudflare's WAF is enhanced by leveraging data collected from 20+ million properties.

Figure 12: Cloudflare Web Application Firewall

(source: Cloudflare)

- Rate Limiting: Protects against DoS attacks, brute-force login attempts, and other abusive behavior targeting the application layer which complement the DDoS WAF solutions. Users can configure thresholds, define responses and gain insights into specific URLs of websites, applications or API endpoints.

- SSL (Secure Socket Layer) / TLS (Transport Layer Security): Encrypts web traffic to prevent data theft and tampering. SSL can also improve performance, increase site search ranking and help ensure regulatory compliance.

- Secure Registrar: Securely registers and manages domain names.

- Orbit: Orbit provides IoT security at the network level by creating a secure and authenticated connection between an IoT device and its origin server, keeping malicious requests from reaching devices.

Figure 13: IoT Device Authentication

(source: Cloudflare)

- Argo Tunnel: Argo Tunnel creates an encrypted tunnel between the origin web server and Cloudflare's nearest data center without opening any public inbound ports.

- Access: Provides secure access to internal applications without a VPN by authenticating and monitoring user access to any domain, application or path on Cloudflare.

Figure 14: Cloudflare Access

(source: Cloudflare)

- Spectrum: A reverse proxy product that extends the benefits of Cloudflare beyond TCP/UDP applications, covering everything from email to IoT devices.

Teams

Teams focuses on securing companies' internal systems and protecting their employees from threats like malware and phishing attacks without sacrificing performance. The service aims to transform IT security for the age of mobile devices, remote work, cloud computing and SaaS. Teams is comprised of two separate services, Access and Gateway.

Cloudflare Access is an access management service based on a zero-trust architecture which secures, authenticates and monitors user access. This service is equivalent to a VPN but is faster and easier for end users to work with. Access management has become a focus area for network security vendors and this service places Cloudflare in competition with companies like Zscaler (ZS) and Palo Alto Networks (PANW). To implement this service Cloudflare works with identity providers like Okta (OKTA), OneLogin, and Ping Identity and endpoint security providers like VMware (VMW), Malwarebytes and Tanium.

Gateway is similar to a next-gen firewall in that it secures and filters outbound internet traffic to protect employees from threats on the public Internet without sacrificing performance. Gateway negates the need for new hardware, eliminates expensive MPLS fees and delivers anti-malware scanning and software closer to the user, helping to stop threats before they reach the network.

To help deliver the Gateway service, Cloudflare acquired S2 Systems for their browser isolation technology. This technology makes web browsing safer and faster by executing browser code on cloud servers rather than on endpoints keeping threats away from the device. S2 Systems technology allows browser isolation without causing noticeable lag or breaking web pages and allows less powerful devices to run complex applications while using less battery, bandwidth and CPU.

Figure 15: Browser Isolation

(source: Cloudflare)

Cloudflare promotes the following as competitive advantages:

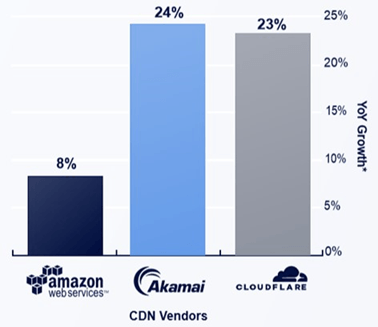

- Intelligence from large user base: Cloudflare has the largest user base but it is not clear that they handle more traffic than competitors like Akamai (AKAM), Amazon and Fastly (FSLY). Data must also be effectively utilized to create value.

- Network scale: Cloudflare's network is large but the capital required to replicate it is modest for companies like Google and Amazon.

- Ease of use

- Security + Performance: Cloudflare appears much more focused on service quality and introducing new services than Akamai or Amazon and is more security focused than Fastly.

None of these factors alone are guaranteed to create a sustainable competitive advantage but the combination of them appears to be driving Cloudflare's performance.

Cloudflare is significantly expanding its network in the U.S. using Vapor IO and EdgeMicro (startups focused on small data sites for edge computing). Locations are selected to maximize latency reduction for as many people as possible based on proximity to end users and network architecture.

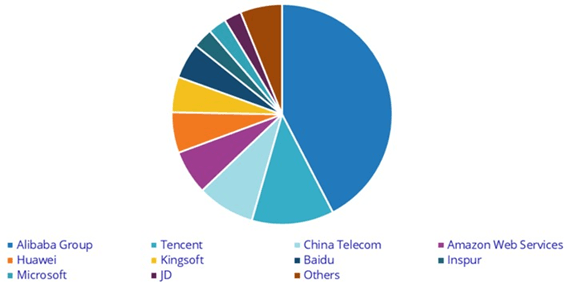

Cloudflare is intent on building a truly global network and entered the China market in 2015 in support of this. Cloudflare is attempting to strengthen its presence in China and recently partnered with JD Cloud & AI (JD) to enable enterprises to deploy cloud-based firewall, DDoS mitigation, content delivery and DNS services worldwide. This strategic collaboration will expand Cloudflare's global availability across 150 additional data centers in mainland China, growing the company's data centers in the region by 700%. Traffic within China will be served from data centers inside of China, while traffic outside of China will continue to be served from the nearest Cloudflare data center. This should allow companies to deliver their content faster, more securely and reliably in-country. JD is a small cloud player in China and this partnership is unlikely to bring significant revenue in the short term but it is a strategic advantage as it allows Cloudflare to offer enhanced services to customers outside of China who provide internet content within China.

Figure 16: 2019 China Public Cloud Market Share

(source: IDC)

Cloudflare launched the Bandwidth Alliance in 2018 to help reduce data transfer fees for shared customers. Bandwidth Alliance partners include Alibaba Cloud (BABA), Tencent Cloud (OTCPK:TCEHY) and Microsoft Azure (MSFT) and the program works by waving bandwidth fees on traffic that is transferred locally through a peering connection which has minimal costs. This makes Cloudflare an important provider of cloud mobility by allowing customers to select best of breed solutions without worrying about data charges from moving workloads between vendors. Unsurprisingly, Amazon is not a member of the alliance as they have the most to lose and the least to gain by reducing friction in cloud services. Cloudflare estimates this will save current customers $50 million a year and although this could be an important differentiator for them, they are open to having competitors like Akamai and Fastly join the alliance.

Revenue is generated primarily from subscriptions to the platform. For self-serve paying customers, plans are per registered domain and it is common for customers to purchase subscriptions to cover multiple Internet properties. Cloudflare offers tiered services with the Pro plan providing basic functionality and the business plan providing additional functionality required by larger organizations, like service level agreements of 100% uptime, dynamic content acceleration and enhanced customer support. Customers can also subscribe to add-on products and platform functionality to meet more advanced needs, such as intelligent routing and code deployment at the edge of the network. Contracts generally range from one to three years in duration and are typically billed on a monthly basis.

Financial Analysis

Cloudflare's revenue growth is strong and has so far shown little sign of decline, which should be expected given the company's small size and large addressable market. If anything Cloudflare's revenue growth should be expected to accelerate as adoption by large customers continues to grow.

Figure 17: Cloudflare Revenue

(source: Created by author using data from Cloudflare)

Figure 18: Cloudflare Revenue Growth

(source: Created by author using data from Cloudflare)

Most of Cloudflare's billings growth currently comes from growth in customer numbers, not billings growth from existing customers. This may be due to most of Cloudflare's existing customers being small companies with limited requirements and limited IT budgets. New cohorts have significantly greater value than older cohorts though, primarily as a result of an increasing number of high value customers.

Figure 19: Cloudflare Customer Cohorts

(source: Cloudflare)

Cloudflare should look to expand revenue from existing customers through upgrades to premium plans and the adoption of more products. Over 70% of Cloudflare's enterprise customers already leverage four or more of their products. Investors should look for an increase in Cloudflare's net retention rate as Cloudflare continues to introduce new services and focus on enterprise customers.

Figure 20: Cloudflare Net Retention Rate

(source: Created by author using data from Cloudflare)

Cloudflare has achieved widespread adoption but so far this has been primarily amongst smaller businesses and websites. As of 2019 Cloudflare products are used by:

- 10% of the Fortune 1,000

- 10% of the top million websites

- 17% of the top 100,000 websites

- 18% of the top 10,000 websites

Customer satisfaction appears to be high amongst existing Cloudflare's customers as indicated by their net promoter score of 68, which is comparable to some of the strongest brands in the world:

- Netflix's (NFLX) NPS is 68

- Starbucks' (SBUX) NPS is 77

- Amazon's NPS 62

- Airbnb's NPS is 74

- Tesla's (TSLA) NPS is 96

It also compares favorably to Fastly's NPS of 64.

Cloudflare aims to increase adoption amongst large enterprises as customers increasingly adopt cloud technology and replace legacy hardware with software solutions. Cloudflare's large customer numbers have grown significantly over the past 3 years and includes companies like Shopify (SHOP) and IBM (IBM). Continued large customer growth should drive revenue growth in coming years and indicate Cloudflare is successfully executing their strategy. Large customers are defined as customers having annual billings in excess of $100,000 per year and Cloudflare's largest customers have billings in excess of $3 million per year.

Figure 21: Cloudflare Customers

(source: Created by author using data from Cloudflare)

Cloudflare currently generates relatively high gross profit margins, although has not yet achieved operating profitability. Cloudflare's gross profit margin is significantly higher than companies like Akamai and Fastly, which is surprising given the large number of free or low value users that Cloudflare serves. This speaks to the efficiency of Cloudflare's network and operations and should hold the company in good stead as they add services and high value customers.

Figure 22: Cloudflare Profit Margins

(source: Created by author using data from Cloudflare)

Table 2: Cloudflare Target Financial Performance

(source: Cloudflare)

Cloudflare is currently focused on growth, not profitability and the current lack of operating profitability is not a concern. Sales and marketing and research and development expenses are elevated in support of future growth. Sales and marketing expenses should be expected to accelerate as Cloudflare continues to target larger customers which are higher touch.

Figure 23: Cloudflare Operating Expenses

(source: Created by author using data from Cloudflare)

Competition

Cloudflare broadly groups their competitors into on-premise vendors, point solutions and public cloud companies with the most similar companies generally falling under point solutions. On-premise vendors are pivoting to cloud services with varying degrees of success, often making acquisitions to rapidly scale their competency in this area. Point solution vendors are expanding offerings to improve their strategic positioning and expand their addressable market in a similar manner to Cloudflare. It is this strategic group which is likely to give Cloudflare the most competition. Public cloud companies can offer niche services, like CDN, at low cost to attract business in other high margin areas, which is a threat to the economics of niche services. Cloudflare is in a reasonably strong position as its services are becoming increasingly important and can help companies to avoid cloud vendor lock-in.

Figure 24: Cloudflare Competitors

(source: Cloudflare)

Cloudflare's competitive position is reasonably strong as they offer integrated solutions which help to lower costs for customers and simplify deployment. Their broad portfolio of services also offers economies of scope as they can introduce new services for very little marginal cost. There is also potential revenue synergies as their broad and integrated services can offer improved functionality compared to point solutions.

Cloudflare promotes their large customer base as one of their key competitive advantages and they clearly have a significantly large customer base than their competitors. It is not clear they handle more traffic though as companies like Akamai and Fastly have more large customers. Akamai in particular is dominant amongst large customers, which explains their revenue leadership.

Figure 25: CDN Customers

(source: Intricately)

Cloudflare is making rapid progress amongst enterprise customers (where enterprise is considered to be a company with more than 1,000 employees) and this customer segment will be an important driver of growth going forward.

Figure 26: CDN Buyers by Spend

(source: Intricately)

Figure 27: CDN Growth in Enterprise Customer Count

(source: Intricately)

Akamai

Akamai offers a globally distributed intelligent edge platform with a portfolio of edge security, web and mobile performance and OTT solutions. Akamai has a larger footprint than Cloudflare, with more than 288,000 servers in over 136 countries. Akamai delivers daily Web traffic reaching more than 50 terabits per second compared to Cloudflare's network capacity of 35 terabits per second. Although Cloudflare has more customers Akamai generates significantly more revenue and likely handles more traffic due to their dominant position amongst large customers. It is estimated that 32% of Akamai's customers spend more than $100,000 per month on their services compared to 0.6% for Cloudflare. In addition 50% of the Fortune Global 500 are Akamai customers compared to 15% for Cloudflare. Akamai offers a similar portfolio of internet performance and security services to Cloudflare and is focused on similar growth areas like zero trust security and access management. Akamai is one of Cloudflare's strongest competitors due to their large footprint and leadership position in web application firewalls, bot management, zero trust security, DDoS mitigation and access management.

Fastly

Fastly offers an edge cloud platform which moves data and applications closer to users and appears to be more performance than security focused. Their services include:

- Edge cloud platform

- CDN

- Image optimization

- Video and streaming

- Cloud security

- Load balancing

Fastly is relatively small but growing rapidly and will provide strong competition for customers with large performance requirements, like audio and video streaming services.

Zscaler

Cloudflare's security focus is increasingly placing the company in competition with cybersecurity companies like Zscaler. Zscaler is a cloud native cybersecurity company focused on zero trust security and access management. Zscaler's security cloud is distributed across more than 100 data centers around the world and allows traffic to be routed locally and securely to the internet over broadband and cellular connections. It is unclear how successful Cloudflare will be in the network security market as they will face strong competition from incumbents like Palo Alto Networks and Zscaler.

Figure 28: Cloudflare Competitor Revenue Growth

(source: Created by author using data from company reports)

Valuation

Cloudflare's valuation is not excessive given their growth rate but their EV/S ratio is at the upper end of its range since listing. Cloudflare's attractiveness as an investment depends on the extent to which they can gain traction amongst larger customers and continue expanding their product portfolio. Based on a discounted cash flow analysis I estimate that Cloudflare's intrinsic value is approximately $52 per share.

Figure 29: Cloudflare EV/S Ratio

(source: Created by author using data from Yahoo Finance)

Figure 30: Comparable Company EV/S Ratios

(source: Created by author using data from Yahoo Finance)