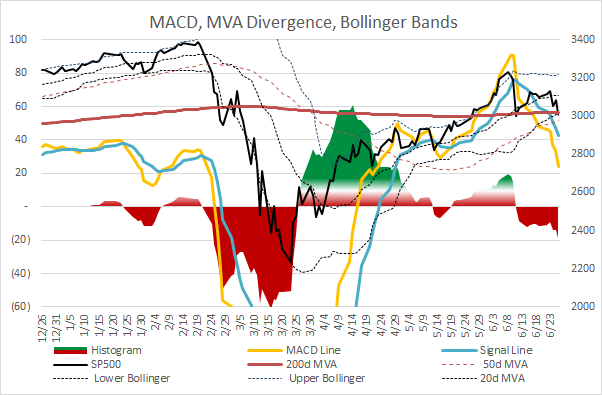

Technical Indicators

The Moving Average Convergence Divergence (MACD) indicator shows that what I consider to be a bear market rally is fading.

Chart #1: Technical Indicators

Source: Created by the Author

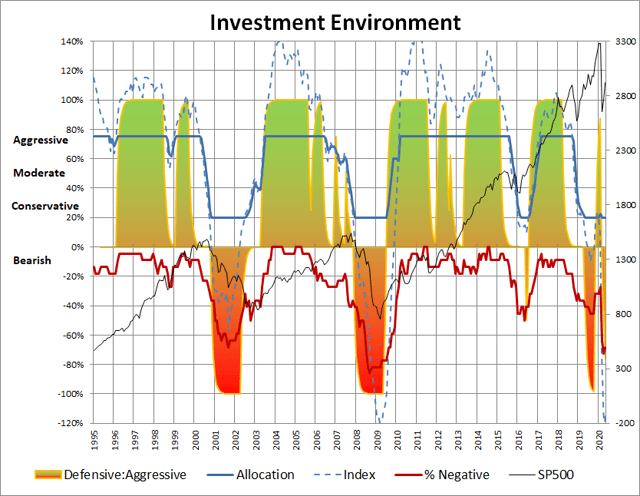

Investment Model

It is no surprise that the Investment Model is cautioning to be conservative. The U.S. is in a recession. Following Howard Mark's philosophy, I choose to be more defensive and near Benjamin Graham's guideline of a minimum allocation to stock of 20%.

Chart #2: Investment Model

Source: Created by the Author Based on St. Louis Federal Reserve FRED

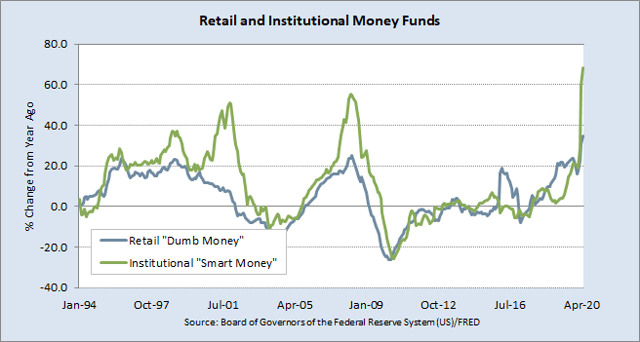

Smart Money

Institutional investors (Smart Money) and Retail Investors (Dumb Money) are both increasing allocations to money funds. A wise move in my opinion.

Chart #3: Money Fund Flows

Source: St. Louis Federal Reserve FRED

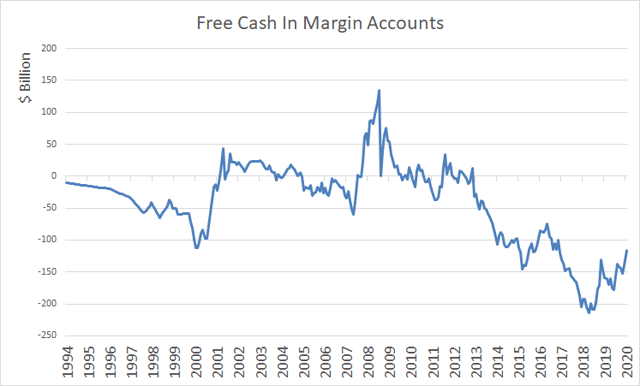

Free Cash In Margin Accounts

Investors are deleveraging by increasing the free cash in margin accounts.

Chart #4: Free Cash in Margin Accounts

Source: Created by the Author Based on FINRA

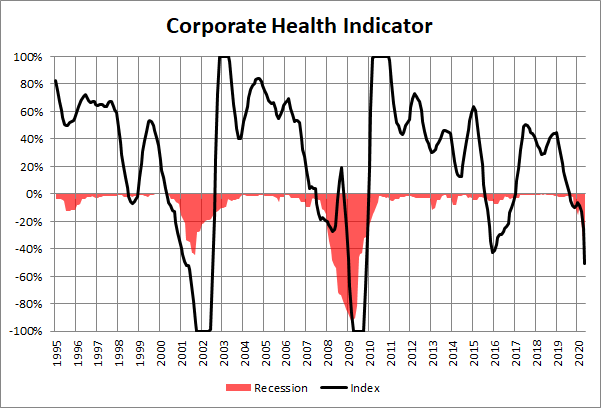

Corporate Health

Corporate Health is a composite of gross value added, disposable income, operating surplus, real output, profits, exports and sales. Bankruptcies have increased more than 25 percent since last year. I look closely at bond quality of funds that I own.

Chart #5: Corporate Health

Source: Created by the Author Based on St. Louis Federal Reserve FRED

Gold - iShares Gold Trust (IAU)

I already have 6 percent of my portfolio in gold (IAU) and am satisfied with this allocation.

Chart #6: Gold

AGFiQ US Market Neutral Anti-Beta (BTAL)

I've written about BTAL in "Small Investors Should Be Conservative Going Into 2020" for interested readers. It is designed to do well when low volatility funds outperform more volatile funds. I sold it when I started simplifying my portfolios. I have recently placed orders to purchase BTAL as conditions have worsened, in my opinion. I like it