Deutsche Lufthansa AG's (OTCQX:DLAKF;OTCQX:DLAKY) extraordinary general meeting has approved the bailout package with an overwhelming majority of 98 percent. The company's largest shareholder Heinz Hermann Thiele - who could have blocked the deal in the general meeting with his 15 percent stake (before the approved capital increase) - voted in favor of the deal in a somewhat unexpected move. Earlier, Mr. Thiele who is also the majority owner of Knorr-Bremse AG (OTCPK:KNBHF) and controlling shareholder of Vossloh AG (OTC:VOSSF;OTCPK:VOSSY), had voiced harsh criticism of the terms of the bailout package and openly called for renegotiations. Previously, I described the terms extensively, so I will not go into detail in this article.

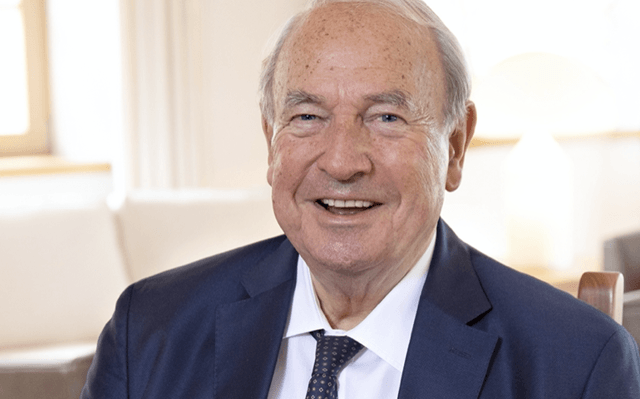

Heinz Hermann Thiele; source: Knorr-Bremse AG

Heinz Hermann Thiele; source: Knorr-Bremse AG

Now that Lufthansa's liquidity is secured, I believe Europe's largest airline group is very well positioned to maintain and possibly increase its lead. An agreement with an important labor union is another encouraging sign. In this article, I will explain why I am taking a rather optimistic view with regard to Lufthansa in the long run and also point to where I still see risk factors.

A starting Lufthansa Boeing 747 airplane; source: Deutsche Lufthansa AG

A starting Lufthansa Boeing 747 airplane; source: Deutsche Lufthansa AG

Unions Appear To Be Reasonable

Immediately prior to the general meeting, Lufthansa reached an agreement with the Ufo union which represents cabin crews. Under the terms of the agreement, employees will be offered early retirement in order to reduce the number of jobs. Furthermore, there will be reduced hours and lower wages. Pension contributions will be capped. Also, there will be no pay rises for the foreseeable future. All in all, the measures are expected to lead to about -17 percent personnel cost and annual savings in excess of €500 million. The deal still requires the approval of union members, but I am rather confident that this will not be