This article is a continuation of the article "Ipiranga Should Give Ultrapar The Fuel It Needs." In that article, I gave a bullish recommendation on Ultrapar (NYSE:UGP) based upon information about Ipiranga, which is the company's service station chain. Ipiranga has strong brand recognition and is number one in perceived value (cost vs. benefit). Also, Ipiranga has the highest customer loyalty in the industry (Brazilian). Ipiranga's customers have a higher tendency to utilize the services they offer, which allows the company to increase sales of value-added products.

In that article, I demonstrated that Ipiranga's management is focusing only on service stations that can offer them a higher return on their investment, both in monetary and non-monetary terms. I believe that Ipiranga will grow its revenue at a rate slightly higher (2.1%) than the industry's rate (1.9%). I think that the 0.2% increase is possible because of the increase in regulations on service stations. 28% of Brazil's service stations are unaffiliated with any brand, and for these service stations to survive, they will need to partner with a larger company that can provide them with technology and brand recognition.

ULTRAGAZ - Ultrapar's Liquefied Petroleum Gas Company

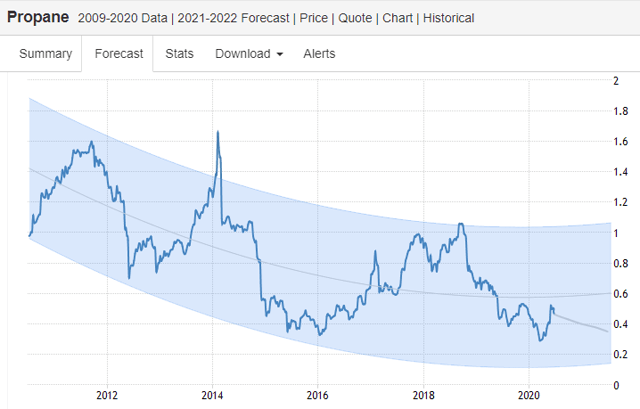

Ultragaz has been slowly losing volume during the past three years, but its net revenue increased due to an increase in LPG prices during the same period, as can be seen in Figure 1 below. LPG prices in Brazil are more stable than in the U.S. because of Petrobras's LPG residential use pricing policy. A couple of years ago, Petrobras "adopted a 12-month price average with quarterly price changes, instead of monthly price changes. The idea was to soften the international price volatility for a product used for cooking so that the Brazilian consumer would not be subjected to seasonal price swings."

Figure 1 - LPG prices

Source: Trading Economics

To estimate Ultragaz's net revenue, I had to find the forecasts for three inputs. Unfortunately, I could not find an estimate for the future demand for LPG in Brazil, so I had to use the global market forecast. LPG demand from 2020 until 2023 is expected to grow at a CAGR of 3%. To estimate the price of LPG, I used Trading Economics' propane forecast for 2021 to 2022. After 2022, I assumed that the cost of propane would remain stable, which is not an optimal solution but better than randomly guessing. The last important factor in estimating net revenue is the exchange rate. I used the Brazilian Central Bank's Market report to determine the future exchange rate.

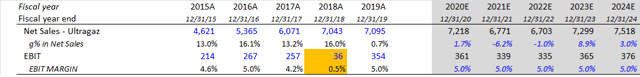

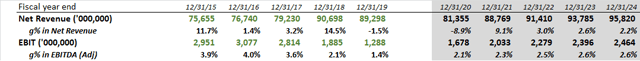

Figure 2 - Ultragaz Estimates For 2020 Until 2024

Source: Company's Financials and Author's Estimates (gray cells)

From 2015 until 2019, Ultragaz's revenue grew at a CAGR of 11.3%, and its EBIT at 13.4%. The 11.3% increase in revenue was mainly a result of a price increase in LPG and the depreciation of the Brazilian Real. From 2020 until 2024, my net revenue estimates produced a CAGR of 1.17%. My EBIT estimates produced a CAGR of 1.24% during the same period. This EBIT growth rate is based upon my belief that the company will continue to benefit from economies of scale but at a slower pace than in the past.

OXITENO - Specialty Chemical Company

Net revenue for Oxiteno depends on the sales of specialty chemicals and commodities (surfactants market). Over the past three years, Oxiteno's volume decreased by 7.1%, but the depreciation of the Brazilian Real (about 28% exposure) and an increase in prices allowed its net revenue to grow at an annual compound rate of 1% (2015-2019). In 2017, net revenue per ton was R$5.01, and in 2019 it was R$5.80, which confirms that an increase in price is what helped the company continue to grow its net revenue.

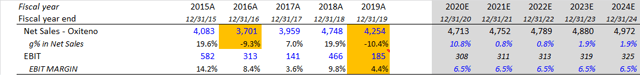

Figure 3 - Oxiteno Estimates For 2020 Until 2024

Source: Company's Financials and Author's Estimates (gray cells)

My net revenue estimates for Oxiteno are based upon a 3% growth of the global surfactants market, a 4% growth of the global specialty chemicals market, and a depreciating real based upon the data from the BCB Focus report mentioned in the Ultragaz section. I also took into consideration, based upon information in the global specialty chemicals report, that South America's growth will be less than the worldwide average. My estimated EBIT margin is based upon the average EBIT margin over the past four years.

Extrafarma And Ultracarga

I could not find any reliable market estimates for Brazilian Drugstores or Bulk Liquid storage companies. The combined net revenue for these two companies accounts for only 2.9% of Ultrapar's total net revenue. That being said, these operations are still relevant.

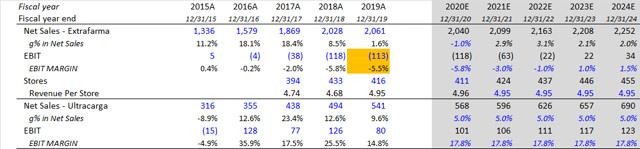

Figure 4 - Extrafarma And Ultracarga Estimates For 2020 Until 2024

Source: Company's Financials and Author's Estimates (gray cells)

In 2018 and 2019, UGP's EBIT margin was lower than its average (3.8%) due to Extrafarma's negative EBIT results. In the short term, I believe this trend will continue as the company closes underperforming drug stores and opens new ones. Extrafarma is reducing the number of employees it has per store, which should decrease its SG&A expenses. In 4Q17, the company had an average of 17 employees per store, and as of 1Q20, its average was 14.9. As this trend continues, Extrafarma should be able to increase its EBIT margin in the long run.

Conclusion

Figure 5 - UGP Estimates For 2020 Until 2024

Source: Company's Financials and Author's Estimates (gray cells)

From 2015 until 2019, UGP net revenue and EBIT had an annual compounded growth of 4.2% and -18.7%, respectively. According to the assumptions in my model, the company's net revenue and EBIT CAGRs should be 1.4% and 13.8%, respectively. Though I do not believe its net revenue will grow as fast as it has been in the past, I think that the company will be more profitable as it takes advantage of its synergies between business units. I am bullish on Ultrapar as I believe, based upon my research, that the company will be more profitable in the long term.