Last week, I reminded investors "stocks don't rise or fall in a straight line, so expecting some form of mean reversion is understandable," and this week, we saw high-flying NASDAQ stocks decline and lessor-loved baskets, such as industrial goods, climb.

This rotation isn't too surprising, given the Invesco QQQ ETF (QQQ) relative outperformance to the SPDR S&P 500 Trust ETF (SPY) since March. I suspect the S&P 500 will outperform the NASDAQ a little longer, but I also believe both will find their footing and resume up trends, because investors are sitting on gobs of zero-to-low yielding assets, and they're itching to buy dips.

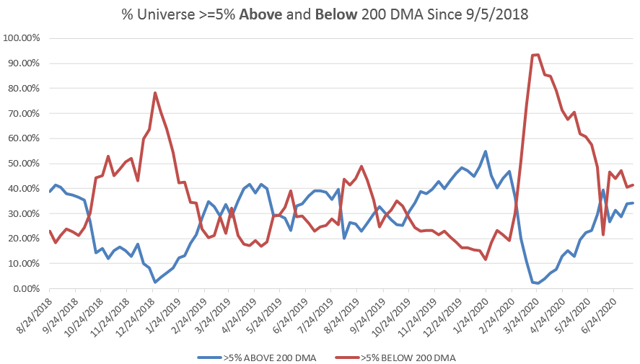

Our overbought/oversold indicator is little changed this week.

About 34% of our 1,500-stock universe trades 5% or more above the 200-day moving average, a "cautionary" reading that suggests selling second-tier stocks and reducing margin. If this measure eclipses 40%, then it would signal it's time get more defensive, but prudently pruning portfolios and proactively picking prices to pay for stocks that go on sale makes sense for now.

Source: Top Stocks for Tomorrow.

To be clear, I don't recommend wholesale selling winners. Top-scoring stocks often continue winning long term, and historically, investors fail to buy back stocks for fear of incorrectly timing their reentry. If a stock has an impaired business model and you've got gains, then book some profit. However, if a company's targeting a large market opportunity and it's enjoying revenue and profit growth, then stick to your long-term thesis until it's broken.

That being said, suitability and concentration risk is a concern. Cloud software stocks have been big winners since March (and many remain top scoring in our research), but a portfolio consisting solely of these companies can expose investors to panic-inspiring, short-term drawdowns. If your holdings have become too concentrated, then using market weakness to hunt for stocks in

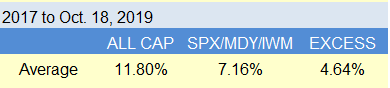

Never miss a money-making idea. Weekly large cap, mid cap, small cap and ADR rankings. Know what sectors, industries, and stocks to buy and when to buy them. Over 400 bps of excess return in the following 52 weeks since 2017. Free trial, special introductory pricing, and you can cancel anytime. Join the conversation. Sign up for Top Stocks For Tomorrow.