BlackRock (NYSE:BLK) continues to perform well by building on one of the best business models in the asset management space. I wrote an article about their model more than six years ago that has aged well. The share price then was in the low $300 and, today, it is over $550. Returns have been acceptable even though the fierce price war on fees has continued during this period.

This article will review performance on a five-year look back and offer some thoughts on the outlook for BlackRock.

Performance and trends:

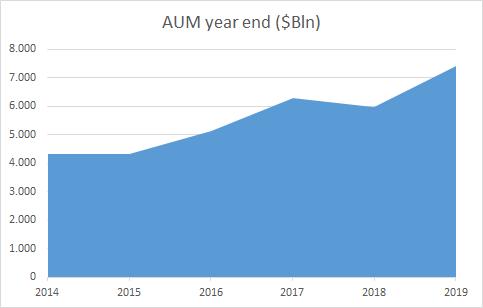

Assets under management (AUM) have grown impressively. Driven by a combination of market share gains and raising equity and bond prices, total AUM for BlackRock has increased from $4.3 Tln in 2014 to $7.4 Tln in 2019. This is equivalent to a cumulative aggregate five-year growth rate of 11.4%.

Source: Author

However, revenue growth has lagged behind AUM. This is the result of what has been called the "Vanguard effect". BlackRock's main competitor, which pioneered index fund investing, has also aggressively lowered fund and ETF fees forcing everyone else to follow. Not everyone can follow, and as a result, scale has become even more important to survive a low fee environment. Most of Vanguard's and BlackRock's biggest ETFs now charge low single-digit fees; effectively discouraging any future competitors and splitting the market for some of the largest and widely-owned index trackers.

By dividing the base fee revenue for a given year by the year-end AUM amount we get an idea of the average fee rate for all products. The trend on "base fee rate" is a direct indicator of the impact of the fee war on BlackRock margins.

Because the markets and AUM have increased during this period, this measure will slightly understate the weighted average fee rate; however, it should still serve