The continuing COVID-19 crisis has wiped out many, many businesses, due to huge amounts of lost sales. Imagine if you owned a business dealing in perishable goods when this crisis hit.

A different side of this scenario is found in the timber business - where business has also slowed down, but those trees keep growing, creating more product to sell.

CatchMark Timber Trust (CTT) is a REIT which "seeks to deliver consistent and growing per share cash flow from disciplined acquisitions and superior management of prime timberlands located in high demand U.S. mill markets."

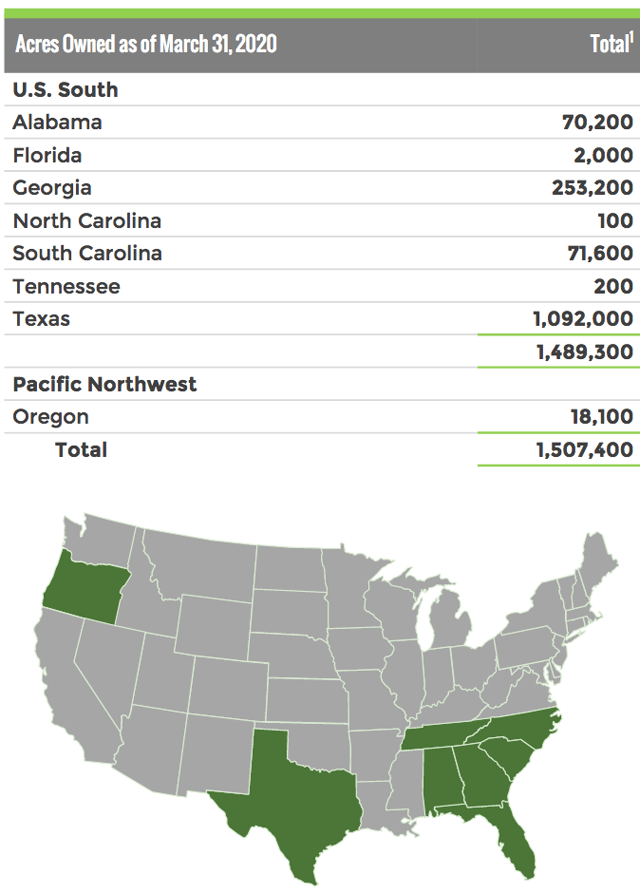

CTT owns a lot of acreage in the Southeast, but its biggest holdings are in Texas, where it owns more than 1 million acres. 95% of CatchMark’s timberlands are located in the top five markets in the U.S. South.

Management commented on how the crisis has deferred some of CTT's revenue on the May 5 Q1 '20 earnings call:

"For CatchMark, particularly with regard to saw timber, the impacts relate to deferring some revenue, not losing revenue.

Our trees are still growing in the forest and the raw materials we provide cause us to be an essential business. Our operating model based on owning and investing in the highest quality timberlands near superior mill markets and working with credit-worthy counterparties has positioned us to manage through this period." (Q1 '20 call)

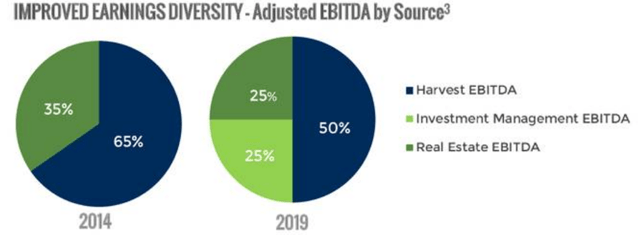

CTT has three main income sources - Harvest brings in 50%, while Real Estate and Investment Mgt. each bring in 25%. The business model has become more diversified since 2014:

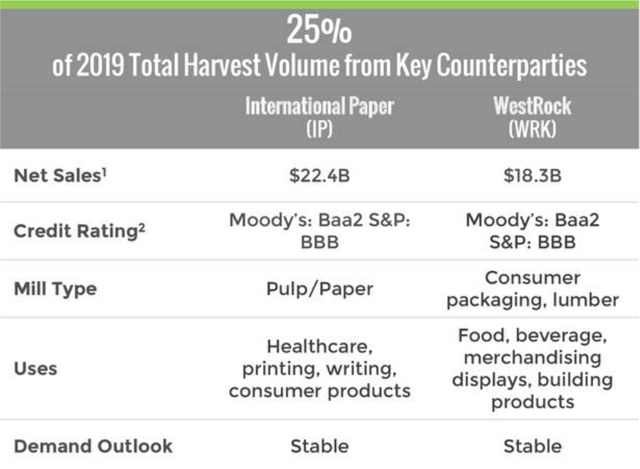

Its two biggest harvest volume customers are large cap players: International Paper, with a market cap $14.6B, and WestRock, with a market cap of $7.9B.

Segments:

With no commercial land development or international exposure, CTT concentrates on its timber operations

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values.