Manufactured housing can be a sensitive subject, and while I understand if some investors are turned off by the ethics of swooping in, acquiring a low-income housing area, and then raising rents, I try to separate myself from the politics and purely look at the investment thesis.

When I last wrote about Sun Communities (NYSE:SUI), I highlighted some of the standout characteristics that I saw as big strengths:

To some, Sun Communities may seem like a fairly run-of-the-mill high growth, low yield play on housing like Avalon Bay Communities (AVB) or Essex Property Trust (ESS). However, I think the nearly 4x total return outperformance over the past 5 years compared to these companies is a result of:

-Significantly higher NOI growth

-Higher occupancies and more “stickiness” (14 year average length of stay)

-Operating in a niche, fragmented market without a lot of public competition

-Cheap housing in the face of rising home prices and historical undersupply

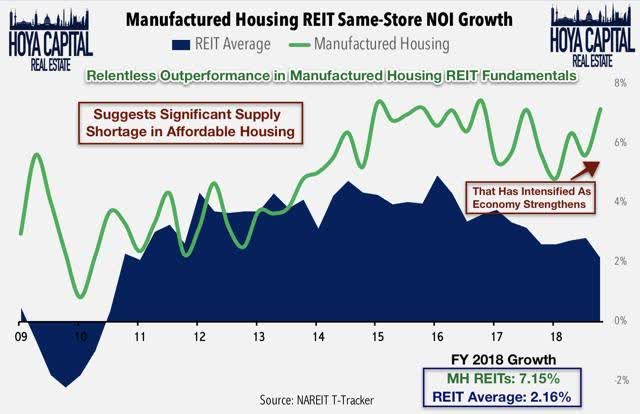

Most of this is still true today, although I would say that manufactured housing has received plenty of attention on Seeking Alpha due to its huge average annual Net Operating Income growth.

Image borrowed from Hoya Capital Real Estate’s article

The strengths that I listed could also be said of Equity LifeStyle Properties (ELS), which is a close peer of Sun Communities. However, this article will focus on the latter.

Image from Yahoo Finance

In the chart above, you can clearly see how the high NOI growth has fueled ELS and SUI to double the returns of the S&P 500 over the past five years. UMH Properties (UMH) in red, however, has been rather disappointing, and I would guess that this has to do with its high-risk, high-yield REIT equities portfolio.

The last time SUI was as cheap as it is today was after the beginning of

With Better Information, You Get Better Results…

At High Yield Landlord, We spend 1000s of hours and well over $50,000 per year researching the REIT, MLP and other real estate markets for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

We are the #1 rated service on Seeking Alpha with a perfect 5/5 rating.

We are the #1 ranked service for Real Estate Investors with over 1000 members.