Source: hedgeye.com

Indeed it has been said that democracy is the worst form of Government except for all those other forms that have been tried from time to time.…

Winston Churchill

Gold is not a form of currency that we are likely to ever use. The world's reserve currency, whichever it is in the future, would not be pegged to the precious metal once again, nor are we likely to ever use gold for transactions or savings in a meaningful way.

However, the way I see gold is as a special form of currency. A currency that becomes relevant only at times when the risk for the global financial system runs very high. Not the risk of recession nor the equity risk, but rather the risk of the stability of the monetary regime.

This is my reason to holding gold as part of my portfolio - as a form of insurance against monetary and fiscal authorities losing control or simply transitioning to a new system.

The long-term drivers of gold

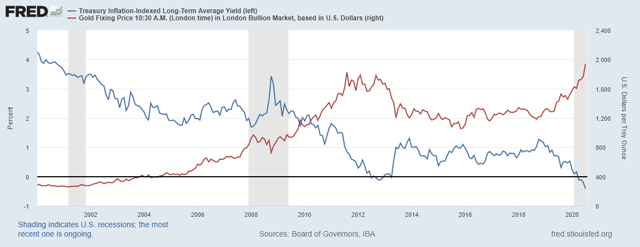

Everyone would agree that one of the most important drivers of the price of gold is the level or real interest rate in the economy and for most of the time this is correct.

Even if it's one of the most important drivers for gold during normal times, there is an even more powerful driver of gold prices - the overall risk for the existing monetary regime. Although we usually think as the existing monetary regime as the only possible scenario going forward, history has taught us that this is not the case.

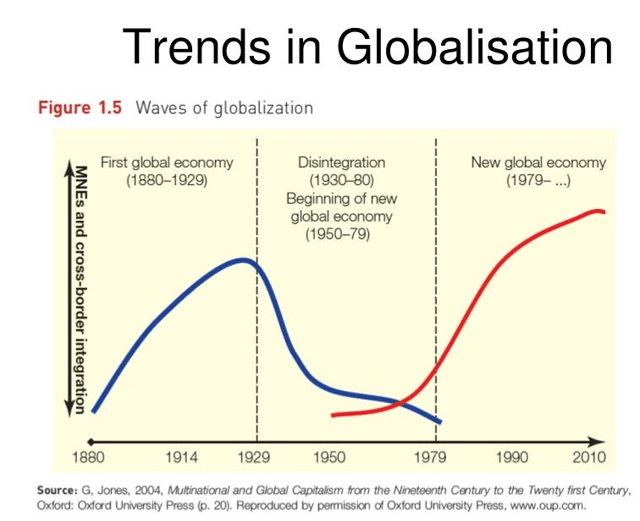

By taking a very long-term view, it appears that changes in monetary regimes coincide with peaks and troughs of long-term trends in globalization.

Source: slideserve.com

Starting with the first peak shown above - the end of the "First global economy" at the end of the 1920s, it happened exactly at the time when the gold standard was abandoned. Changing the monetary regime was one key factors that helped overcome the difficulties of The Great Depression.

The years that led to the depression to a large extent resemble the last decade we lived through, although there are differences as well. To start with, the depression came after one of the longest expansion periods in history - "the roaring twenties", while level of indebtedness accelerated.

In his paper "Paradigm Shifts" Ray Dalio describes the 1920s period as follows:

It started with a recession and the markets discounting negative growth as stock yields were significantly above bond yields, yet there was fast positive growth funded by an acceleration in debt during the decade, so stocks did extremely well. By the end of the decade, the markets discounted fast growth and ended with a classic bubble (i.e., with debt-financed purchases of stocks and other assets at high prices) that burst in 1929, the last year of the decade.

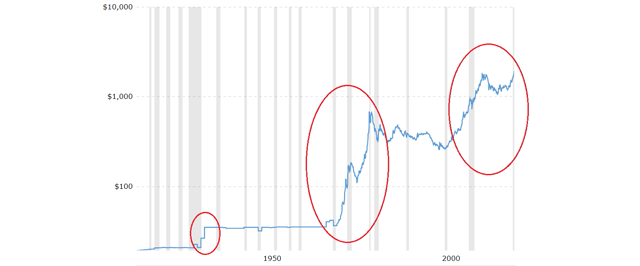

As countries abandoned the gold standard and embraced the change of the monetary regime, gold saw its first large bull market for the last century - increasing by more than 50% in price from around $20 to $35 per ounce.

Following the Second World War the world adopted a new monetary system - the Bretton Woods, which lasted from the mid-1940s to the early 1970s. The system was based on the U.S. dollar convertibility in gold while other currencies were freely exchanged against it.

In the beginning of the 1970s, when the trend in globalization reached a bottom in the chart above, the world was once again faced with a change in the existing monetary regime and gold witnessed its second massive bull market - increasing from $35 to nearly $600 over the decade.

And again many parallels could be drawn from the 1970s to nowadays:

At the beginning of the decade, there was a high level of indebtedness, a balance of payments problem, and a strained gold standard that was abandoned in 1971. As a result, the promise to convert money for gold was broken, money was "printed" to ease debt burdens, the dollar was devalued to reduce the external deficits ...

Source: Paradigm Shifts

The third large bull market in the precious metal started in the 2000s, up until the 2012 when talks of loose monetary policy normalization begun and treasury yields reached a temporary bottom. At this point the supposedly last round of quantitative easing - QE3 was announced and the bull market in gold came to a stop. However, as we will see down below, there are many reasons to believe that this was most likely just temporary and gold could continue to make new highs.

The current gold bull market once again coincides with a peak in globalization which I talked about in my recent article - "What The New Market Paradigm Would Look Like".

Gold Prices - 100 Year Historical Chart

Source: macrotrends.net

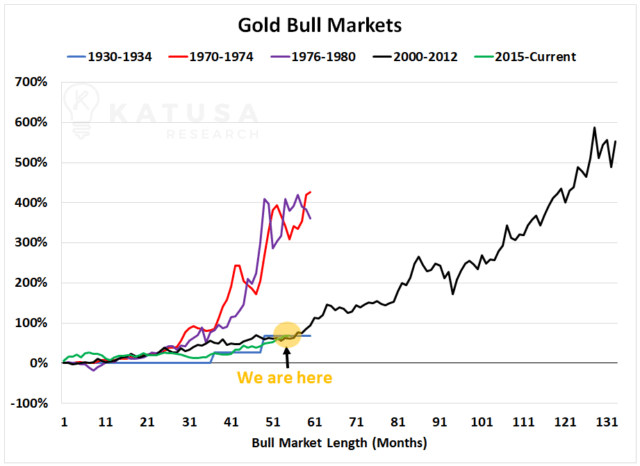

Each of the three periods described above could also be traced to the chart below, showing all major Gold Bull Markets over the past century.

Source: katusaresearch.com

Another shift in monetary regime

Although there have been many hopes and dreams since 2012 that normalization of the monetary system could indeed happen, these were blown away by the most recent round of unconventional monetary fiscal and monetary policies. This has resulted in continuation of the 2000-2012 gold bull market shown above.

Although this could easily be blamed by the black swan event COVID-19, there are many other factors that sooner or later would have led to this extreme monetary response:

- The September 2019 repo crisis showed how vulnerable the system has become even at a time with ample liquidity.

- There are significant risks to the pension system, which has become increasingly reliant on the stock market due to extremely low rate of return on their fixed income portfolios.

- Overall normalization of the Fed's balance sheet and interest rates has been taking far too long and with economic downturns on average every 10-years it was only a matter of time until the Fed would have had resorted to yet another round of easing.

The trend that has been set in motion long time ago towards more unconventional loose monetary and fiscal policies was just accelerated by the recent pandemic. Policies such as unlimited QE and Helicopter Money that were once considered just theoretical possibilities are now considered normal.

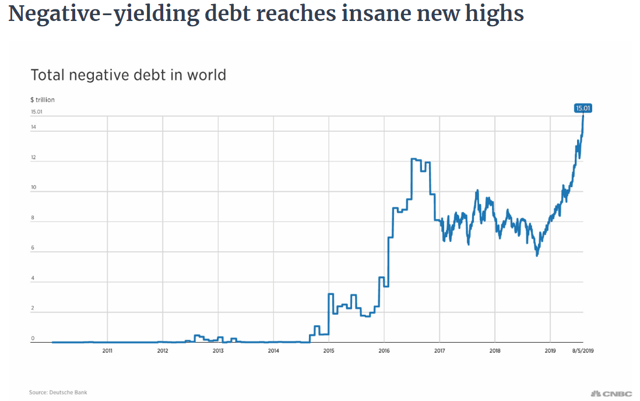

The amount of negative-yielding debt globally has been another red flag that the current monetary system is no longer functioning properly and that the level of intervention is reaching extreme levels.

Source: enterprise.press

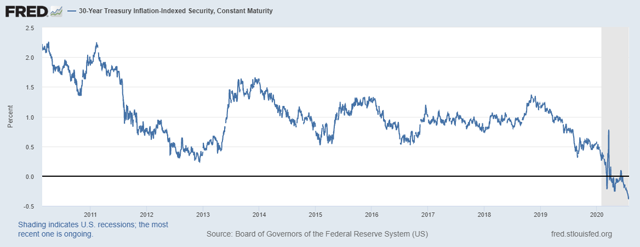

Negative real interest rates even on 30-year TIPS was another milestone reached recently.

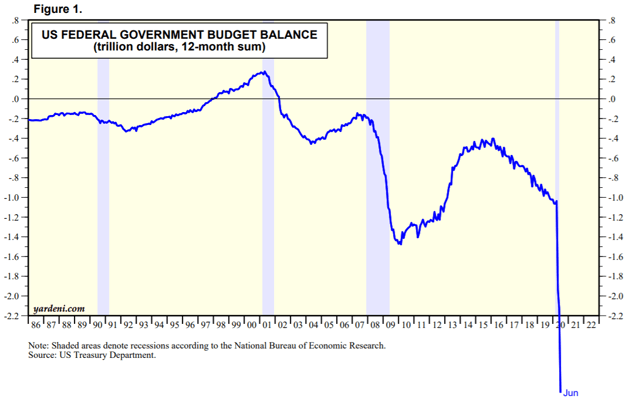

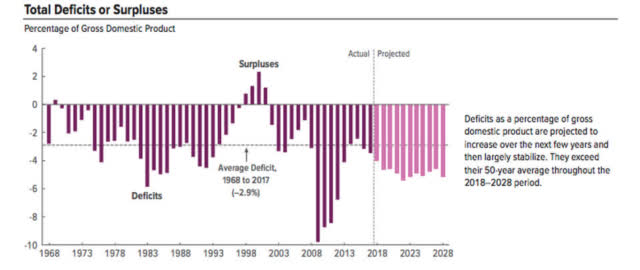

All this while the federal budget deficit also reached extreme levels.

Levels so extreme that they have not been seen before under the current monetary system and surpassed expectations by a very wide margin.

Source: forbes.com

The pandemic also gave a significant push to deglobalization and a new market paradigm, which will likely accelerate inflationary pressures down the line. For further analysis on this you can read my recent article on the new market paradigm.

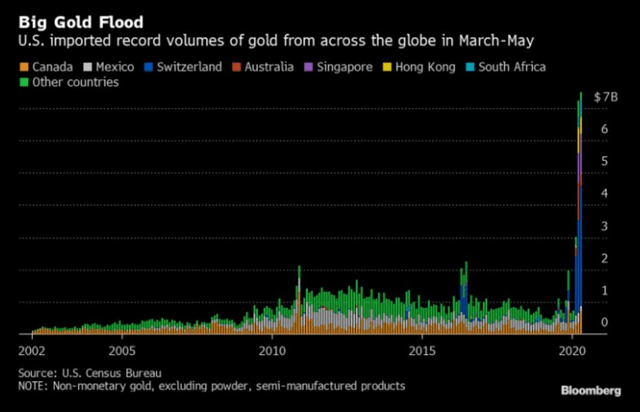

At the same time the U.S. imported a record amount of gold, while experts with unconventional and more radical ideas are gaining ground.

Swiss exports of gold to the United States leapt to 111.7 tonnes in April -- by far the biggest monthly total on record -- while shipments to other destinations dwindled, customs data showed on Tuesday.

Source: reuters.com

The amount has been considerable when put within a historical context.

With all that in mind, the risk for the current monetary regime is significant and even if authorities manage the transition towards a new monetary system well, the level of uncertainty around it would provide a tailwind for gold prices.

Gold as part of an equity portfolio

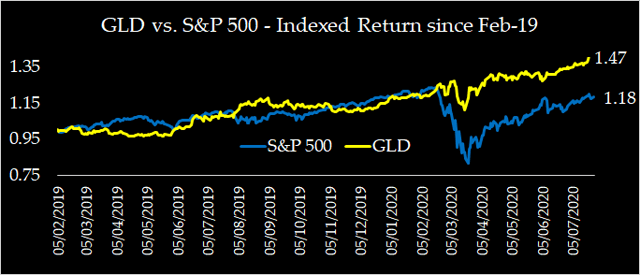

The first time I wrote about gold was back in February 2019, when the precious metal was trading at around $1,300 per ounce.

Since I wrote "Why Caution Is Required As Never Before And The Case For Investing In Gold", the precious metal has appreciated nearly 50%, compared to 18% for the S&P 500.

Source: author's calculations based on data from Yahoo!Finance

At the same time gold's correlation with the equity market has been in the negative territory for most of the time since 2015, which gave it yet another positive when held as part of an equity portfolio.

Source: author's calculations based on data from Yahoo!Finance

From an ETF perspective, SPDR Gold Shares (GLD) has had a much better diversification properties than the VanEck Vectors Gold Miners ETF (GDX), which invests in gold mining stocks. Thus, the former has been a better choice from a portfolio diversification perspective.

To illustrate GLD diversification properties, below I calculated the total return and daily standard deviation of portfolios using a mix between GLD and S&P 500 over the past year.

*x axis shows the percentage held in GLD with the rest in the S&P 500

Source: author's calculations based on data from Yahoo!Finance

Although this is not to say that having close to 100% of one's portfolio in the GLD is a sensible strategy, it illustrates that adding even a small exposure to the precious metal has been beneficial from both total return and risk perspectives.

As an UK based investor, I have been using a close substitute to the GLD - WisdomTree Physical Gold ETC, which I have been holding since 2018 and I intend to hold for a very long time. In my view the effort of forecasting where the precious metal will be trading 1, 6 or 12 months from now is futile. Taking into account everything said in the previous sections, holding gold as part of an equity portfolio makes sense for me over the long term and until the risks for the current monetary system subside.

Conclusion

Holding gold as part of an equity portfolio in a barbell like strategy is my approach to ride the current wave of uncertainty and high risk. I don't see the precious metal as a speculative investment, nor as a simple inflation hedge. The way I see gold is a currency of last resort, which preserves purchasing power over the long term and gains ground at inflection points when the existing monetary system becomes less sustainable.

That is why I do not speculate where the precious metal price would be next month or one year from now. I look at it as a much longer-term hedge and way to preserve wealth during tumultuous times, when the level of unknowns in the global economy and monetary system is extremely high. So far, this strategy is paying off.