Take a quick look at the whole LNG maritime transport sector. There was good news published last week.

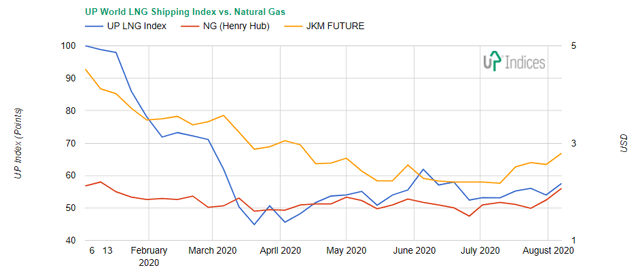

First the Natural Gas prices started rising accompanied by the world LNG shipping companies as shown in the first chart. UP World LNG Shipping Stock Index includes 17 world LNG shipping companies and is described in my previous article.

UP World LNG Shipping Stock Index versus Natural Gas prices (source: UP-Indices.com)

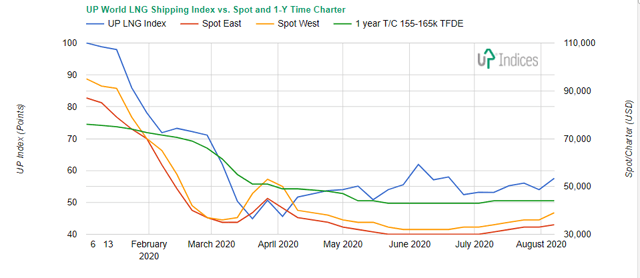

This price recovery was accompanied by a small rise of spot prices as shown on the second chart. One-year time charters didn´t move. Many inquiries have come in for winter shipping requirements but charterers want shorter tenors than what shipowners desire, says Poten & Partners.

UP World LNG Shipping Stock Index versus Spot rates and 1-year charter rates. (source: UP-Indices.com, this chart also uses data from Fearnleys)

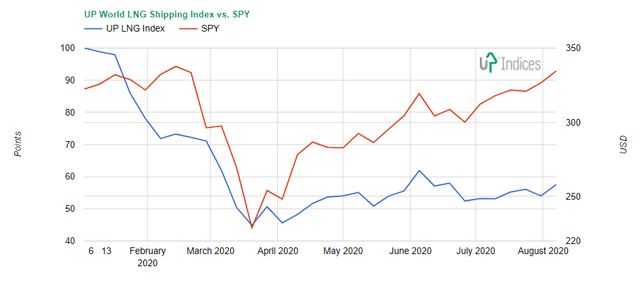

The third chart compares UP World LNG Shipping Index with ETF SPY. You can see that the world LNG shipping stocks are moving less than the rest of the US market. But last week the UP Index rose over 6 % while SPY added "only" 2.5 %.

UP World LNG Shipping Stock Index versus ETF SPY (source: UP-Indices.com)

How is this positive sentiment reflected by US listed companies? The general answer is: not so far.

Dynagas LNG

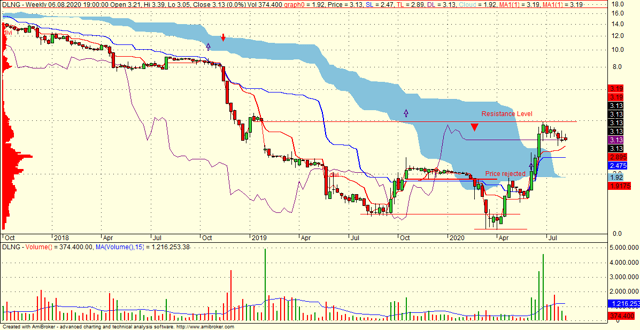

Dynagas LNG Partners LP (DLNG) has a rest after a successful period. The resistance at $4 persists as same as the support line around $3. Volume is now low again and will be low till a significant move. Thanks to long-term high-rates contracts, DLNG is in a better position than the others.

DLNG weekly chart (source: author via Amibroker platform)

DLNG weekly chart (source: author via Amibroker platform)

Flex LNG

The fleet of Flex LNG Ltd. (FLNG) is still rising. On July 29 was delivered Flex Aurora as the first newbuilding this year and will