After predicting that Moderna (NASDAQ:MRNA) would have trouble trading at $100 a few months ago and then going nowhere next, readers may think this update will turn bearish.

It will not.

Investors should have expected the bearish selling on Moderna, Novavax (NVAX), and especially Sorrento (OTC:SRNE) and Inovio Pharmaceuticals (INO). Markets honed in their frenzied buying on the electric vehicle segment and cloud-computing technology stocks. Plus, clinical results from the vaccine players no longer give the biotechnology stocks a reason to bid shares higher. The “sell on the news” cycle happened faster than ever before. So, as Moderna’s Phase III trial tests continue, what happens to its share price in the near term?

Pre-clinical Data Posted

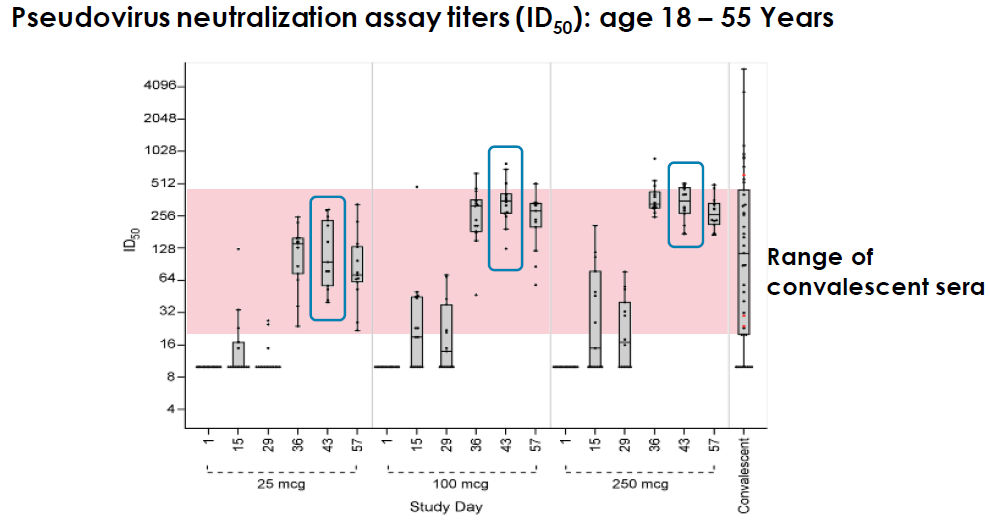

Moderna posted strong pre-clinical results on Aug. 26. The study involved just 20 subjects but gave the company many key data points. Two weeks after a dose of between 25 mcg and 250 mcg, all participants had neutralizing antibodies (“nAbs”).

Data courtesy of Moderna

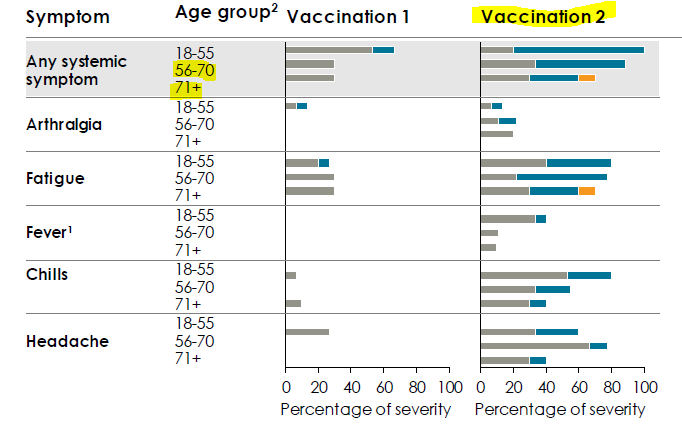

Importantly, the second vaccination resulted in a response in all age groups. The age group that benefits the most from a vaccine responded with the symptoms listed below.

With all groups exceeding the median of convalescent sera, subjects demonstrate an immune response. As this astute reader posted, “this vaccine is harmless because of it's [sic] simple design (a plasmid + lipid nanoprotein + genetic code for Covid-19 spike protein). There is no irritant added to make the vaccine work better; no dead virus to cause adverse effects later.”

When Moderna mass produces the vaccine and distributes it worldwide, it will need to advertise its efficacy and safety. Otherwise, society will give into the anti-vaxxer movement. Instead of protecting the population from SARS-2, those unwilling to take the two-dose vaccine will spread the virus and endanger the vulnerable groups.

Phase 3

Please [+]Follow me for deeply-discounted picks that will rebound while avoiding the biotech stocks likely to slump. Click on the "follow" button beside my name and check real-time for free alerts.

Join the DIY (do-it-yourself) investing marketplace.