Investment Thesis

Addus HomeCare Corporation (NASDAQ:ADUS) operates in the Home Care space, which is expected to grow aggressively over the coming decade due to multiple industry tailwinds. The company has demonstrated strong growth in both earnings and revenue, and management has also succeeded in making several acquisitions in a highly fragmented industry at enviable multiples. It is easy to imagine a long growth runway for Addus, but current valuation and a handful of drawbacks leave me largely neutral on this name.

Introduction

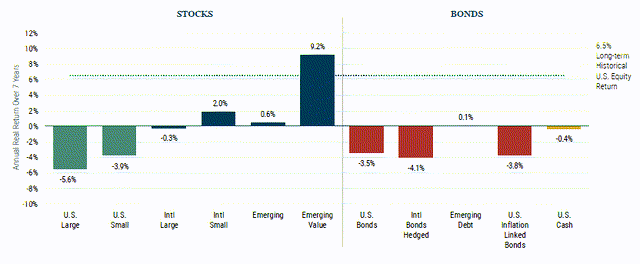

There are a lot of things I don't like about our current market. I think valuations are scary, particularly in speculative tech, and it has led me to move away from some of my more speculative tech investments. With the market's expected future returns based on current valuations muted, I find myself looking more at real estate and alternative assets like bitcoin.

Source: GMO

More than ever before, I think it is important for those who are active stock pickers to dig deep to find growth and value that are underappreciated. This is the best way to drive returns in an overvalued market. This had led me to far-flung corners of the market, such as my OTC top holding P10 Holdings (PIOE) or my favorite SPAC (PSTH), and has more recently led me to stumble across Addus HomeCare Corporation.

Of course, the question is: does Addus fit the bill?

Addus HomeCare Corporation

Addus HomeCare Corporation operates in three segments, all of which are designed to bring its clients care at home. The first is "Personal Care," and this is by far the largest. This involves providing non-medical assistance with ADLs (Activities of Daily Living), critical for keeping elderly, ill, or disabled persons in their homes and out of nursing facilities. Note that this is not "medical" care and is really more just having someone come over to help out with